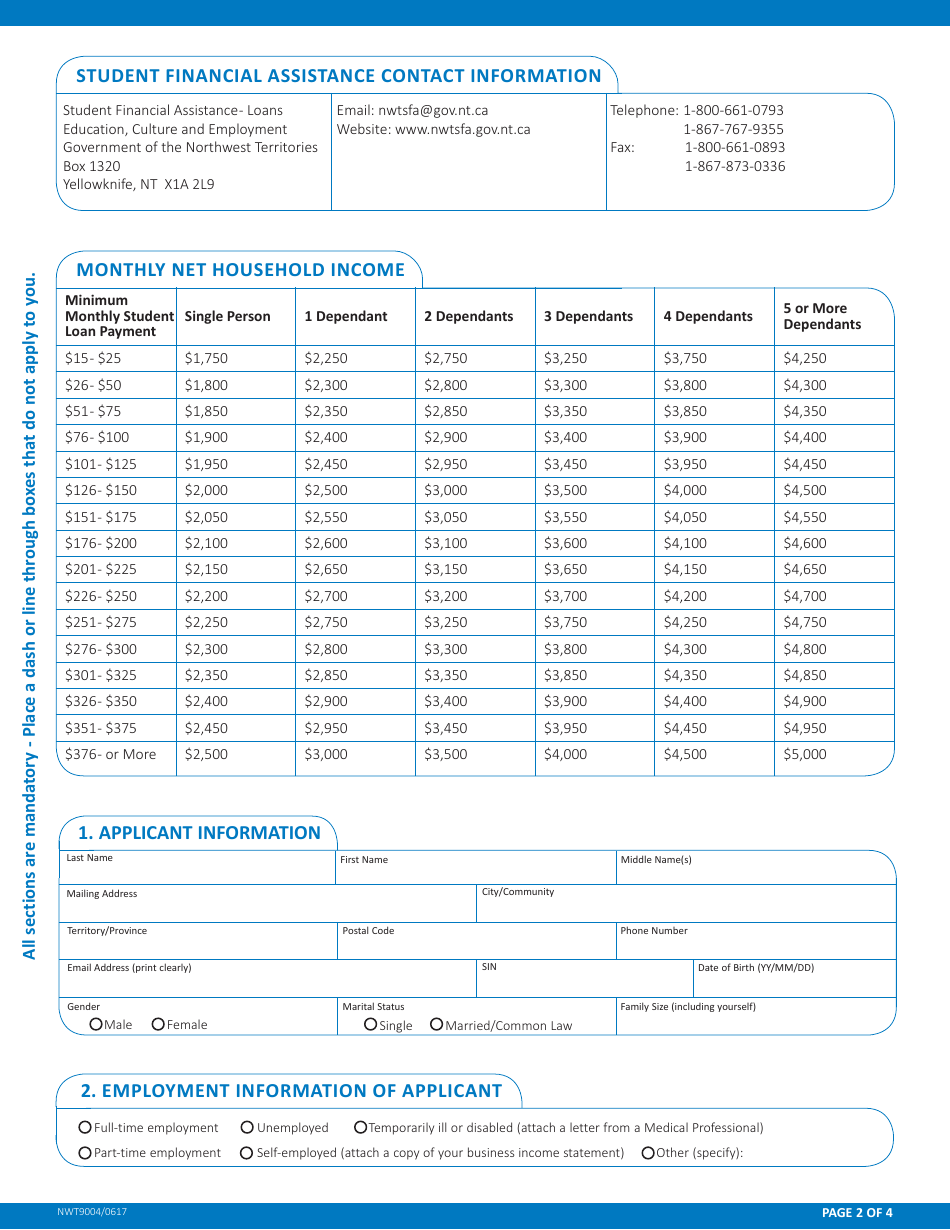

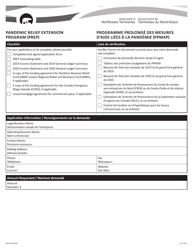

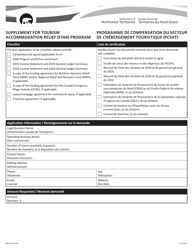

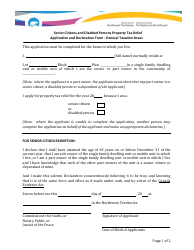

Form NWT9004 Application for Interest Relief - Northwest Territories, Canada

Form NWT9004 is an application for interest relief in the Northwest Territories, Canada. It is used to request relief from paying interest on certain amounts owed to the government, such as taxes or other debts.

The application for interest relief in the Northwest Territories, Canada is filed by the individual or business that is seeking relief from the payment of interest on overdue taxes.

FAQ

Q: What is Form NWT9004?

A: Form NWT9004 is an application for Interest Relief in Northwest Territories, Canada.

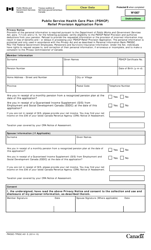

Q: Who can use Form NWT9004?

A: Anyone who resides in Northwest Territories, Canada and is experiencing financial hardship can use Form NWT9004 to apply for Interest Relief.

Q: What is Interest Relief?

