This version of the form is not currently in use and is provided for reference only. Download this version of

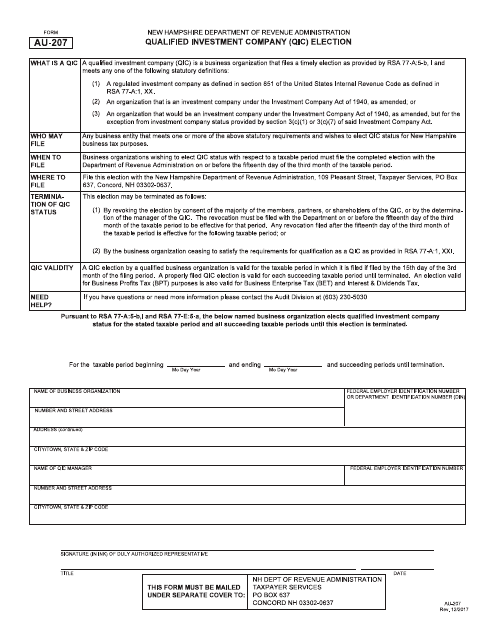

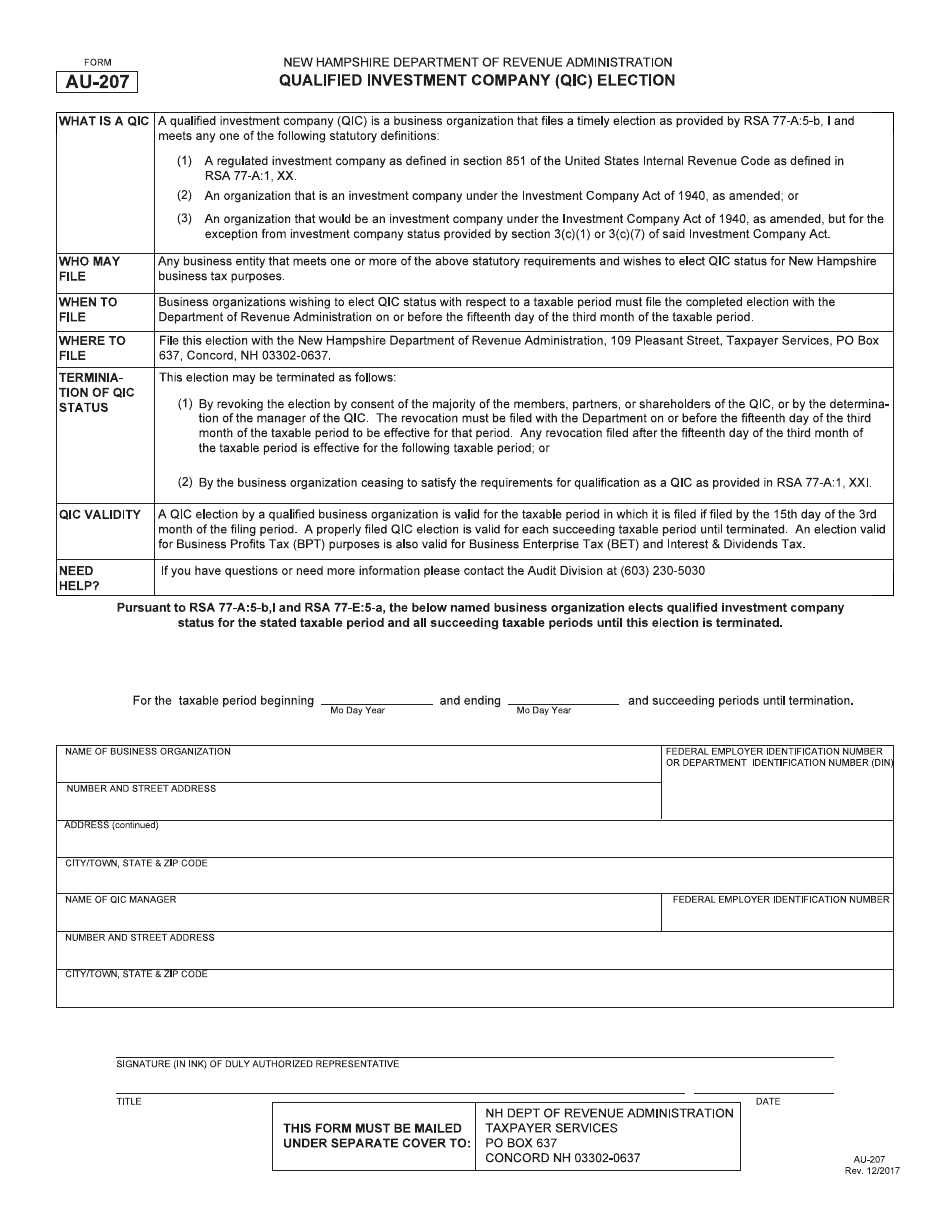

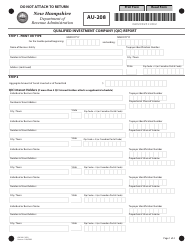

Form AU-207

for the current year.

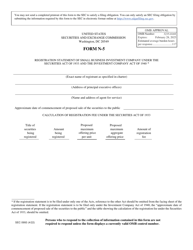

Form AU-207 Qualified Investment Company (Qic) Election - New Hampshire

What Is Form AU-207?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form AU-207?

A: Form AU-207 is the Qualified Investment Company (QIC) Election form in New Hampshire.

Q: What is a Qualified Investment Company (QIC) election?

A: A Qualified Investment Company (QIC) election is a form submitted by an investment company in New Hampshire to elect to be taxed at the entity level rather than passing the tax liability to its shareholders.

Q: Who needs to file Form AU-207 in New Hampshire?

A: Investment companies in New Hampshire that want to elect to be taxed as Qualified Investment Companies (QICs) need to file Form AU-207.

Q: How does filing Form AU-207 benefit an investment company?

A: Filing Form AU-207 allows an investment company to be taxed at the entity level, which can provide certain tax advantages.

Q: Can all investment companies elect to be Qualified Investment Companies (QICs)?

A: No, not all investment companies can elect to be Qualified Investment Companies (QICs). Certain eligibility criteria must be met.

Q: Are there any deadlines for filing Form AU-207?

A: Yes, Form AU-207 must be filed by the due date of the investment company's New Hampshire Business Profits Tax Return for the taxable year.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-207 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.