This version of the form is not currently in use and is provided for reference only. Download this version of

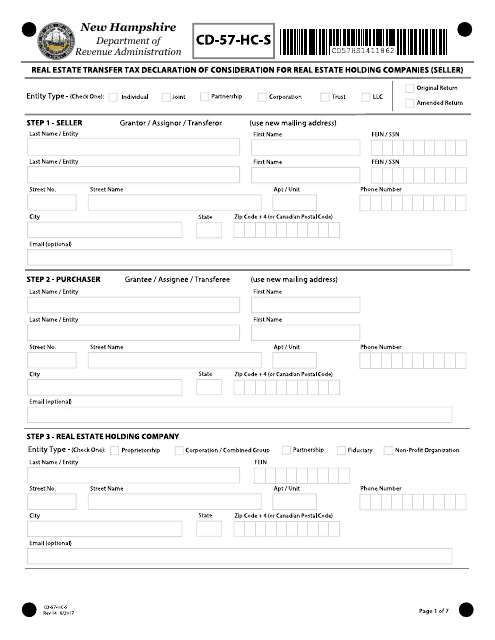

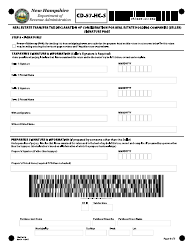

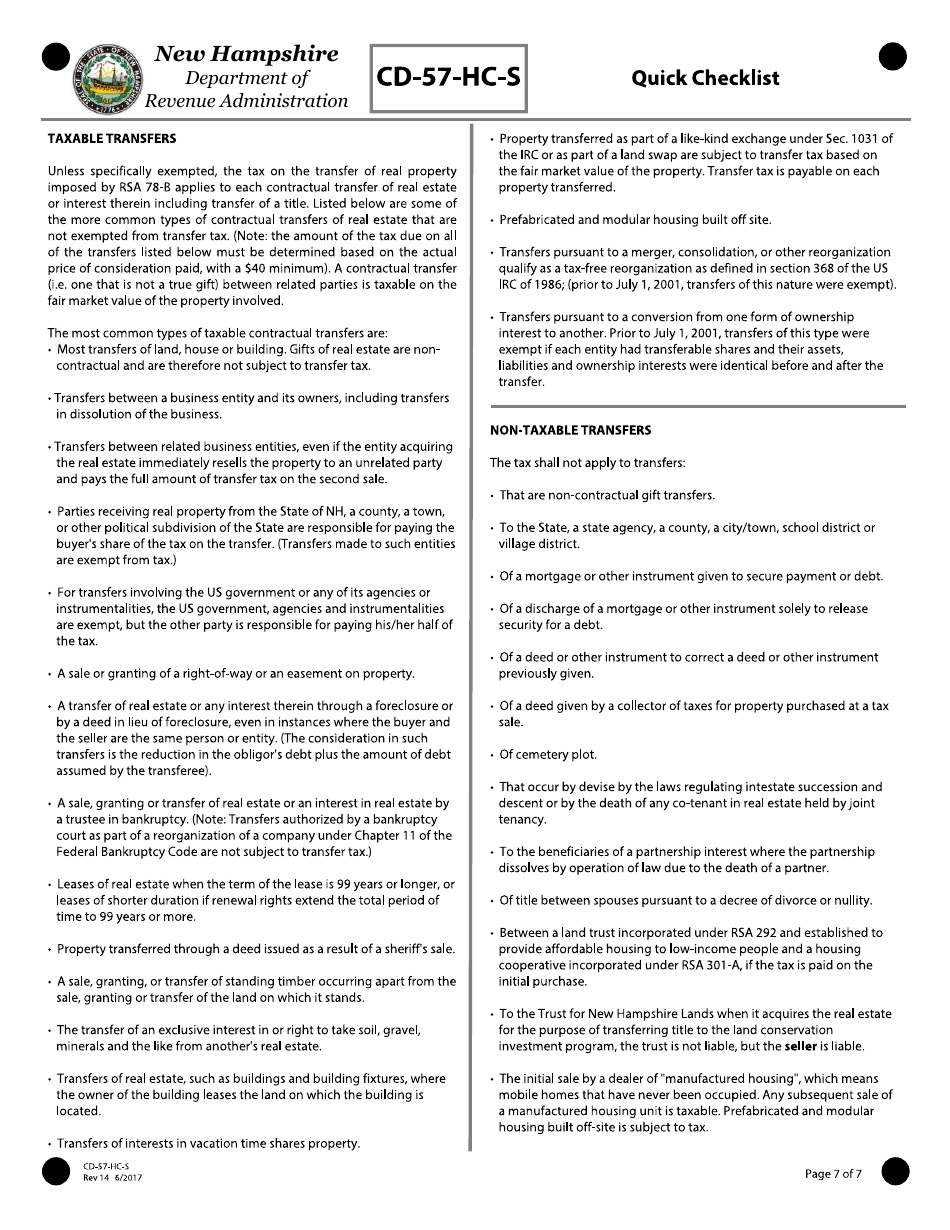

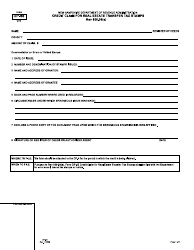

Form CD-57-HC-S

for the current year.

