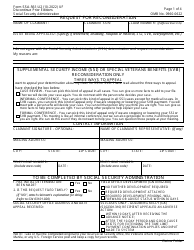

This version of the form is not currently in use and is provided for reference only. Download this version of

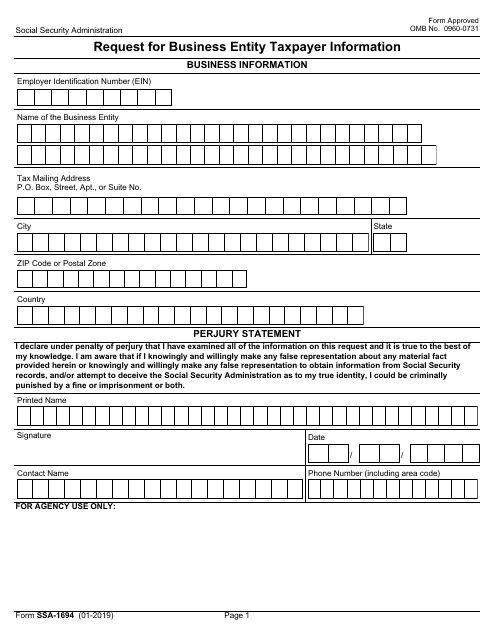

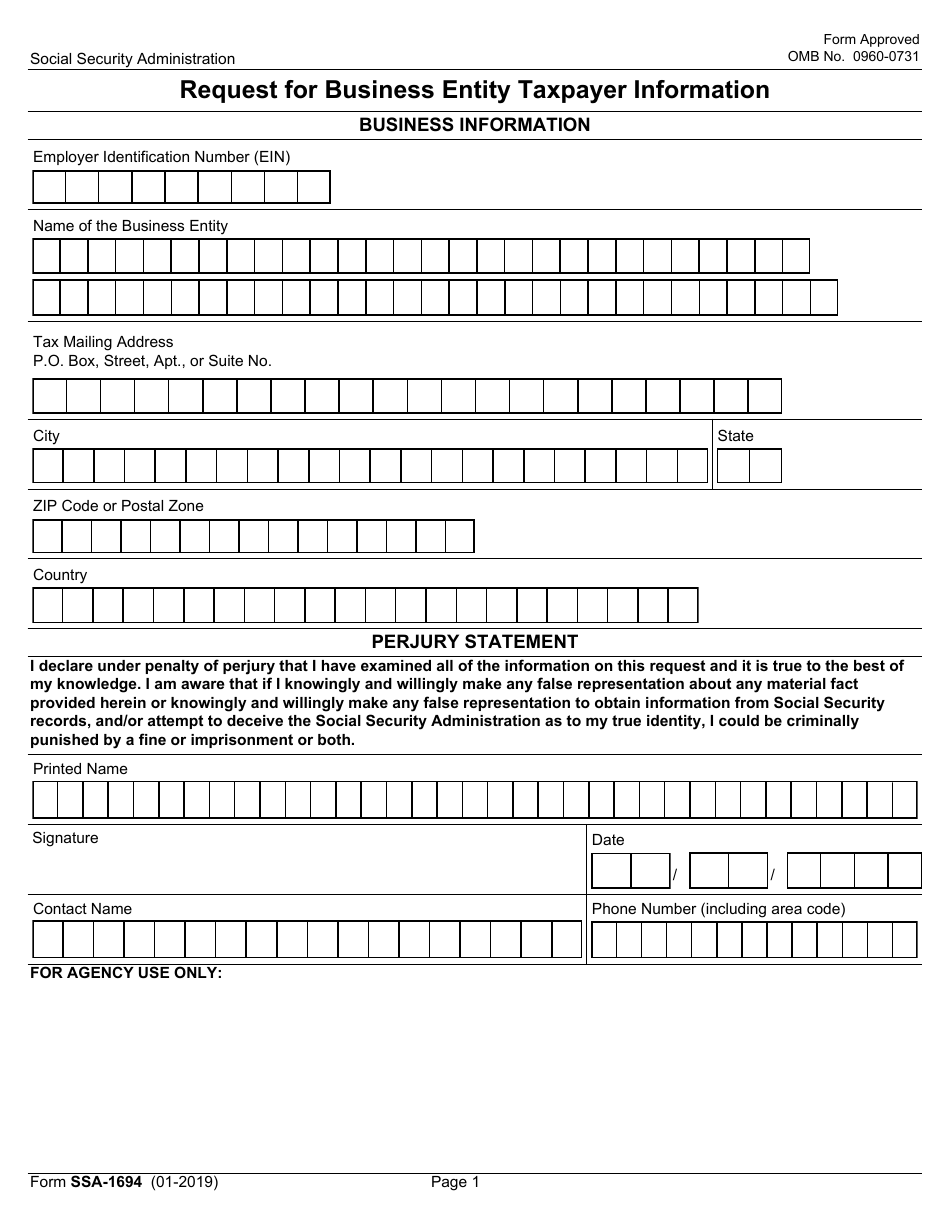

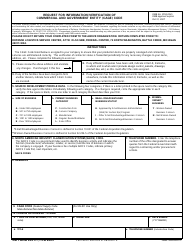

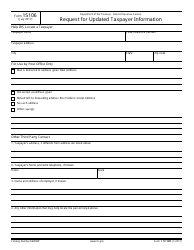

Form SSA-1694

for the current year.

