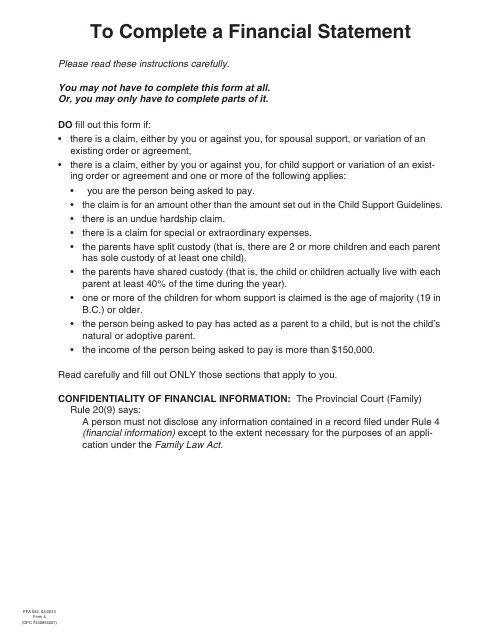

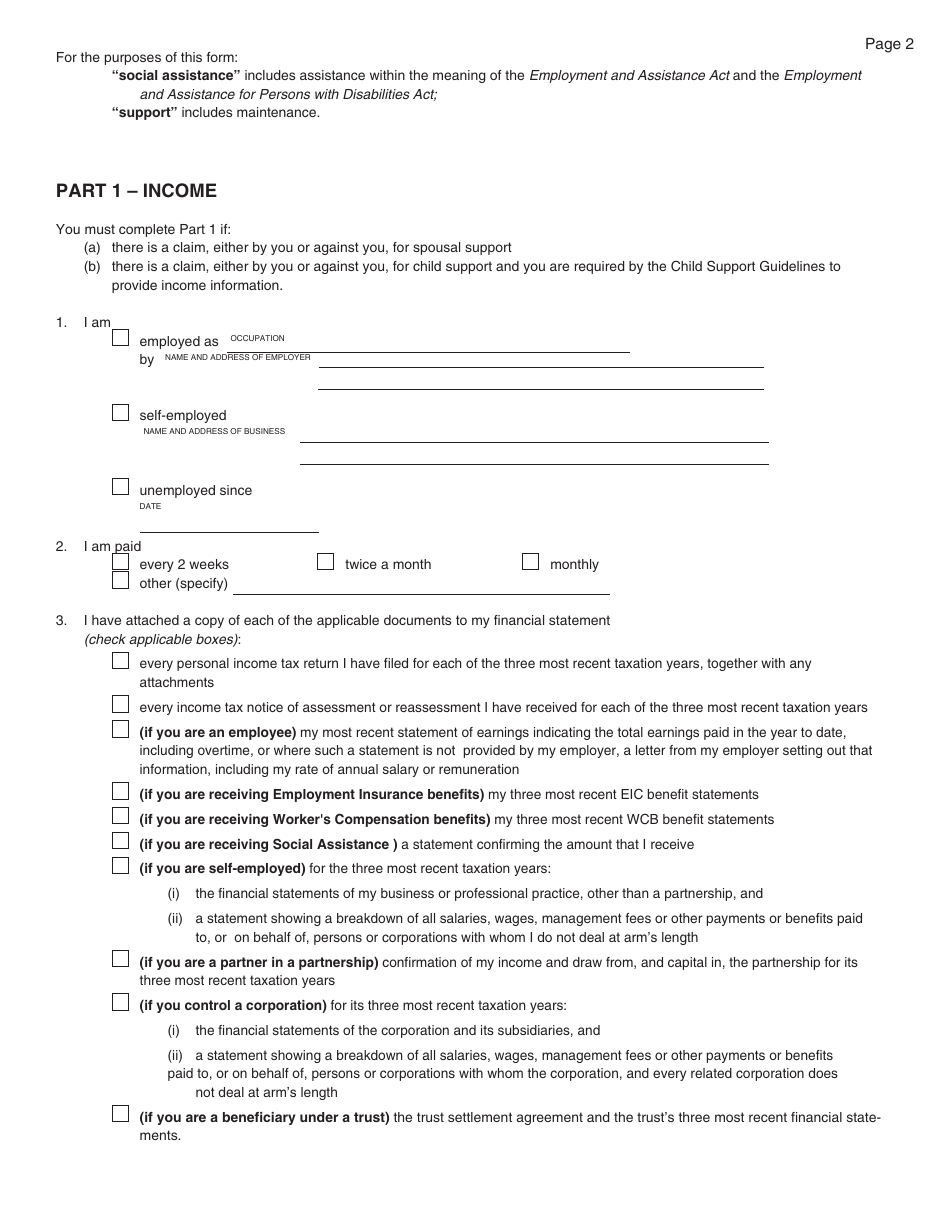

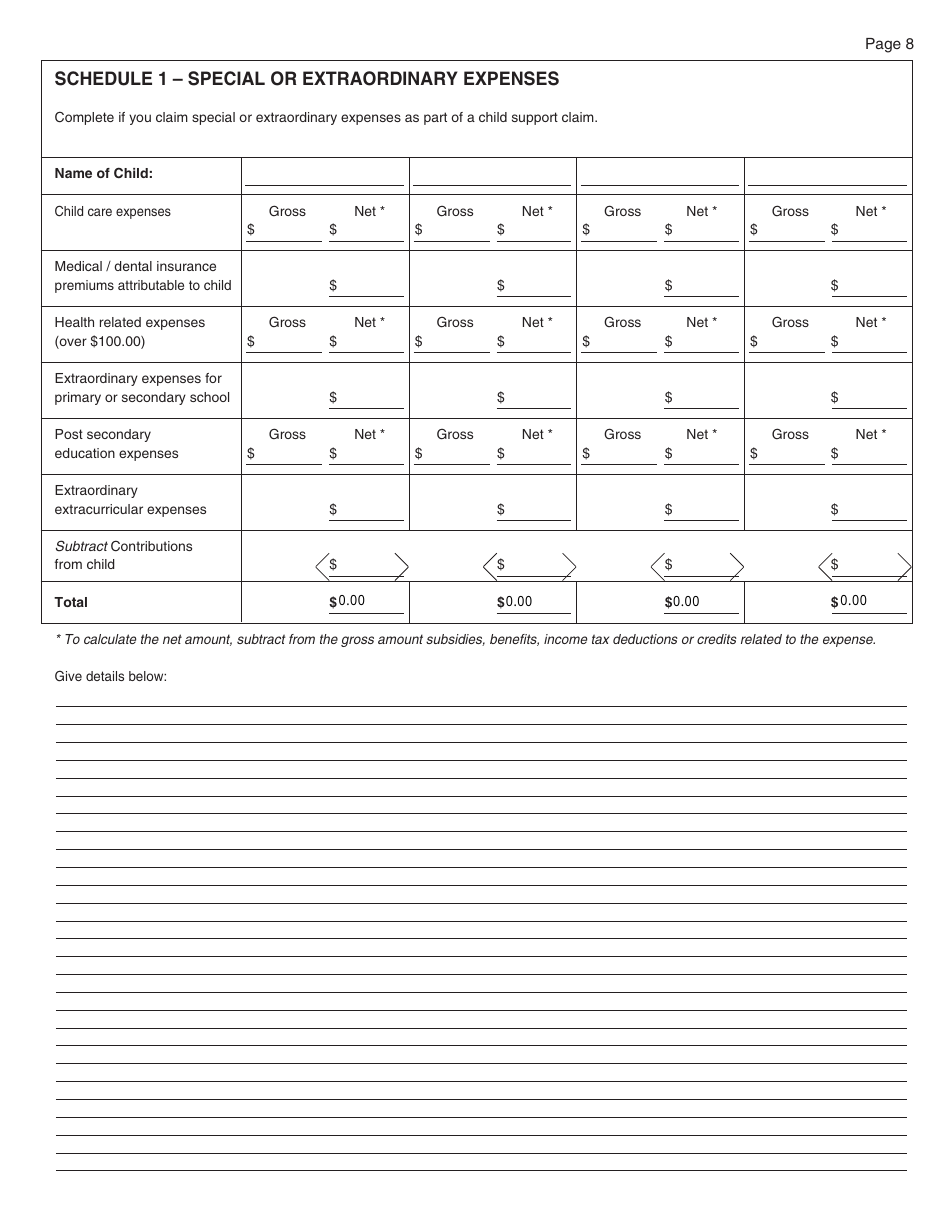