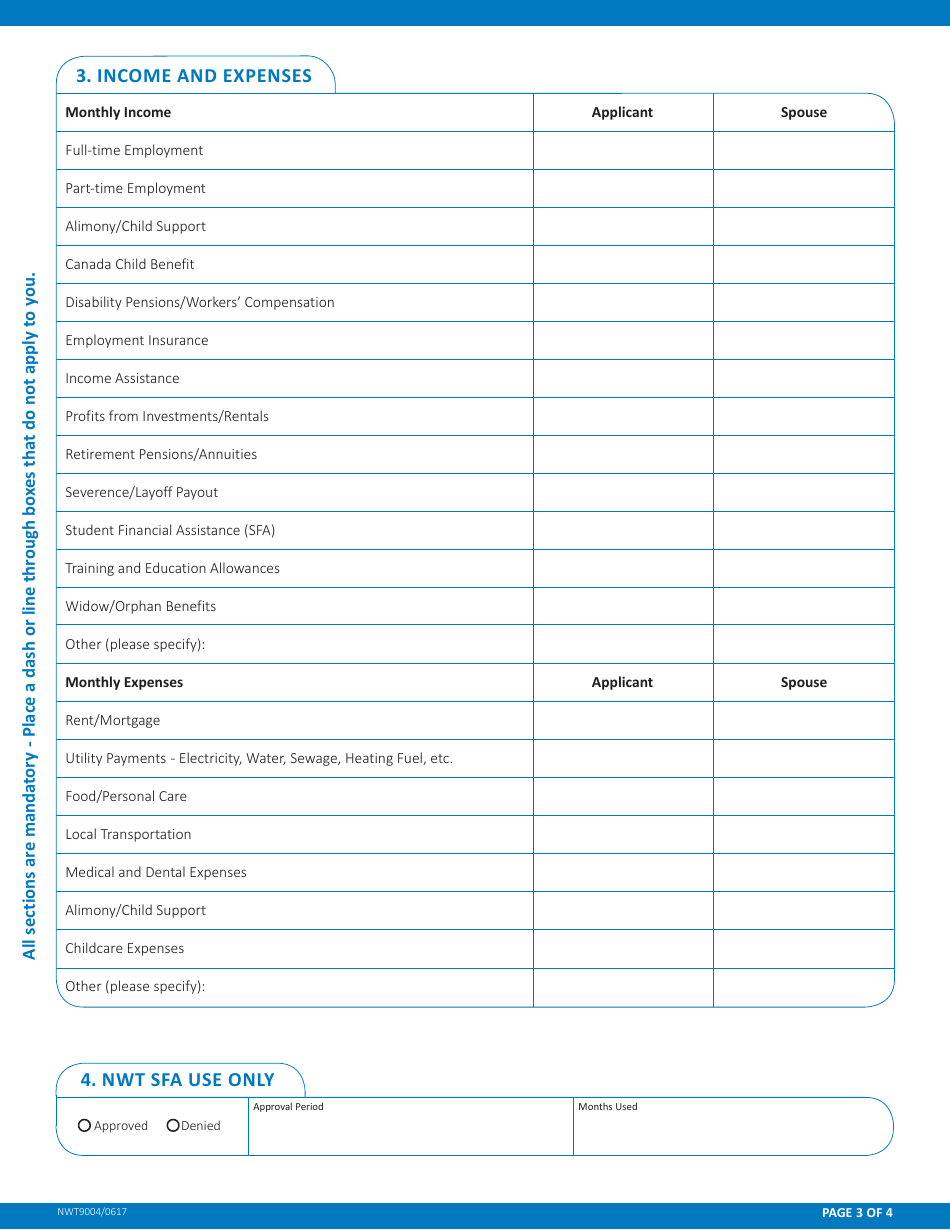

A: Interest Relief is a program that helps individuals in Northwest Territories, Canada who are facing financial difficulties by providing them with temporary relief from paying interest on certain debts.

Q: What type of debts does Interest Relief cover?

A: Interest Relief can cover various types of debts, such as loans, credit cards, and lines of credit.

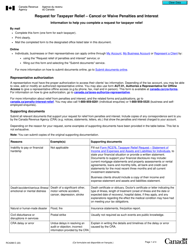

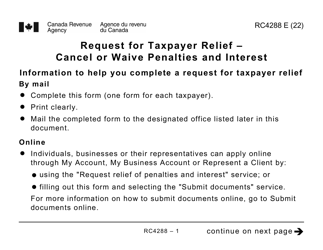

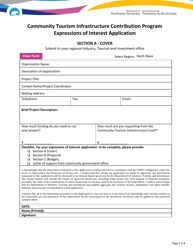

Q: How do I fill out Form NWT9004?

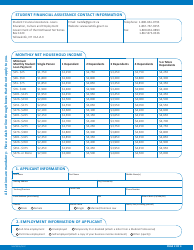

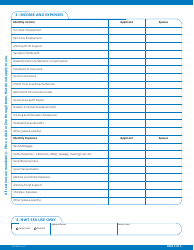

A: To fill out Form NWT9004, you will need to provide information about your financial situation, including your income, expenses, and the debts you are seeking interest relief for. You may also need to provide supporting documents.

Q: Is there a deadline for submitting Form NWT9004?

A: There may be a deadline for submitting Form NWT9004, so it's important to check with the Northwest Territories Department of Finance to determine the current deadline.

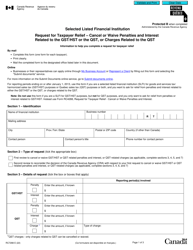

Q: What happens after I submit Form NWT9004?

A: After you submit Form NWT9004, your application will be reviewed by the Northwest Territories Department of Finance. They will assess your eligibility and determine whether you qualify for Interest Relief.

Q: Can I appeal if my application for Interest Relief is denied?

A: Yes, if your application for Interest Relief is denied, you have the right to appeal the decision. You will need to follow the appeal process outlined by the Northwest Territories Department of Finance.