Form SSA-1694 Request for Business Entity Taxpayer Information

What Is Form SSA-1694?

This is a legal form that was released by the U.S. Social Security Administration on January 1, 2019 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-1694?

A: Form SSA-1694 is a request form for business entity taxpayer information.

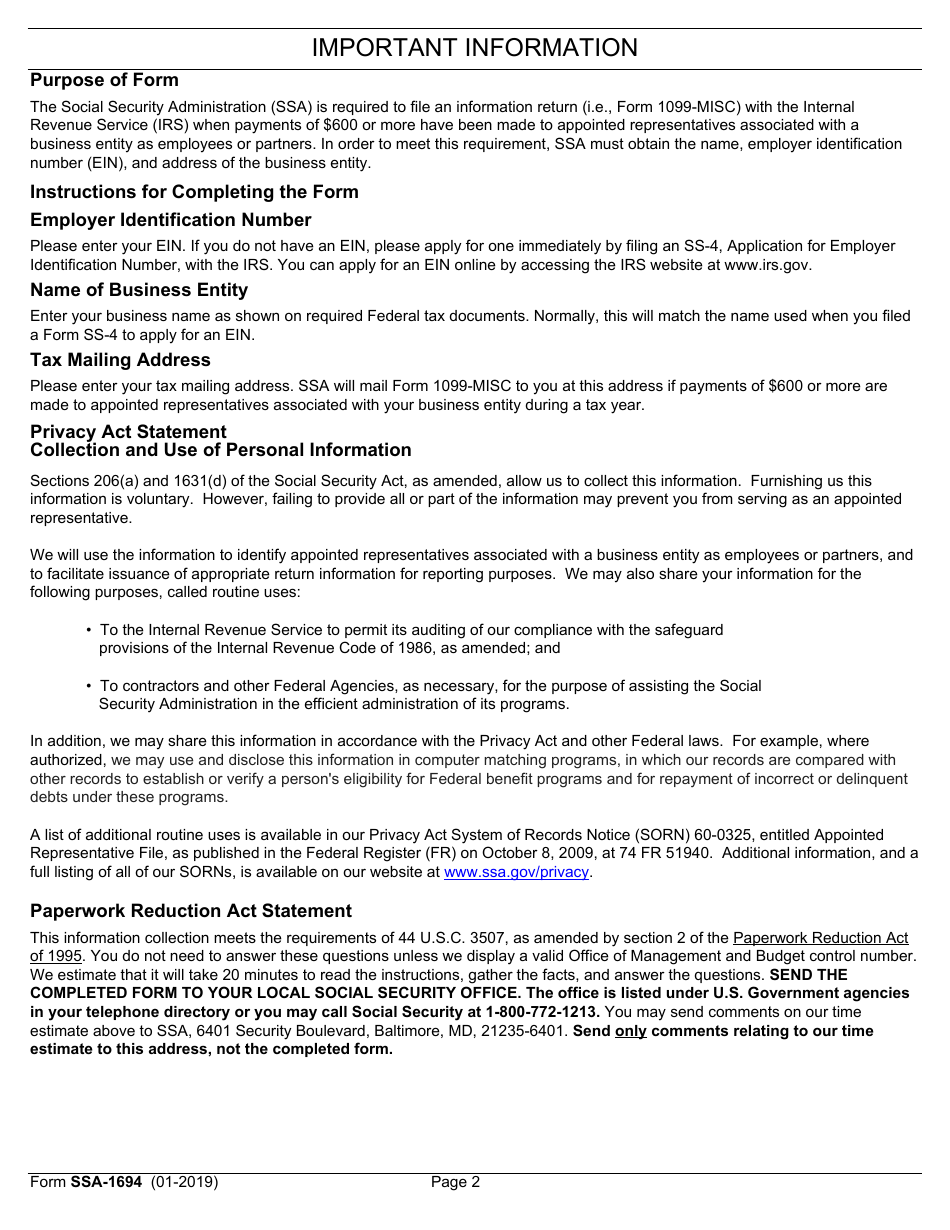

Q: What is the purpose of Form SSA-1694?

A: The purpose of Form SSA-1694 is to gather information about a business entity's taxpayer information.

Q: Who needs to fill out Form SSA-1694?

A: Business entities that are required to provide their taxpayer information.

Q: Is Form SSA-1694 mandatory?

A: Yes, if you are a business entity required to provide your taxpayer information, filling out Form SSA-1694 is mandatory.

Q: Are there any fees associated with Form SSA-1694?

A: No, there are no fees associated with filing Form SSA-1694.

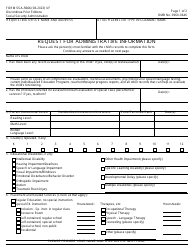

Q: What information is required on Form SSA-1694?

A: Form SSA-1694 requires information such as the business entity's name, business type, Employer Identification Number (EIN), contact information, and more.

Q: Are there any deadlines for submitting Form SSA-1694?

A: There are no specific deadlines mentioned on the Form SSA-1694. However, it is recommended to submit the form as soon as possible when requested by the Social Security Administration.

Form Details:

- Released on January 1, 2019;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SSA-1694 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.