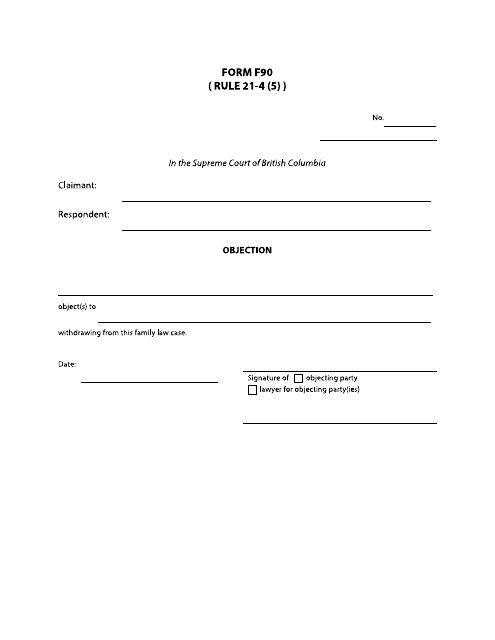

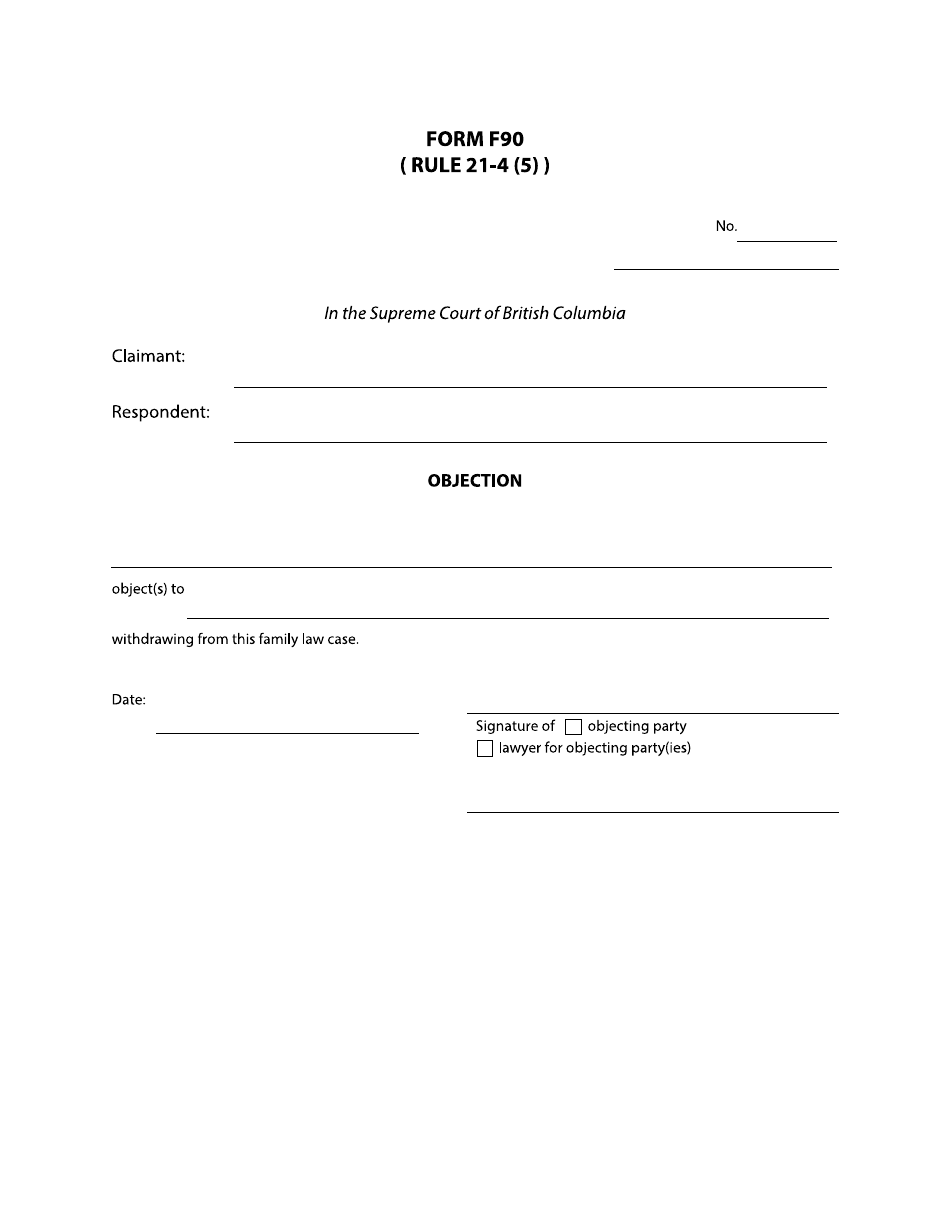

Form F90 Objection - British Columbia, Canada

Form F90 Objection is used in British Columbia, Canada for filing an objection to an assessment or decision made by the British Columbia Assessment Authority. It allows property owners to dispute the assessed value of their property for property tax purposes.

In British Columbia, Canada, individuals or corporations who wish to file an objection to an assessment can complete and file the Form F90 Objection with the Ministry of Finance.

FAQ

Q: What is a Form F90 Objection?

A: A Form F90 Objection is a formal document used in British Columbia, Canada to object to a property assessment.

Q: When is a Form F90 Objection used?

A: A Form F90 Objection is used when a property owner disagrees with the assessed value of their property and wants to challenge it.

Q: How do I file a Form F90 Objection?

A: To file a Form F90 Objection, you need to complete the form and submit it to the British Columbia Assessment Authority within the specified deadline.

Q: What information is required in a Form F90 Objection?

A: A Form F90 Objection requires details about the property, reasons for the objection, and supporting evidence.

Q: What happens after I file a Form F90 Objection?

A: After filing a Form F90 Objection, the British Columbia Assessment Authority will review the objection and may schedule a hearing to resolve the dispute.

Q: Can I seek professional help to complete a Form F90 Objection?

A: Yes, property owners can seek help from professionals like appraisers or tax consultants to complete a Form F90 Objection.