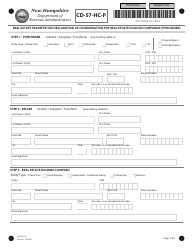

This version of the form is not currently in use and is provided for reference only. Download this version of

Form CD-57-S

for the current year.

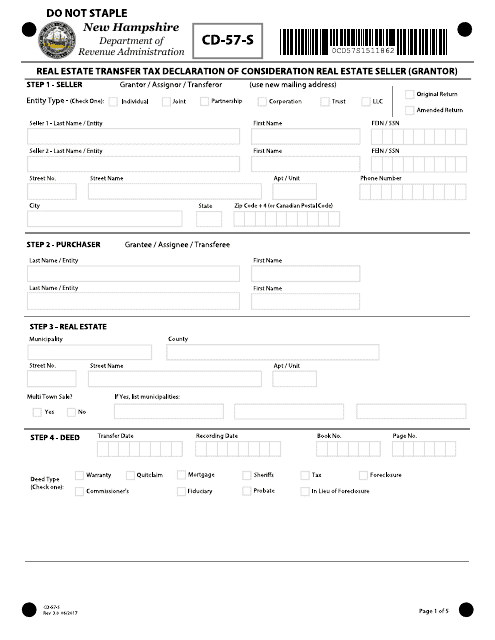

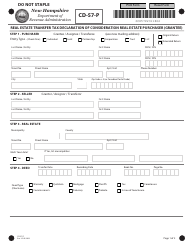

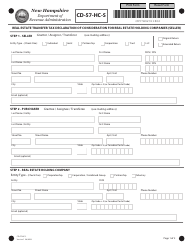

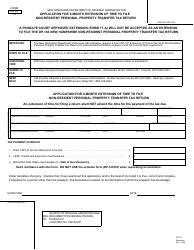

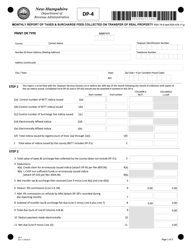

Form CD-57-S Real Estate Transfer Tax Declaration of Consideration Real Estate Seller (Grantor) - New Hampshire

