This version of the form is not currently in use and is provided for reference only. Download this version of

Form NH-1310

for the current year.

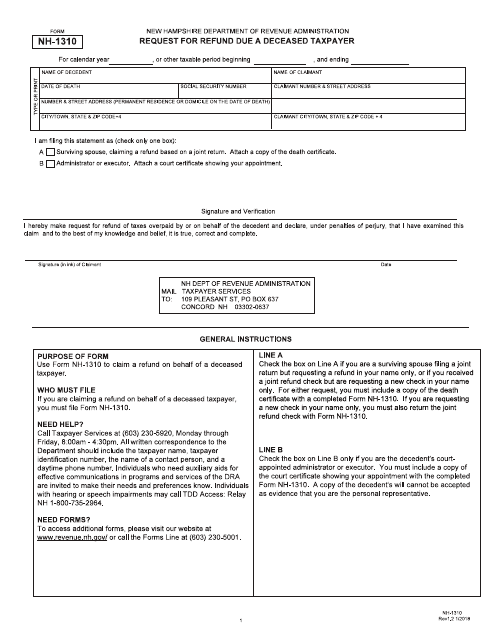

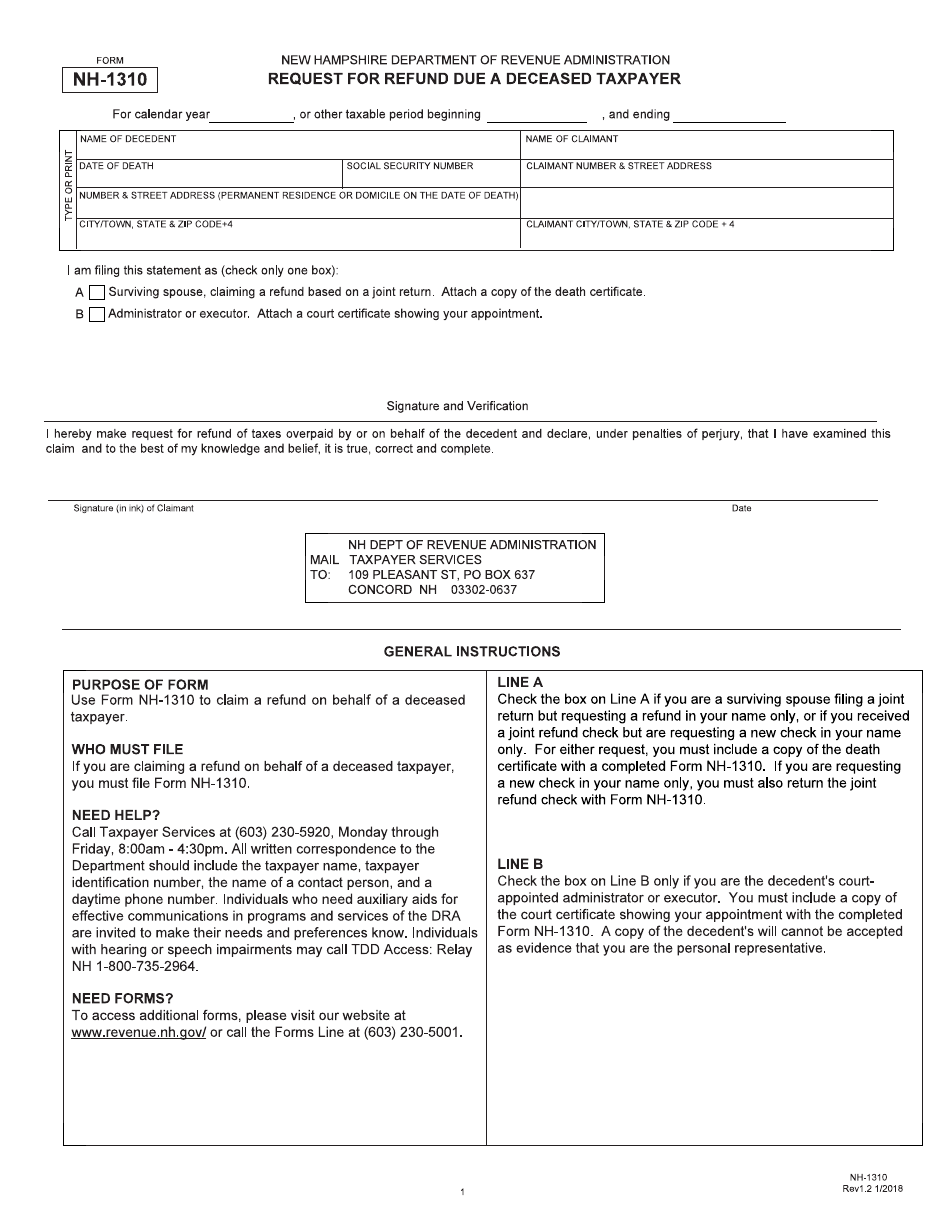

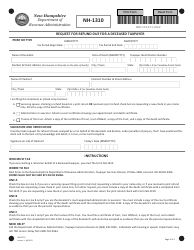

Form NH-1310 Request for Refund Due a Deceased Taxpayer - New Hampshire

What Is Form NH-1310?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form NH-1310?

A: Form NH-1310 is a request forrefund due to a deceased taxpayer in New Hampshire.

Q: Who can use form NH-1310?

A: Form NH-1310 can be used by individuals or authorized representatives of the deceased taxpayer.

Q: Why would someone use form NH-1310?

A: Form NH-1310 is used to request a refund of taxes paid by a deceased taxpayer.

Q: How do I fill out form NH-1310?

A: You need to provide the deceased taxpayer's information, the refund amount requested, and attach supporting documents.

Q: Is there a deadline to submit form NH-1310?

A: Yes, form NH-1310 must be submitted within three years from the original due date of the tax return.

Q: What supporting documents should I attach with form NH-1310?

A: You should attach a copy of the deceased taxpayer's death certificate and any other relevant documents.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1310 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.