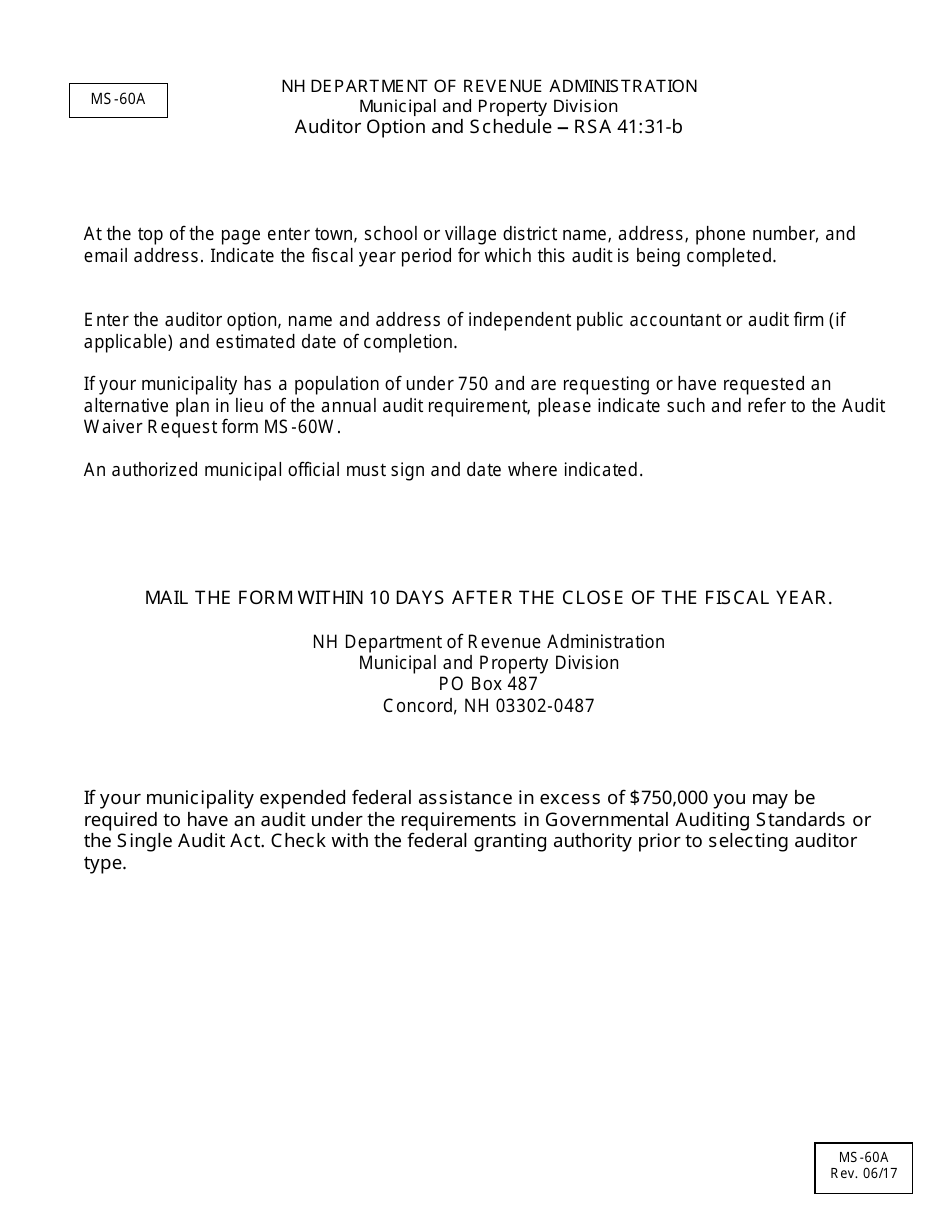

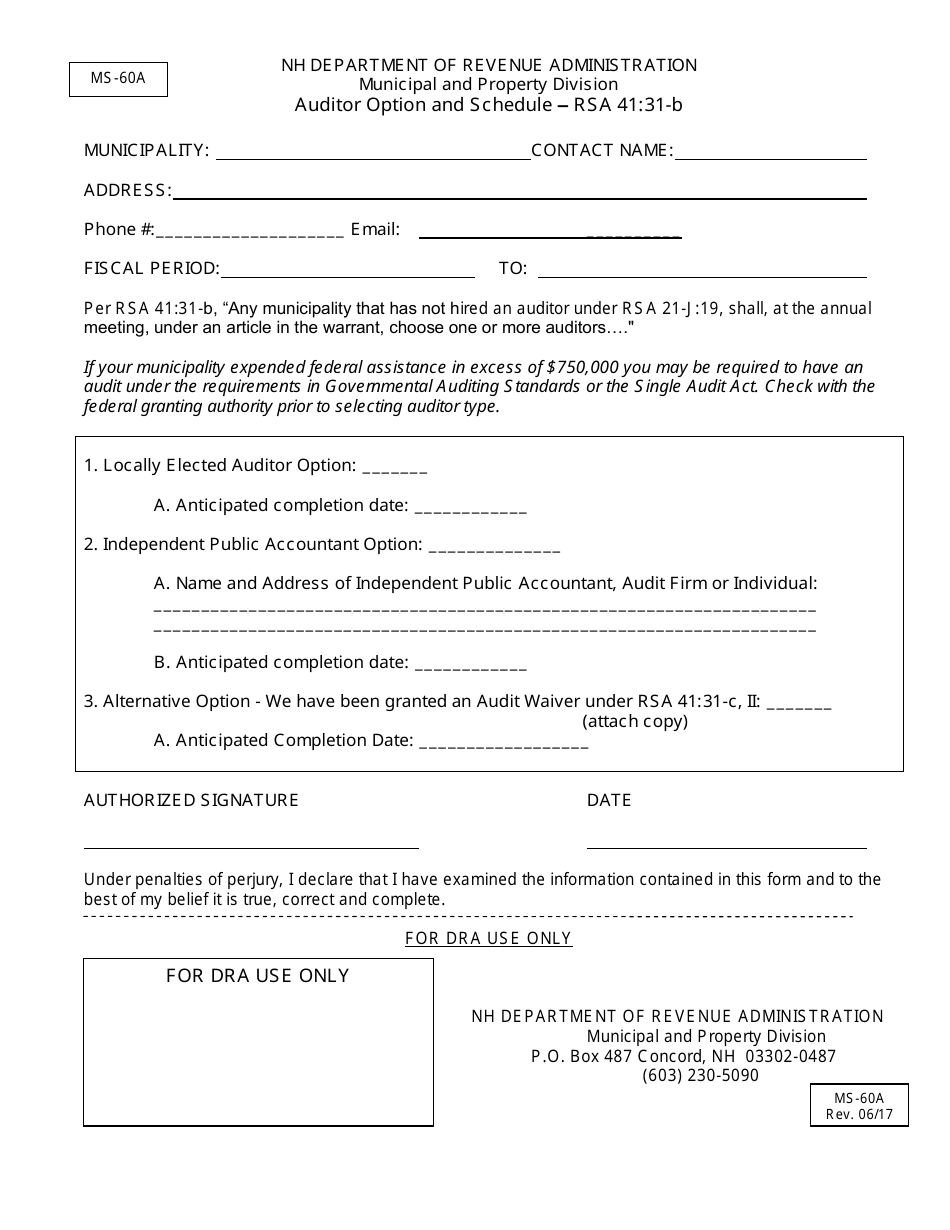

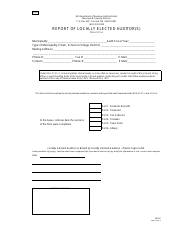

Form MS-60A Auditor Option and Schedule - New Hampshire

What Is Form MS-60A?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MS-60A Auditor Option and Schedule?

A: Form MS-60A Auditor Option and Schedule is a document used in New Hampshire for filing an auditor's report.

Q: Who needs to file Form MS-60A?

A: Any entity that is required to have an audit performed by a certified public accountant in New Hampshire needs to file Form MS-60A.

Q: What information is required to complete Form MS-60A?

A: Form MS-60A requires information about the auditor, the entity being audited, the audit period, and the auditor's report.

Q: Is there a deadline for filing Form MS-60A?

A: Yes, Form MS-60A must be filed within 180 days after the close of the audit period.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MS-60A by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.