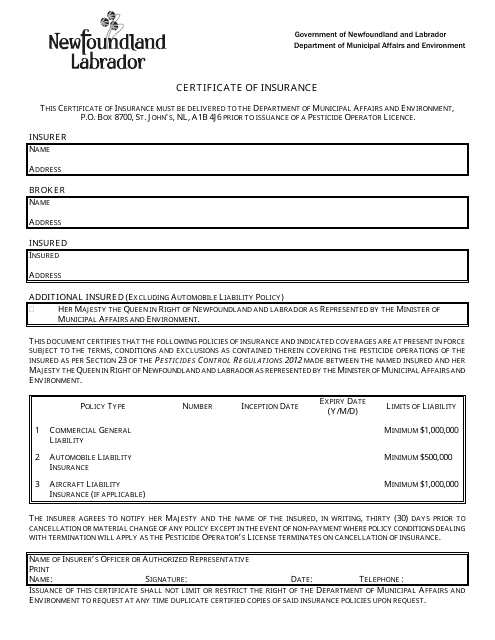

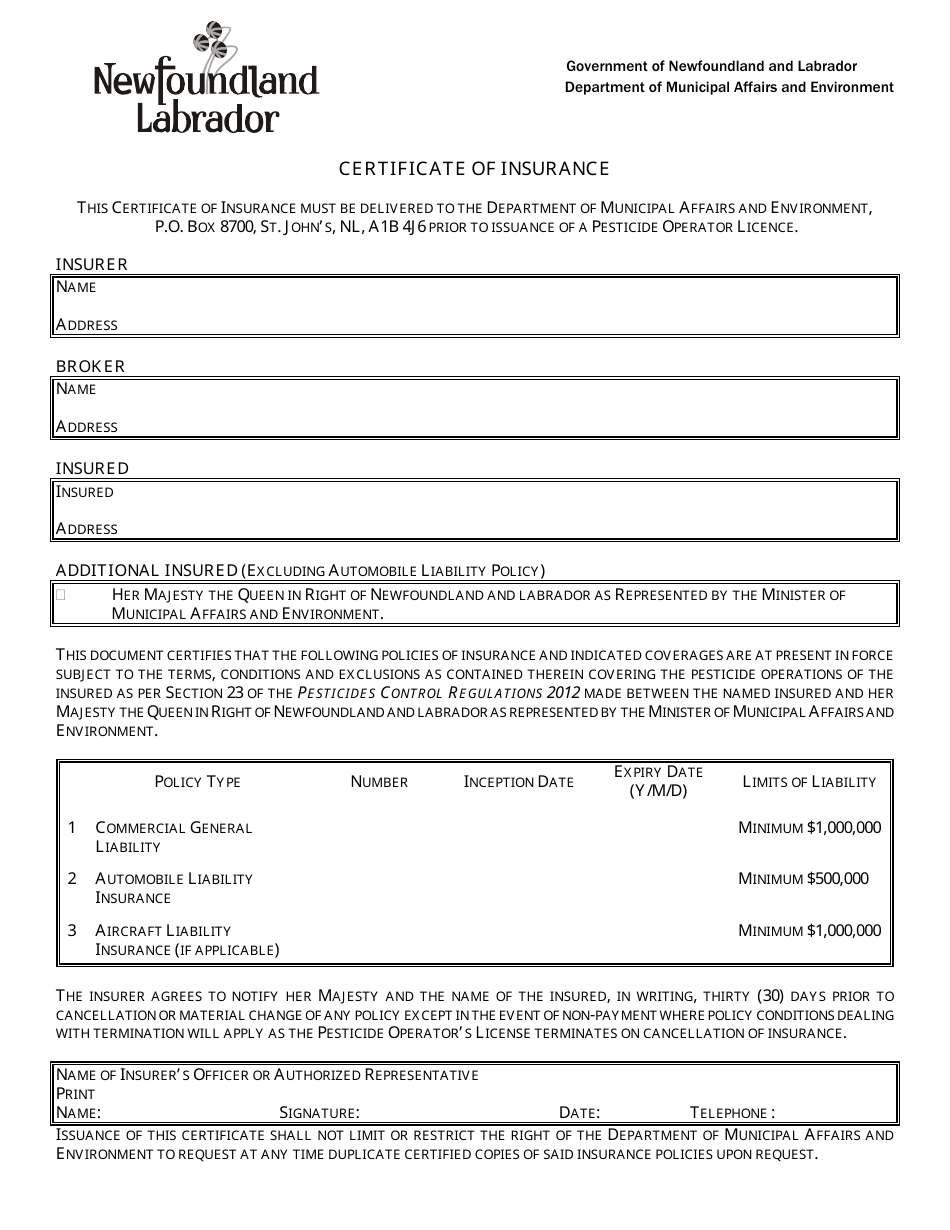

Certificate of Insurance - Newfoundland and Labrador, Canada

A Certificate of Insurance in Newfoundland and Labrador, Canada is a document that provides proof of insurance coverage. It typically outlines the details of an insurance policy, including the types and amounts of coverage, the policyholder's name, and the effective dates of the policy. This certificate is often required in various situations, such as when renting a property, participating in certain events, or conducting business activities. It helps demonstrate that the insured party has the necessary insurance protection in place.

The certificate of insurance in Newfoundland and Labrador, Canada is typically filed by the insurance company.

FAQ

Q: What is a Certificate of Insurance?

A: A Certificate of Insurance is a document that provides proof of insurance coverage.

Q: Why do I need a Certificate of Insurance?

A: You may need a Certificate of Insurance to prove that you have adequate insurance coverage, such as for renting a property or for certain business transactions.

Q: Who can issue a Certificate of Insurance?

A: A Certificate of Insurance is typically issued by an insurance company or an insurance agent/broker.

Q: What information is included in a Certificate of Insurance?

A: A Certificate of Insurance usually includes information about the policyholder, the insurance coverage, and any applicable limits and endorsements.

Q: How can I obtain a Certificate of Insurance?

A: You can request a Certificate of Insurance from your insurance provider or agent/broker. They will typically generate the document for you.

Q: Is a Certificate of Insurance legally binding?

A: No, a Certificate of Insurance is not a legally binding contract. It is simply a document that provides proof of insurance coverage.

Q: How long is a Certificate of Insurance valid for?

A: The validity period of a Certificate of Insurance can vary depending on the insurance policy and the purpose for which it is issued. It is typically valid for a specific period of time.

Q: Can a Certificate of Insurance be canceled?

A: Yes, a Certificate of Insurance can be canceled if the underlying insurance policy is canceled or if the policyholder no longer requires the coverage.

Q: Can a Certificate of Insurance be modified?

A: Yes, a Certificate of Insurance can be modified if there are changes to the insurance coverage or if additional endorsements are added to the policy.

Q: Is a Certificate of Insurance required by law?

A: The requirement for a Certificate of Insurance can vary depending on the specific circumstances and applicable laws and regulations. It is best to consult with an insurance professional or legal advisor to determine if a Certificate of Insurance is required in your situation.