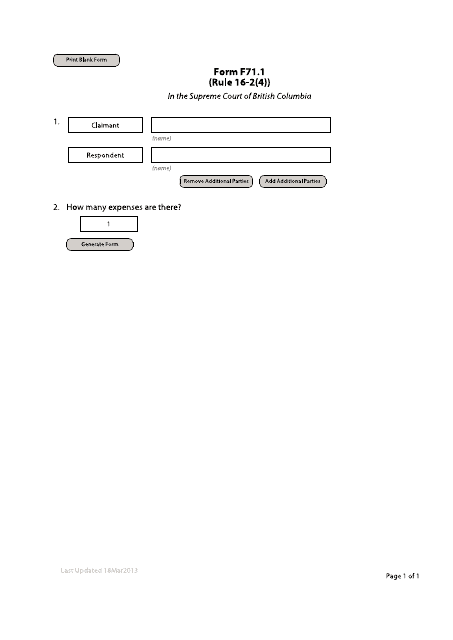

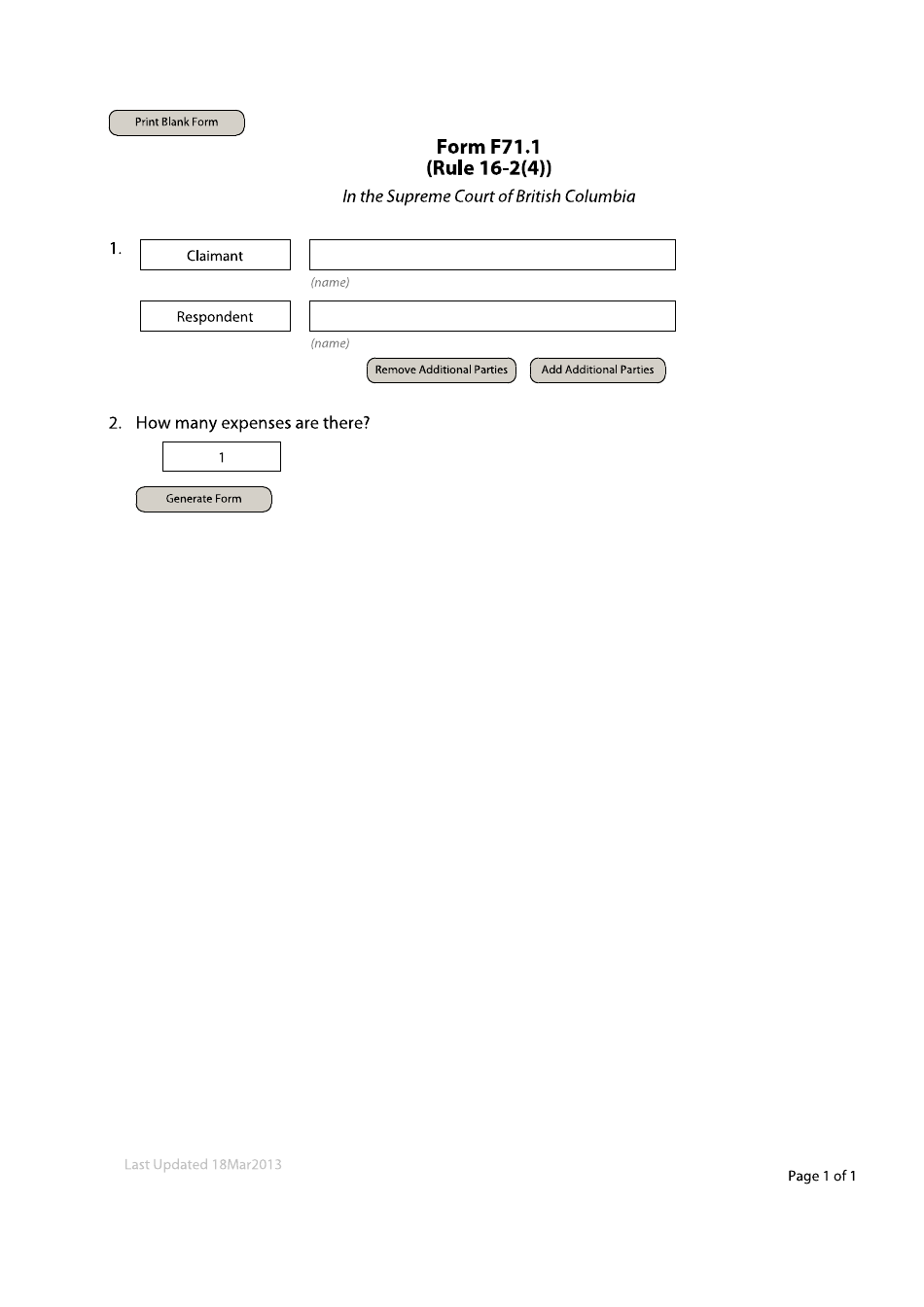

Form F71.1 List of Expenses - British Columbia, Canada

Form F71.1 List of Expenses is used in British Columbia, Canada for reporting expenses related to a child support claim.

The Form F71.1 List of Expenses in British Columbia, Canada is filed by the person who is claiming expenses related to a legal action, typically in a family law matter.

FAQ

Q: What is Form F71.1?

A: Form F71.1 is a list of expenses.

Q: What is the purpose of Form F71.1?

A: The purpose of Form F71.1 is to document expenses in British Columbia, Canada.

Q: Who needs to complete Form F71.1?

A: Anyone in British Columbia, Canada who wants to claim expenses.

Q: What expenses can be listed on Form F71.1?

A: Any legitimate expenses incurred by an individual or business in British Columbia, Canada.

Q: What information is required on Form F71.1?

A: Form F71.1 typically requires details such as the date and description of the expense, as well as the amount spent.

Q: Do I need to submit supporting documents with Form F71.1?

A: It is recommended to keep supporting documents for your expenses in case you're asked to provide them later.

Q: Is Form F71.1 specific to British Columbia, Canada?

A: Yes, Form F71.1 is specific to expenses in British Columbia, Canada.

Q: Is Form F71.1 for personal or business expenses?

A: Form F71.1 can be used for both personal and business expenses.

Q: What should I do after completing Form F71.1?

A: After completing Form F71.1, you should submit it to the appropriate tax authority or include it with your tax return.

Q: Can I claim all my expenses on Form F71.1?

A: You can claim legitimate expenses, but it's important to follow the tax rules and guidelines set by the government.

Q: Are there any deadlines for submitting Form F71.1?

A: Specific deadlines for submitting Form F71.1 may vary, so it's advisable to check with the tax authority or consult a tax professional.

Q: What happens if I don't complete Form F71.1?

A: If you are required to complete Form F71.1 and you fail to do so, you may miss out on potential deductions or face penalties.

Q: Can I amend Form F71.1 after submitting it?

A: In some cases, you may be able to amend Form F71.1 if you made an error or need to update information. Check with the tax authority for specific instructions.

Q: Is Form F71.1 the only form for listing expenses in British Columbia, Canada?

A: Form F71.1 is a commonly used form for listing expenses, but there may be other forms or documentation required depending on the nature of the expenses.

Q: Can I claim expenses from previous years with Form F71.1?

A: Form F71.1 is typically used for the current tax year. If you need to claim expenses from previous years, you may need to use a different form or consult a tax professional.