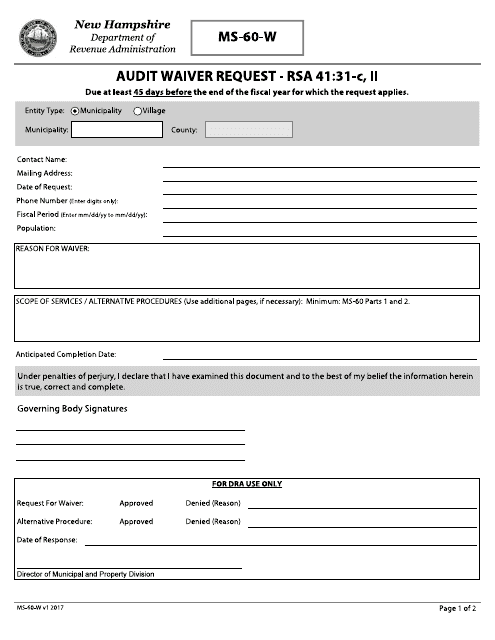

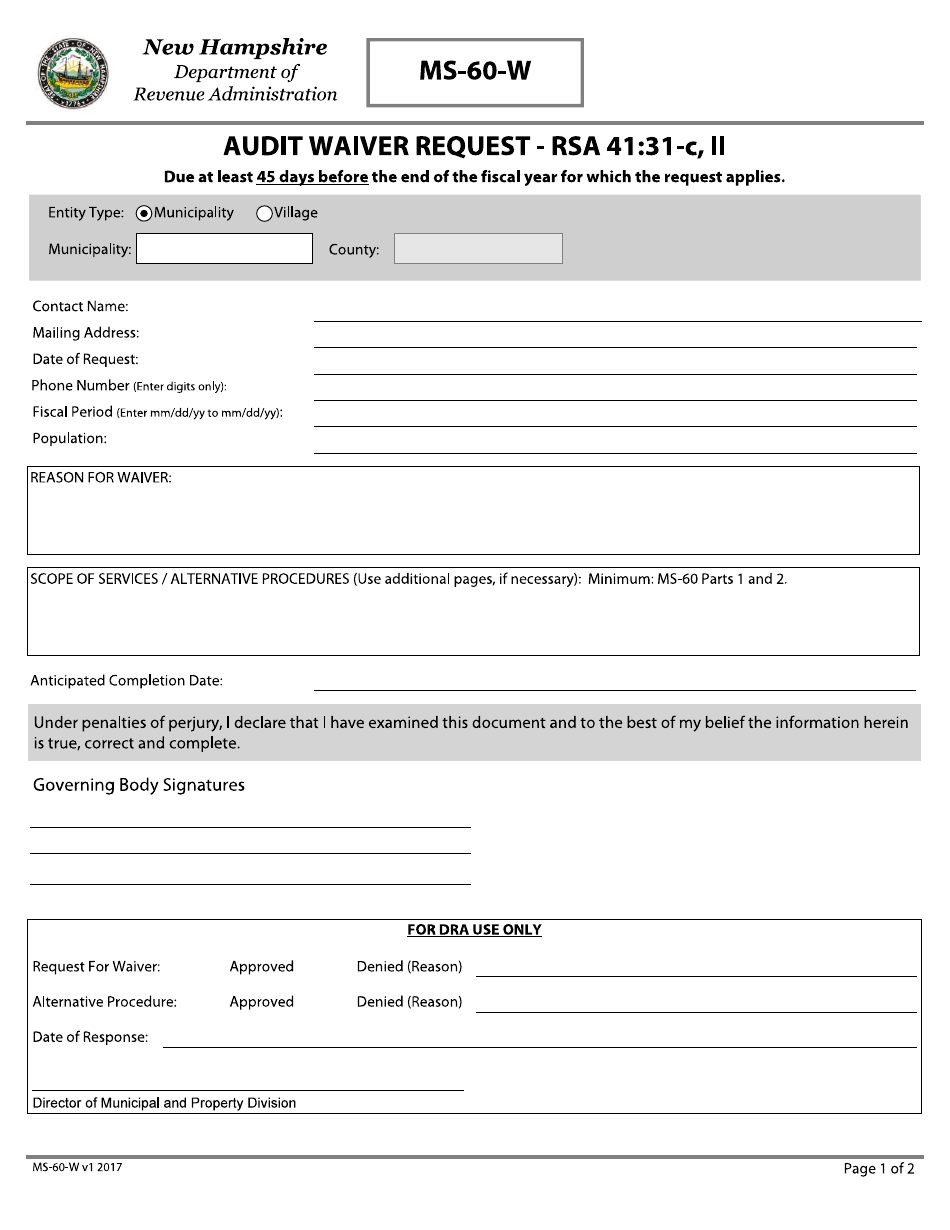

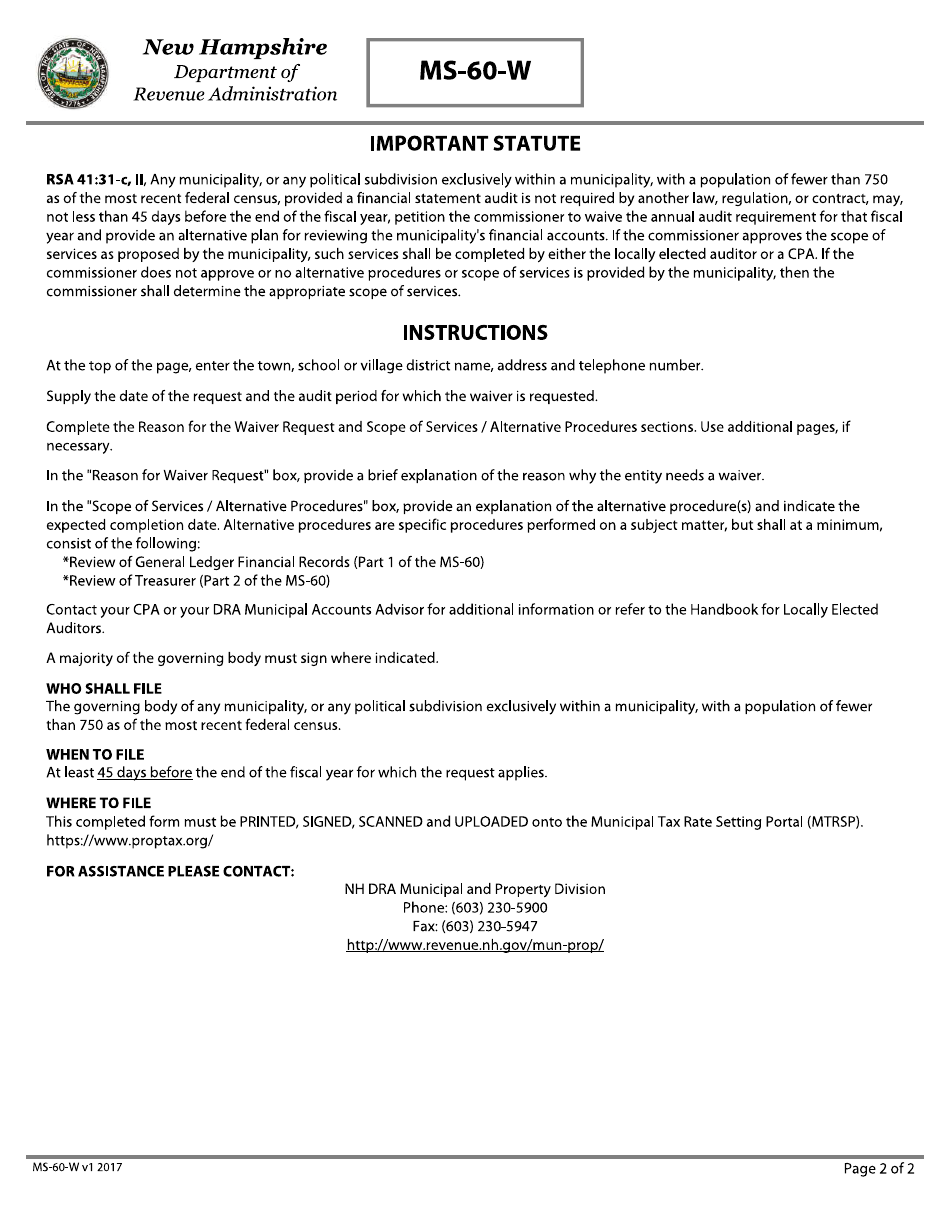

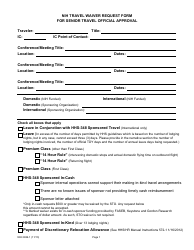

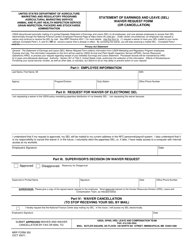

Form MS-60-W Audit Waiver Request - New Hampshire

What Is Form MS-60-W?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MS-60-W?

A: Form MS-60-W is the Audit Waiver Request form for the state of New Hampshire.

Q: When should I use Form MS-60-W?

A: You should use Form MS-60-W to request a waiver from audit requirements for specific taxes in New Hampshire.

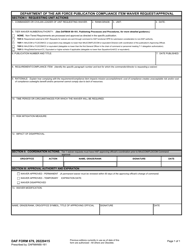

Q: Which taxes does Form MS-60-W apply to?

A: Form MS-60-W applies to the Business Enterprise Tax (BET), Business Profits Tax (BPT), Interest and Dividends Tax (I&D), and Communications Services Tax (CST).

Q: What are the requirements for requesting an audit waiver?

A: The taxpayer must meet certain criteria, such as having a small amount of tax due or filing accurate and complete tax returns for at least two consecutive years.

Q: Is there a deadline for submitting Form MS-60-W?

A: Yes, Form MS-60-W must be submitted on or before the original due date of the tax return for the tax year in question.

Q: Can I request an audit waiver for multiple tax years?

A: Yes, you can request an audit waiver for multiple tax years on one Form MS-60-W, as long as the tax years are consecutive.

Q: What happens after I submit Form MS-60-W?

A: The Department of Revenue Administration will review your request and notify you of their decision in writing.

Q: What if my request for an audit waiver is denied?

A: If your request for an audit waiver is denied, you may still be subject to an audit for the tax year in question.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MS-60-W by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.