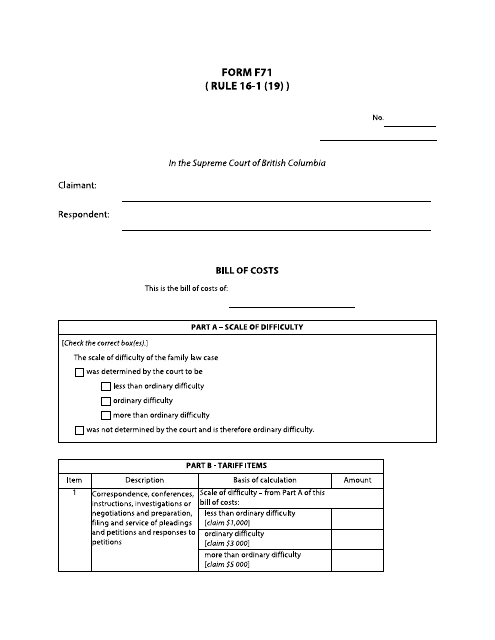

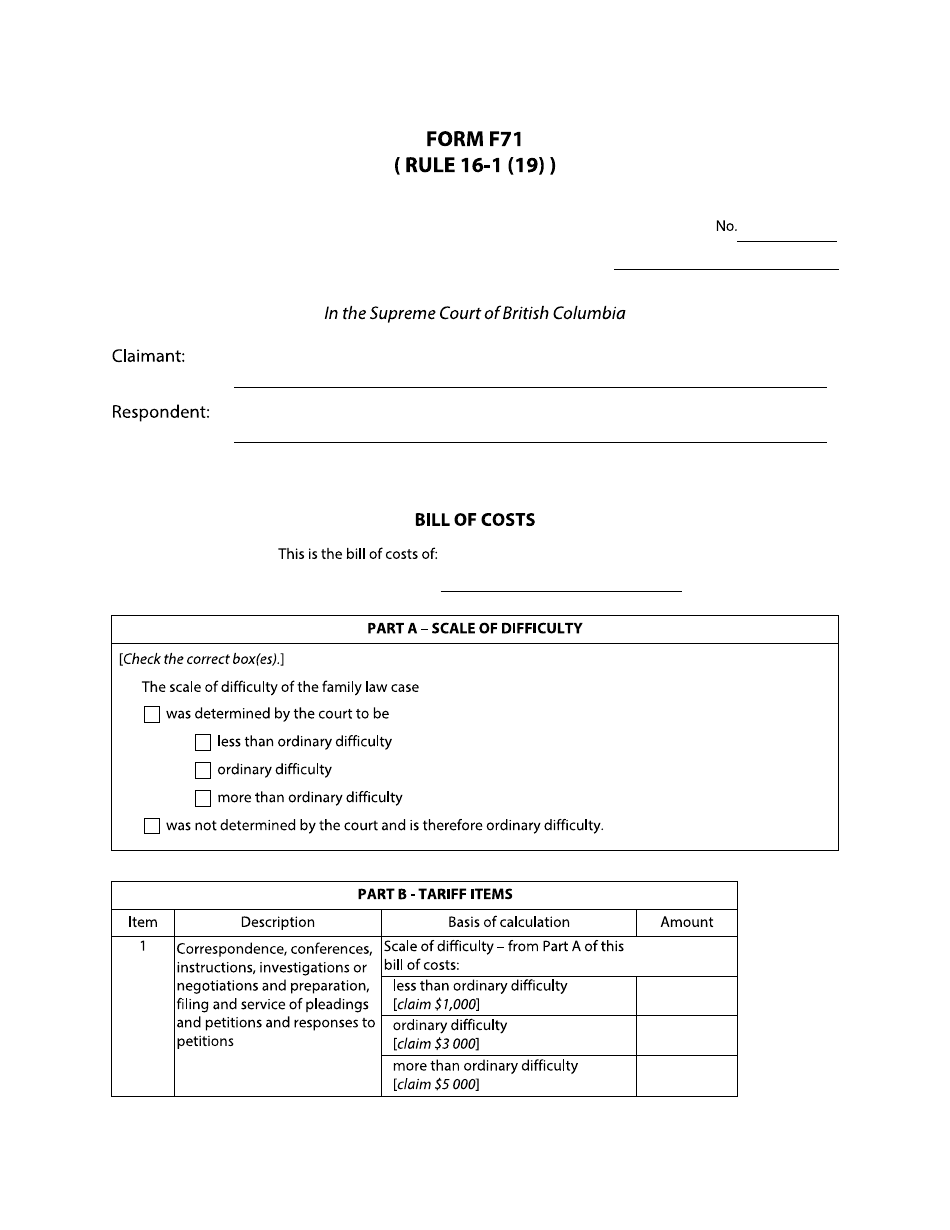

Form F71 Bill of Costs - British Columbia, Canada

Form F71 Bill of Costs in British Columbia, Canada is used for the purpose of itemizing and quantifying the costs incurred in a legal proceeding. It is typically prepared by the party seeking reimbursement of their legal costs and is submitted to the court for assessment. The form helps in seeking clarity and transparency in terms of the expenses associated with a legal case.