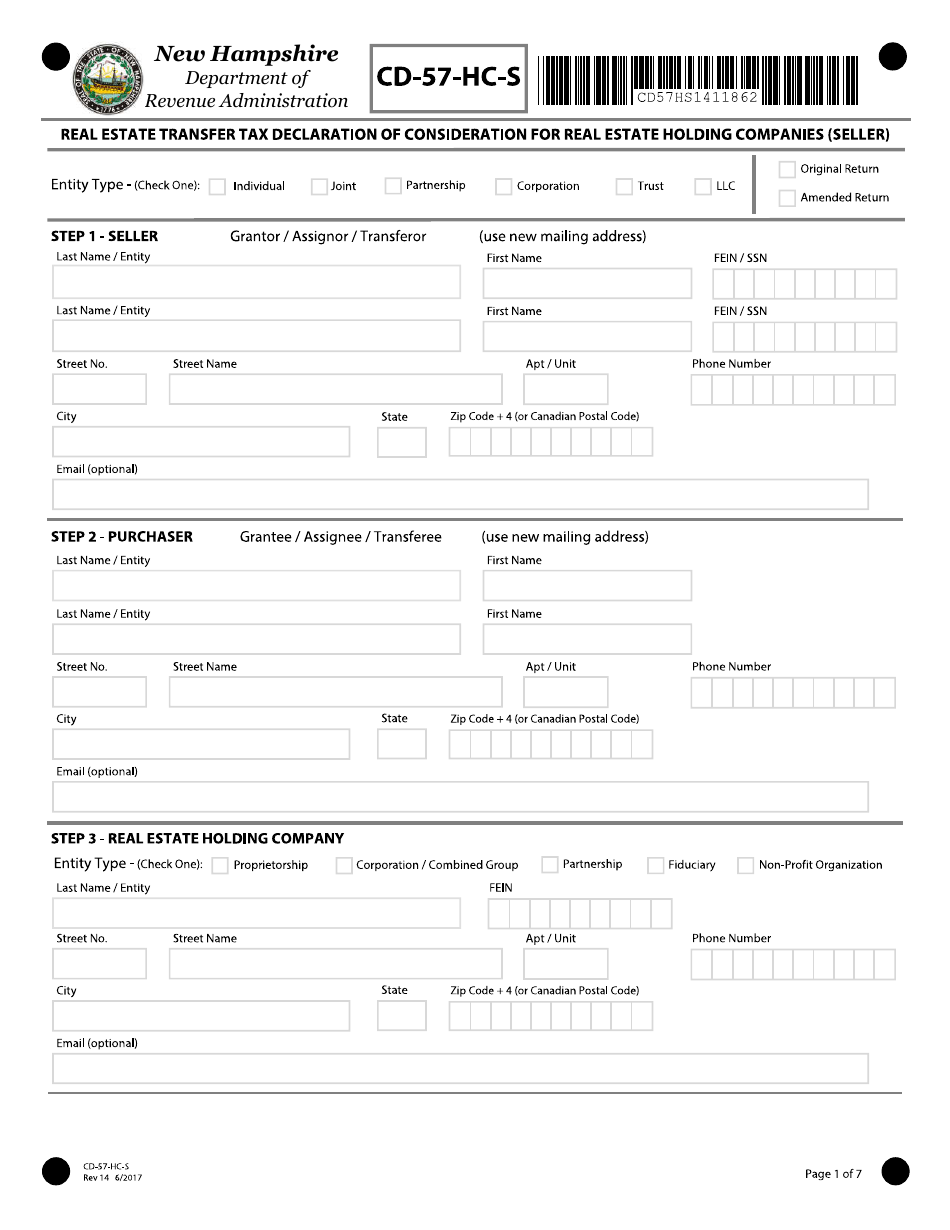

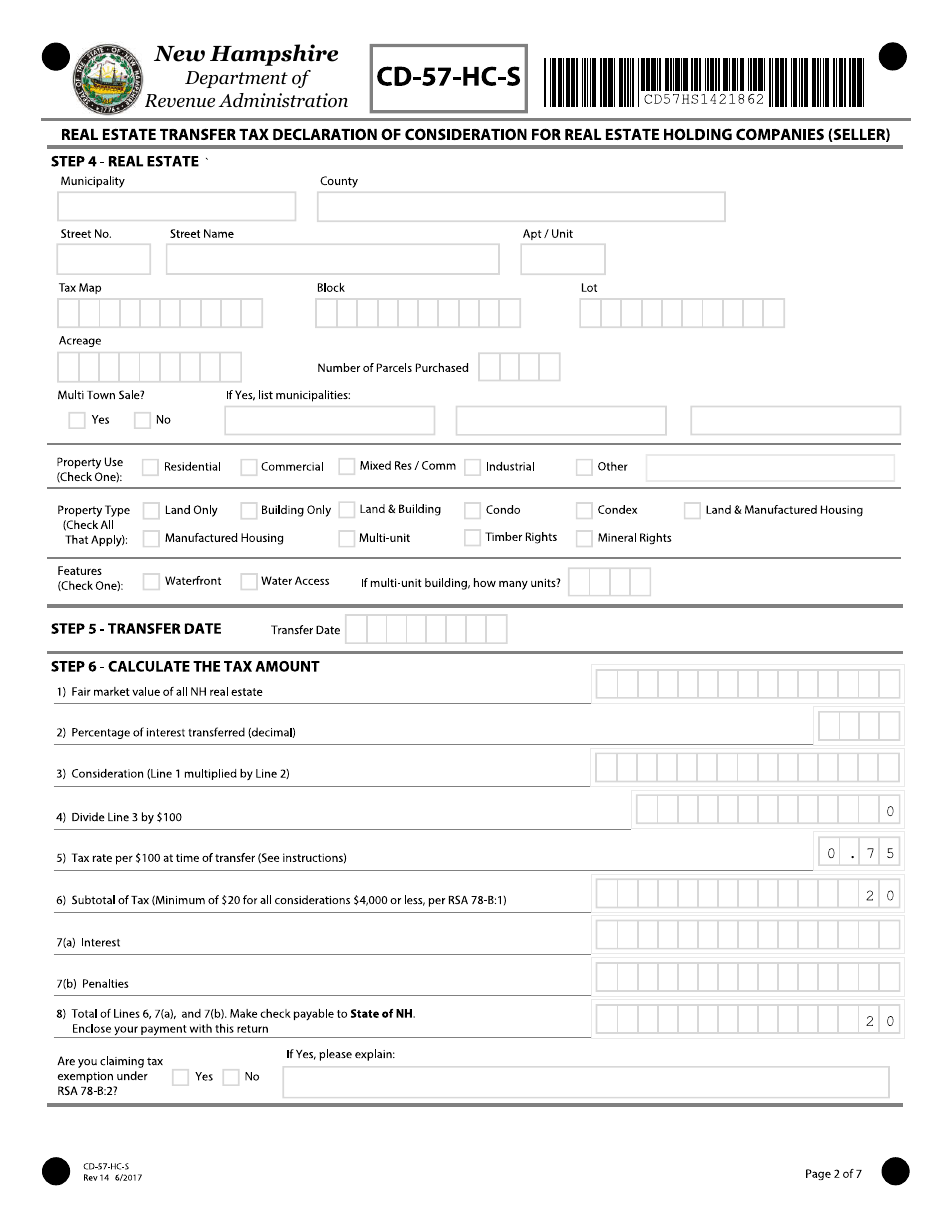