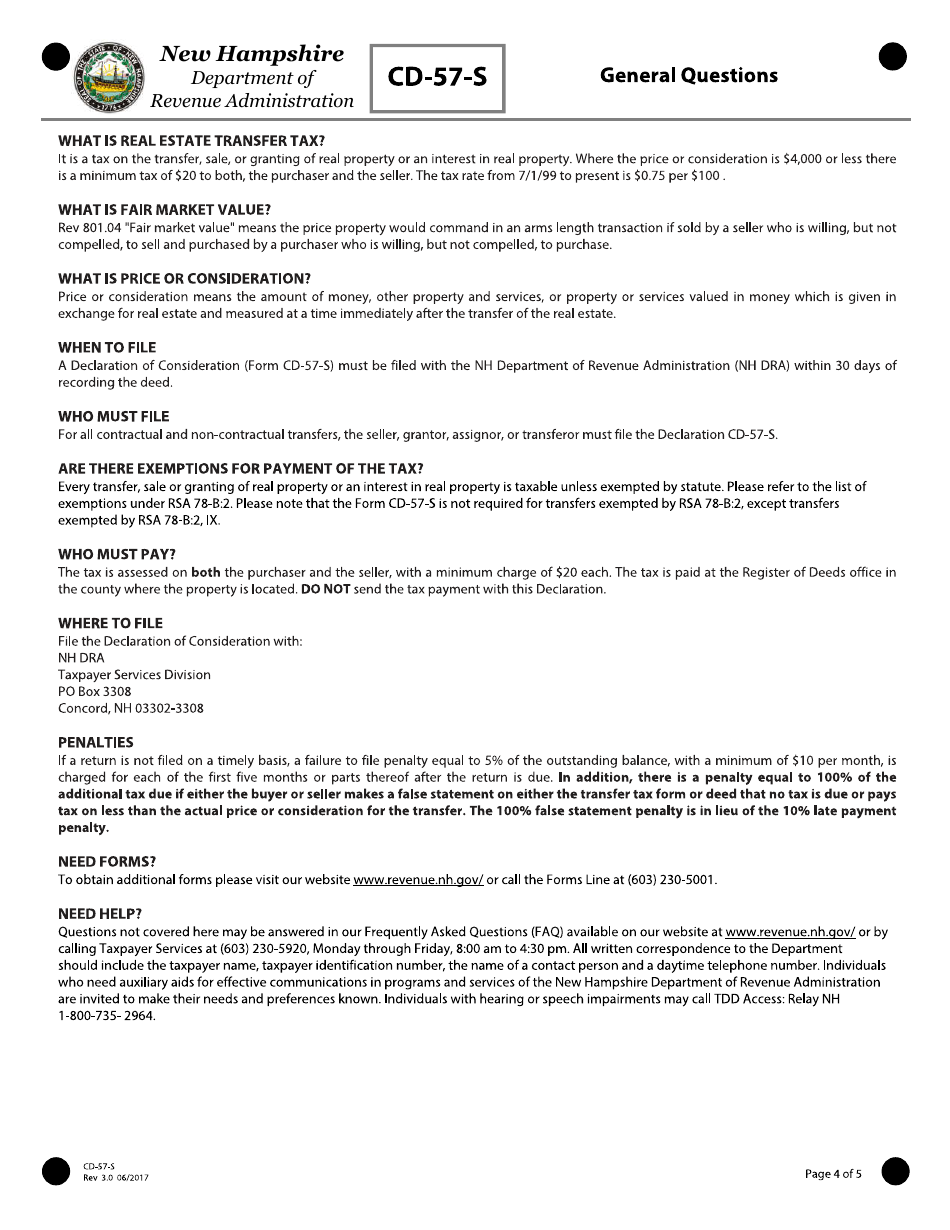

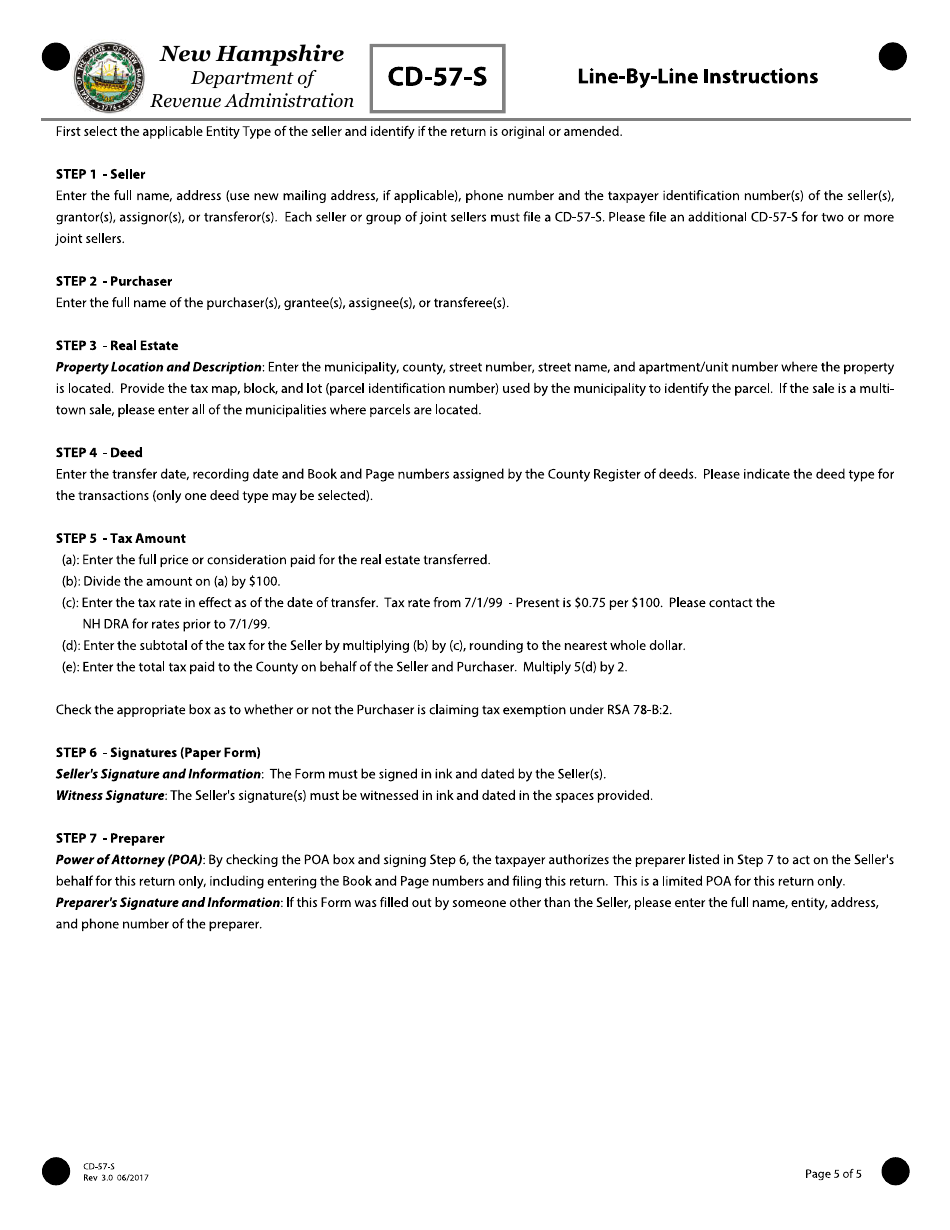

What Is Form CD-57-S?