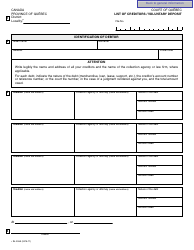

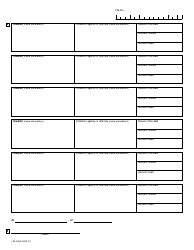

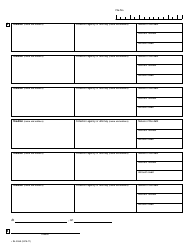

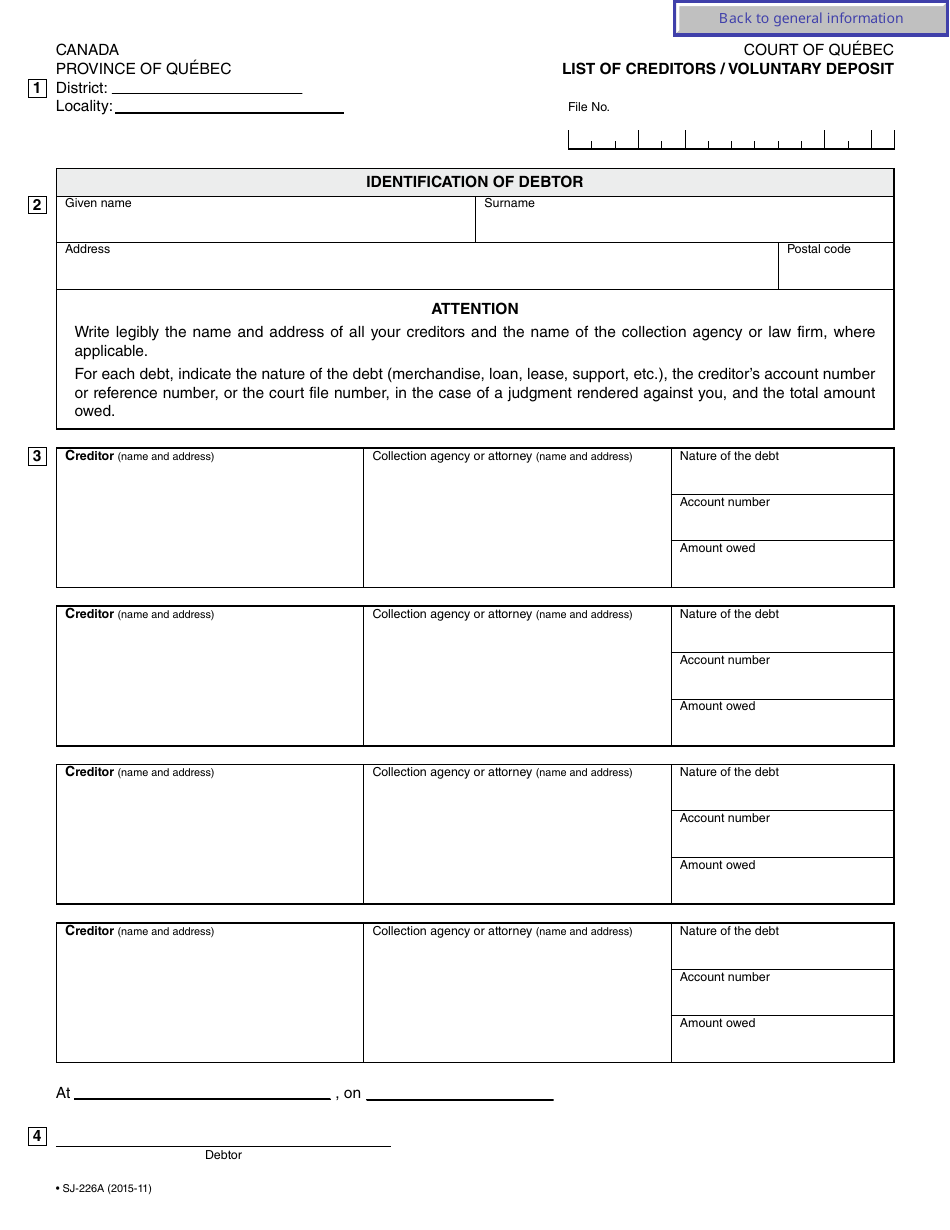

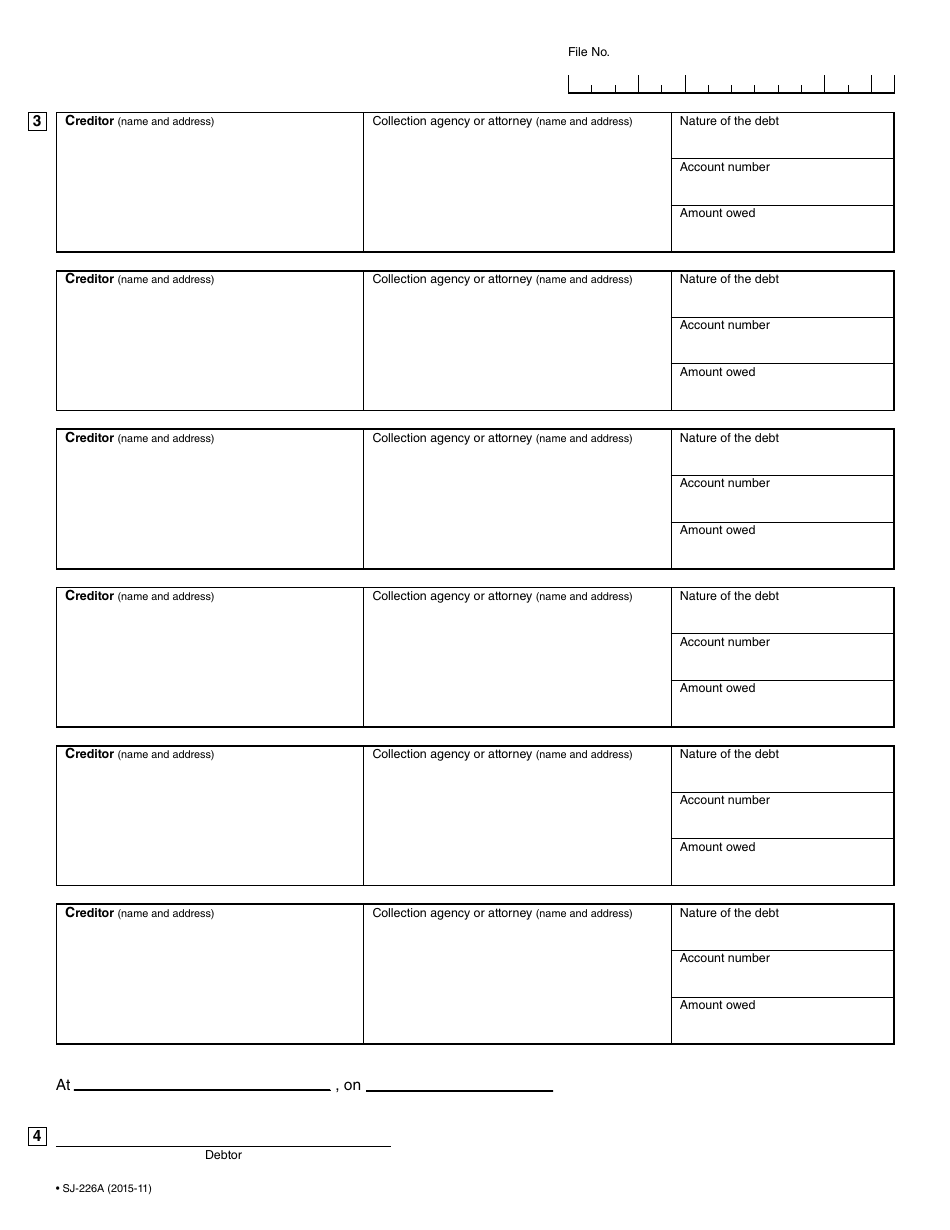

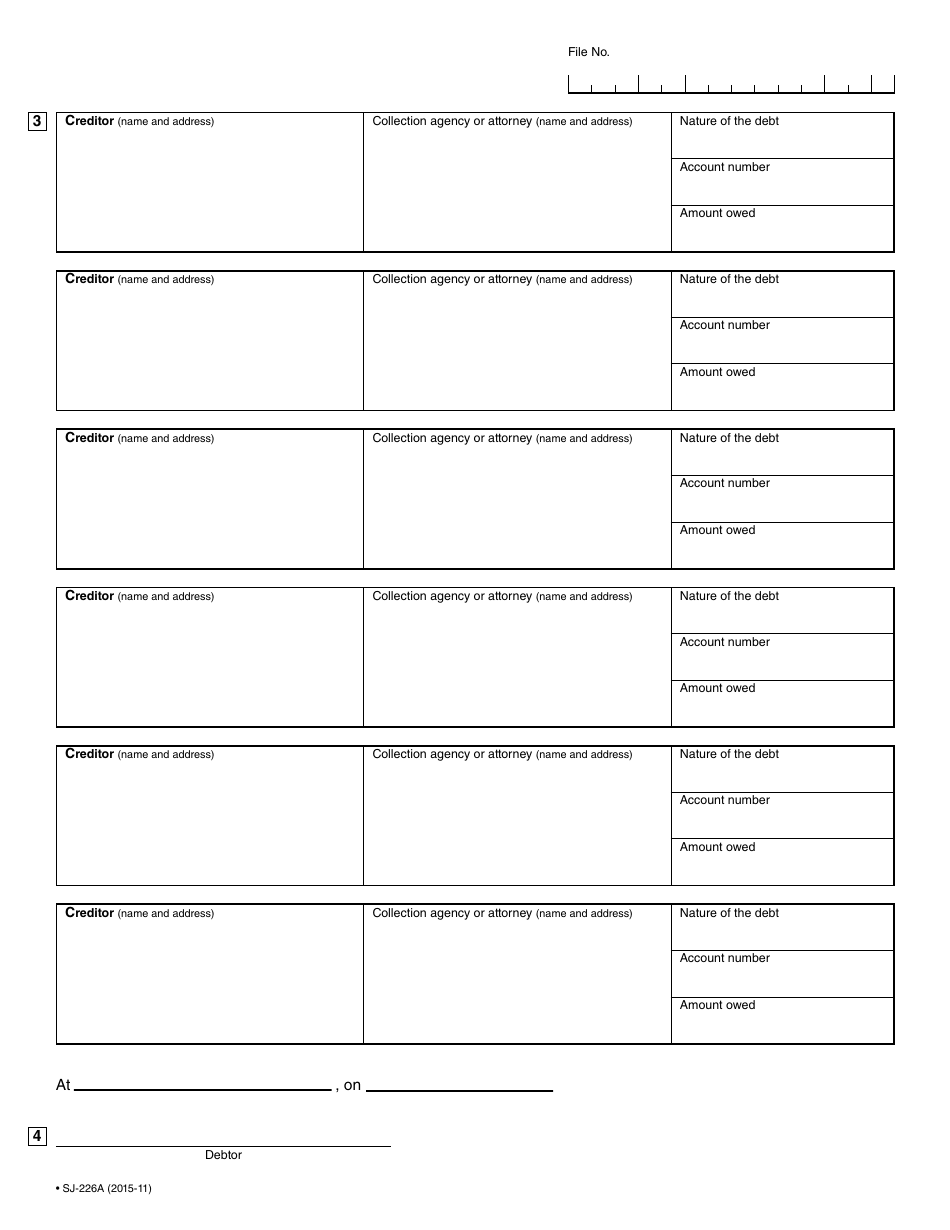

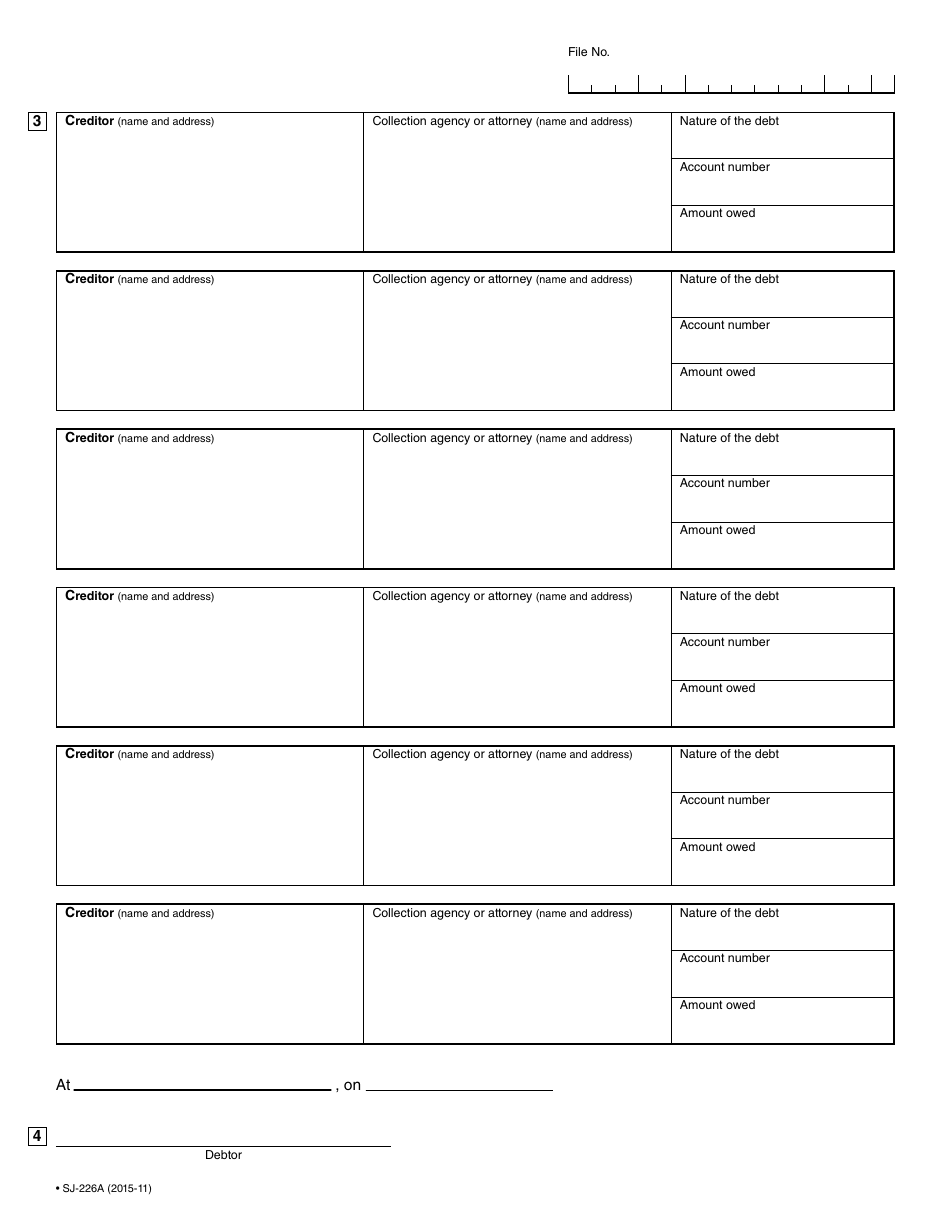

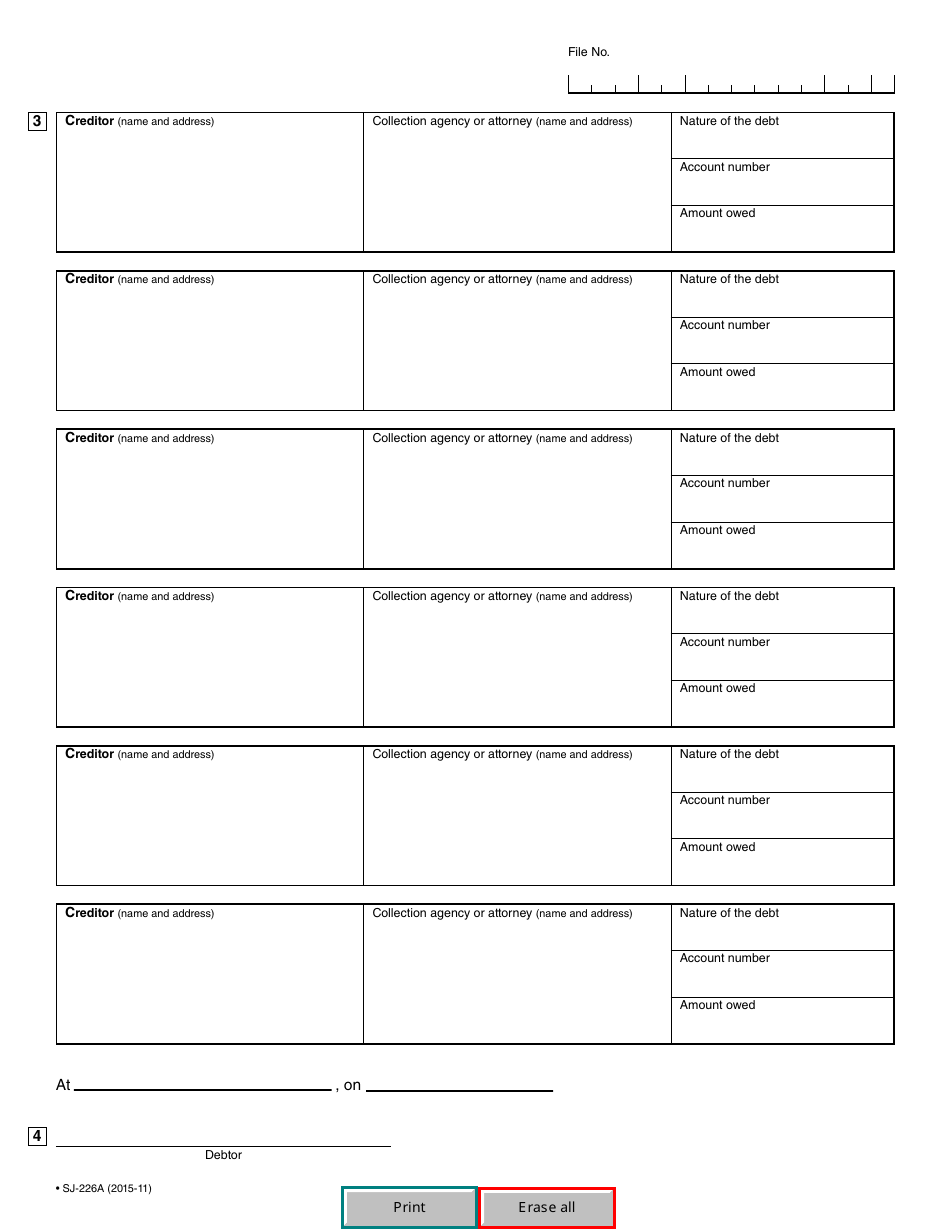

Form SJ-226A List of Creditors (Voluntary Deposit) - Quebec, Canada

Form SJ-226A List of Creditors (Voluntary Deposit) is used in Quebec, Canada for