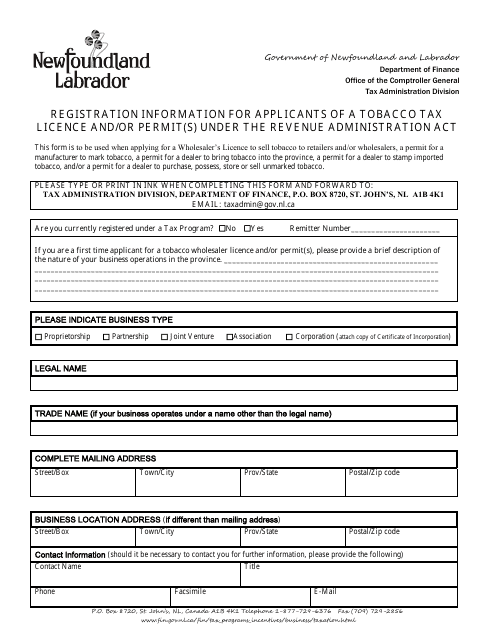

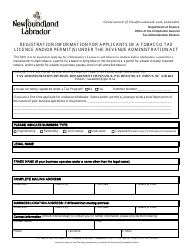

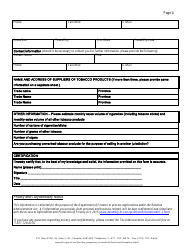

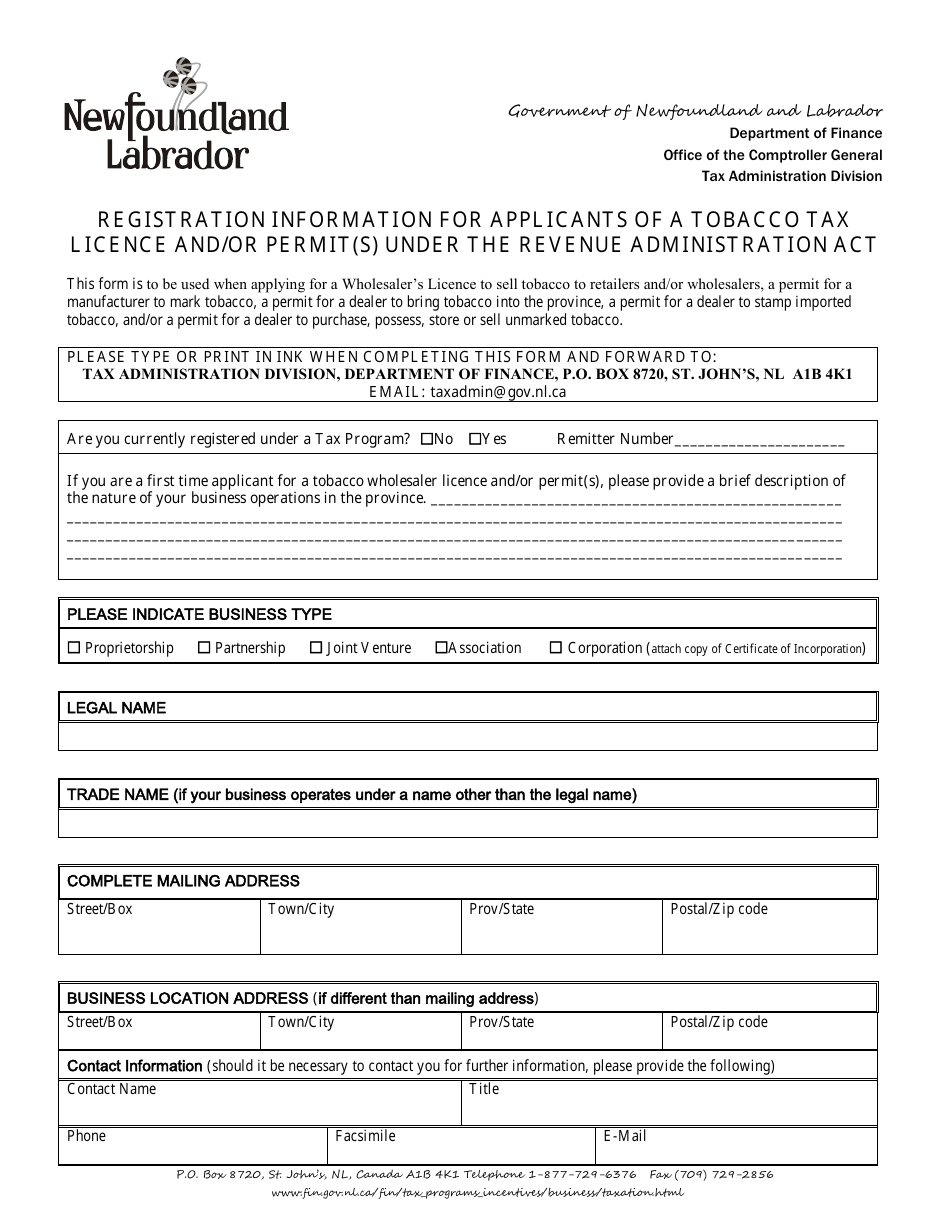

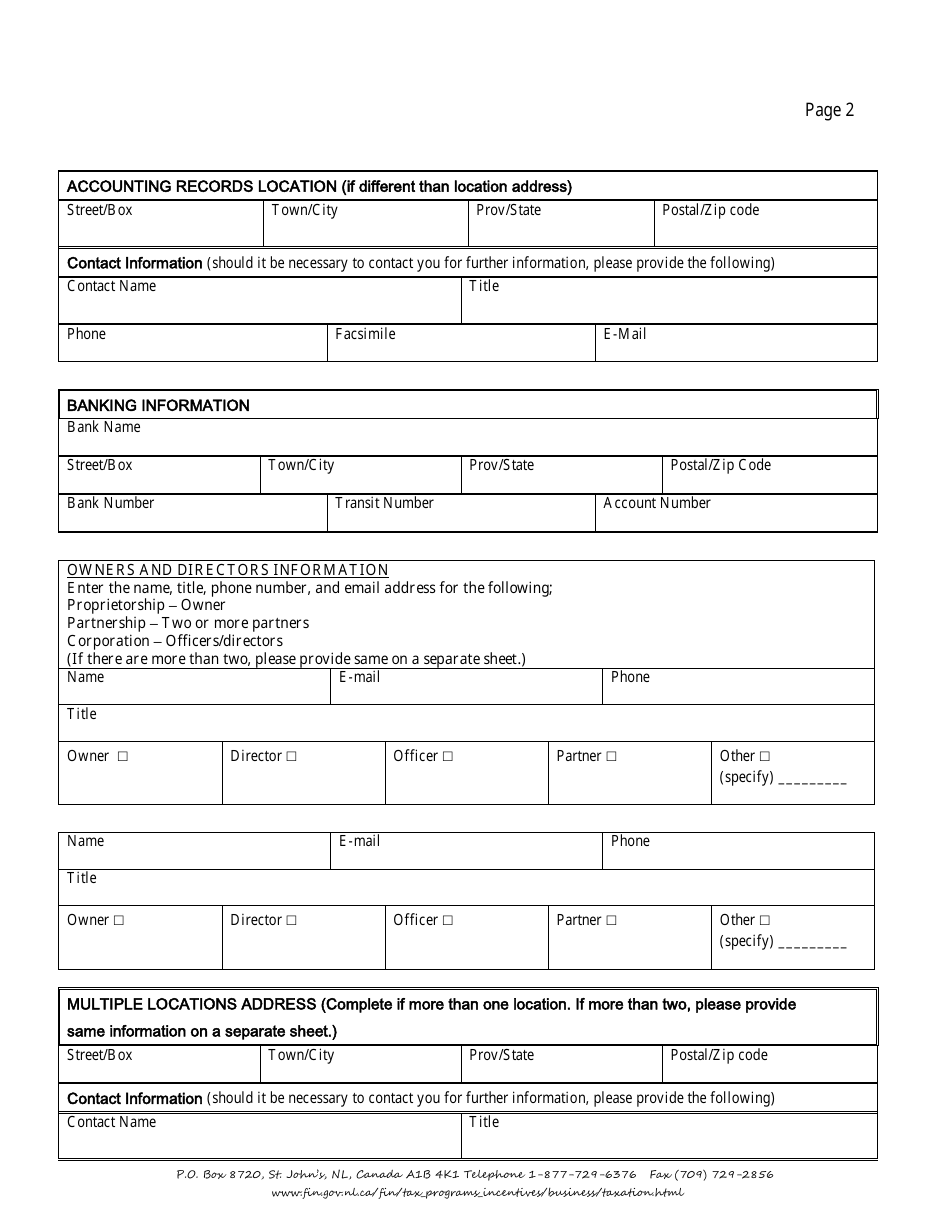

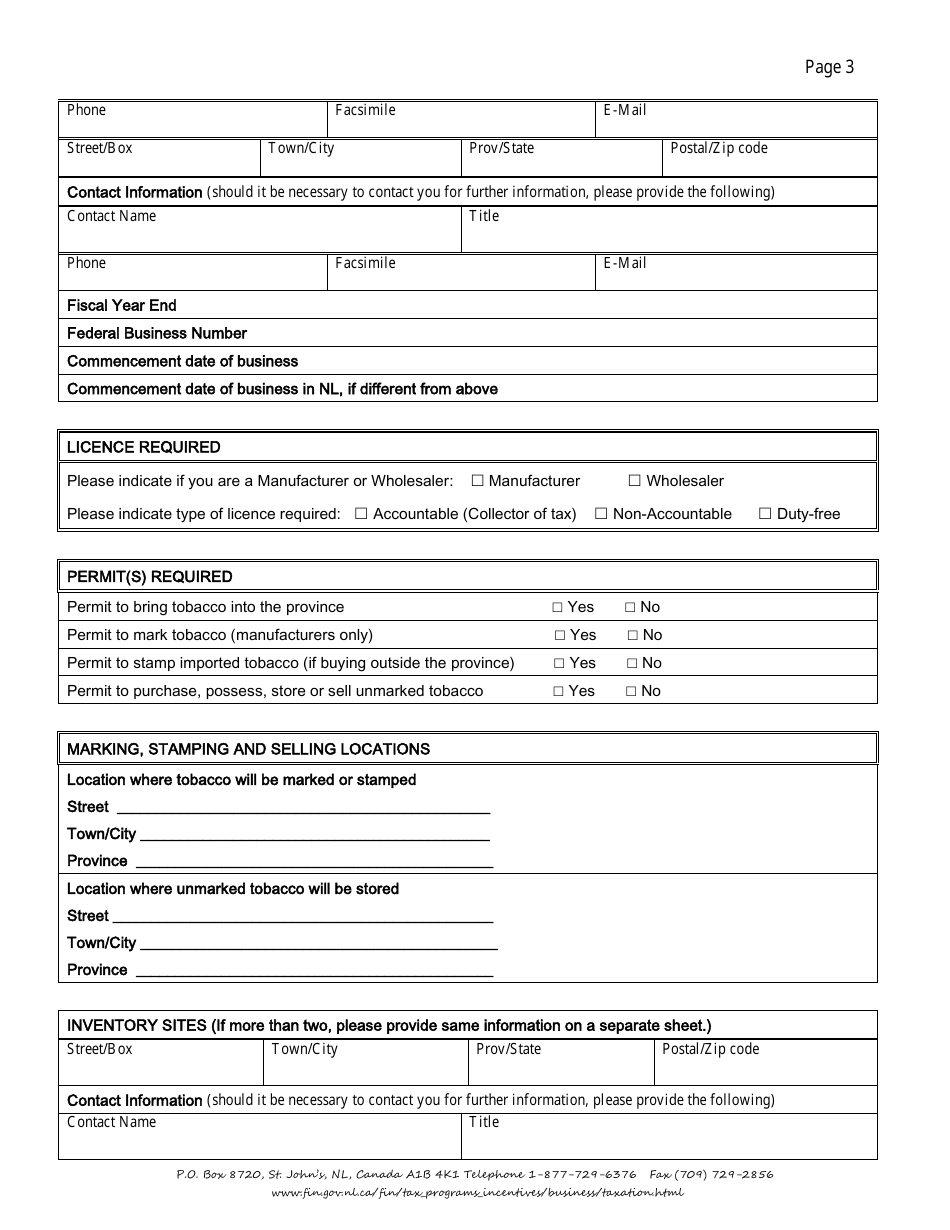

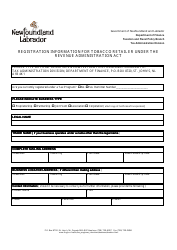

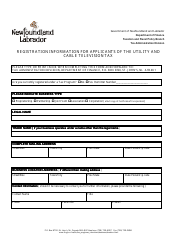

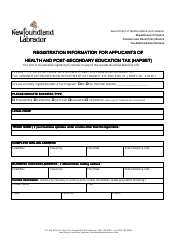

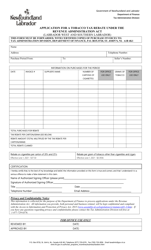

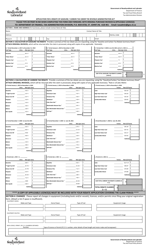

Registration Information for Applicants of a Tobacco Tax Licence and / or Permit(S) Under the Revenue Administration Act - Newfoundland and Labrador, Canada

Registration information for applicants of a tobacco tax license and/or permit under the Revenue Administration Act in Newfoundland and Labrador, Canada is used to establish and verify the identity of the applicant, as well as to ensure compliance with the relevant laws and