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

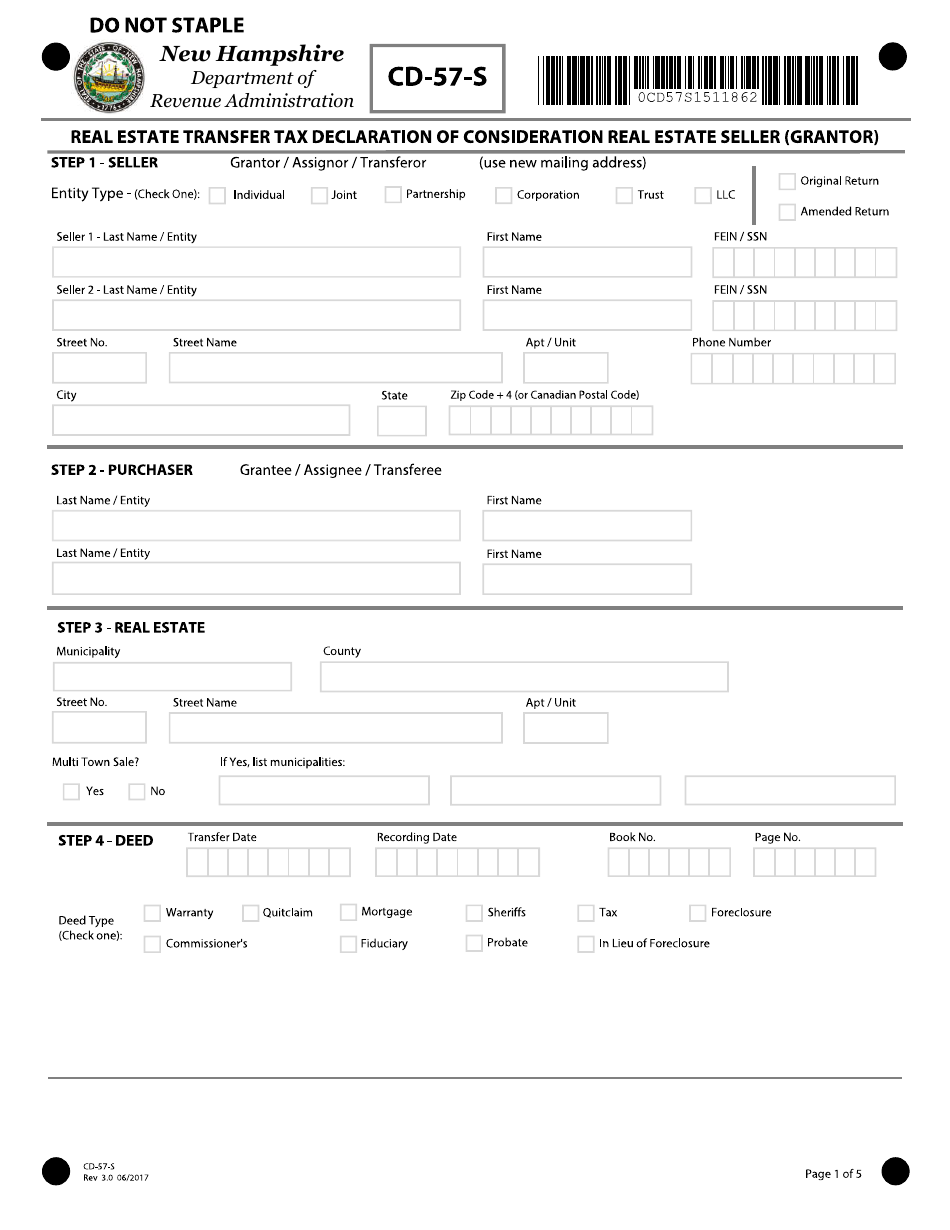

Q: What is Form CD-57-S?