individuals who are filing for voluntary deposit or seeking financial protection under the Quebec Civil Code. It is used to list all the creditors to whom the debtor owes money.

In Quebec, Canada, the form SJ-226A List of Creditors (Voluntary Deposit) is filed by the individual or business that intends to make a voluntary deposit of their assets in order to pay off their debts.

FAQ

Q: What is Form SJ-226A?

A: Form SJ-226A is a document used for listing creditors in a voluntary deposit process in Quebec, Canada.

Q: What is a voluntary deposit?

A: A voluntary deposit is a legal process in which an individual or business voluntarily deposits their assets with a trustee to be distributed to creditors.

Q: Who uses Form SJ-226A?

A: Form SJ-226A is used by individuals or businesses in Quebec, Canada who are going through a voluntary deposit process.

Q: What does Form SJ-226A require?

A: Form SJ-226A requires the filer to list their creditors, including their names, addresses, and amounts owed.

Q: Do I need a lawyer to fill out Form SJ-226A?

A: While it is not mandatory to have a lawyer, it is recommended to seek legal advice to ensure the correct completion of Form SJ-226A.

Q: What happens after submitting Form SJ-226A?

A: After submitting Form SJ-226A, the court will review the information provided and proceed with the voluntary deposit process.

Q: Can creditors challenge the voluntary deposit?

A: Yes, creditors have the right to challenge the voluntary deposit within a certain period of time after it has been filed.

Q: What are the benefits of a voluntary deposit?

A: Some benefits of a voluntary deposit include protection from legal actions by creditors, a structured repayment plan, and the possibility of debt reduction.

Q: Are all debts eligible for a voluntary deposit?

A: No, certain debts, such as secured debts, child support payments, and certain tax debts, may not be eligible for a voluntary deposit.