The Form F71 Bill of Costs in British Columbia, Canada is typically filed by the party who is seeking to recover their legal costs after a court proceeding.

FAQ

Q: What is Form F71 Bill of Costs?

A: Form F71 Bill of Costs is a document used in British Columbia, Canada, to outline the costs incurred in a legal proceeding and request reimbursement.

Q: When is Form F71 Bill of Costs used?

A: Form F71 Bill of Costs is used after completing a legal proceeding, such as a court case, to claim reimbursement for allowable costs.

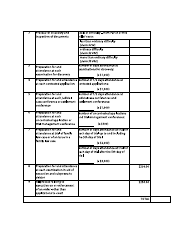

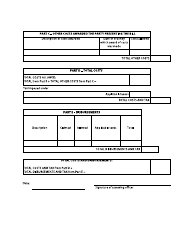

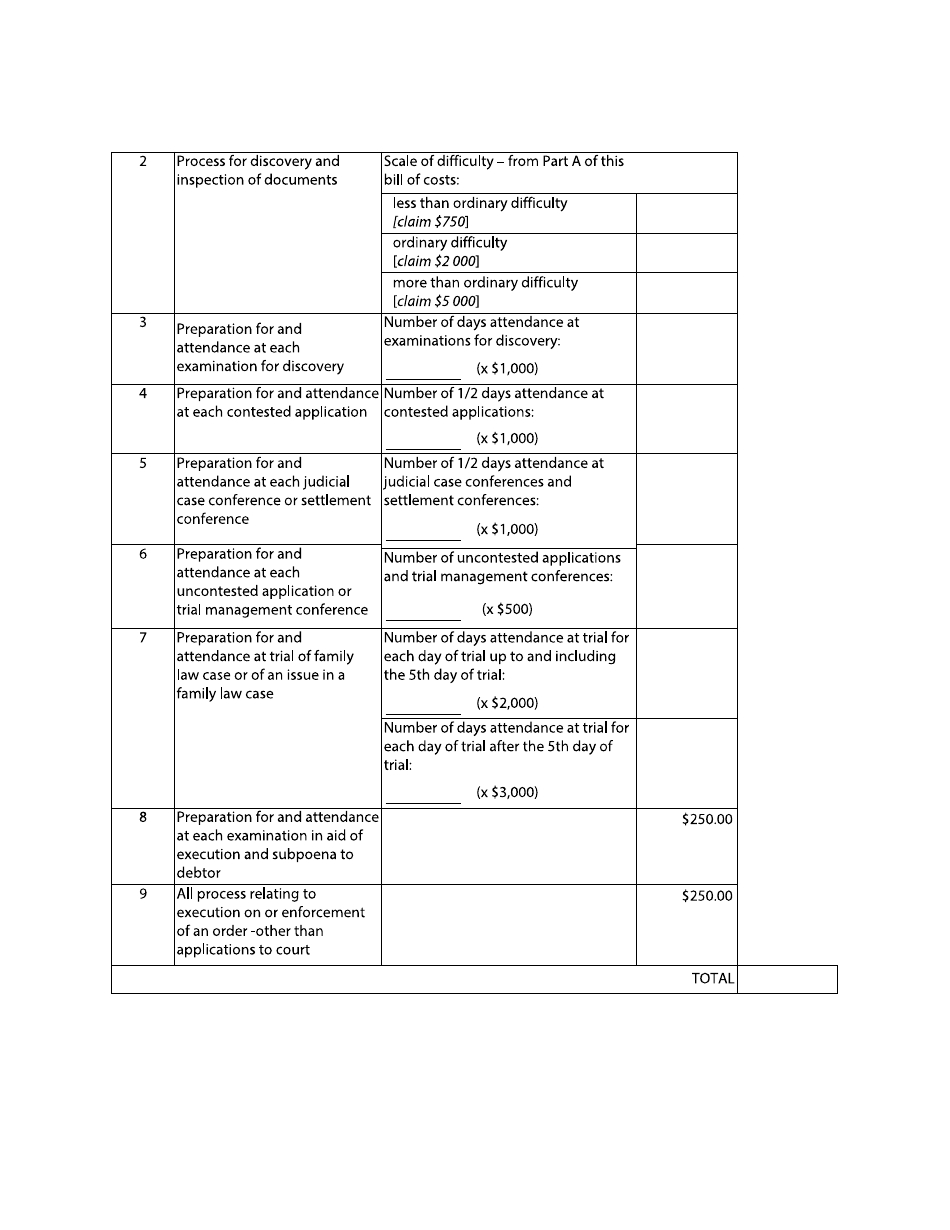

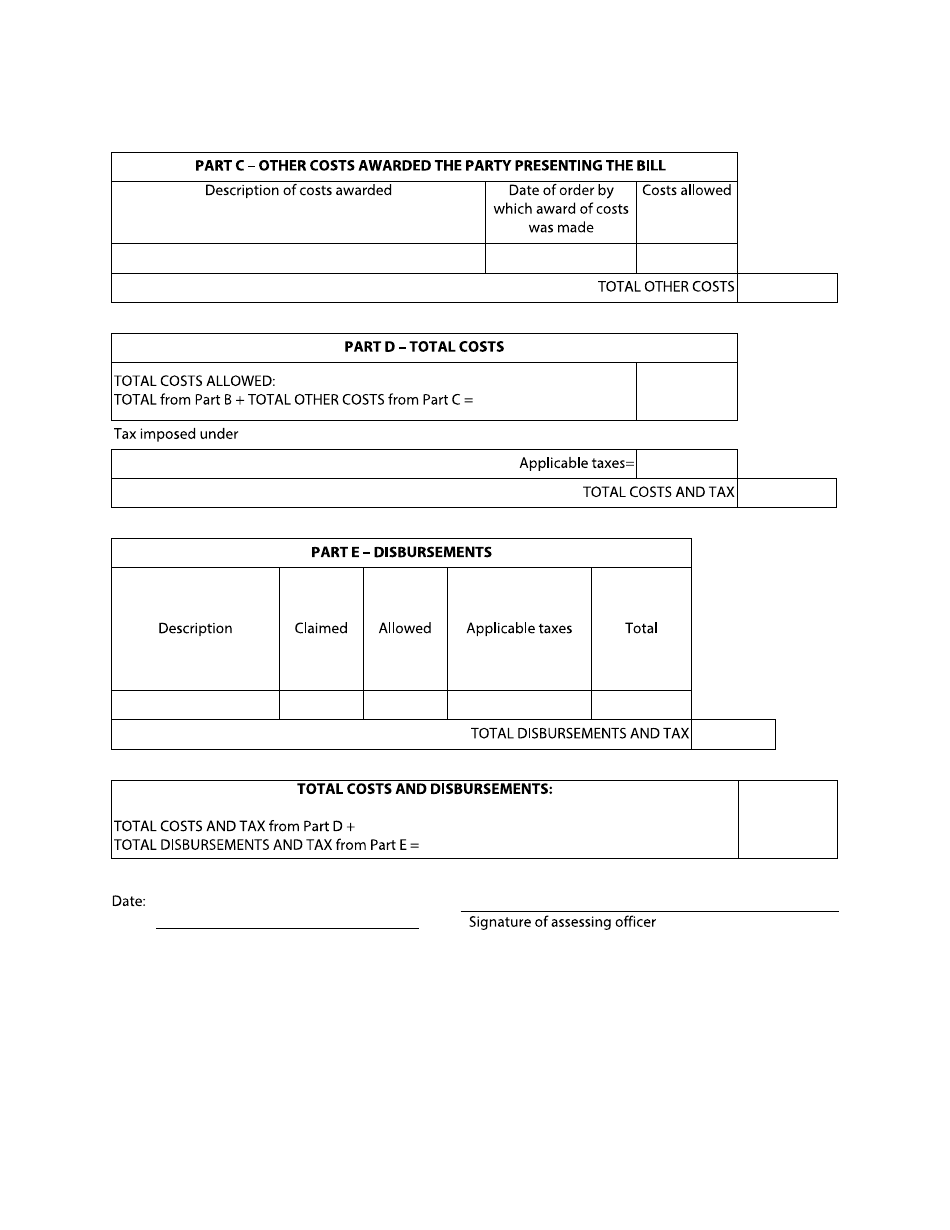

Q: What information is required in Form F71 Bill of Costs?

A: Form F71 Bill of Costs requires detailed information about the costs incurred, including dates, descriptions, and amounts.

Q: Who can submit a Form F71 Bill of Costs?

A: Generally, the party who incurred the costs, or their legal representative, can submit a Form F71 Bill of Costs.

Q: How is Form F71 Bill of Costs submitted?

A: Form F71 Bill of Costs is typically submitted to the court or tribunal where the legal proceeding took place.

Q: What happens after submitting Form F71 Bill of Costs?

A: The court or tribunal will review the Form F71 Bill of Costs and determine the amount of reimbursement that will be granted.