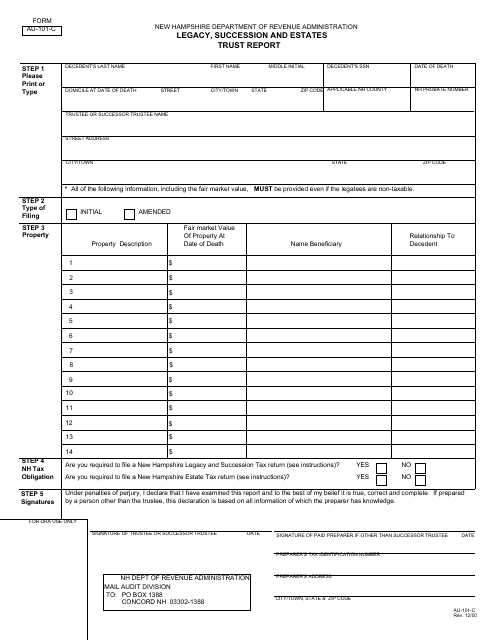

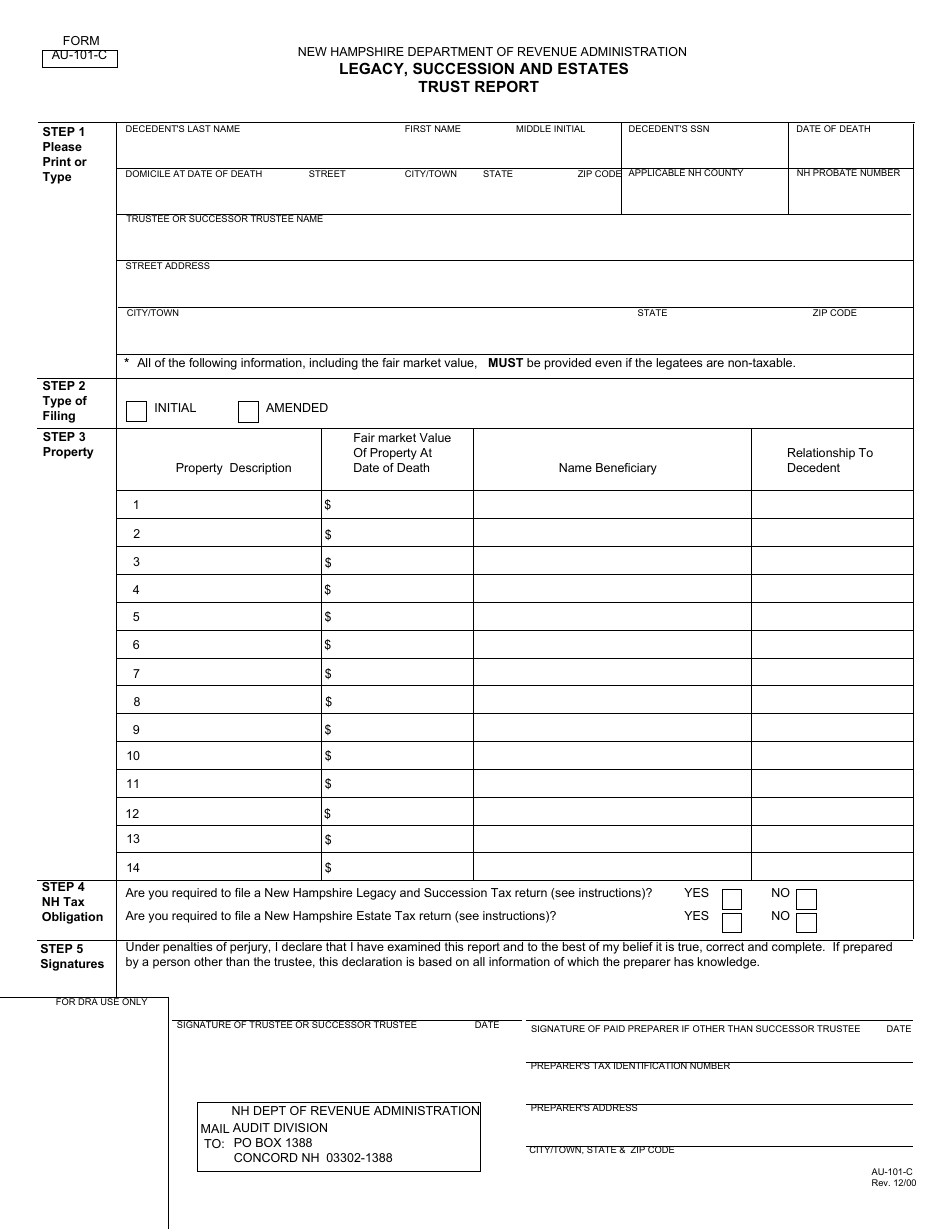

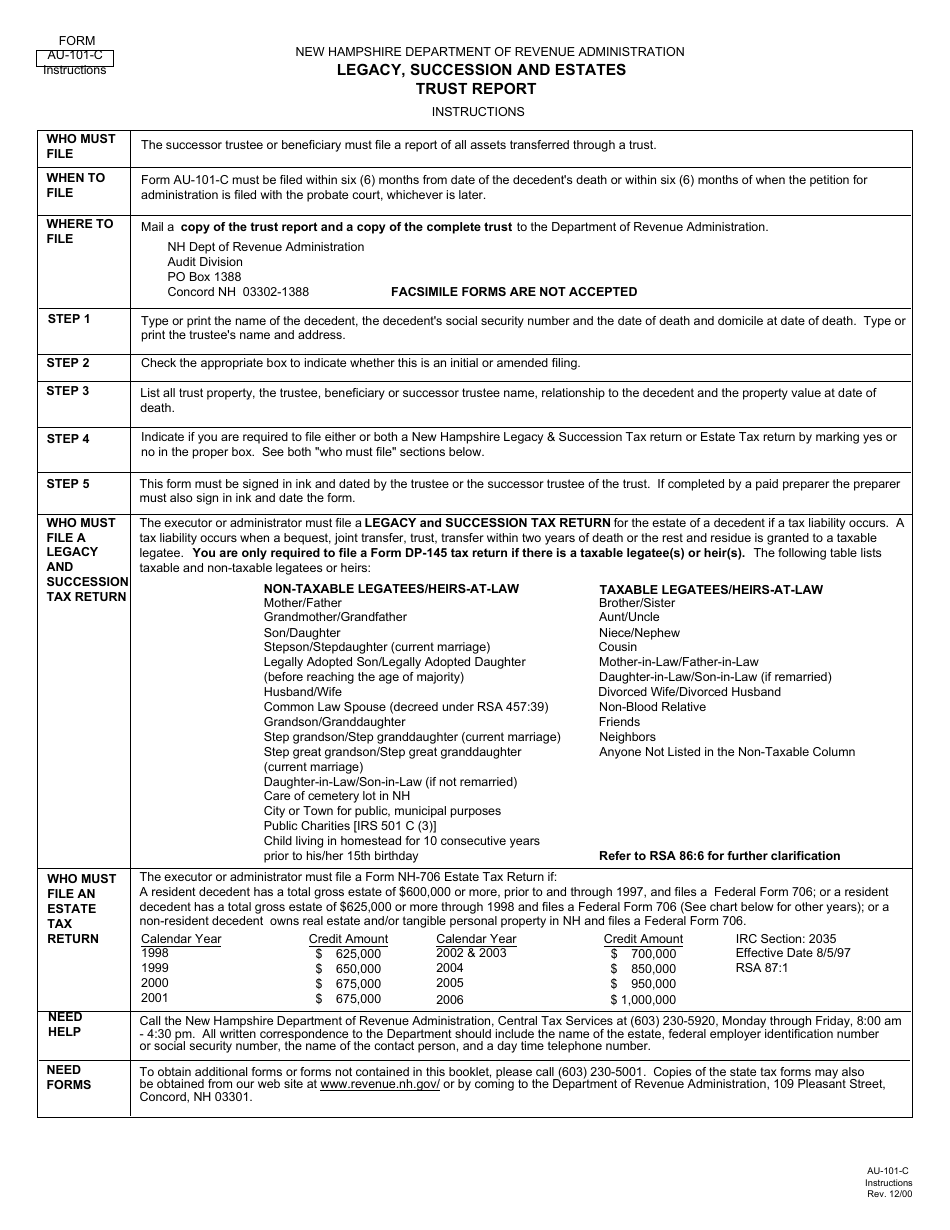

Form AU-101-C Legacy, Succession and Estates Trust Report - New Hampshire

What Is Form AU-101-C?

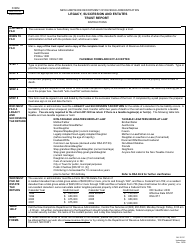

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AU-101-C?

A: Form AU-101-C is the Legacy, Succession and Estates Trust Report.

Q: What is the purpose of form AU-101-C?

A: The purpose of form AU-101-C is to report information regarding legacy, succession and estates trusts in New Hampshire.

Q: Who needs to file form AU-101-C?

A: Individuals or entities who have legacy, succession or estates trusts in New Hampshire need to file form AU-101-C.

Q: How often do I need to file form AU-101-C?

A: Form AU-101-C needs to be filed annually by the 15th day of the fourth month following the close of the trust's taxable year.

Q: Are there any penalties for not filing form AU-101-C?

A: Yes, failing to file form AU-101-C or filing it late may result in penalties imposed by the New Hampshire Department of Revenue Administration.

Form Details:

- Released on December 1, 2000;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-101-C by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.