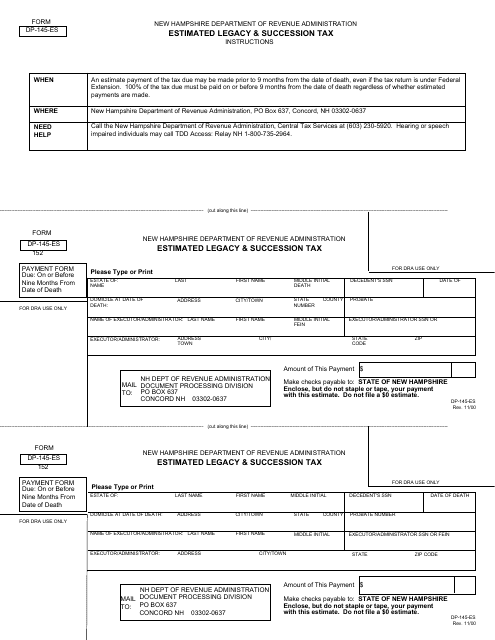

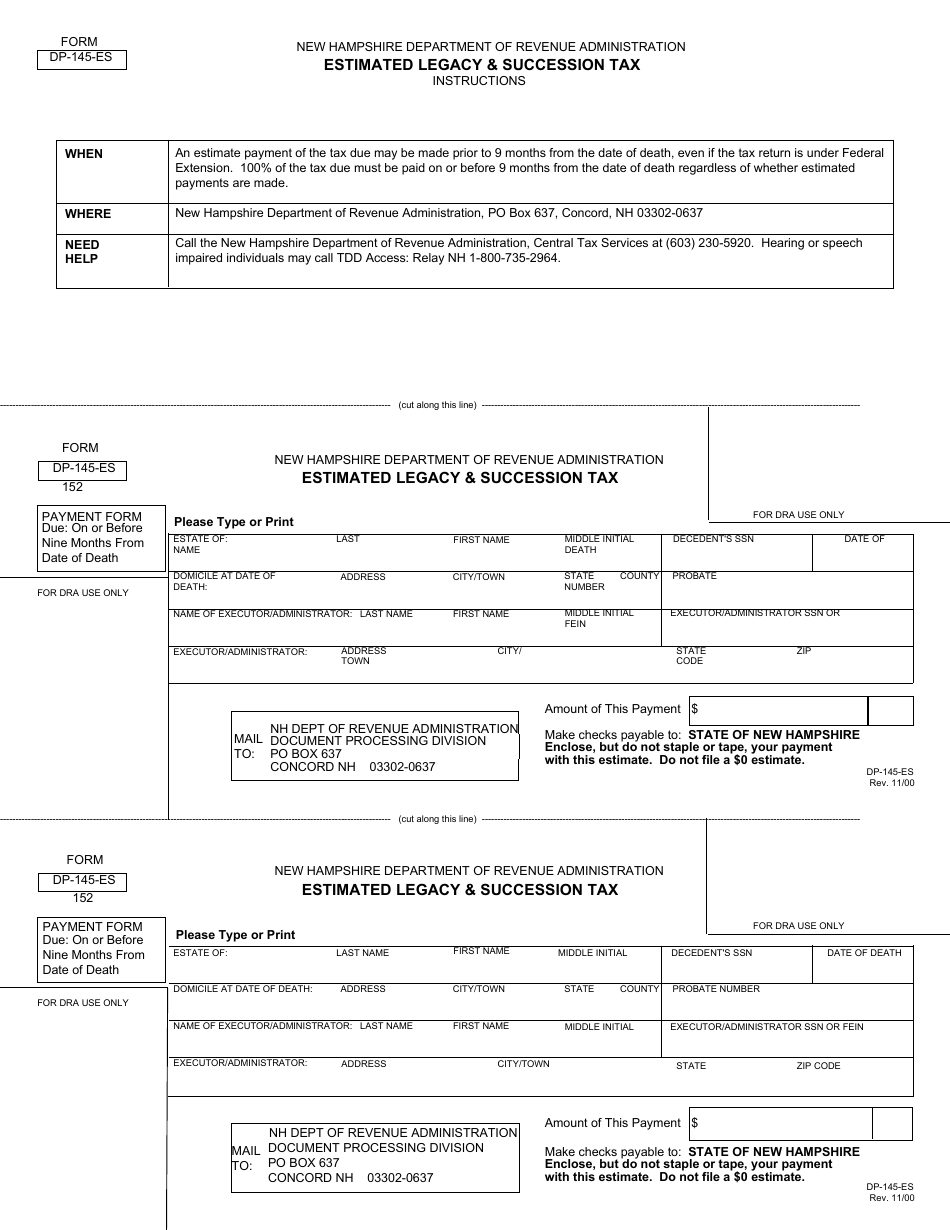

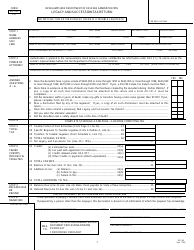

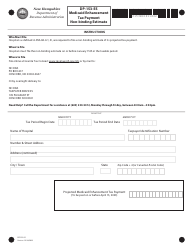

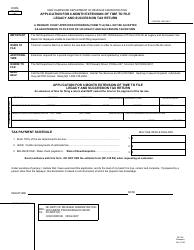

Form DP-145-ES Estimated Legacy & Succession Tax - New Hampshire

What Is Form DP-145-ES?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-145-ES?

A: Form DP-145-ES is the Estimated Legacy & Succession Tax form for the state of New Hampshire.

Q: What is the purpose of Form DP-145-ES?

A: The purpose of Form DP-145-ES is to estimate and pay the Legacy & Succession Tax owed to the state of New Hampshire.

Q: Who needs to file Form DP-145-ES?

A: Individuals who expect to owe Legacy & Succession Tax to the state of New Hampshire should file Form DP-145-ES.

Q: When should Form DP-145-ES be filed?

A: Form DP-145-ES should be filed on a quarterly basis, with estimated tax payments due on April 15th, June 15th, September 15th, and January 15th.

Q: What information is required to complete Form DP-145-ES?

A: Information required to complete Form DP-145-ES includes the taxpayer's name, address, social security number, and estimations of taxable legacy and succession assets.

Q: Are there any penalties for late filing or non-payment?

A: Yes, there may be penalties for late filing or non-payment of the Legacy & Succession Tax. It is important to file and pay on time to avoid penalties and interest charges.

Q: Is there a minimum threshold for Legacy & Succession Tax?

A: Yes, the Legacy & Succession Tax only applies if the value of the taxable legacy and succession assets exceeds $100,000.

Form Details:

- Released on November 1, 2000;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DP-145-ES by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.