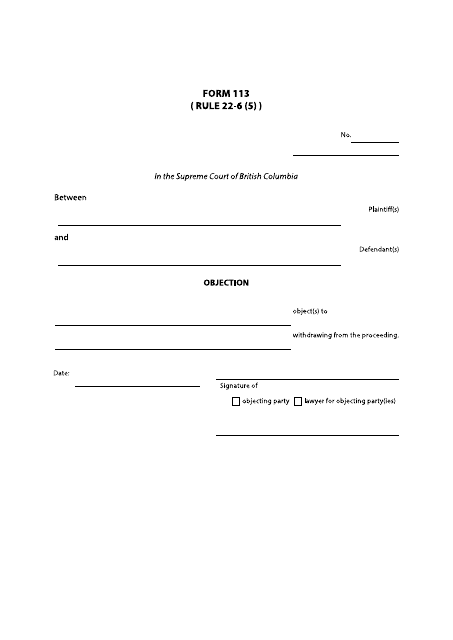

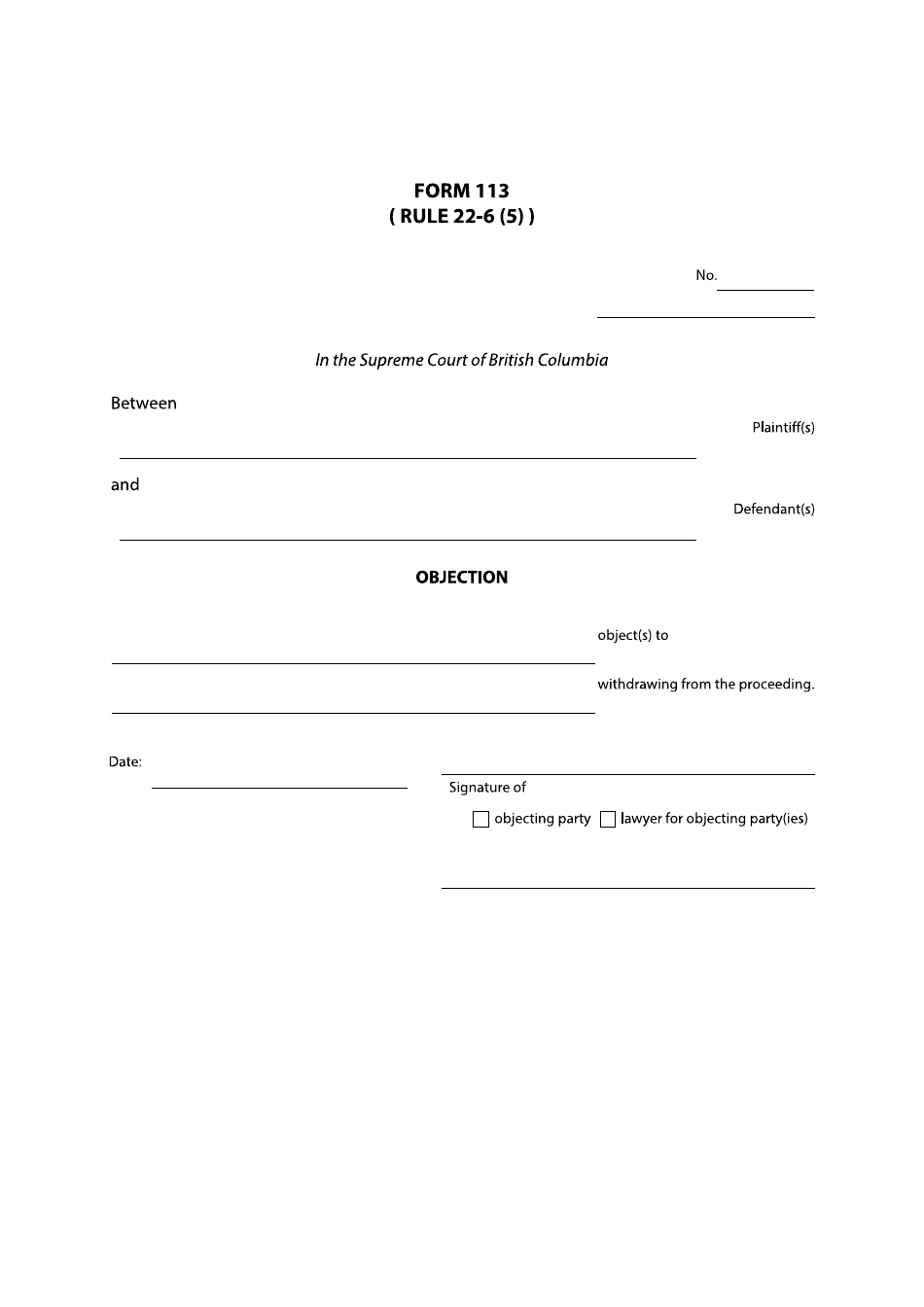

Form 113 Objection - British Columbia, Canada

Form 113 Objection in British Columbia, Canada is used for filing objections to property assessments.

The Form 113 objection in British Columbia, Canada is filed by the taxpayer.

FAQ

Q: What is Form 113?

A: Form 113 is a document used in British Columbia, Canada.

Q: What is the purpose of Form 113?

A: Form 113 is used to file an objection in British Columbia, Canada.

Q: Who can use Form 113?

A: Anyone who wants to file an objection in British Columbia, Canada can use Form 113.

Q: Are there any fees associated with filing Form 113?

A: Yes, there may be fees associated with filing Form 113. You should check with the relevant government authority for more information.

Q: What should I do after filling out Form 113?

A: After filling out Form 113, you should submit it to the appropriate government authority according to the instructions provided on the form.

Q: How long does it take for a decision to be made after filing Form 113?

A: The time it takes for a decision to be made after filing Form 113 can vary. You should check with the relevant government authority for an estimated timeframe.

Q: Can I appeal a decision made after filing Form 113?

A: Yes, you may have the option to appeal a decision made after filing Form 113. You should check with the relevant government authority for more information on the appeals process.