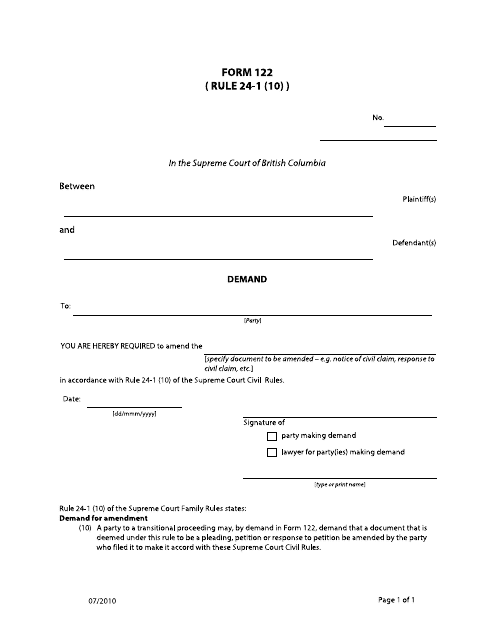

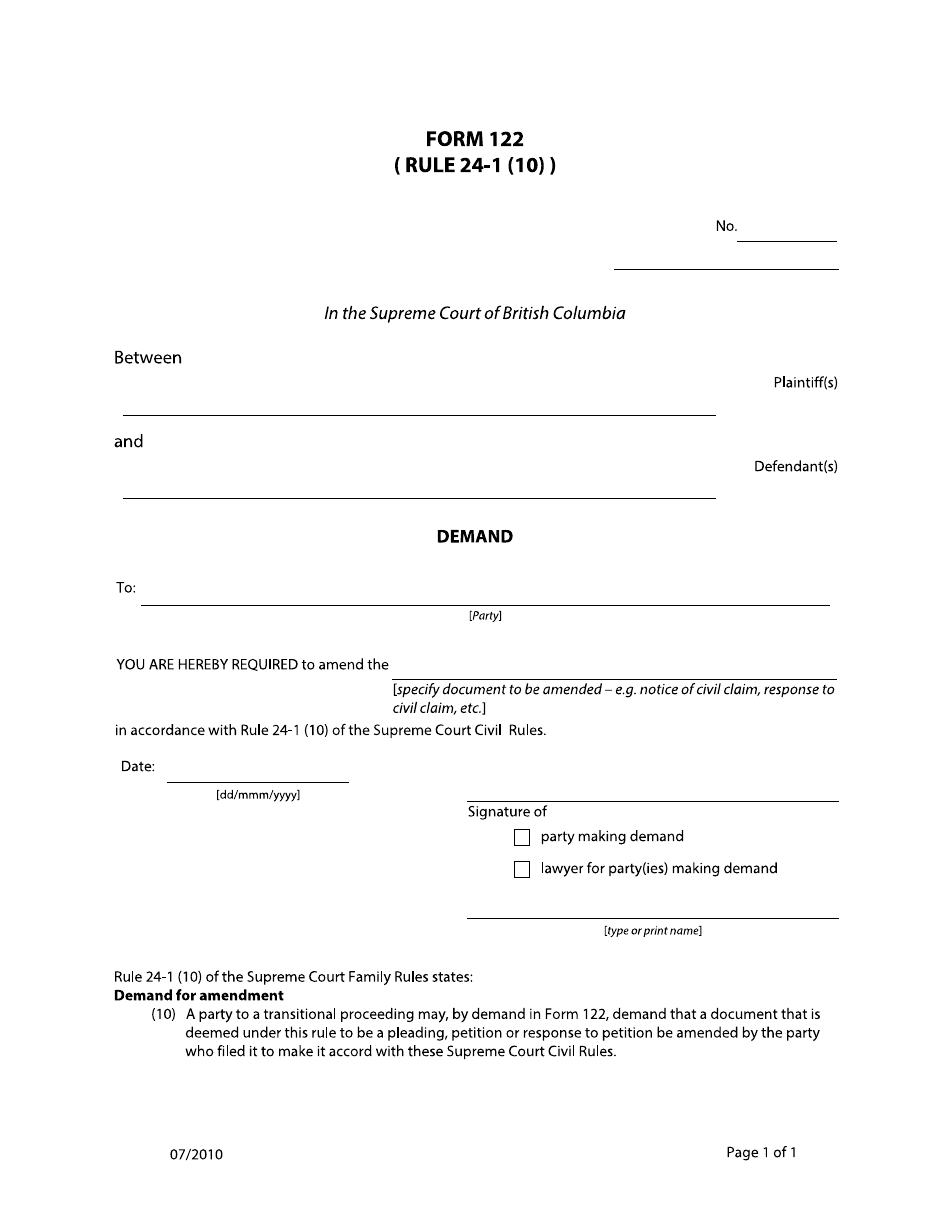

Form 122 Demand - British Columbia, Canada

Form 122 Demand in British Columbia, Canada is used to request payment for outstanding debts or unpaid fees. It allows creditors to make a formal demand for payment from debtors.

The Form 122 Demand in British Columbia, Canada is typically filed by the party making the claim or seeking a resolution.

FAQ

Q: What is Form 122?

A: Form 122 is a legal document used in British Columbia, Canada.

Q: What is the purpose of Form 122?

A: Form 122 is used to demand the payment of money owed by a debtor.

Q: Who can use Form 122?

A: Form 122 can be used by individuals, businesses, or organizations who are owed money.

Q: How do I fill out Form 122?

A: You need to fill out the debtor's information, details of the debt, and sign the form. It is recommended to seek legal advice when filling out the form.

Q: What can I do if the debtor doesn't respond to Form 122?

A: If the debtor doesn't respond, you may need to take legal action by filing a claim in court.

Q: Is there a fee to file Form 122?

A: There may be a fee to file Form 122. You should check with the court or legal authority for the current fee schedule.

Q: Can Form 122 be used outside of British Columbia?

A: Form 122 is specific to British Columbia and may not be applicable in other provinces or countries.

Q: Can I use Form 122 for non-monetary demands?

A: Form 122 is primarily used for monetary demands. For non-monetary demands, you may need to consult with a lawyer for the appropriate form or legal action.

Q: How long is Form 122 valid?

A: Form 122 does not have an expiration date. However, it is recommended to serve the form promptly and take appropriate legal action if necessary.

Q: Do I need a lawyer to use Form 122?

A: While it is not mandatory to have a lawyer, it is advisable to seek legal advice when using Form 122 to ensure the proper procedure is followed.

Q: Can Form 122 be used for personal loans?

A: Yes, Form 122 can be used for personal loans as long as the debt is valid and owed in British Columbia.

Q: What should I do after receiving a Form 122?

A: If you receive a Form 122, you should carefully review the details, consult with a lawyer if needed, and respond appropriately within the specified time frame.

Q: Can I negotiate the debt after receiving Form 122?

A: Yes, you can negotiate the debt after receiving Form 122. It is recommended to discuss the options with the creditor or seek legal advice.