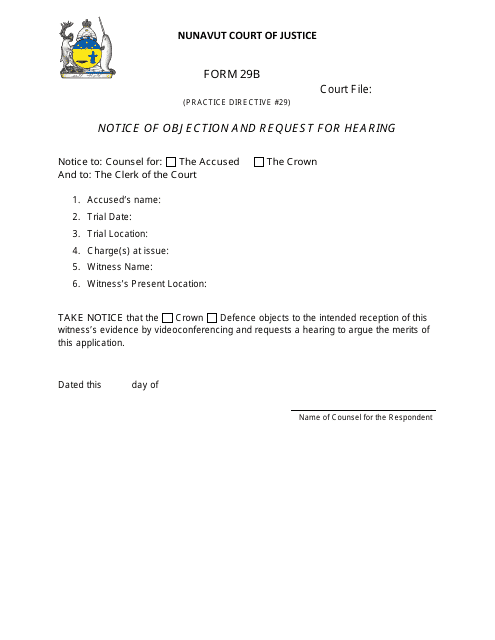

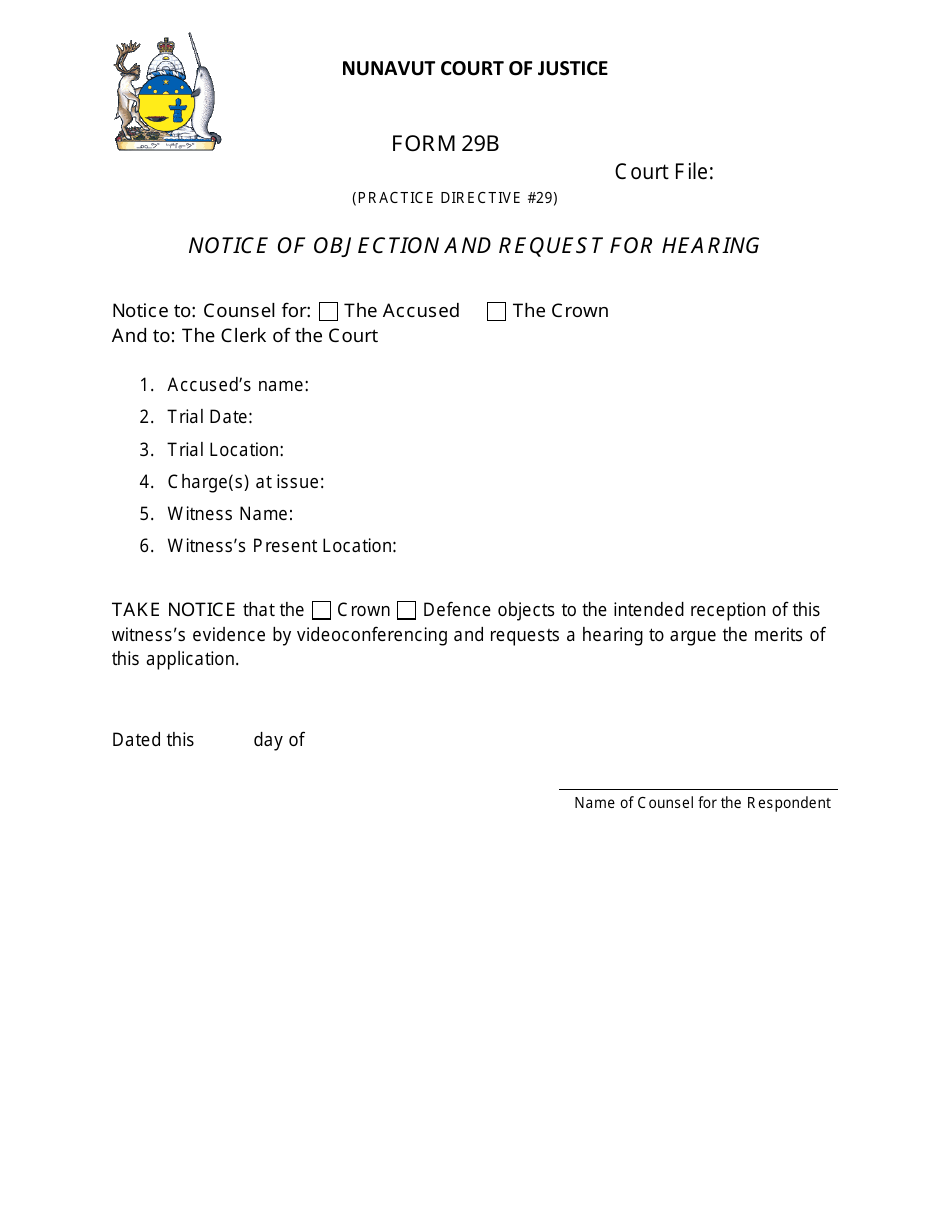

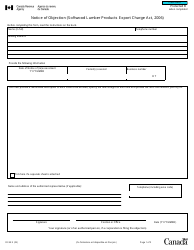

Form 29B Notice of Objection and Request for Hearing - Nunavut, Canada

Form 29B, Notice of Objection and Request for Hearing, is used in Nunavut, Canada, for taxpayers who want to object to a tax assessment or decision made by the Canada Revenue Agency (CRA). It allows individuals to formally state their disagreement with the CRA's decision and request a hearing to present their case.

The Form 29B Notice of Objection and Request for Hearing in Nunavut, Canada is filed by the individual or organization who wishes to contest a decision made by the Canada Revenue Agency (CRA) regarding their taxes.

FAQ

Q: What is Form 29B?

A: Form 29B is a Notice of Objection and Request for Hearing document.

Q: What is the purpose of Form 29B?

A: The purpose of Form 29B is to formally object to a decision made by the government in Nunavut, Canada and request a hearing to address the objection.

Q: What information should I include in Form 29B?

A: You should include your personal details, the decision you are objecting to, reasons for your objection, and any supporting documents or evidence.

Q: What should I do after filling out Form 29B?

A: After filling out Form 29B, you must submit it to the appropriate government office as instructed on the form.

Q: What happens after submitting Form 29B?

A: Once you submit Form 29B, the government will review your objection and schedule a hearing to address your concerns.

Q: Can I appeal the decision made after the hearing?

A: Yes, if you disagree with the decision made after the hearing, you may have the option to appeal further through the appropriate legal channels.