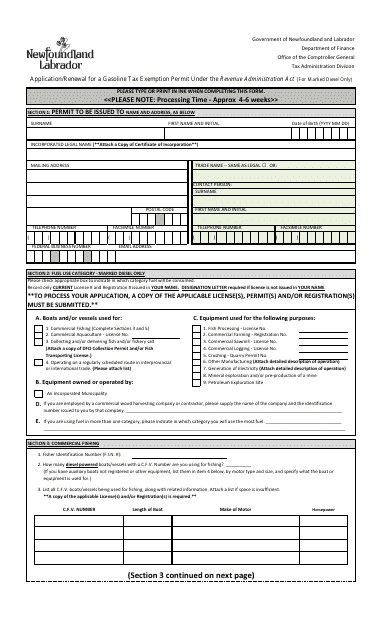

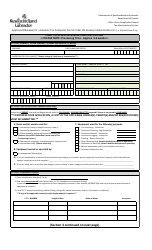

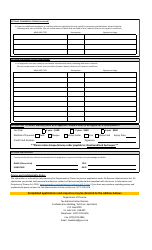

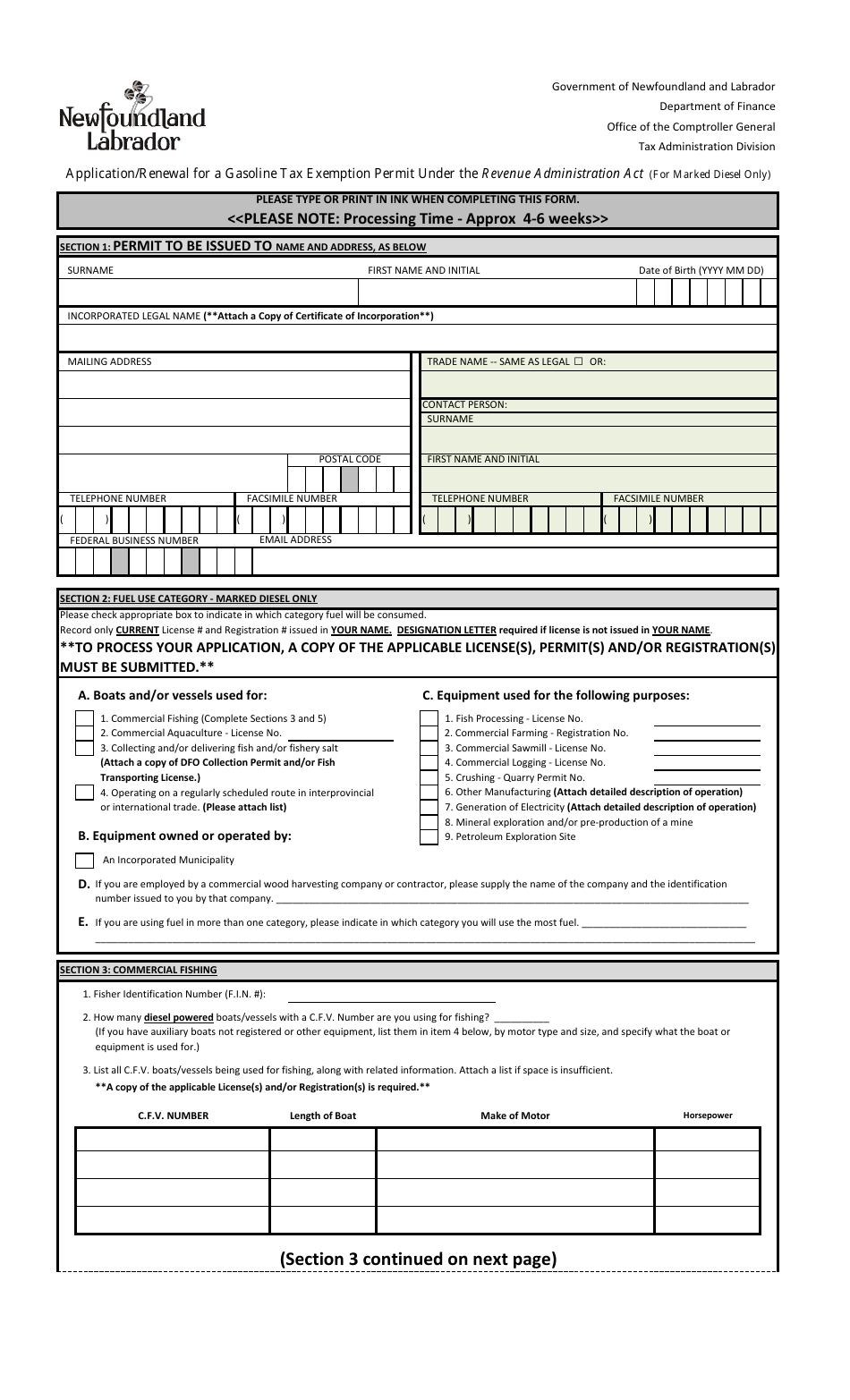

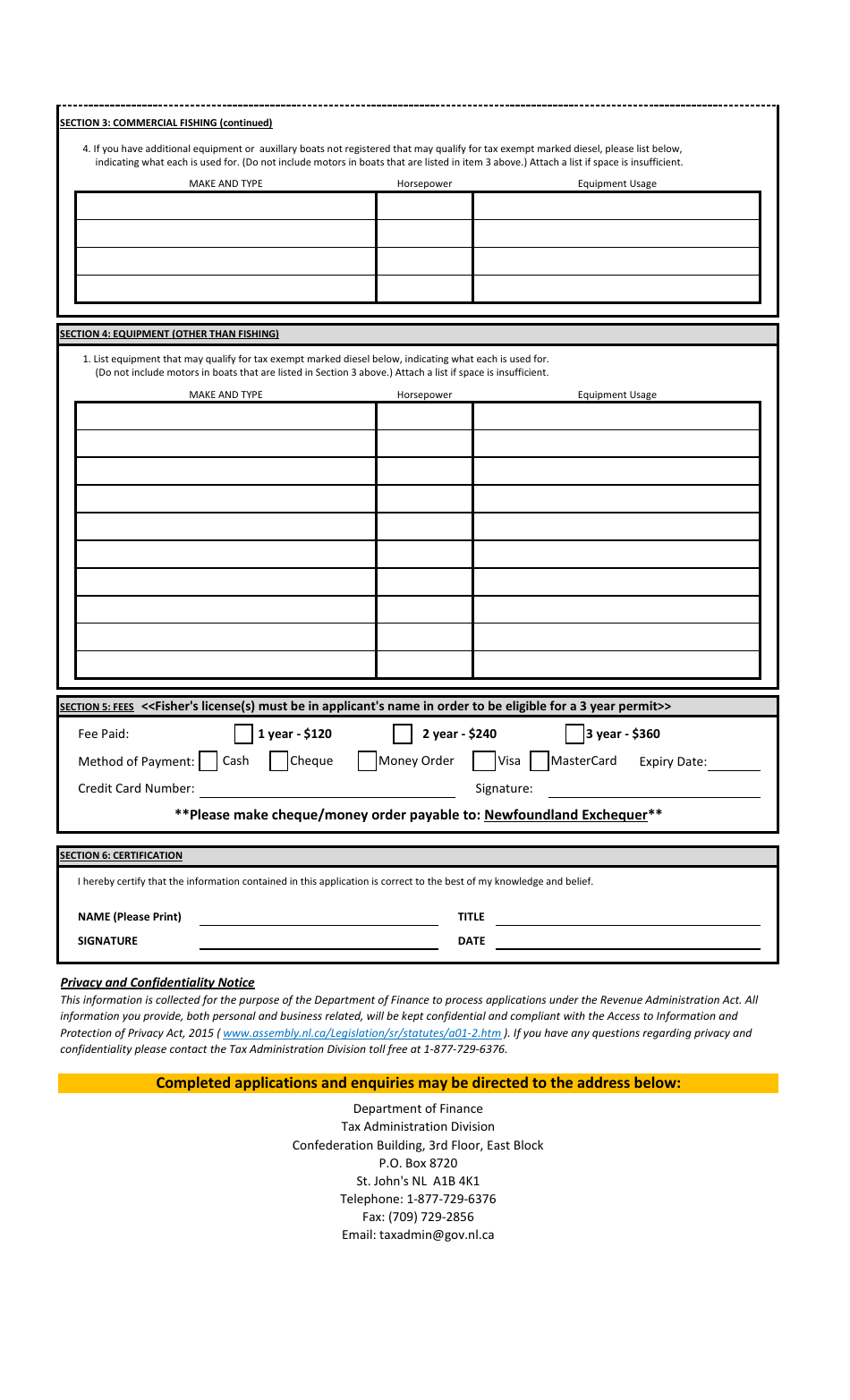

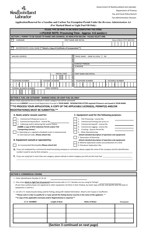

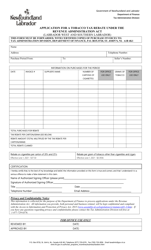

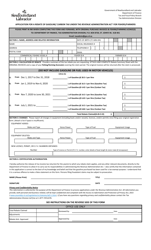

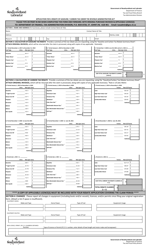

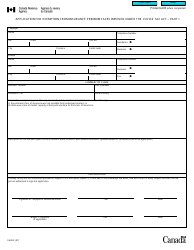

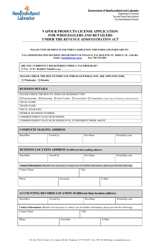

Application / Renewal for a Gasoline Tax Exemption Permit Under the Revenue Administration Act (For Marked Diesel Only) - Newfoundland and Labrador, Canada

The Application/Renewal for a Gasoline Tax Exemption Permit in Newfoundland and Labrador, Canada is for obtaining or renewing a permit that allows individuals or organizations to purchase marked diesel fuel without paying the gasoline tax. This exemption is specifically for marked diesel fuel only.