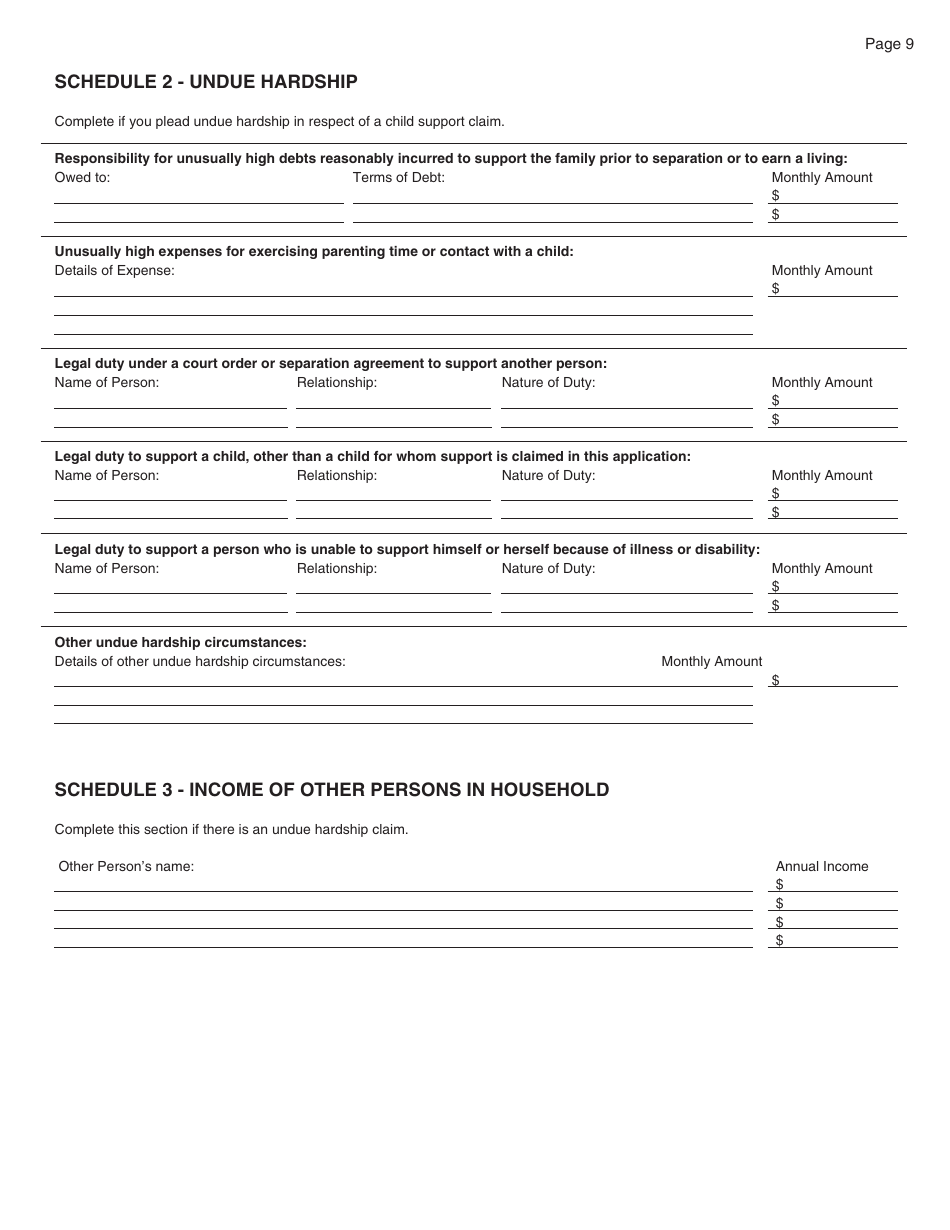

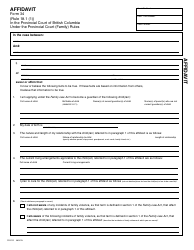

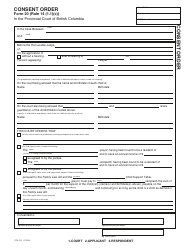

