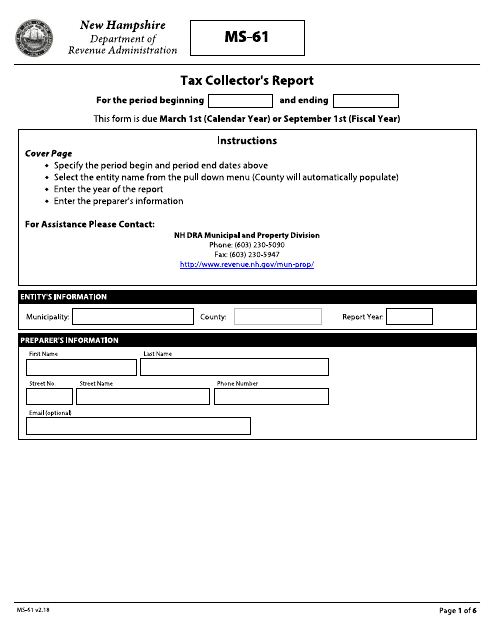

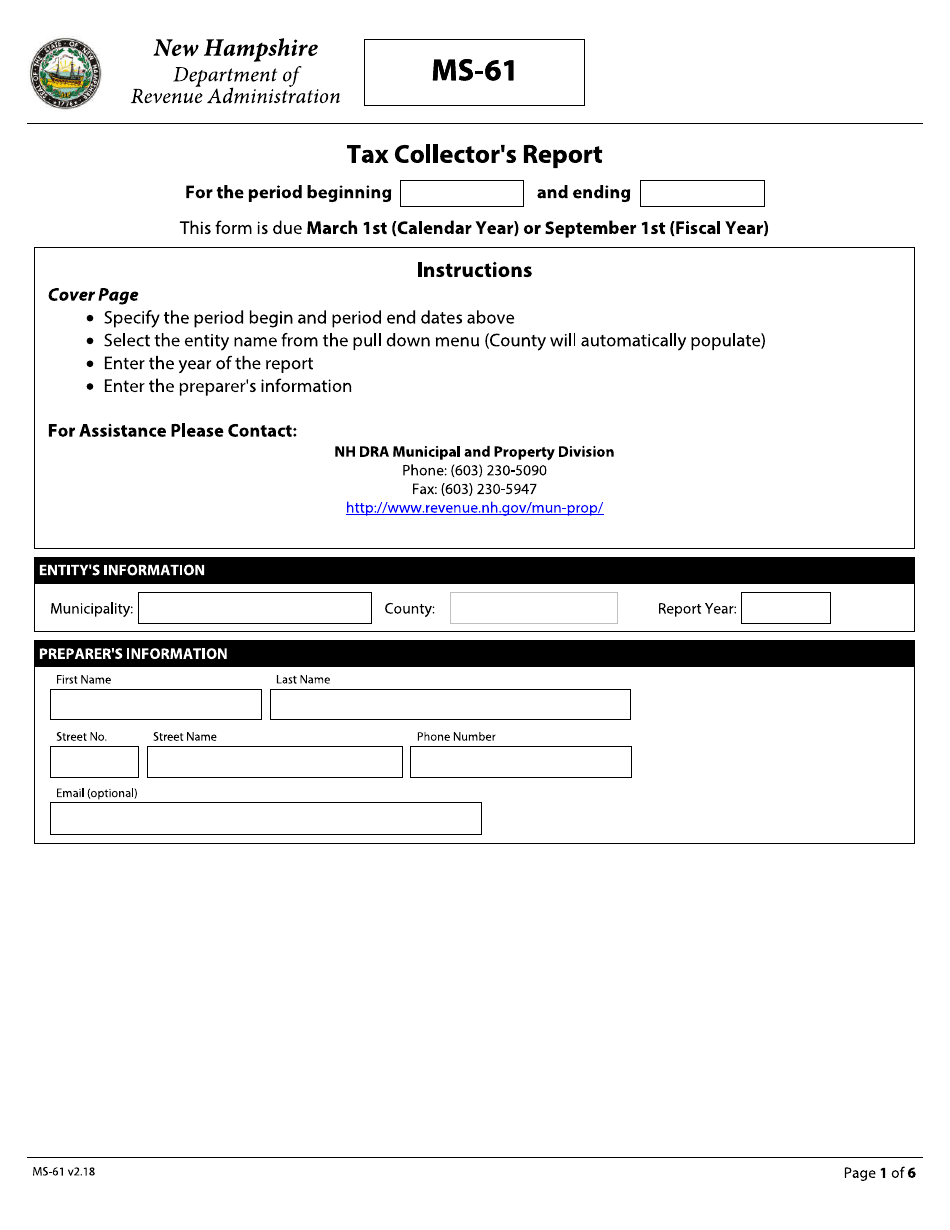

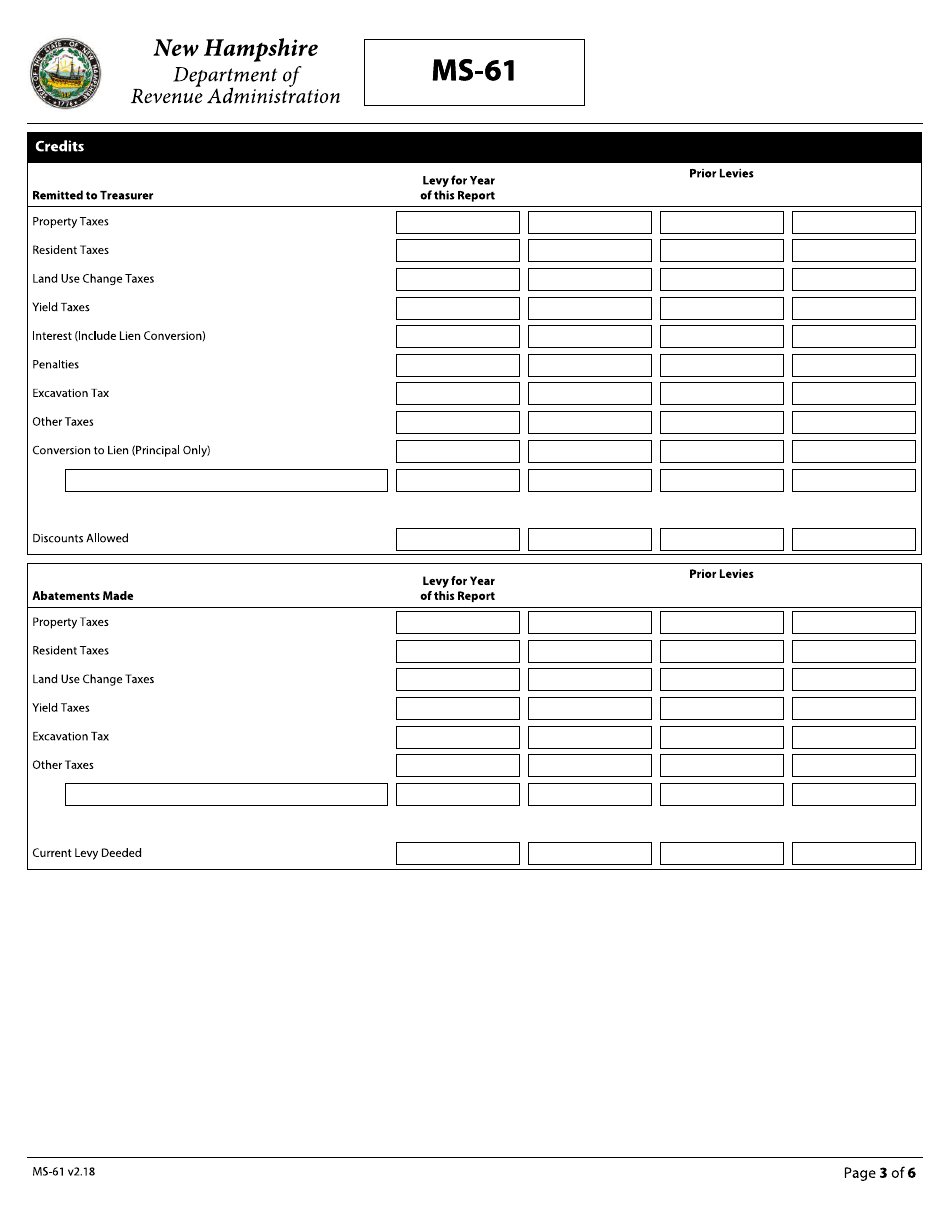

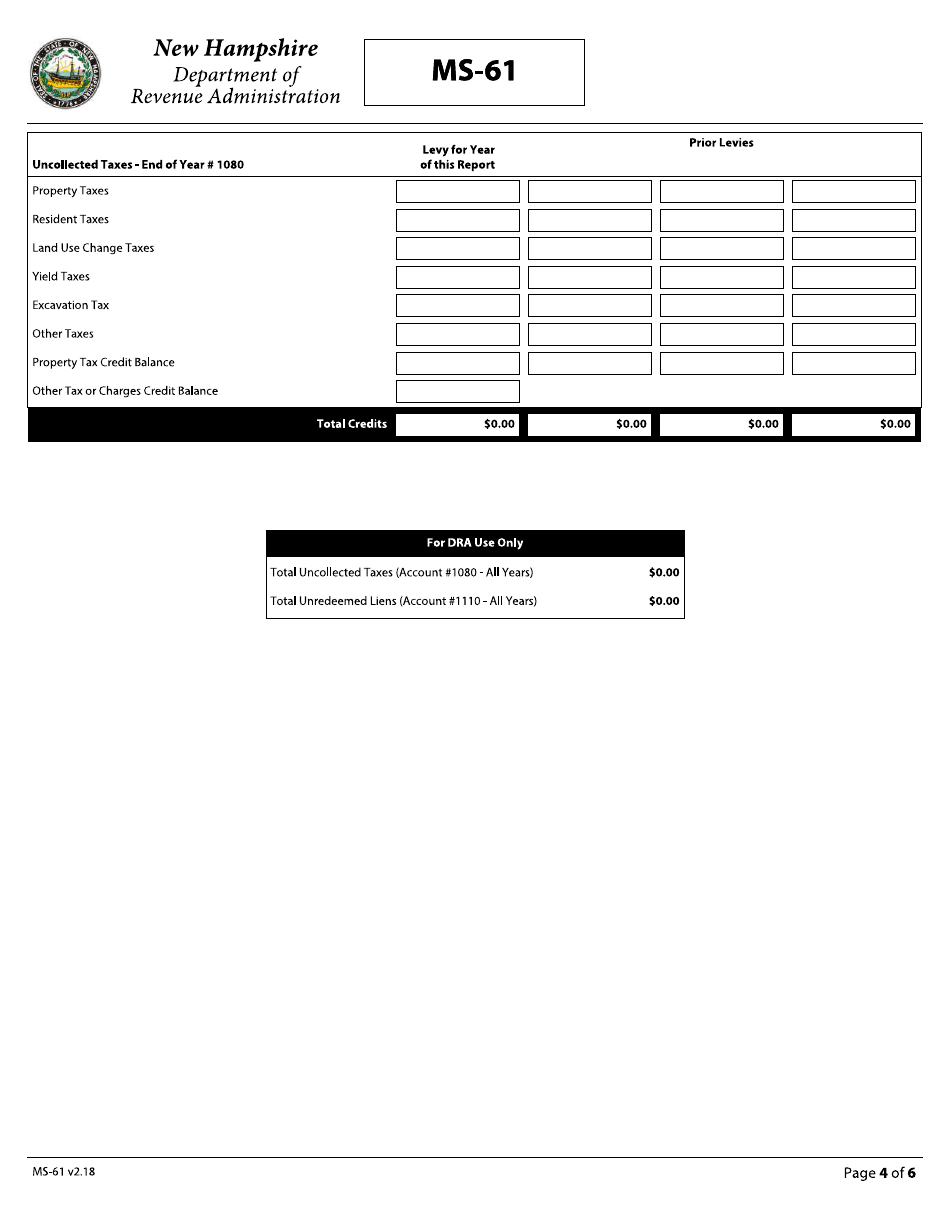

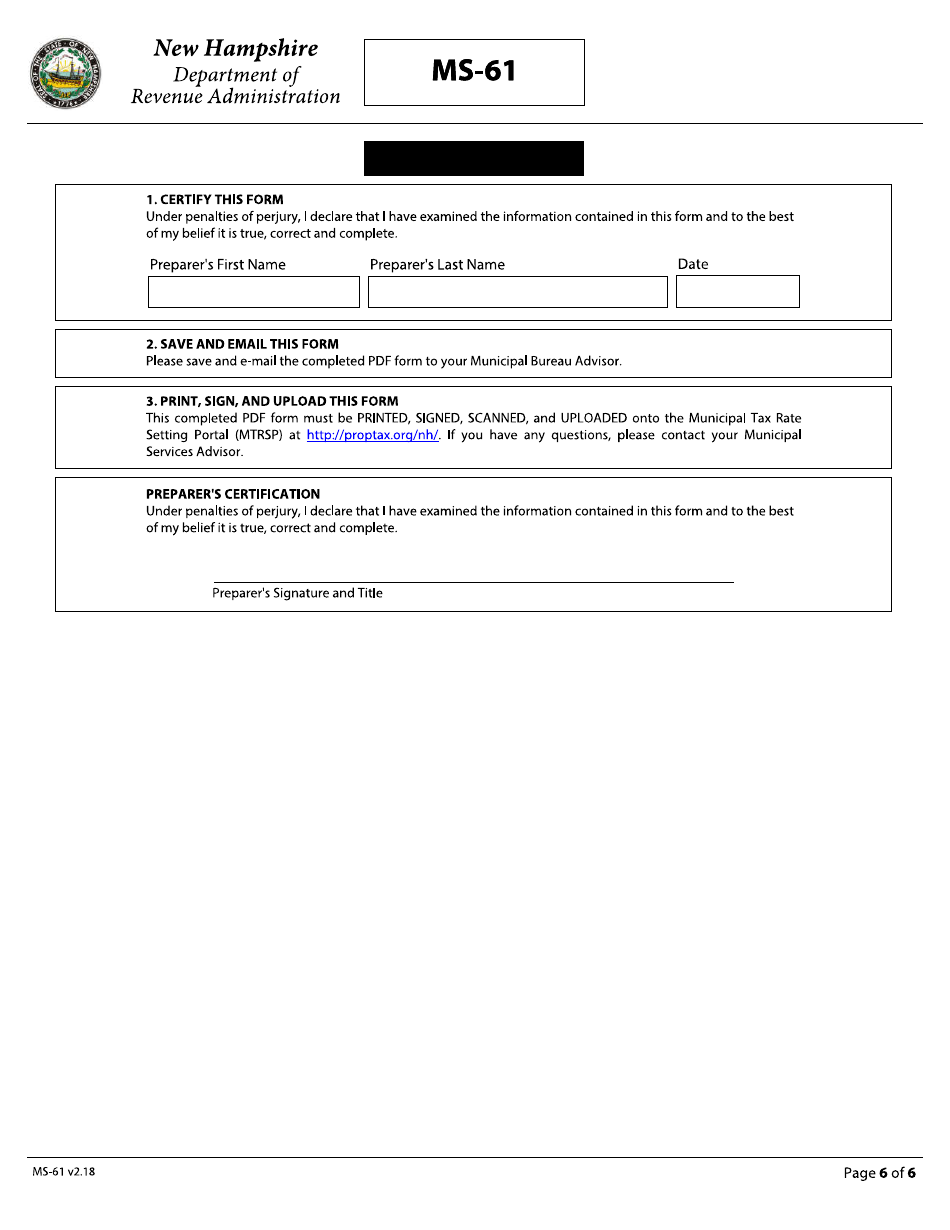

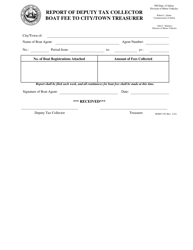

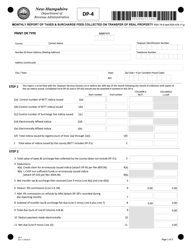

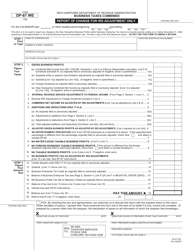

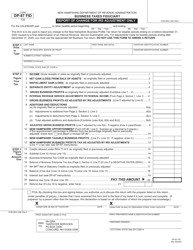

