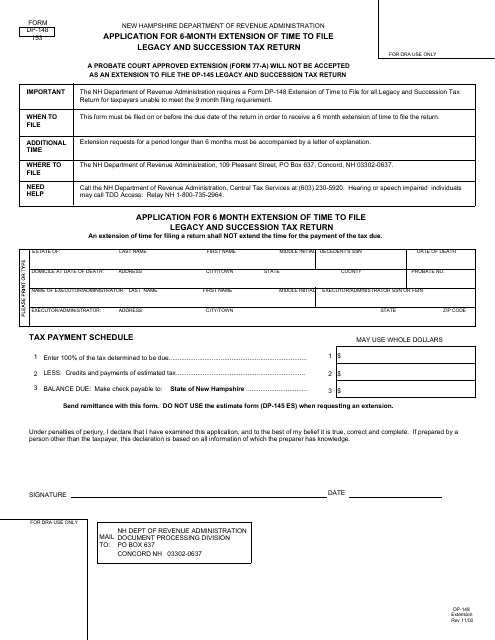

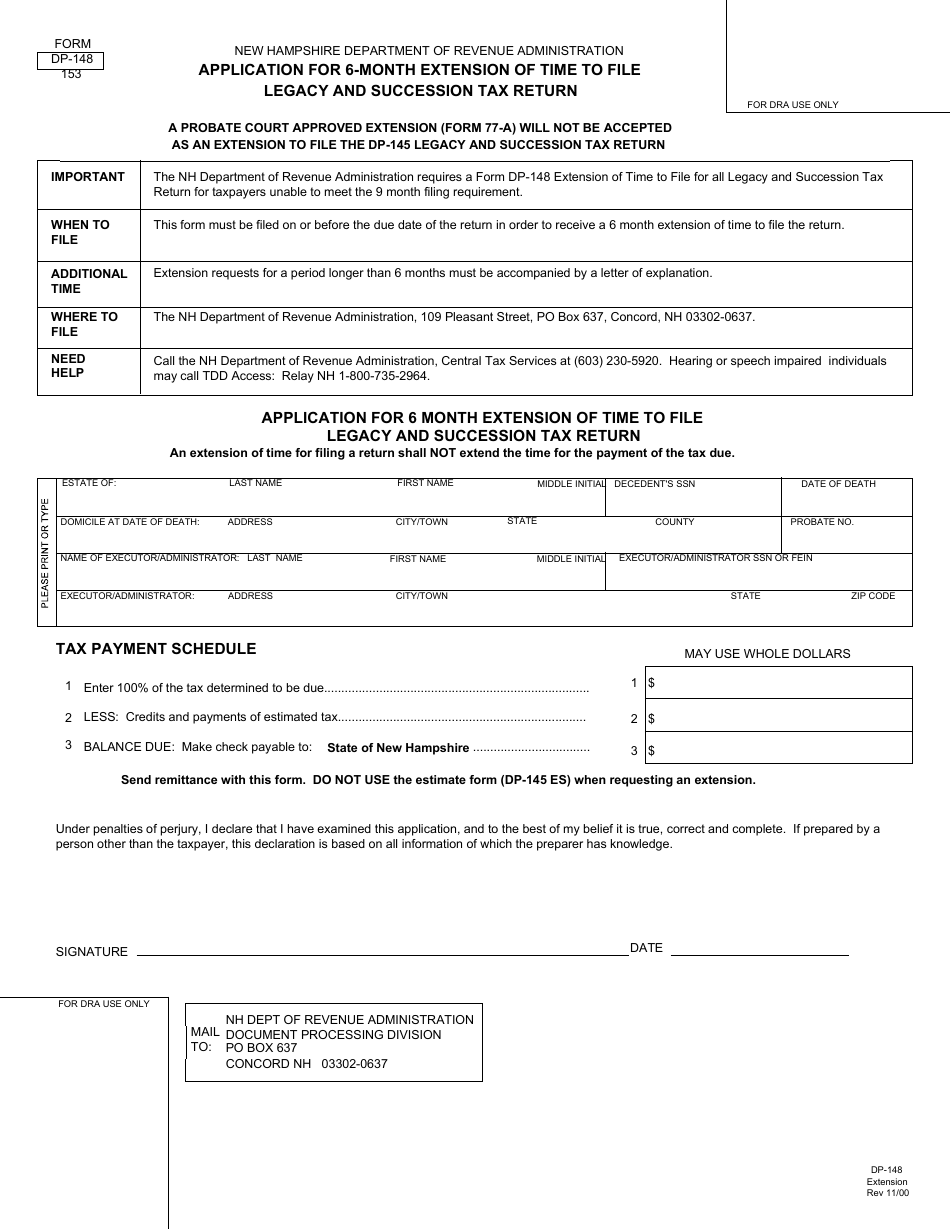

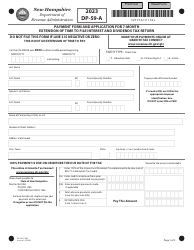

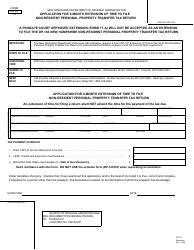

Form DP-148 Application for 6-month Extension of Time to File Legacy and Succession Tax Return - New Hampshire

What Is Form DP-148?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-148?

A: Form DP-148 is the application for a 6-month extension of time to file the Legacy and Succession Tax Return in New Hampshire.

Q: Who needs to file Form DP-148?

A: Anyone who needs an extension of time to file their Legacy and Succession Tax Return in New Hampshire.

Q: Why would someone need to file Form DP-148?

A: Someone may need to file Form DP-148 if they cannot file their Legacy and Succession Tax Return by the original due date.

Q: How long does the extension granted by Form DP-148 last?

A: The extension granted by Form DP-148 provides an additional 6 months to file the Legacy and Succession Tax Return.

Form Details:

- Released on November 1, 2000;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-148 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.