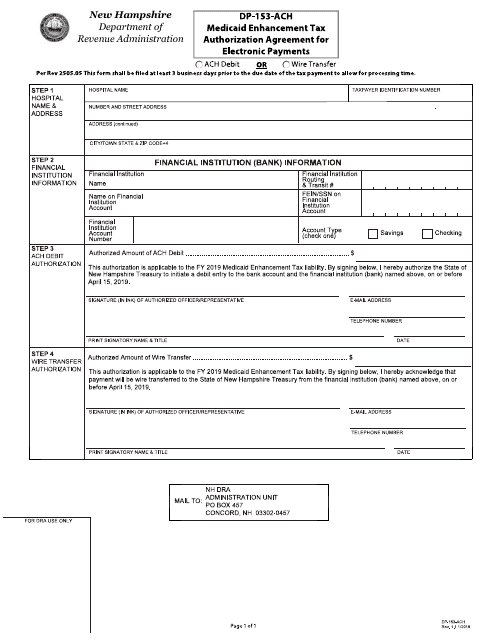

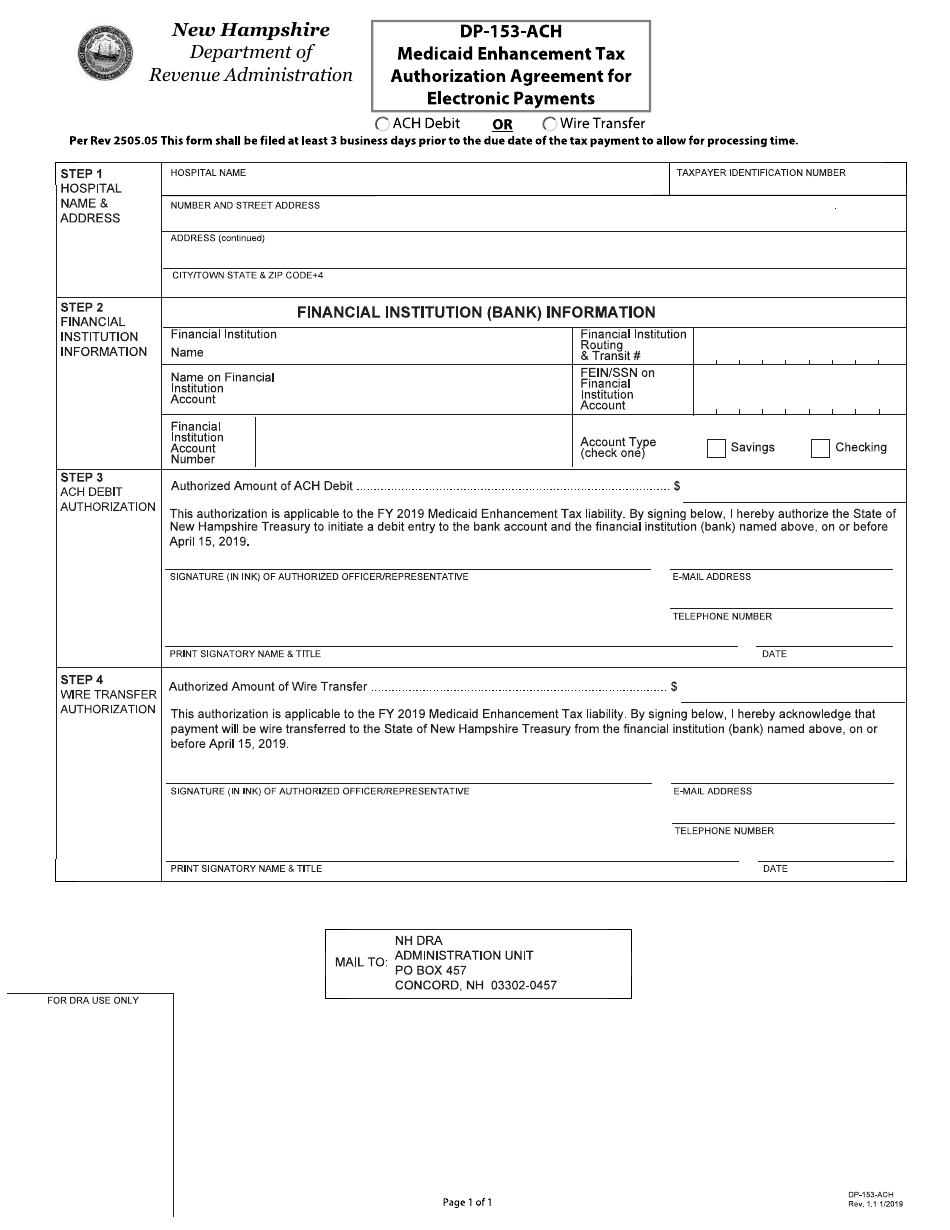

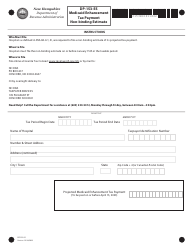

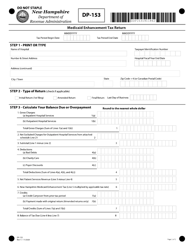

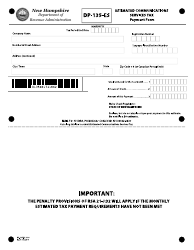

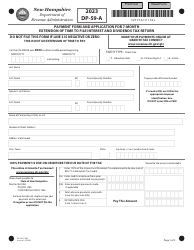

Form DP-153-ACH Medicaid Enhancement Tax Authorization Agreement for Electronic Payments - New Hampshire

What Is Form DP-153-ACH?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-153-ACH?

A: Form DP-153-ACH is an authorization agreement for electronic payments related to the Medicaid Enhancement Tax in New Hampshire.

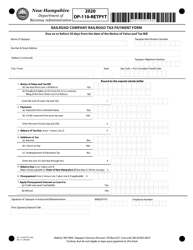

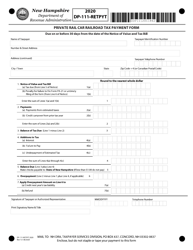

Q: What is the Medicaid Enhancement Tax?

A: The Medicaid Enhancement Tax is a tax imposed on certain healthcare providers in New Hampshire to help fund the state's Medicaid program.

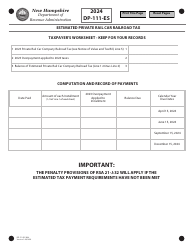

Q: Why do I need to complete Form DP-153-ACH?

A: You need to complete Form DP-153-ACH in order to authorize electronic payments for the Medicaid Enhancement Tax.

Q: What information is required on Form DP-153-ACH?

A: Form DP-153-ACH requires you to provide your business information, banking details, and authorization for electronic payments.

Q: Are there any fees associated with electronic payments?

A: No, there are no additional fees for electronic payments. However, your bank may have its own charges for processing the transactions.

Q: When is the deadline for submitting Form DP-153-ACH?

A: The deadline for submitting Form DP-153-ACH may vary. It is important to check the instructions provided by the New Hampshire Department of Revenue Administration.

Q: What should I do if I have additional questions or need assistance with Form DP-153-ACH?

A: If you have additional questions or need assistance with Form DP-153-ACH, you should contact the New Hampshire Department of Revenue Administration directly.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-153-ACH by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.