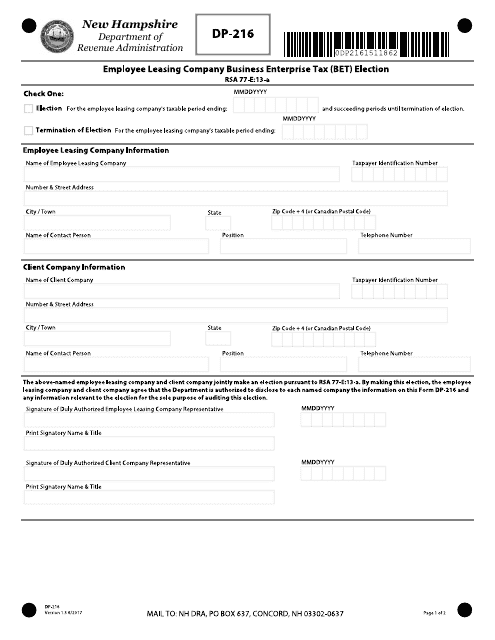

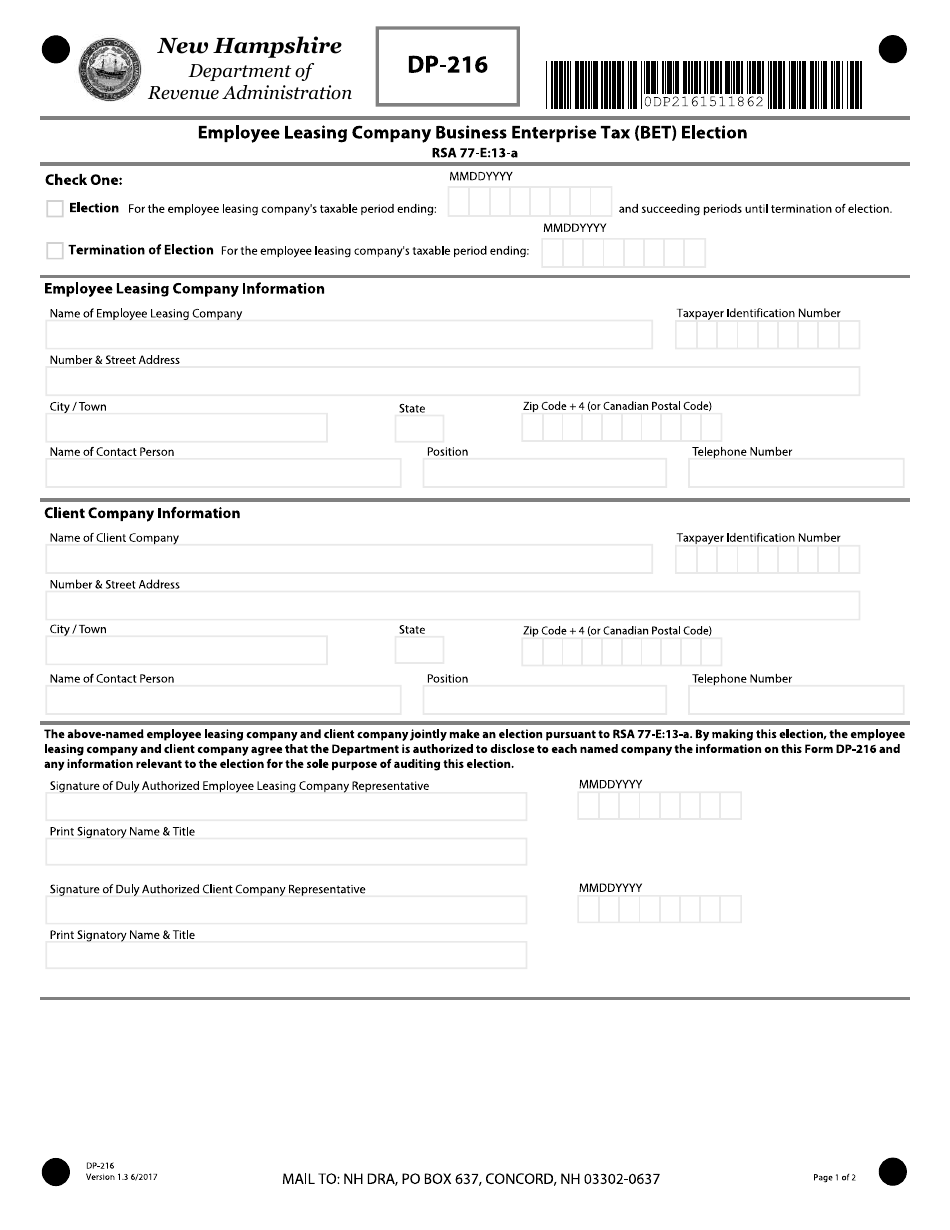

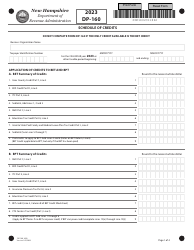

Form DP-216 Employee Leasing Company Business Enterprise Tax (Bet) Election - New Hampshire

What Is Form DP-216?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-216?

