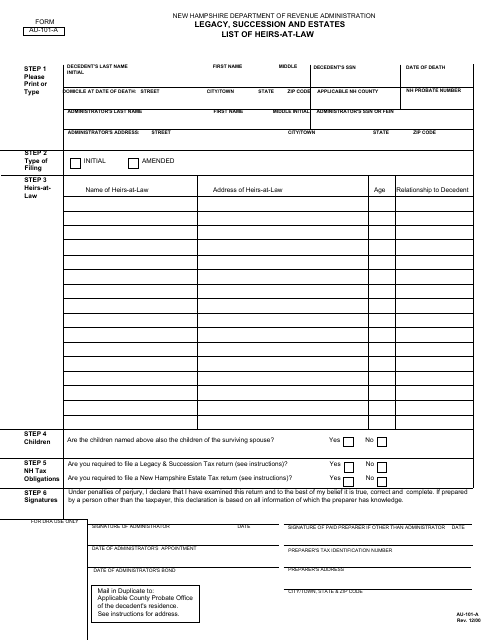

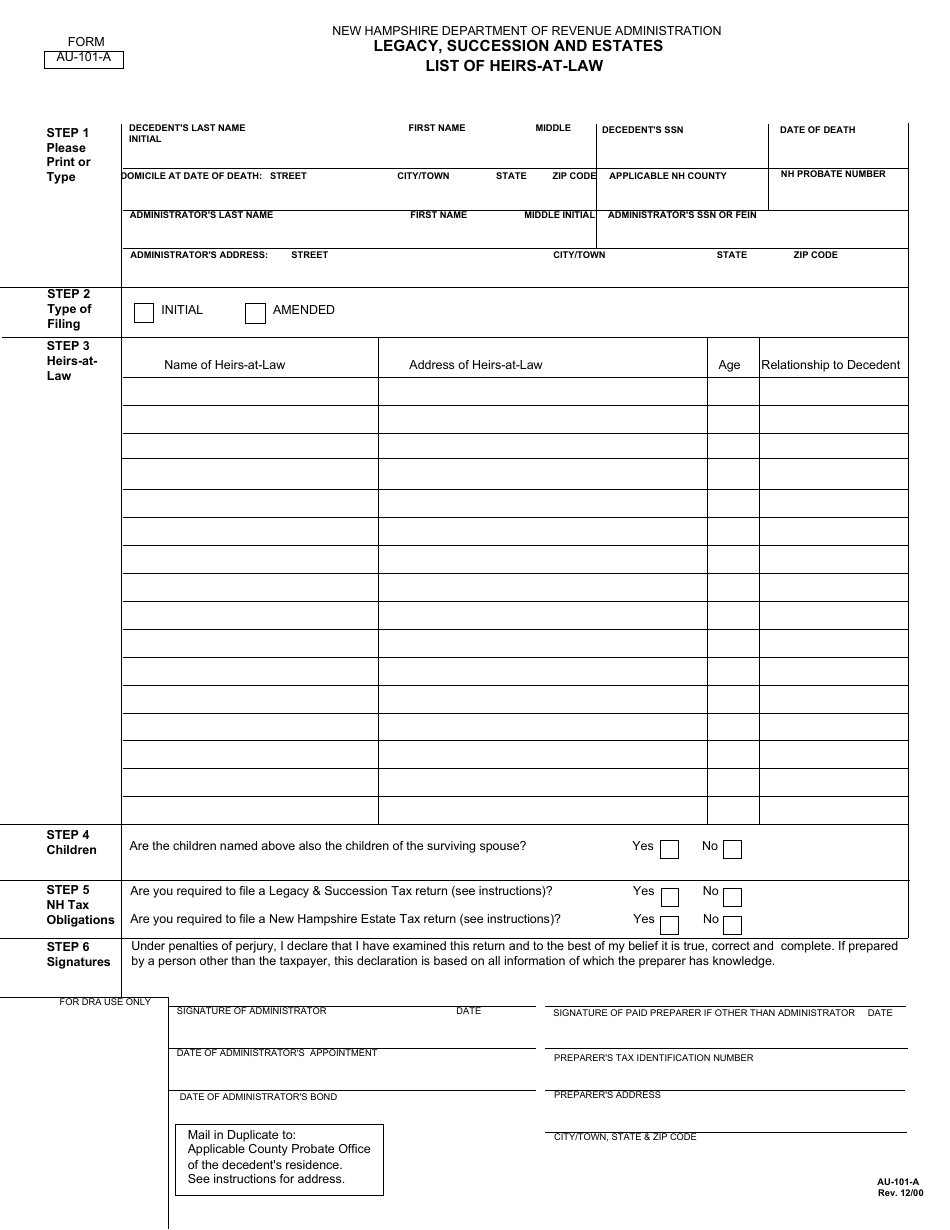

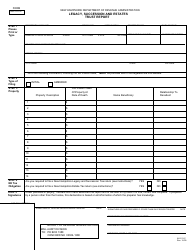

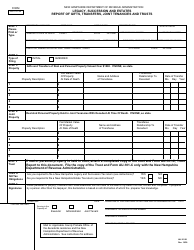

Form AU-101-A Legacy, Succession and Estates List of Heirs-At-Law - New Hampshire

What Is Form AU-101-A?

