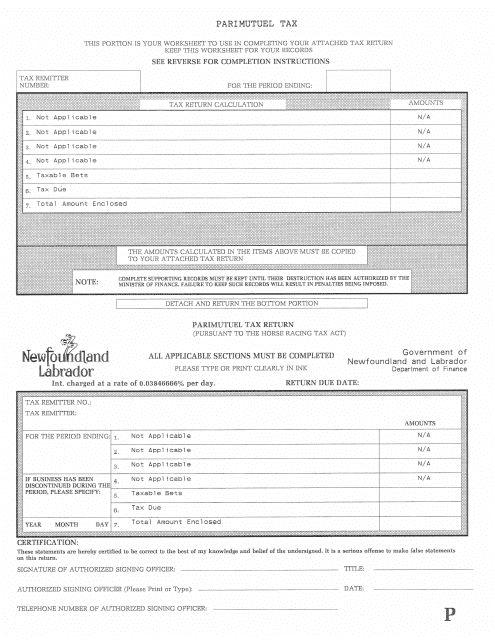

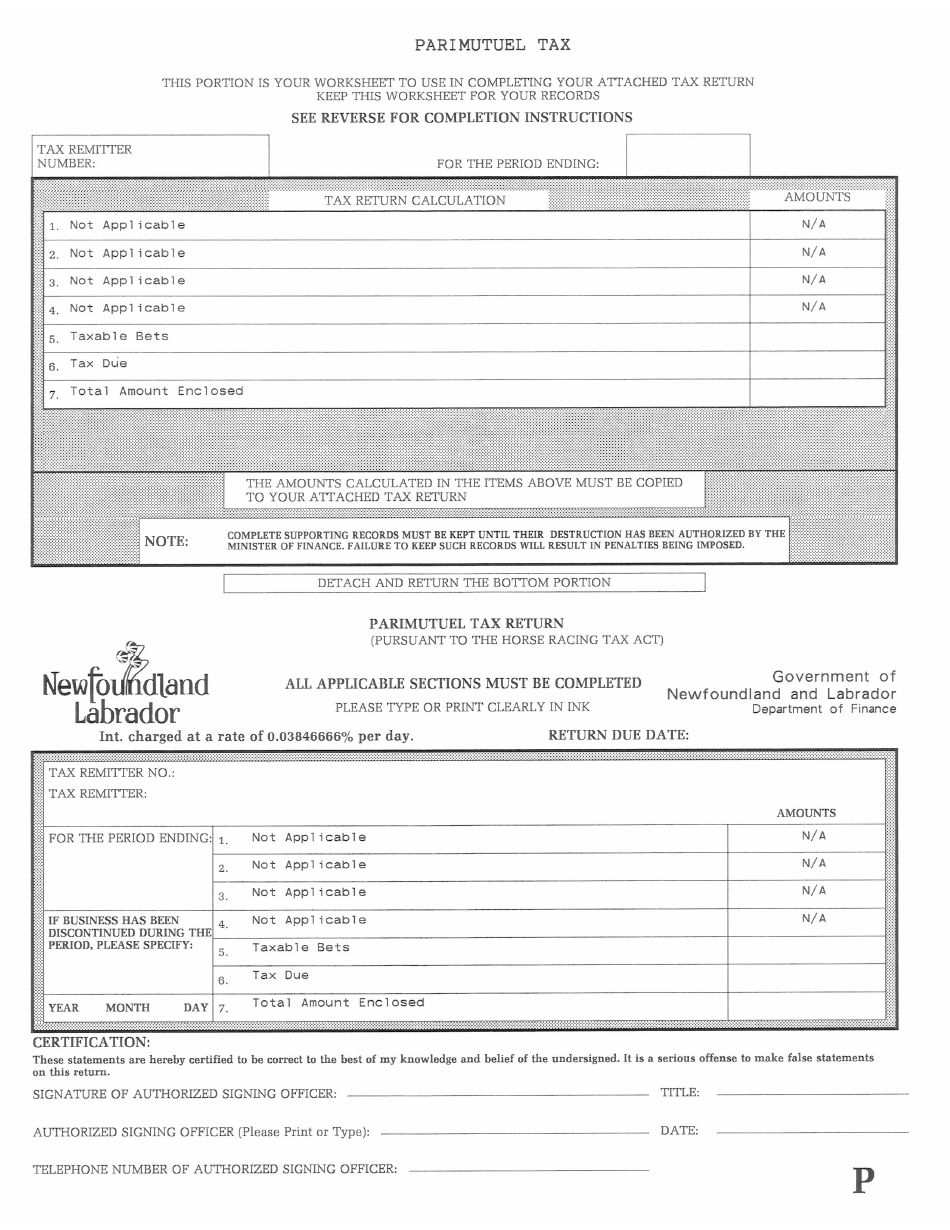

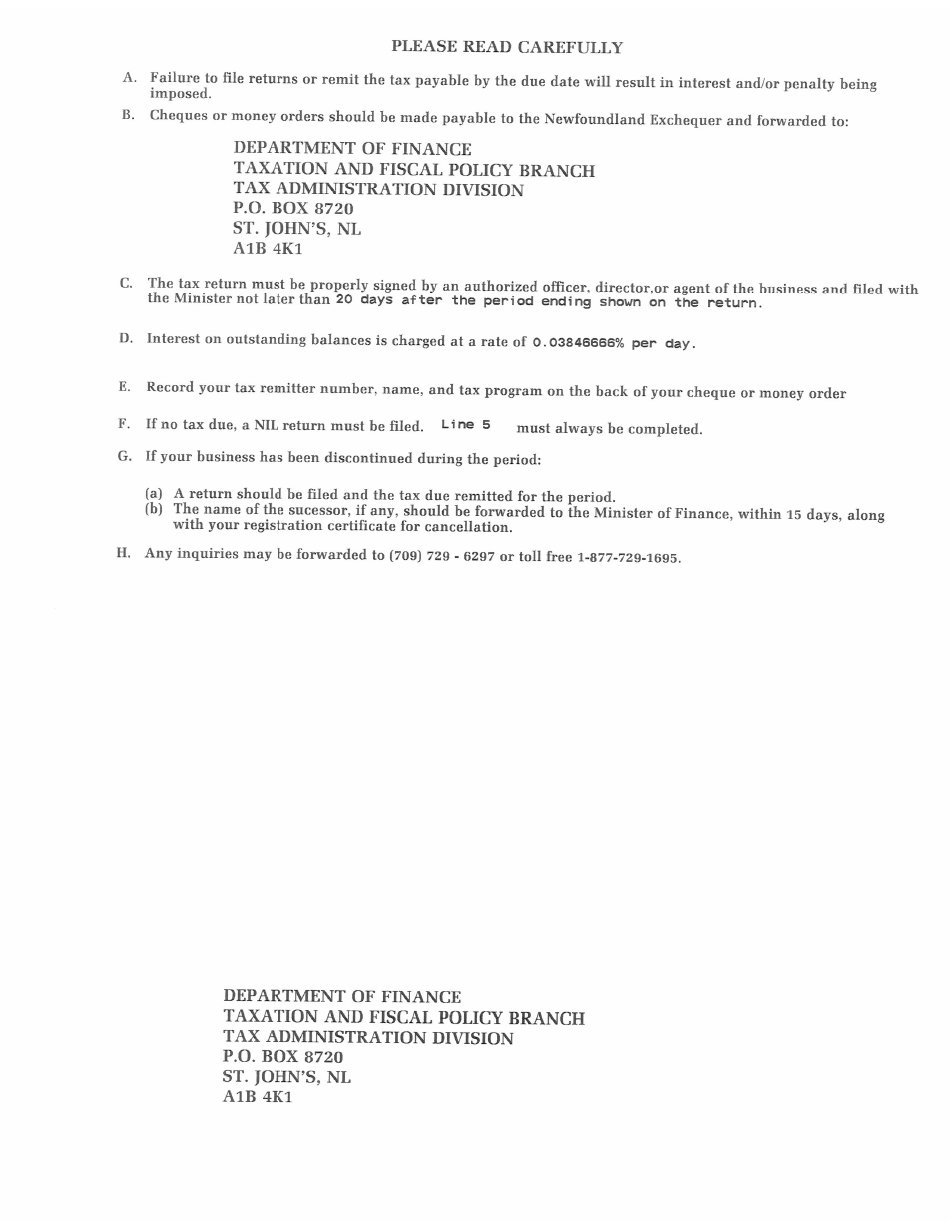

Parimutuel Tax - Newfoundland and Labrador, Canada

The Parimutuel Tax in Newfoundland and Labrador, Canada is a tax imposed on betting activities in horse racing and other forms of parimutuel wagering. The tax revenue generated from this helps to support the horse racing industry and related programs in the province.

The parimutuel tax in Newfoundland and Labrador, Canada, is filed by the gambling operators who offer parimutuel betting services.

FAQ

Q: What is the parimutuel tax?

A: The parimutuel tax is a type of tax on horse racing and other sports betting activities.

Q: Who is responsible for collecting the parimutuel tax?

A: The responsibility of collecting the parimutuel tax lies with the provincial government of Newfoundland and Labrador in Canada.

Q: How is the parimutuel tax calculated?

A: The parimutuel tax is typically calculated as a percentage of the total amount wagered on horse racing or other sports betting.

Q: What is the purpose of the parimutuel tax?

A: The purpose of the parimutuel tax is to generate revenue for the government and support the horse racing industry in Newfoundland and Labrador.

Q: Is the parimutuel tax applicable to all types of sports betting?

A: No, the parimutuel tax specifically applies to horse racing and other forms of parimutuel betting, where the odds and payouts depend on the total amount wagered by all participants.