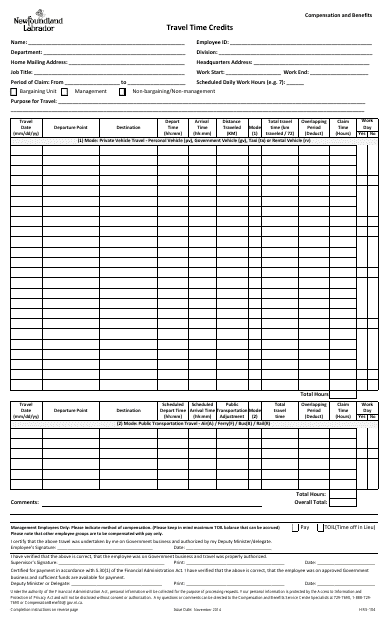

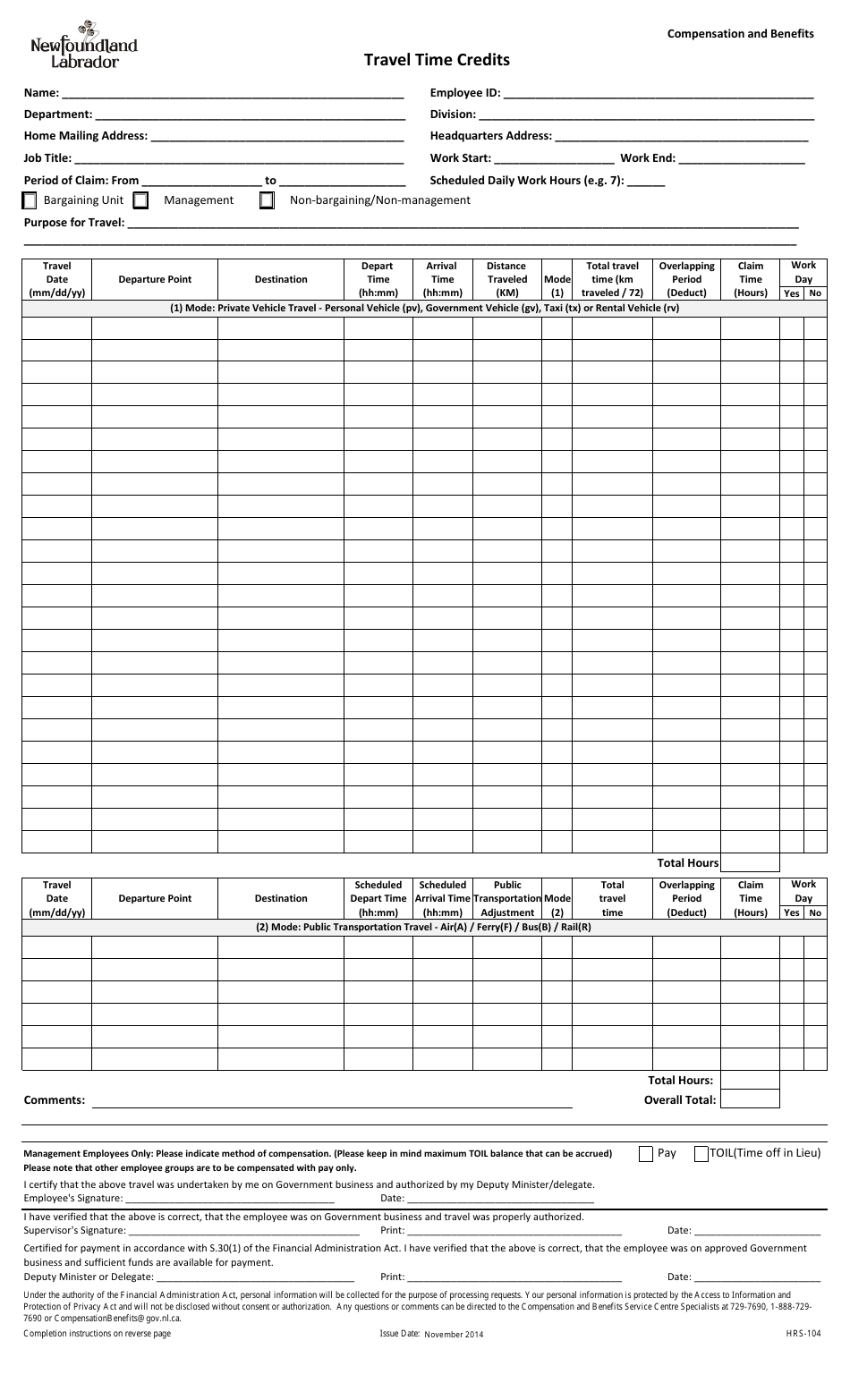

Form HRS-104 Travel Time Credits - Newfoundland and Labrador, Canada

The Form HRS-104 Travel Time Credits in Newfoundland and Labrador, Canada is used to claim travel time credits for eligible expenses incurred during authorized work-related travel. These credits can be used to offset regular hours of work or be converted into monetary compensation.

FAQ

Q: What is Form HRS-104?

A: Form HRS-104 is a document used to claim travel time credits for employees in Newfoundland and Labrador, Canada.

Q: Who can use Form HRS-104?

A: Form HRS-104 can be used by employees in Newfoundland and Labrador who are eligible for travel time credits.

Q: What are travel time credits?

A: Travel time credits are additional compensation granted to employees for time spend traveling for work purposes.

Q: How do I claim travel time credits?

A: You can claim travel time credits by filling out and submitting Form HRS-104 to your employer.

Q: Is Form HRS-104 specific to Newfoundland and Labrador?

A: Yes, Form HRS-104 is specific to employees in Newfoundland and Labrador, Canada.

Q: Are travel time credits mandatory?

A: No, travel time credits are not mandatory and may vary depending on the employer and employment agreement.

Q: Can self-employed individuals claim travel time credits?

A: No, travel time credits are typically only available to employees and not self-employed individuals.

Q: What can travel time credits be used for?

A: Travel time credits are additional compensation and can be used as part of an employee's regular pay or as time off.

Q: Are there any limitations on travel time credits?

A: There may be limitations on the amount of travel time credits that can be claimed or the types of expenses that are eligible.