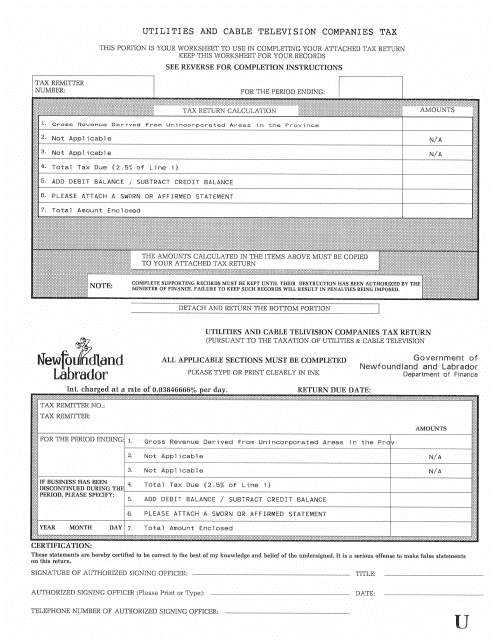

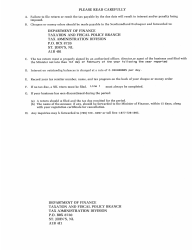

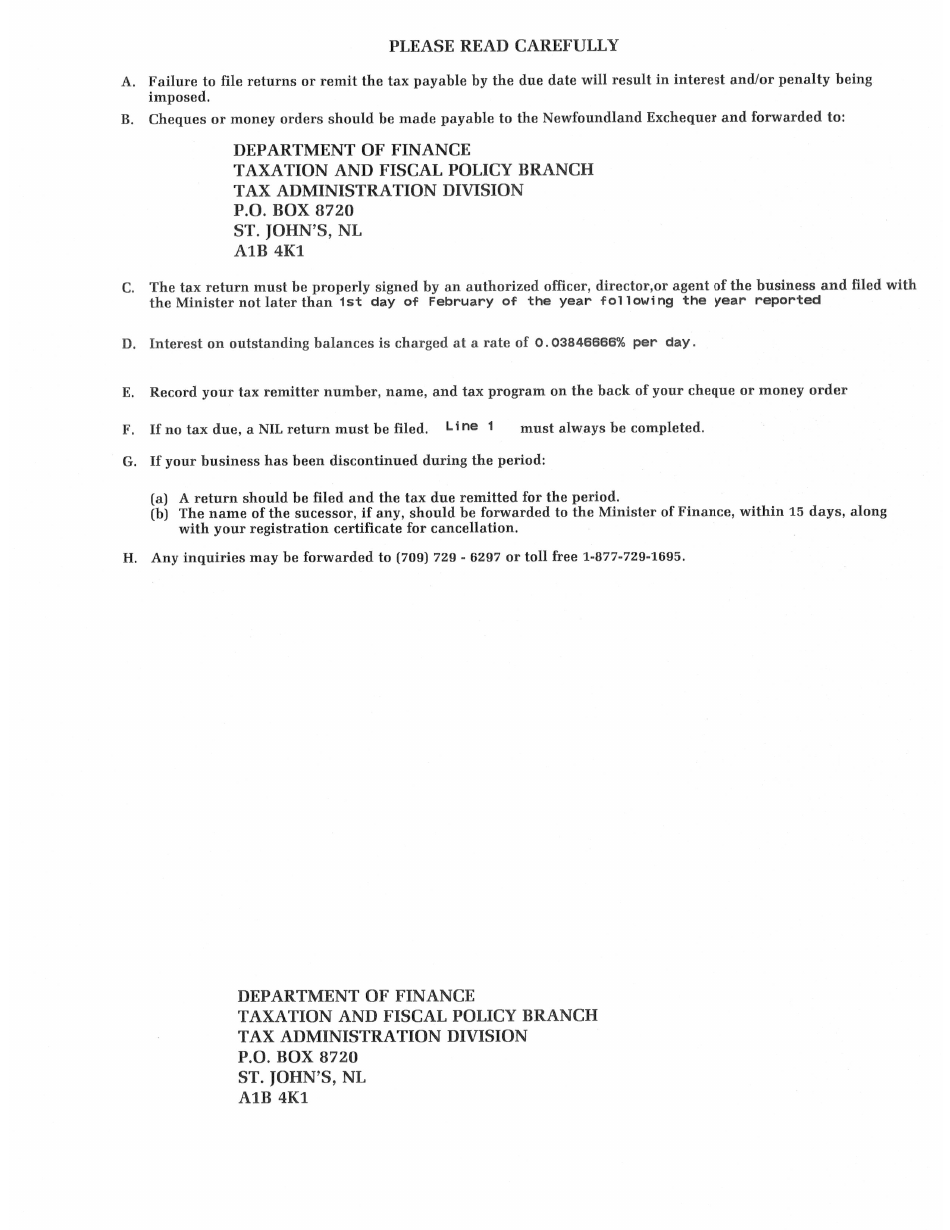

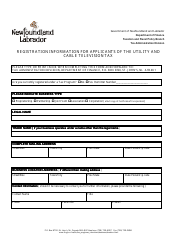

Utilities and Cable Television Companies Tax - Newfoundland and Labrador, Canada

The Utilities and Cable Television Companies Tax in Newfoundland and Labrador, Canada is levied on companies engaged in providing utilities and cable television services. The tax revenue is used to fund various public services and infrastructure projects in the province.

The utilities and cable television companies tax in Newfoundland and Labrador, Canada is filed by the companies themselves.

FAQ

Q: What is the Utilities and Cable Television Companies Tax in Newfoundland and Labrador?

A: The Utilities and Cable Television Companies Tax is a tax levied on the revenues of utility companies and cable television companies in the province of Newfoundland and Labrador, Canada.

Q: How is the Utilities and Cable Television Companies Tax calculated?

A: The Utilities and Cable Television Companies Tax is calculated based on a percentage of the total revenues generated by utility companies and cable television companies in Newfoundland and Labrador.

Q: Who is responsible for paying the Utilities and Cable Television Companies Tax?

A: Utility companies and cable television companies operating in Newfoundland and Labrador are responsible for paying the Utilities and Cable Television Companies Tax.

Q: What is the purpose of the Utilities and Cable Television Companies Tax?

A: The Utilities and Cable Television Companies Tax helps generate revenue for the government of Newfoundland and Labrador to fund public services and infrastructure projects.

Q: Is the Utilities and Cable Television Companies Tax included in my utility or cable television bill?

A: No, the Utilities and Cable Television Companies Tax is not directly included in your utility or cable television bill. It is a tax paid by the companies themselves.