A: Form DP-216 is the Employee Leasing CompanyBusiness Enterprise Tax (Bet) Election form for New Hampshire.

Q: What is the purpose of Form DP-216?

A: The purpose of Form DP-216 is to elect to be subject to the Business Enterprise Tax (Bet) as an employee leasing company in New Hampshire.

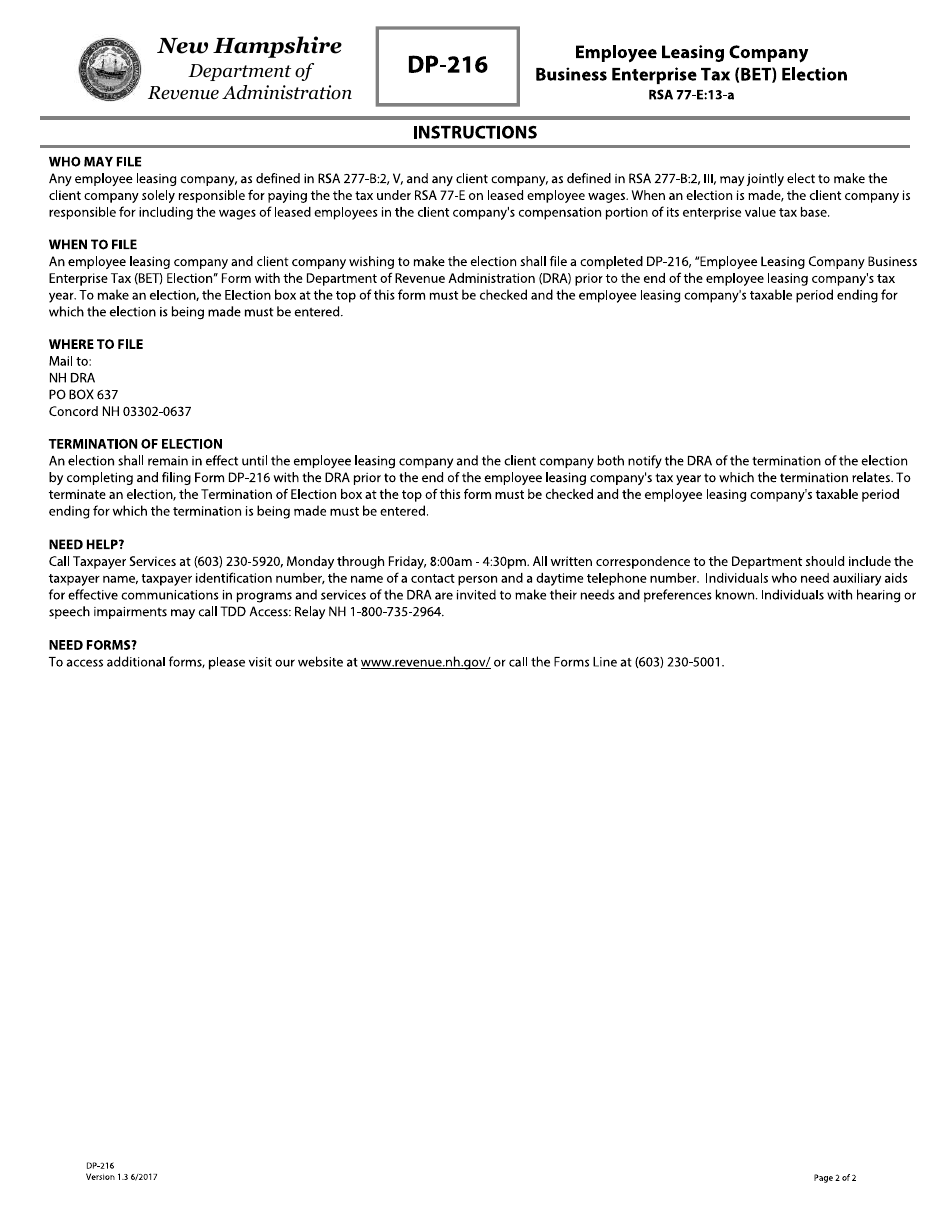

Q: Who is required to file Form DP-216?

A: Employee leasing companies in New Hampshire are required to file Form DP-216 to elect to be subject to the Business Enterprise Tax (Bet).

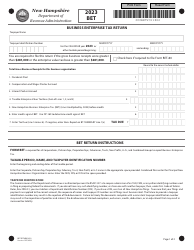

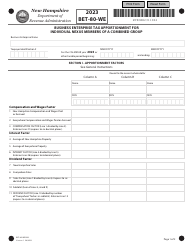

Q: What is the Business Enterprise Tax (Bet) in New Hampshire?

A: The Business Enterprise Tax (Bet) is a tax imposed on certain entities engaged in business activities in New Hampshire.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-216 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.