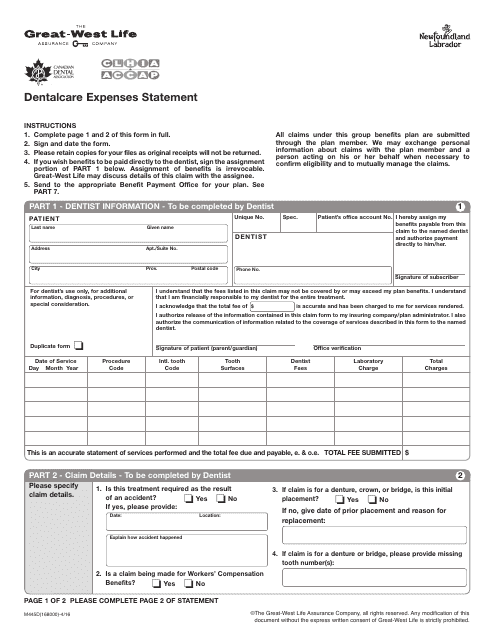

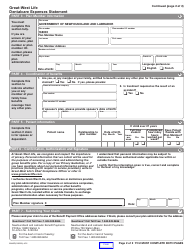

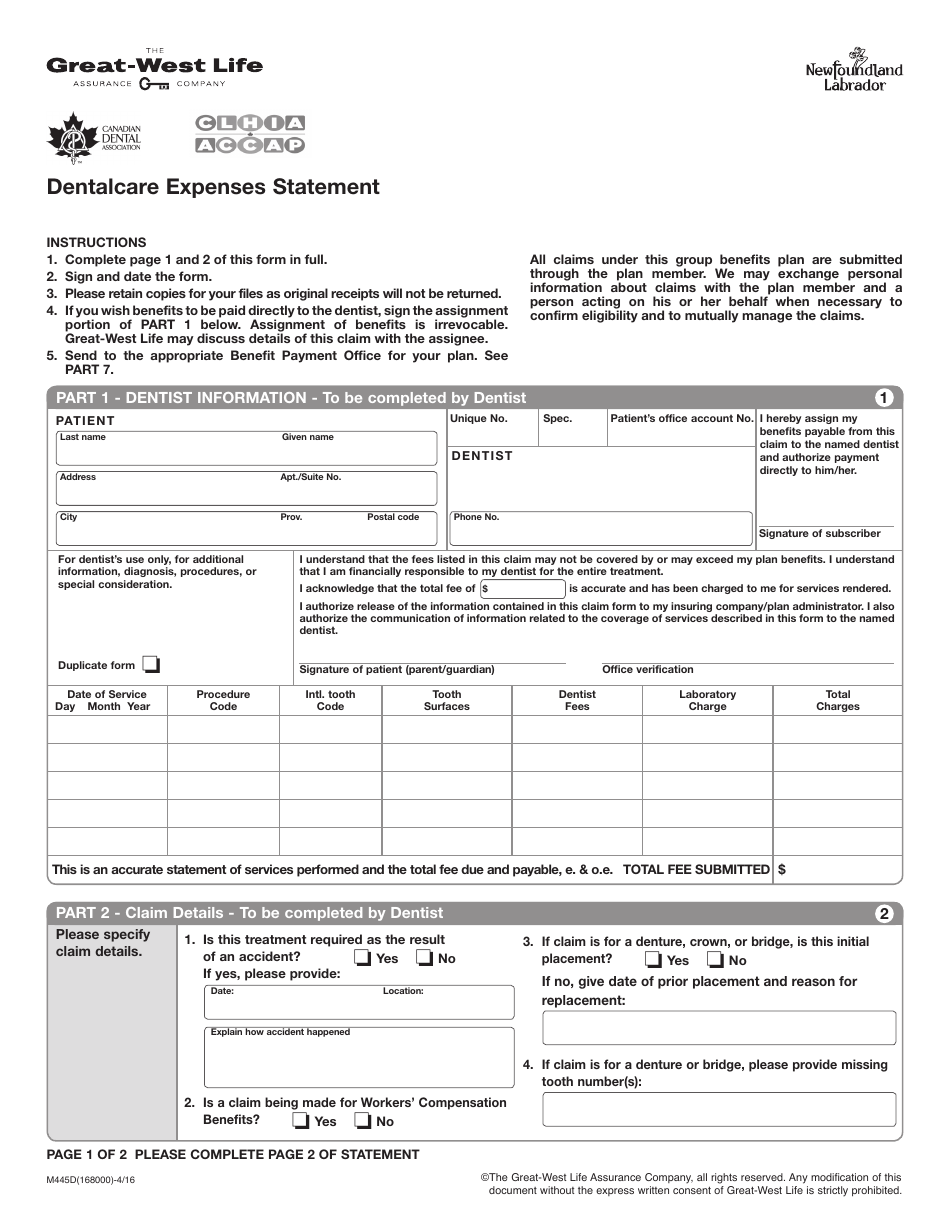

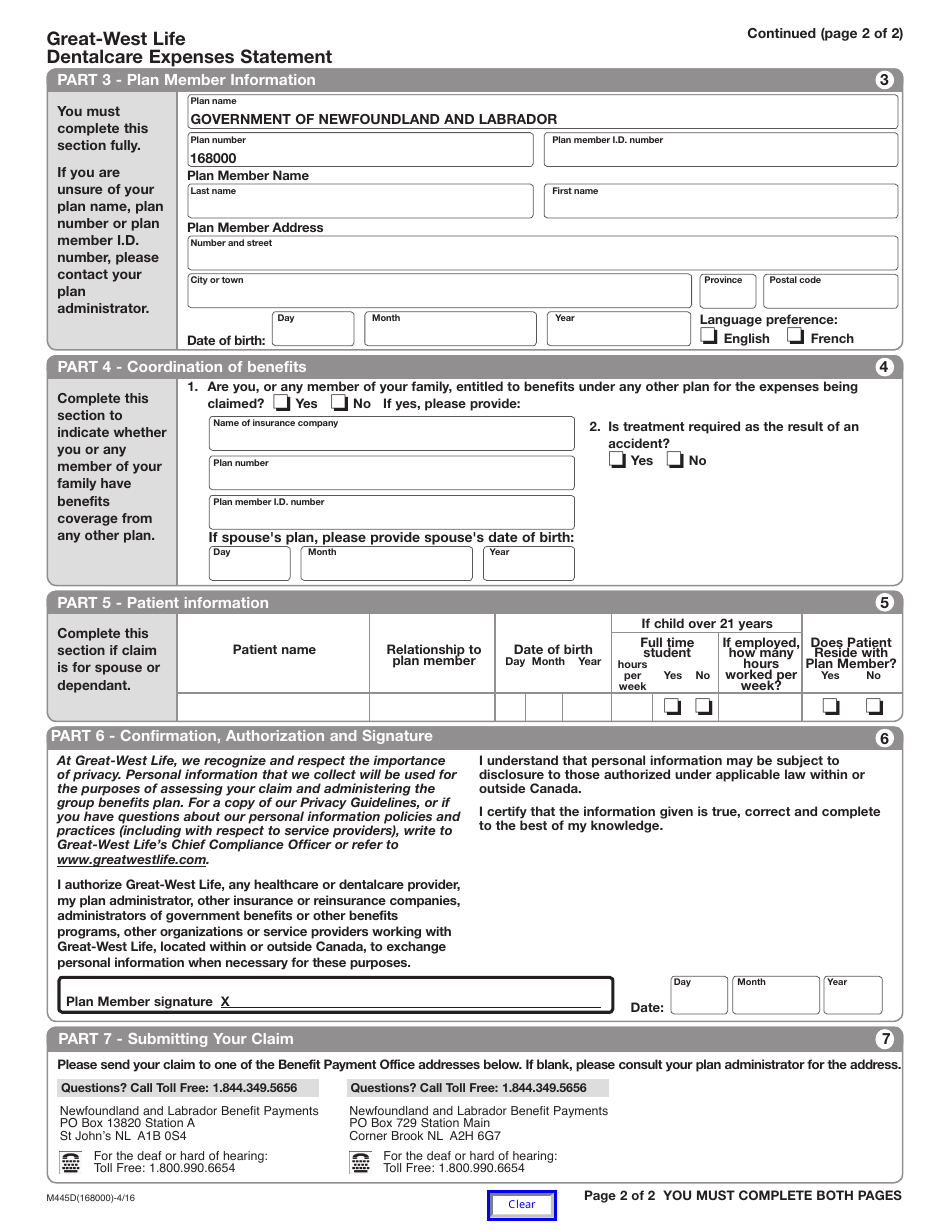

Form M445D Dentalcare Expenses Statement - Newfoundland and Labrador, Canada

Form M445D Dentalcare Expenses Statement is used in Newfoundland and Labrador, Canada to claim dental care expenses as a tax deduction. It allows individuals to report the amount spent on eligible dental expenses when filing their taxes.

The Form M445D Dentalcare Expenses Statement in Newfoundland and Labrador, Canada is filed by individuals who want to claim dental care expenses on their provincial tax return.

FAQ

Q: What is Form M445D?

A: Form M445D is a Dentalcare Expenses Statement used in Newfoundland and Labrador, Canada.

Q: What is the purpose of Form M445D?

A: The purpose of Form M445D is to report dentalcare expenses for tax purposes.

Q: Who needs to fill out Form M445D?

A: Individuals who want to claim dentalcare expenses on their tax return in Newfoundland and Labrador, Canada.

Q: What information is required on Form M445D?

A: Form M445D requires information such as the individual's name, address, social insurance number, and a breakdown of dentalcare expenses.

Q: Can I claim all dentalcare expenses on my tax return?

A: No, only eligible dentalcare expenses can be claimed on your tax return. The CRA provides a list of eligible expenses.

Q: Are there any limitations to claiming dentalcare expenses?

A: Yes, there are certain limitations and restrictions on the amount of dentalcare expenses that can be claimed. It is important to review the guidelines provided by the CRA.

Q: When is the deadline to submit Form M445D?

A: The deadline to submit Form M445D is typically the same as the deadline for filing your tax return, which is April 30th of the following year.

Q: What should I do with my receipts for dentalcare expenses?

A: It is important to keep your receipts for dentalcare expenses in case the CRA requests them for verification purposes.