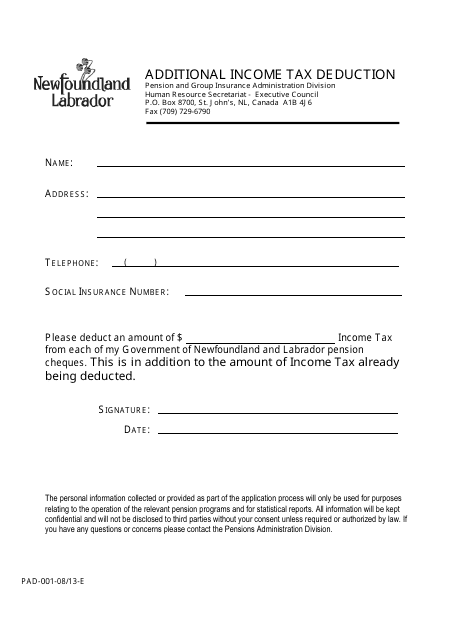

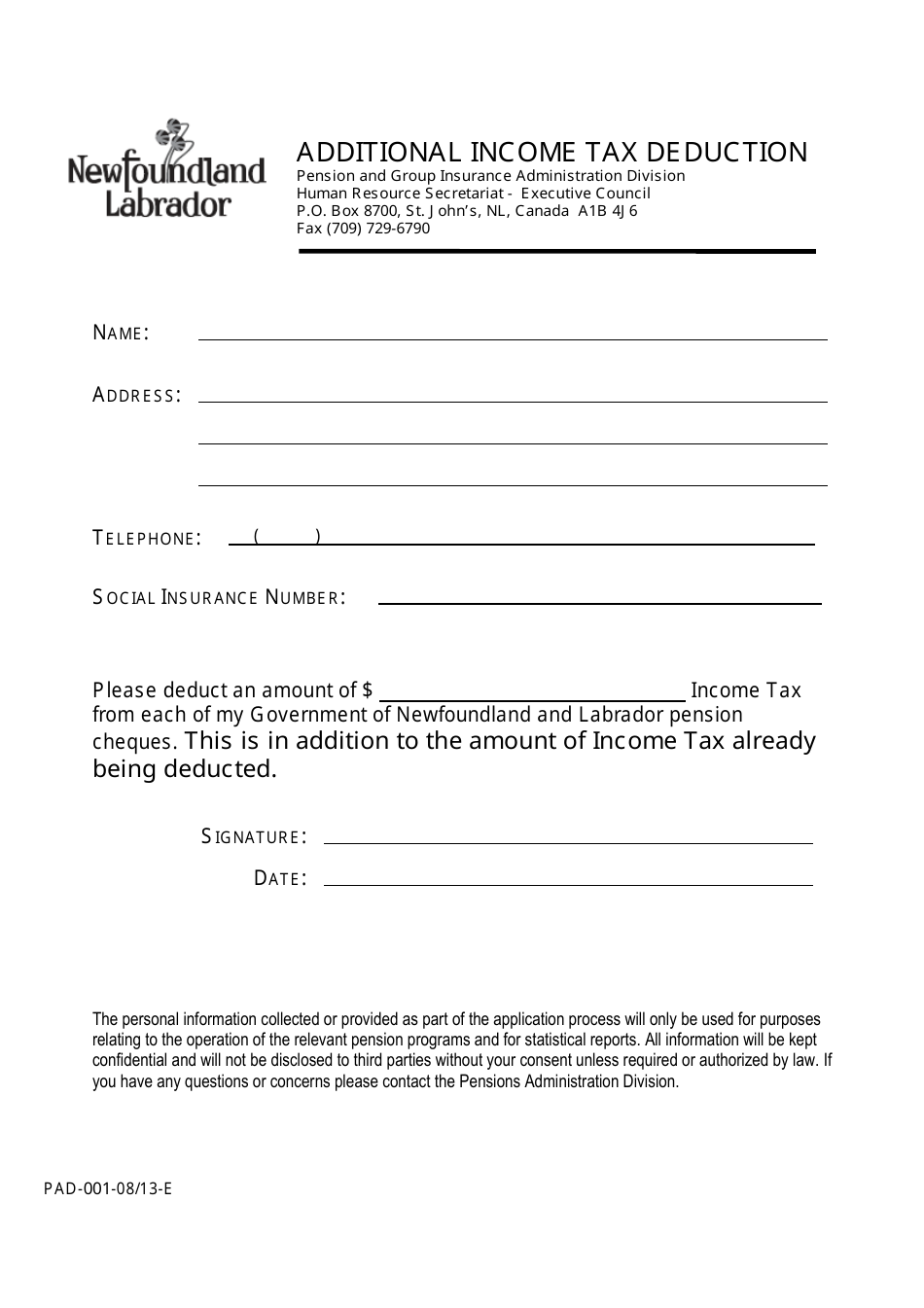

Form PAD-001 Additional Income Tax Deduction - Newfoundland and Labrador, Canada

Form PAD-001 Additional Income Tax Deduction in Newfoundland and Labrador, Canada is used to claim additional income tax deductions for certain expenses related to personal income tax.

The Form PAD-001 Additional Income Tax Deduction in Newfoundland and Labrador, Canada is filed by individuals who want to claim additional deductions on their income tax.

FAQ

Q: What is Form PAD-001?

A: Form PAD-001 is a form used in Newfoundland and Labrador, Canada to claim an additional income tax deduction.

Q: What does the form allow you to claim?

A: The form allows you to claim additional income tax deductions in Newfoundland and Labrador.

Q: Who can use Form PAD-001?

A: Form PAD-001 can be used by residents of Newfoundland and Labrador, Canada who are eligible for additional income tax deductions.

Q: What type of deductions can be claimed on the form?

A: The form allows you to claim deductions for various expenses, such as child care, medical expenses, and charitable donations.

Q: When should I file Form PAD-001?

A: Form PAD-001 should be filed with your annual income tax return by the deadline specified by the Canada Revenue Agency.

Q: Are there any eligibility requirements for claiming deductions on Form PAD-001?

A: Yes, there are specific eligibility requirements for each type of deduction. You should review the instructions on the form or seek advice from a tax professional.

Q: Can I claim deductions for previous years using Form PAD-001?

A: No, Form PAD-001 is only for claiming deductions for the current tax year.

Q: What should I do if I made an error on Form PAD-001?

A: If you made an error on Form PAD-001, you should contact the Canada Revenue Agency or the Newfoundland and Labrador Taxation and Fiscal Policy Division for guidance on how to correct it.

Q: Is there a deadline for filing Form PAD-001?

A: Yes, the deadline for filing Form PAD-001 is usually the same as the deadline for filing your annual income tax return, which is typically April 30th of each year.