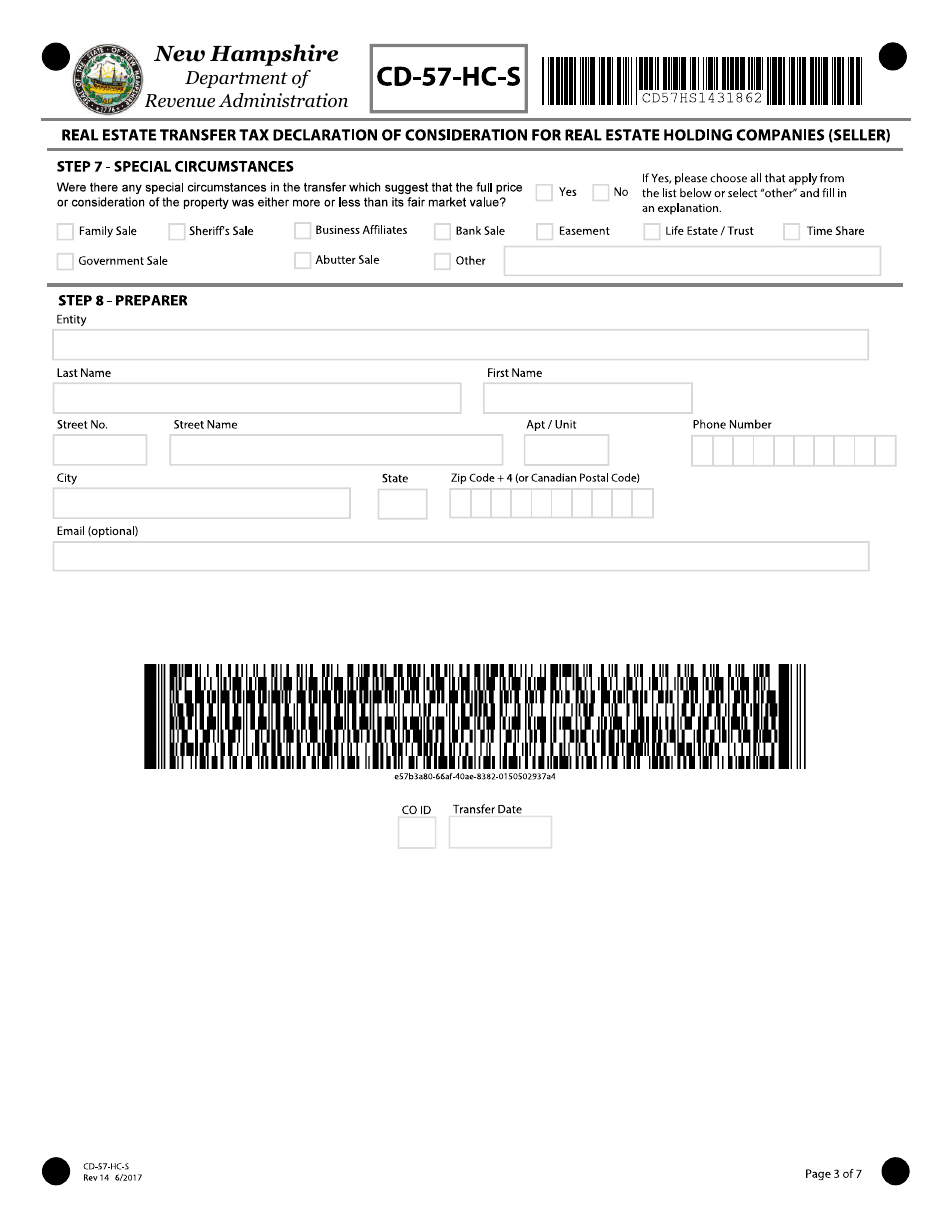

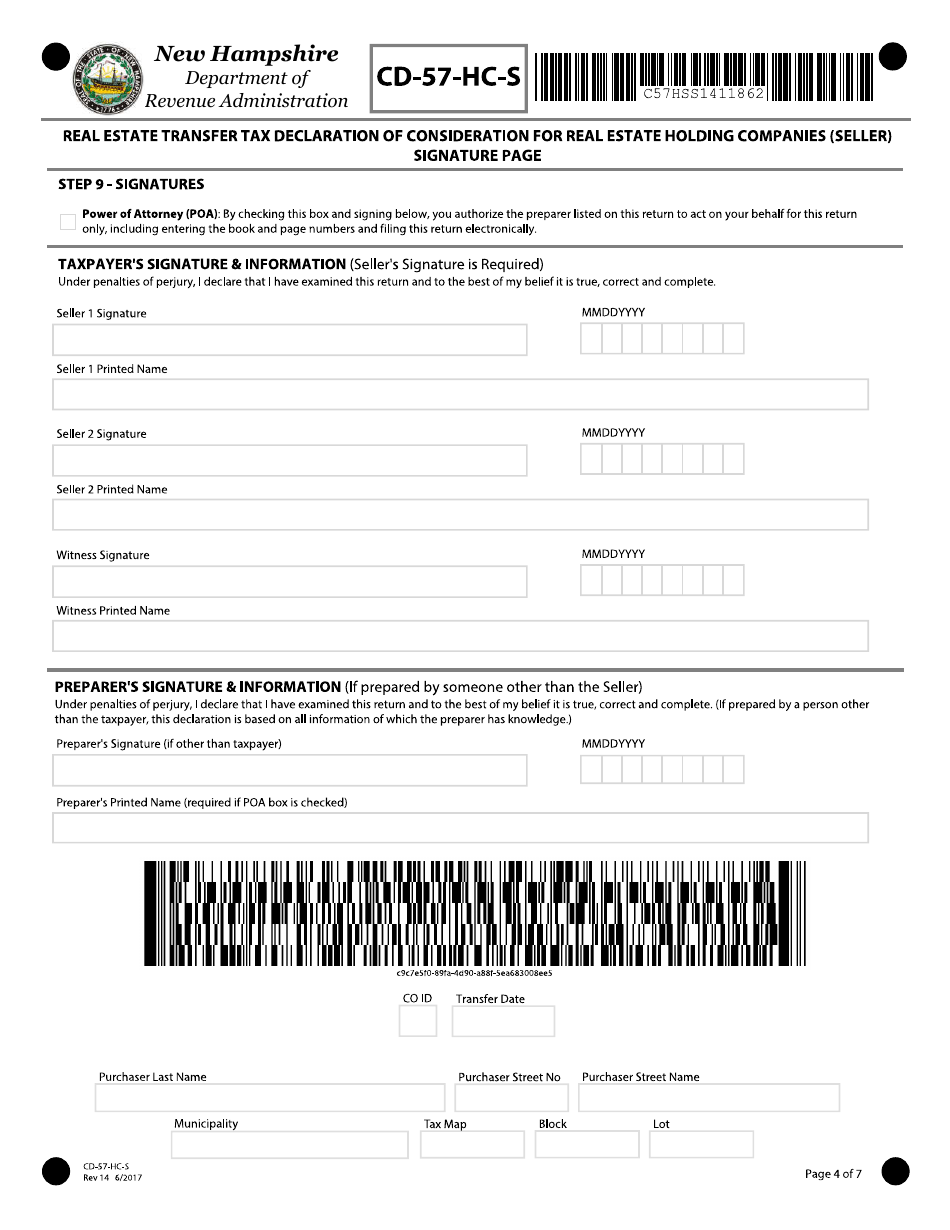

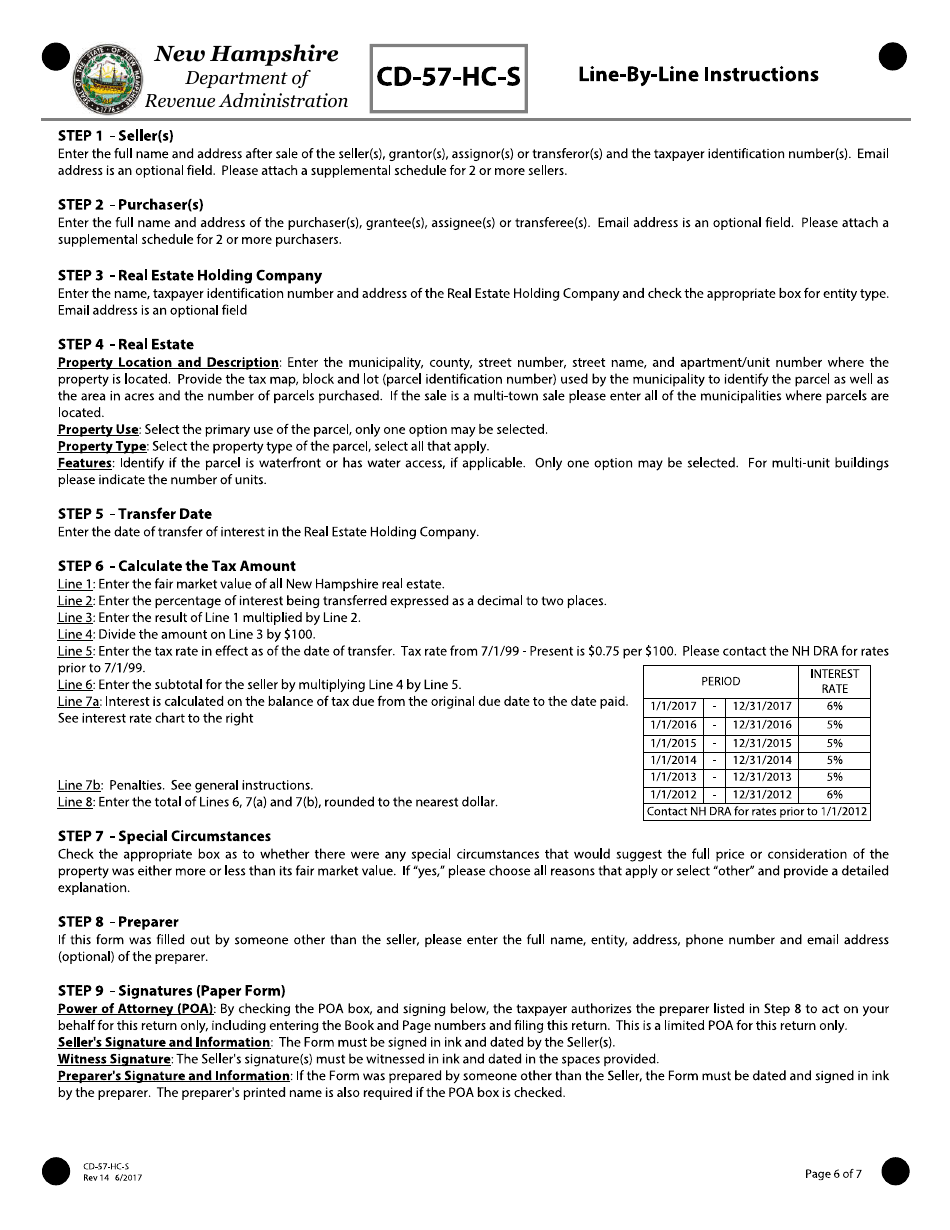

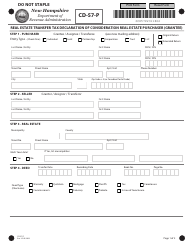

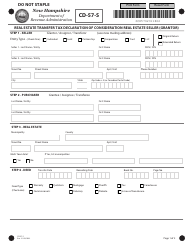

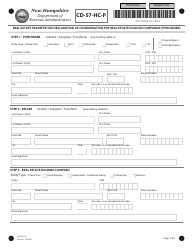

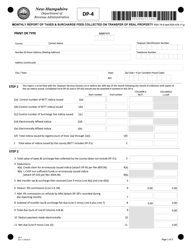

Form CD-57-HC-S Real Estate Transfer Tax Declaration of Consideration for Holding Companies (Seller) - New Hampshire

