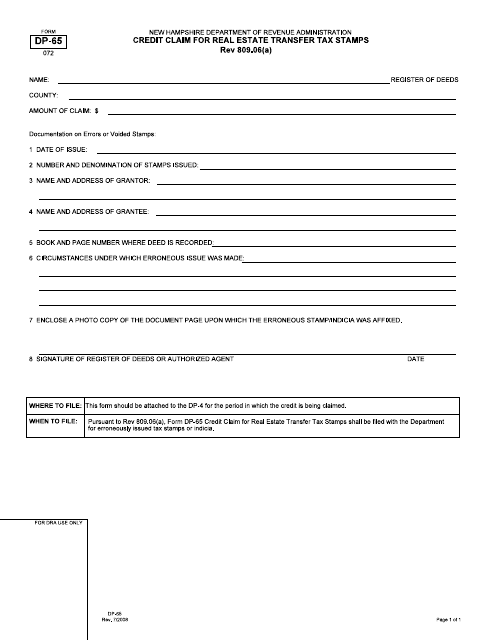

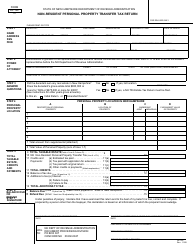

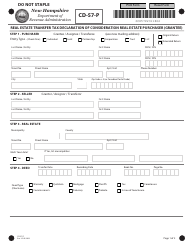

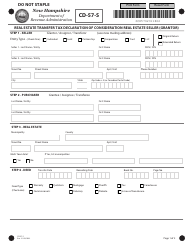

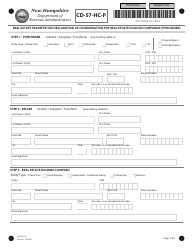

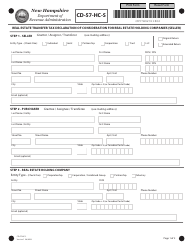

Form DP-65 Credit Claim for Real Estate Transfer Tax Stamps - New Hampshire

What Is Form DP-65?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DP-65?

A: Form DP-65 is the Credit Claim for Real Estate Transfer Tax Stamps in New Hampshire.

Q: What is the purpose of form DP-65?

A: The purpose of form DP-65 is to claim a credit for real estate transfer tax stamps.

Q: Who needs to fill out form DP-65?

A: Anyone who wishes to claim a credit for real estate transfer tax stamps in New Hampshire needs to fill out form DP-65.

Q: What is the real estate transfer tax in New Hampshire?

A: The real estate transfer tax is a tax imposed on the transfer of real property in New Hampshire.

Q: What are real estate transfer tax stamps?

A: Real estate transfer tax stamps are evidence of payment of the real estate transfer tax.

Q: How can I obtain form DP-65?

A: You can obtain form DP-65 from the New Hampshire Department of Revenue Administration.

Q: Are there any fees for filing form DP-65?

A: No, there are no fees for filing form DP-65.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DP-65 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.