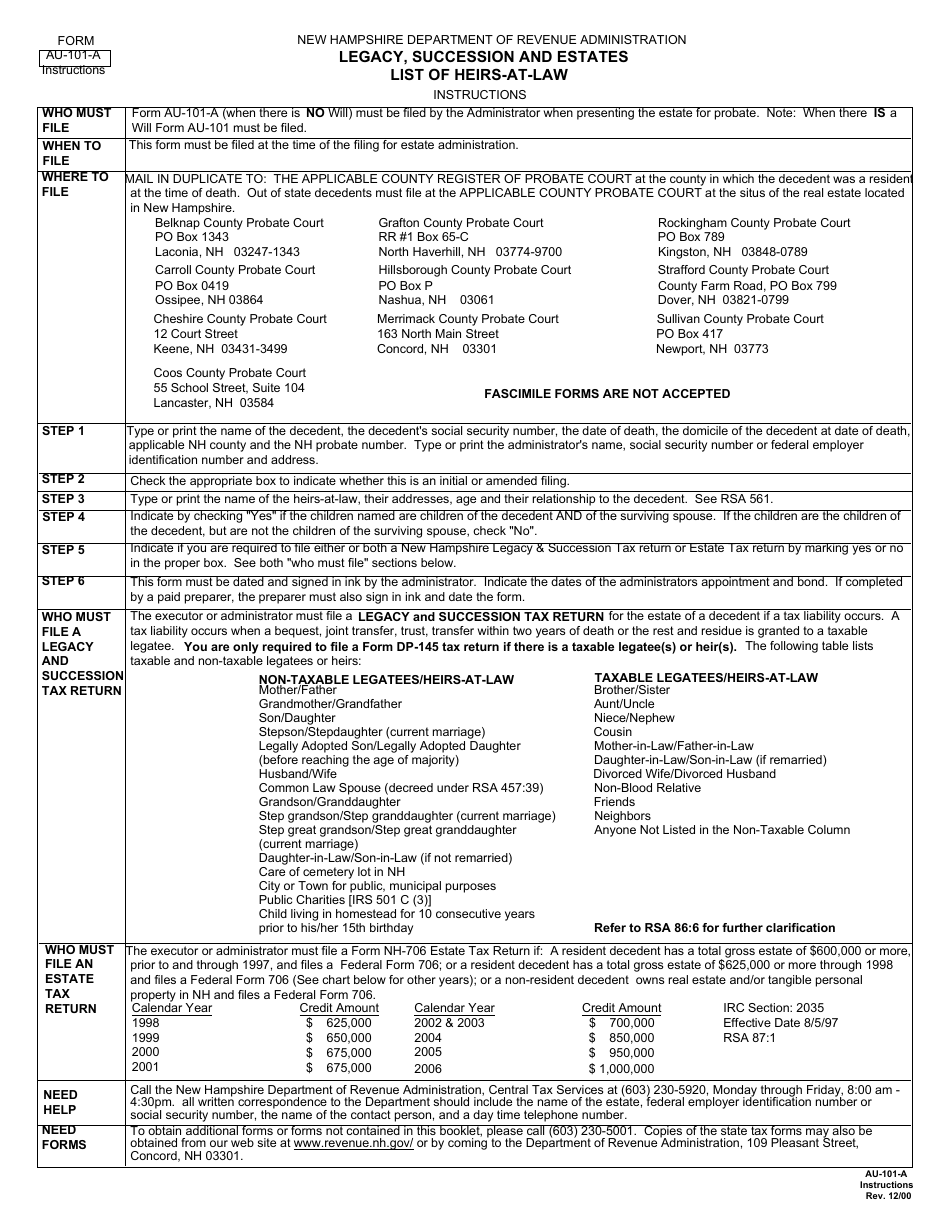

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

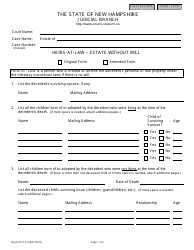

Q: What is Form AU-101-A?

A: Form AU-101-A is a legal document in New Hampshire that lists the heirs-at-law of a deceased person.

Q: What is Legacy, Succession and Estates?

A: Legacy, Succession and Estates refers to the process of distributing the assets and properties of a deceased person's estate to their rightful heirs.

Q: Who are heirs-at-law?

A: Heirs-at-law are individuals who are entitled to inherit the estate of a deceased person based on the laws of intestacy.

Q: What does Form AU-101-A include?

A: Form AU-101-A includes the names and addresses of the deceased person's heirs-at-law.

Q: Why is Form AU-101-A important?

A: Form AU-101-A is important for documenting and establishing the rightful heirs of a deceased person's estate, ensuring a fair and legal distribution of assets.

Form Details:

- Released on December 1, 2000;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-101-A by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.