What Is Form CD-57-HC-S?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

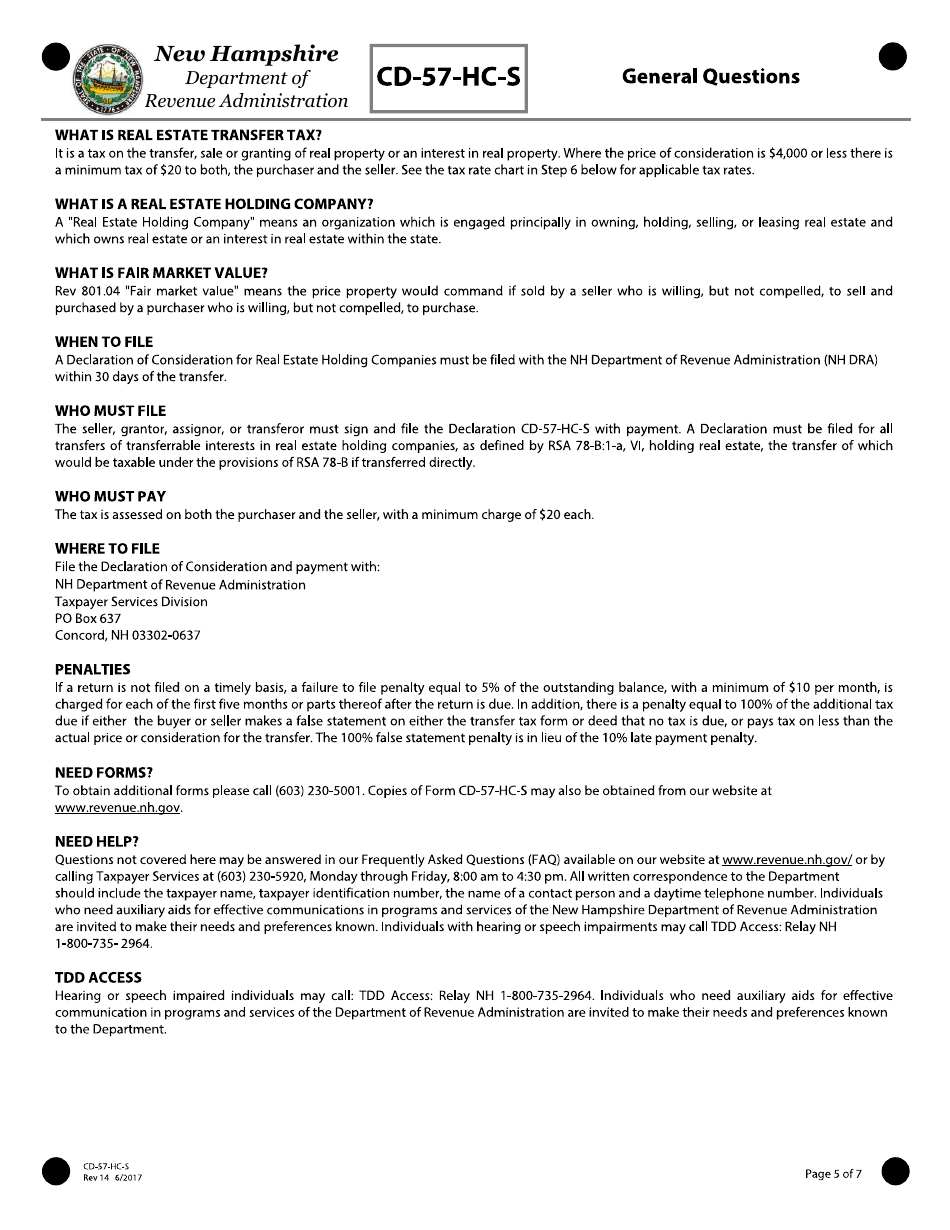

Q: What is Form CD-57-HC-S?

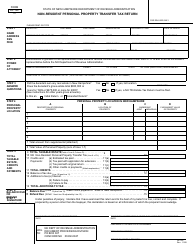

A: Form CD-57-HC-S is the Real Estate Transfer Tax Declaration of Consideration for Holding Companies (Seller) in New Hampshire.

Q: Who needs to fill out this form?

A: This form needs to be filled out by holding companies acting as sellers in a real estate transfer in New Hampshire.

Q: What is the purpose of Form CD-57-HC-S?

A: The purpose of this form is to declare the consideration (the purchase price or value of the property) for a real estate transfer involving a holding company.

Q: Are there any fees associated with filing this form?

A: Yes, there is a transfer tax fee that is based on the consideration declared on Form CD-57-HC-S.

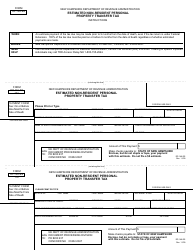

Q: What happens after I fill out this form?

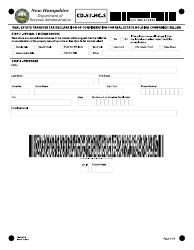

A: After you fill out this form, you must submit it to the New Hampshire Department of Revenue Administration along with the corresponding transfer tax payment.

Q: Are there any exemptions or special rules for holding companies?

A: Yes, there are certain exemptions and special rules for holding companies. It is recommended to consult with a tax professional or the Department of Revenue Administration for specific guidance.

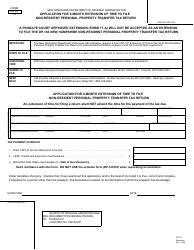

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-57-HC-S by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.