The application/renewal for a gasoline tax exemption permit under the Revenue Administration Act in Newfoundland and Labrador, Canada is filed by the taxpayer or their authorized representative.

FAQ

Q: What is a Gasoline Tax Exemption Permit?

A: A Gasoline Tax Exemption Permit allows the holder to purchase gasoline without paying tax on it.

Q: Who can apply for a Gasoline Tax Exemption Permit?

A: Businesses and individuals who require gasoline for exempt purposes can apply for a permit.

Q: What is marked diesel?

A: Marked diesel is diesel fuel that is specially dyed and is exempt from gasoline tax.

Q: What is the Revenue Administration Act?

A: The Revenue Administration Act is the legislation that governs taxation and revenue administration in Newfoundland and Labrador.

Q: How do I apply for a Gasoline Tax Exemption Permit?

A: To apply for a permit, you need to complete an application form and submit it to the appropriate government office.

Q: What are the exempt purposes for which a Gasoline Tax Exemption Permit can be issued?

A: Exempt purposes include farming, fishing, forestry, tourism, and certain types of construction.

Q: Is the Gasoline Tax Exemption Permit valid for a specific period of time?

A: Yes, the permit is valid for a specific period of time which is indicated on the permit.

Q: Can the Gasoline Tax Exemption Permit be transferred to another person or business?

A: No, the permit cannot be transferred and can only be used by the person or business named on the permit.

Q: What happens if I am found using a Gasoline Tax Exemption Permit for non-exempt purposes?

A: Using the permit for non-exempt purposes is illegal and can result in penalties and fines.