regulations related to the sale and distribution of tobacco products. It helps to track and monitor the activities of tobacco sellers and to enforce tax collection.

The registration information for applicants of a tobacco tax license and/or permit under the Revenue Administration Act in Newfoundland and Labrador, Canada is filed by the Department of Finance - Government of Newfoundland and Labrador.

FAQ

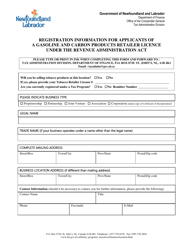

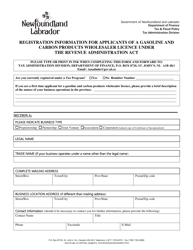

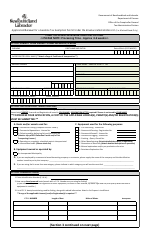

Q: Who needs to register for a tobacco tax license and/or permit?

A: Anyone who wants to sell tobacco products in Newfoundland and Labrador, Canada.

Q: What is the Revenue Administration Act?

A: The Revenue Administration Act is the legislation that governs the administration and collection of taxes in Newfoundland and Labrador, Canada.

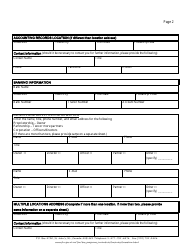

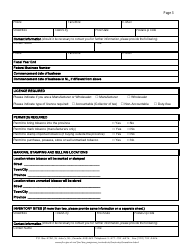

Q: What are the registration requirements for a tobacco tax license and/or permit?

A: You need to complete the registration application and provide certain information, such as your business details and criminal record check.

Q: How can I obtain the registration application?

A: You can obtain the registration application by contacting the Newfoundland and Labrador Revenue Administration Division.

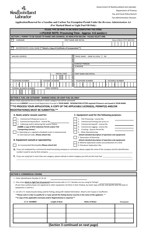

Q: Is there a fee for the tobacco tax license and/or permit?

A: Yes, there is a fee for the license and/or permit. The fee amount is specified by the Revenue Administration Division.

Q: How long does it take to process the registration application?

A: The processing time can vary, but it typically takes about 4-6 weeks to process the application.

Q: What happens after my registration application is approved?

A: Once your application is approved, you will receive your tobacco tax license and/or permit, allowing you to sell tobacco products in Newfoundland and Labrador.

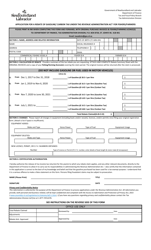

Q: Do I need to renew my tobacco tax license and/or permit?

A: Yes, the license and/or permit needs to be renewed annually. You will receive a renewal notice from the Revenue Administration Division.

Q: Can I transfer my tobacco tax license and/or permit to another person or business?

A: No, the tobacco tax license and/or permit cannot be transferred to another person or business. It is issued to the specific applicant.

Q: What are the penalties for operating without a tobacco tax license and/or permit?

A: Operating without a license and/or permit can result in fines, penalties, and legal consequences as per the Revenue Administration Act.