This version of the form is not currently in use and is provided for reference only. Download this version of

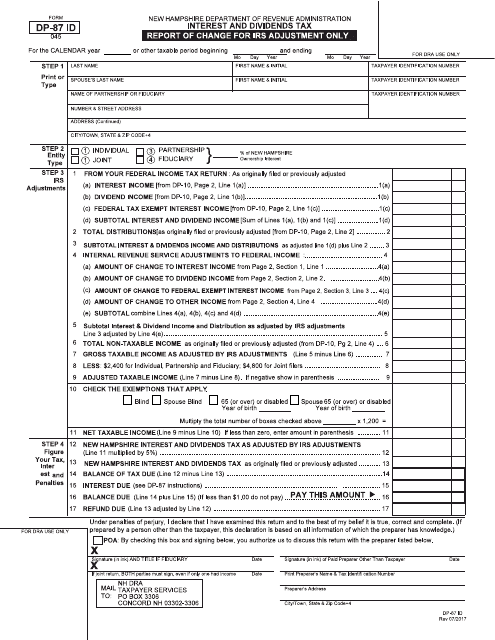

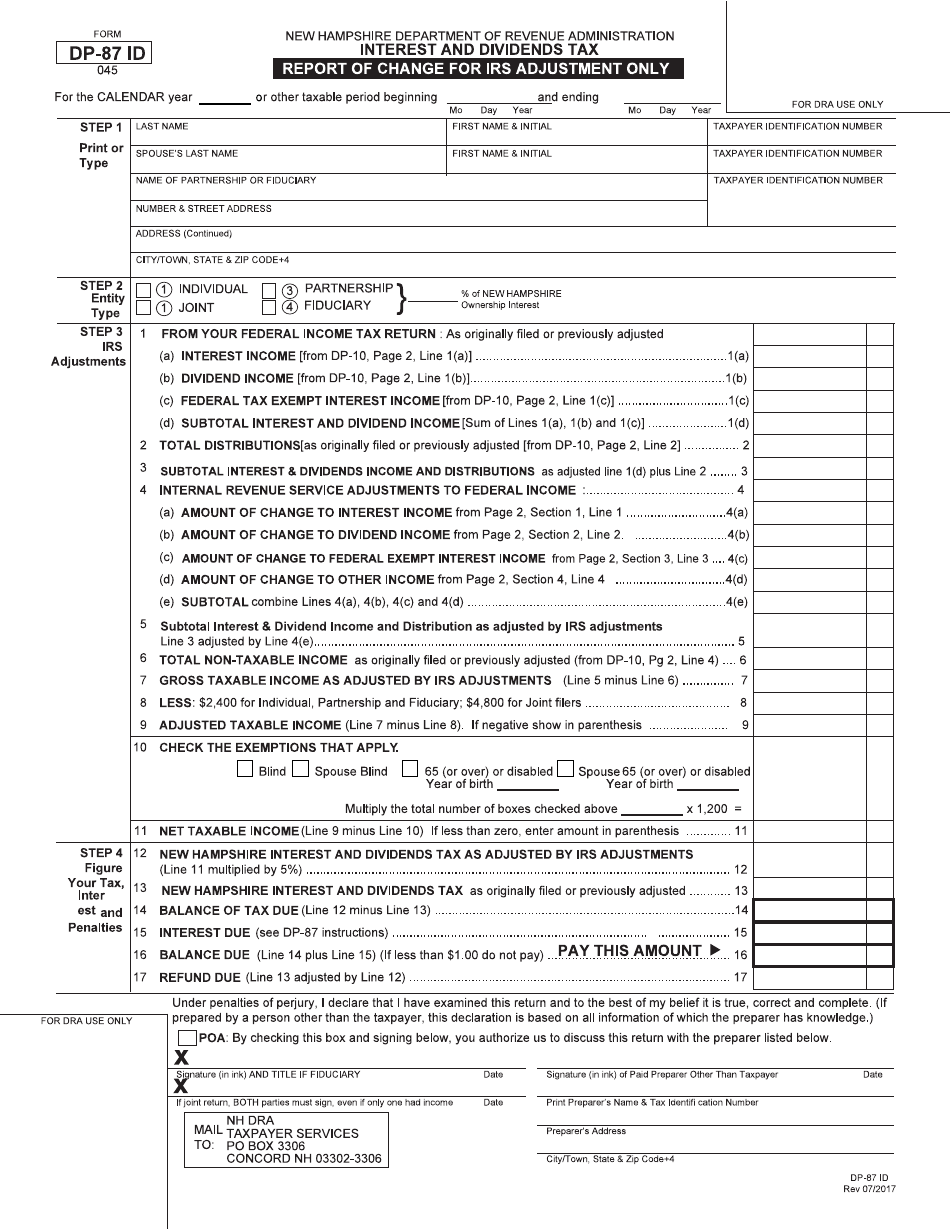

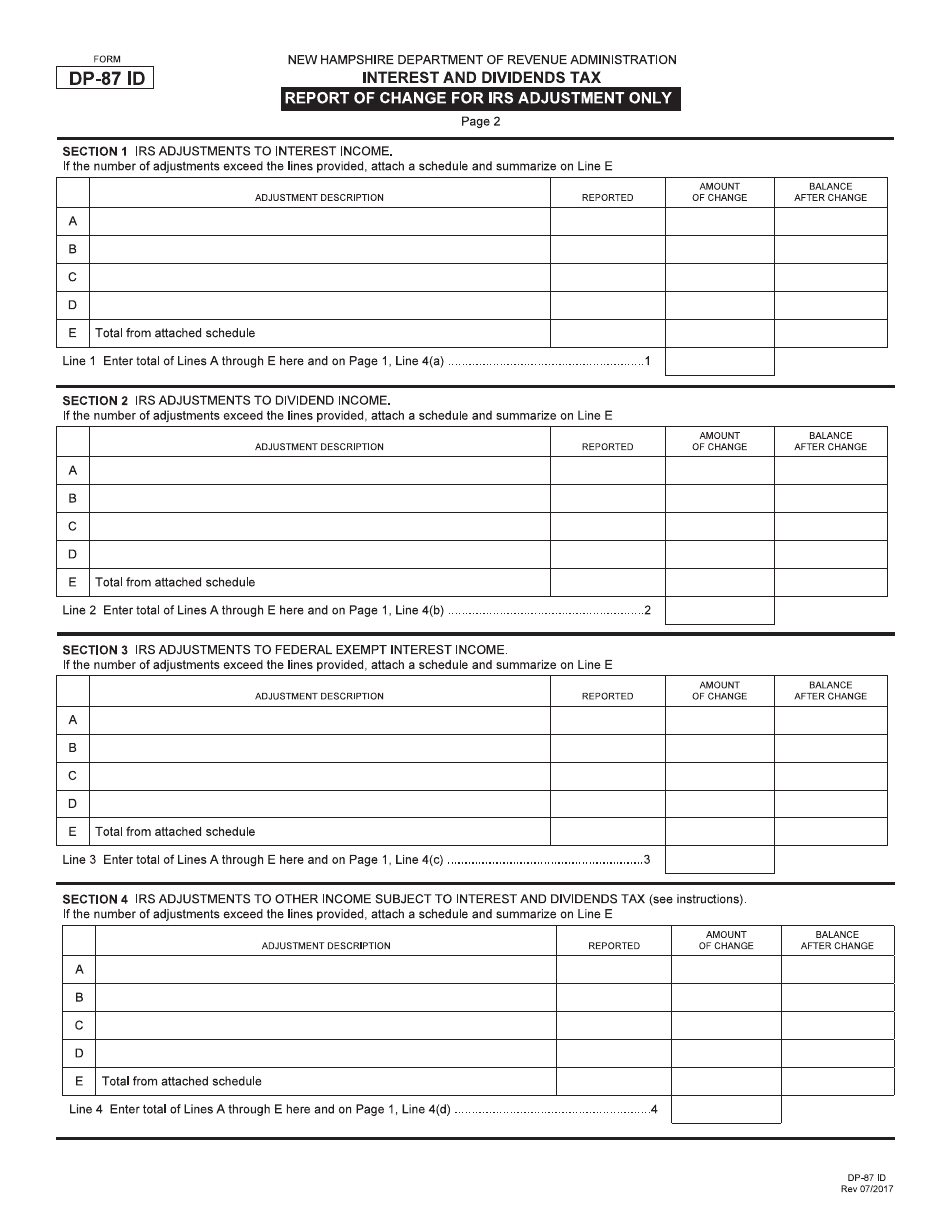

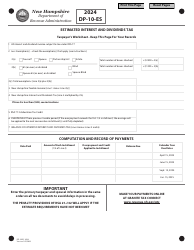

Form DP-87 ID

for the current year.

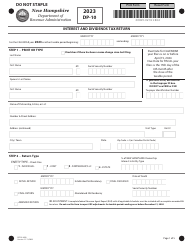

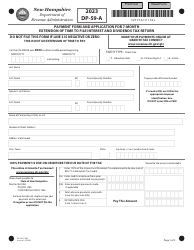

Form DP-87 ID Report of Change (Roc) Interest and Dividends - New Hampshire

What Is Form DP-87 ID?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-87?

A: Form DP-87 is the Report of Change (ROC) for Interest and Dividends in New Hampshire.

Q: What is the purpose of Form DP-87?

A: The purpose of Form DP-87 is to report any changes in interest and dividends for tax purposes in New Hampshire.

Q: Who needs to file Form DP-87?

A: Anyone who has had changes in their interest and dividend income in New Hampshire needs to file Form DP-87.

Q: When is the deadline for filing Form DP-87?

A: The deadline for filing Form DP-87 is April 15th of each year.

Q: What happens if I don't file Form DP-87?

A: If you fail to file Form DP-87, you may be subject to penalties and interest on any tax owed.

Q: Are there any exceptions to filing Form DP-87?

A: There are no exceptions to filing Form DP-87 if you have had changes in your interest and dividend income in New Hampshire.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-87 ID by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.