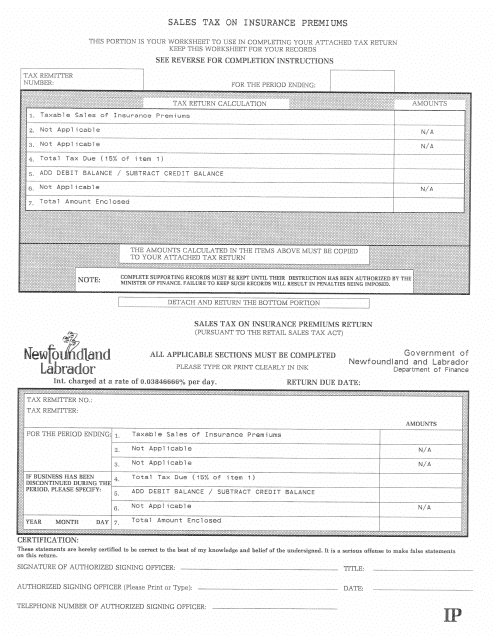

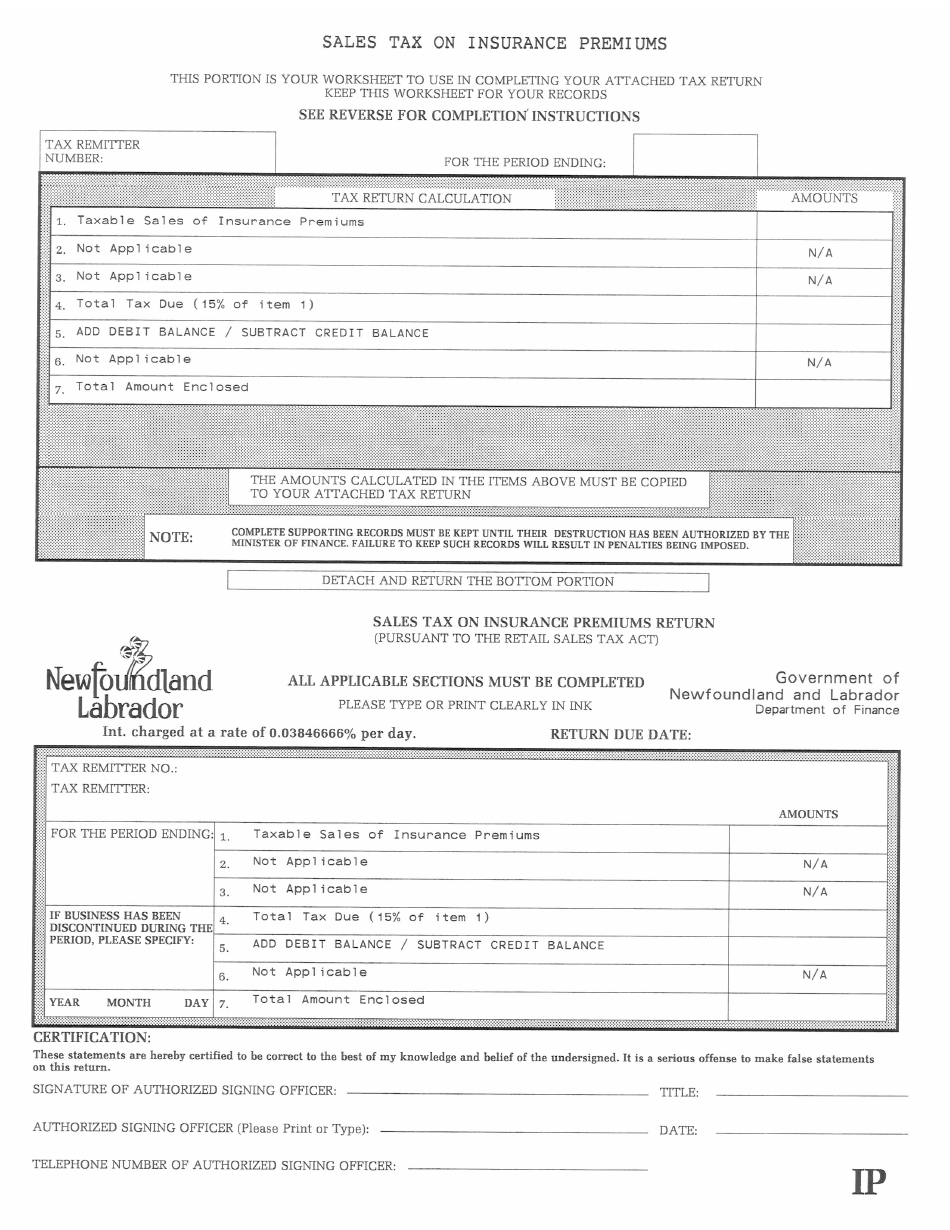

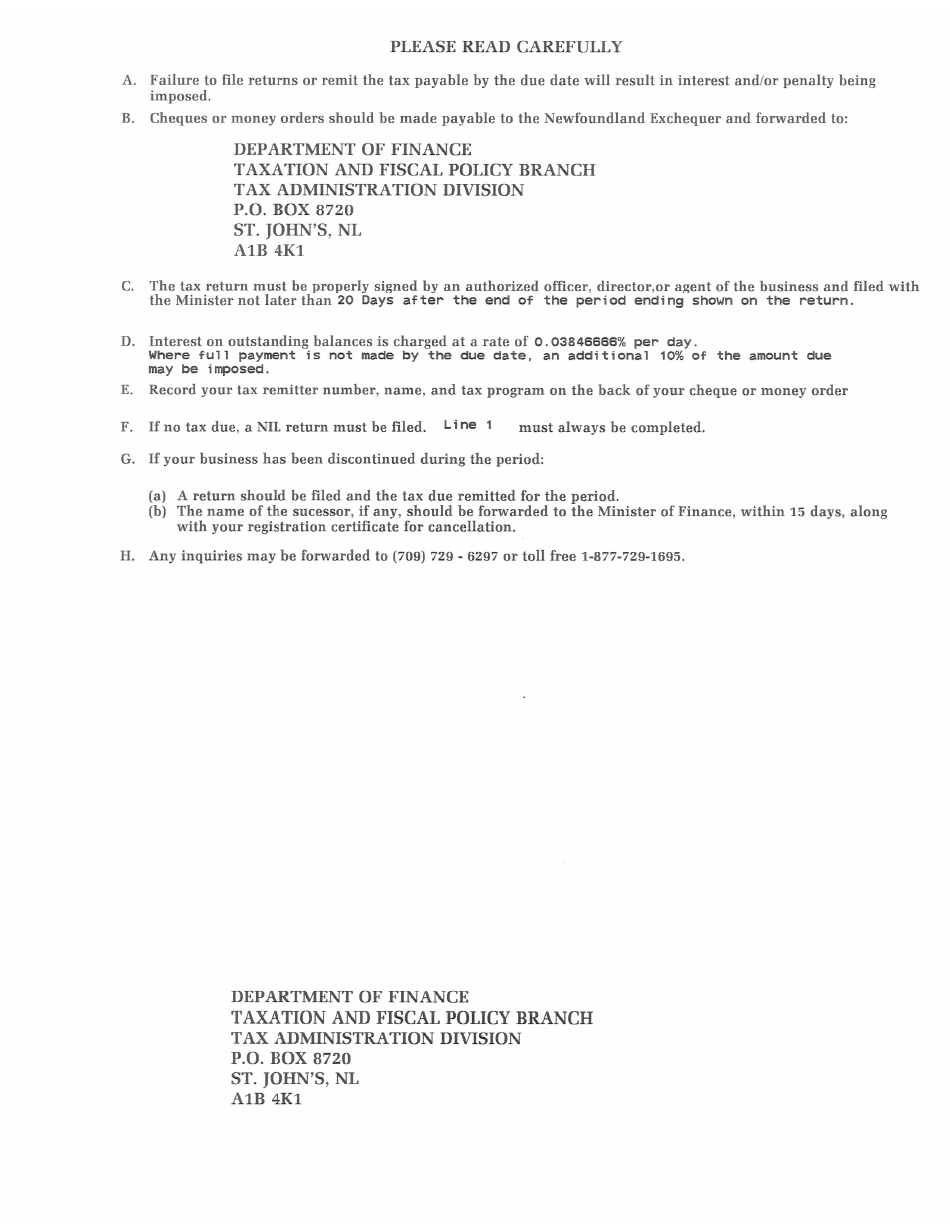

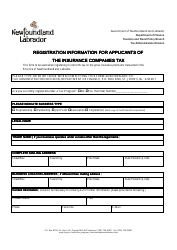

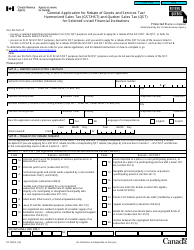

Sales Tax on Insurance Premiums - Newfoundland and Labrador, Canada

The Sales Tax on Insurance Premiums in Newfoundland and Labrador, Canada is charged on insurance policies to generate revenue for the provincial government. It helps finance government services and programs.

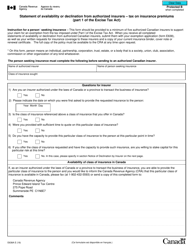

In Newfoundland and Labrador, Canada, the sales tax on insurance premiums is filed by insurance companies.

FAQ

Q: Is sales tax applied on insurance premiums in Newfoundland and Labrador?

A: Yes, sales tax is typically applied on insurance premiums in Newfoundland and Labrador.

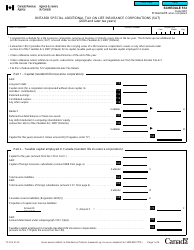

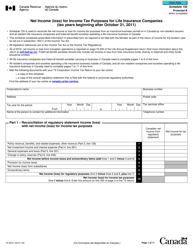

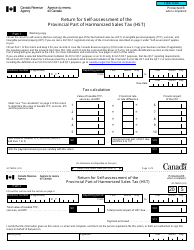

Q: What is the sales tax rate on insurance premiums in Newfoundland and Labrador?

A: The sales tax rate on insurance premiums in Newfoundland and Labrador is currently 15%.

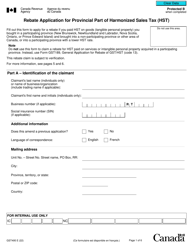

Q: Which type of sales tax is applied on insurance premiums in Newfoundland and Labrador?

A: The sales tax applied on insurance premiums in Newfoundland and Labrador is the Harmonized Sales Tax (HST).

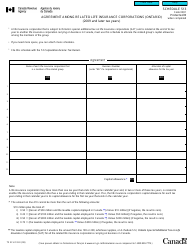

Q: Do all types of insurance premiums have sales tax applied in Newfoundland and Labrador?

A: No, certain types of insurance premiums such as life insurance and health insurance are exempt from sales tax in Newfoundland and Labrador.

Q: Are there any exceptions or exemptions to the sales tax on insurance premiums in Newfoundland and Labrador?

A: Yes, certain types of insurance premiums are exempt from sales tax in Newfoundland and Labrador. Examples include life insurance and health insurance.