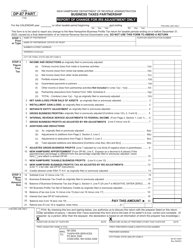

Form MS-61 Tax Collector's Report - New Hampshire

What Is Form MS-61?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MS-61?

A: Form MS-61 is the Tax Collector's Report in the state of New Hampshire.

Q: Who needs to file Form MS-61?

A: Tax collectors in New Hampshire are required to file Form MS-61.

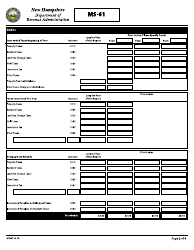

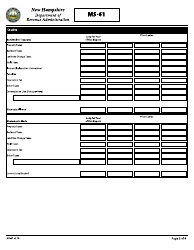

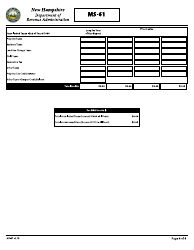

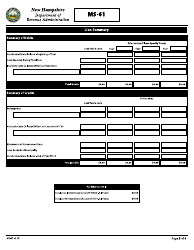

Q: What information is required on Form MS-61?

A: Form MS-61 requires tax collectors to report detailed information about the taxes collected and received.

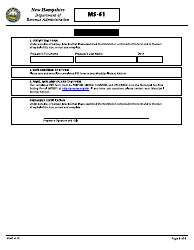

Q: When is Form MS-61 due?

A: Form MS-61 is due on or before the 15th day of the month following the end of the corresponding tax period.

Q: Are there any penalties for not filing Form MS-61 on time?

A: Yes, there are penalties for late filing or failure to file Form MS-61, so it is important to meet the deadlines.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MS-61 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.