A: Form CD-57-S is the Real Estate Transfer Tax Declaration of Consideration for the Real Estate Seller (Grantor) in New Hampshire.

Q: Who is required to fill out Form CD-57-S?

A: The Real Estate Seller (Grantor) in a real estate transaction in New Hampshire is required to fill out Form CD-57-S.

Q: What is the purpose of Form CD-57-S?

A: The purpose of Form CD-57-S is to declare the consideration amount for the real estate transaction.

Q: What is considered as consideration for a real estate transaction?

A: Consideration for a real estate transaction includes any form of payment, such as money, property, or services, exchanged between the parties involved.

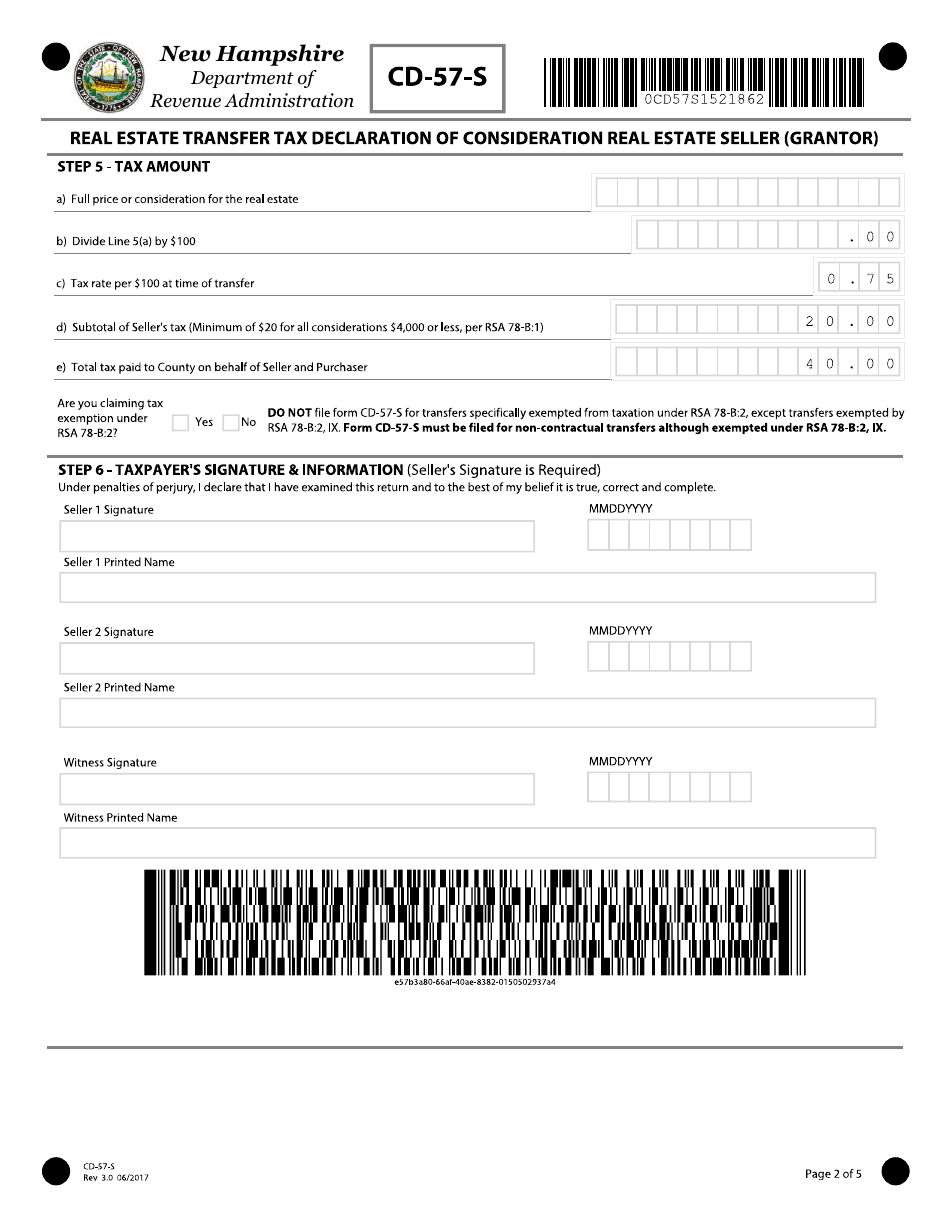

Q: Is there a fee for filing Form CD-57-S?

A: Yes, there is a fee associated with filing Form CD-57-S. The fee is based on the consideration amount declared on the form.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CD-57-S by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.