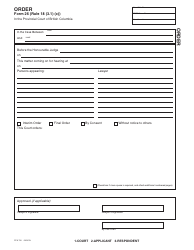

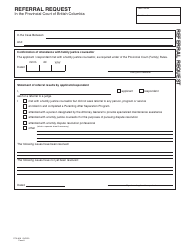

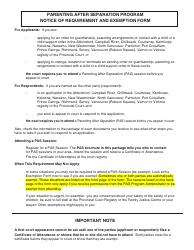

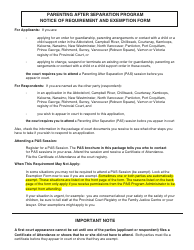

PCFR Form 4 (PFA022) Financial Statement - British Columbia, Canada

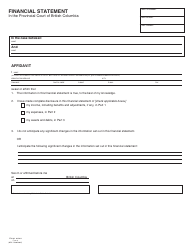

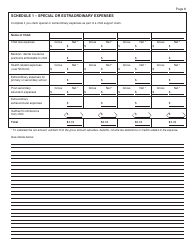

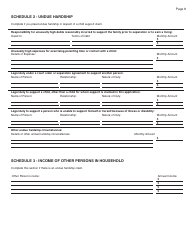

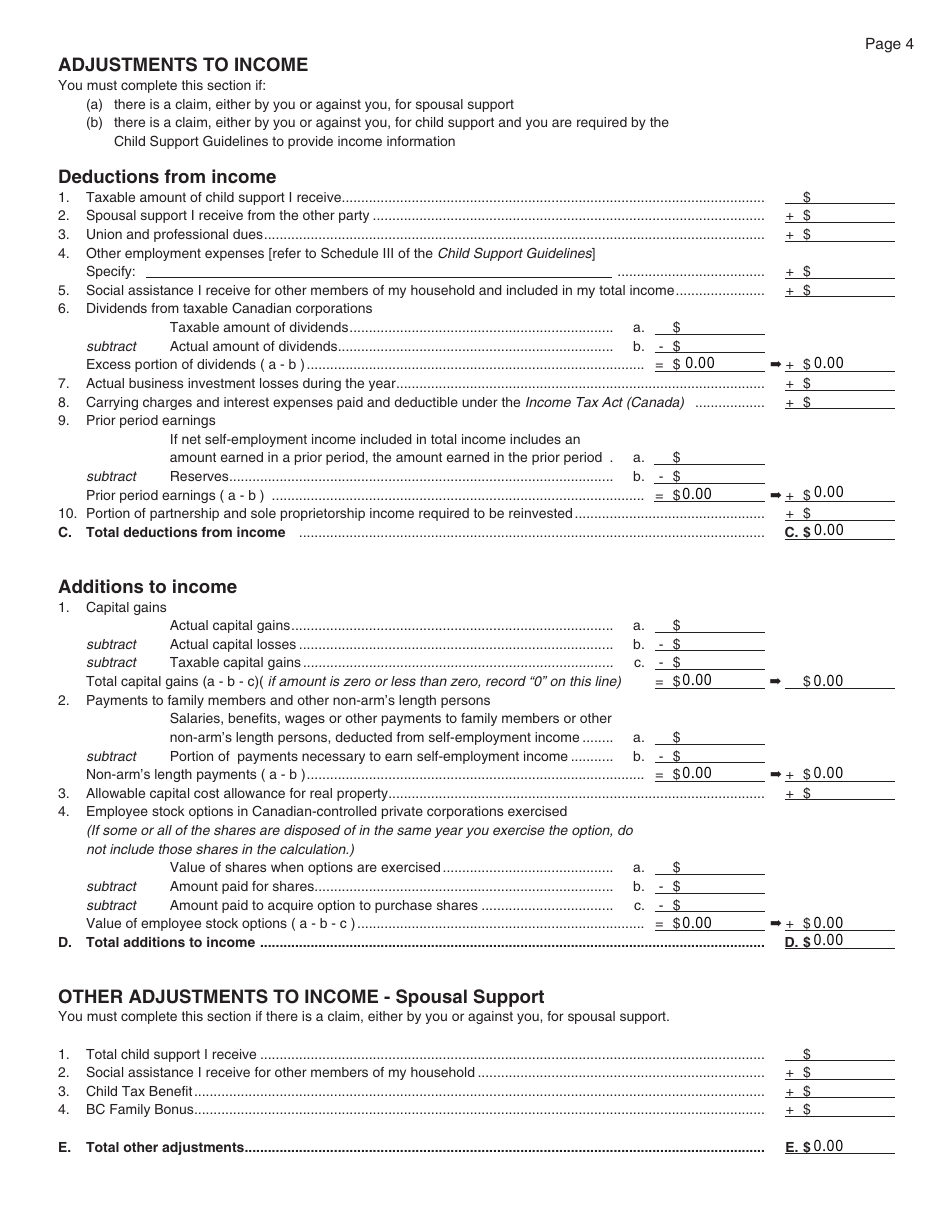

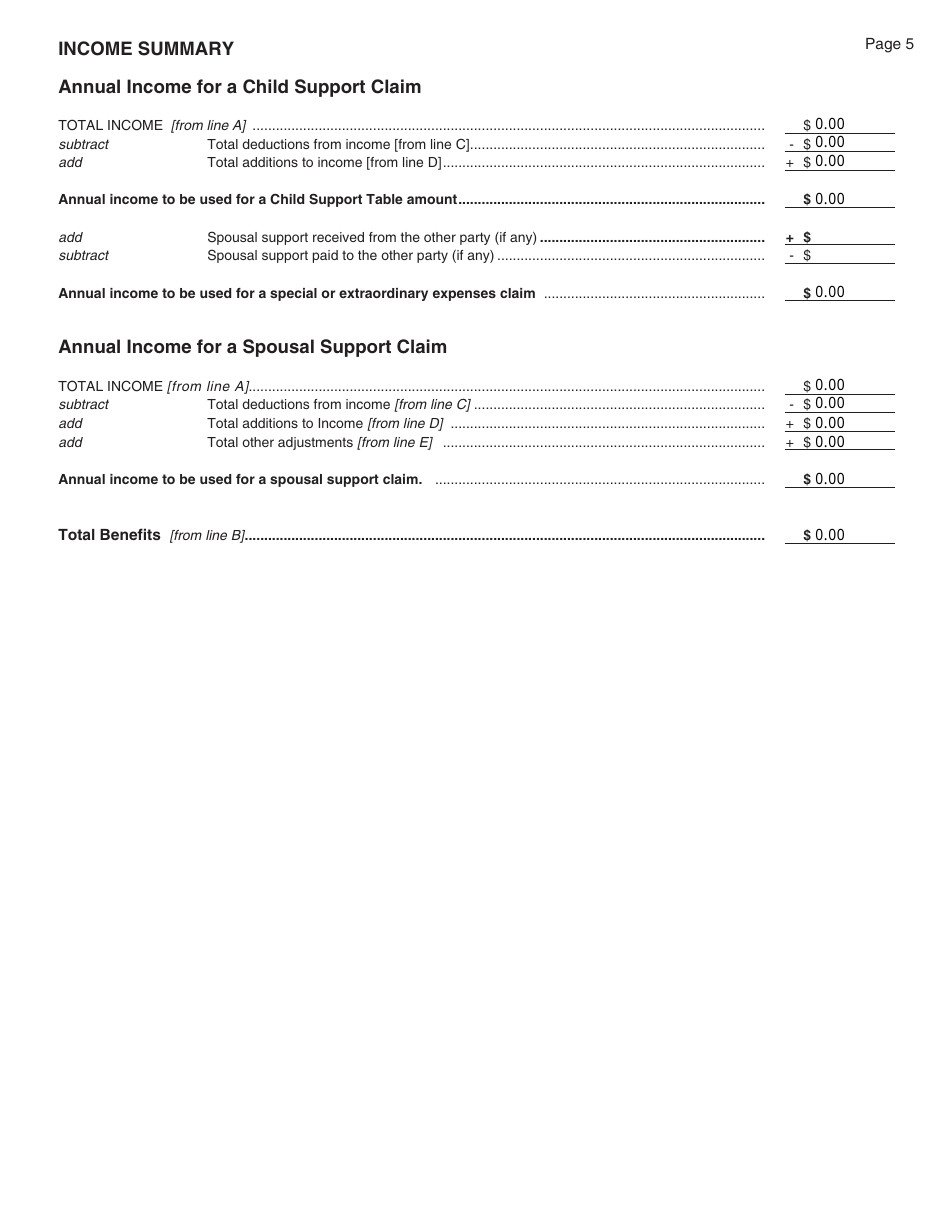

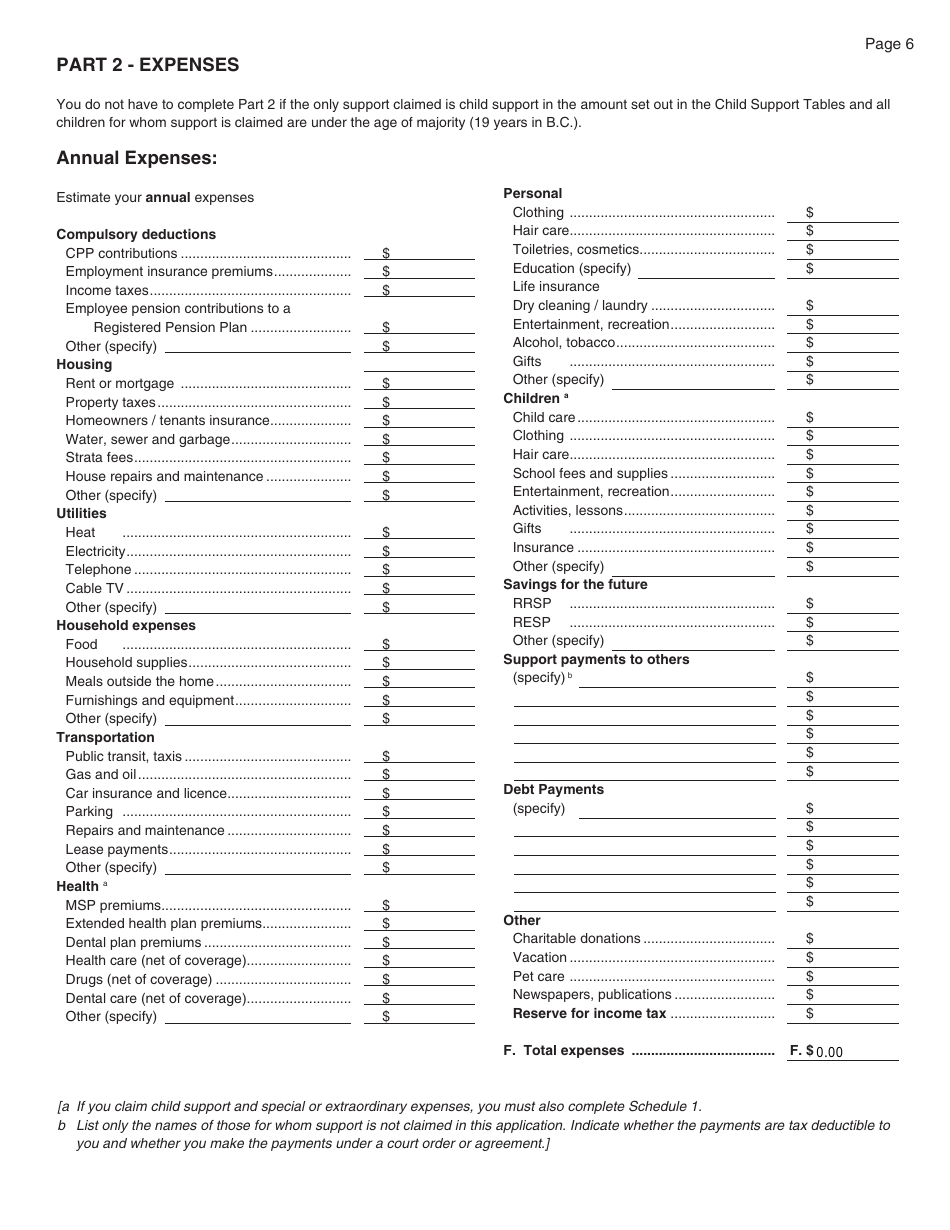

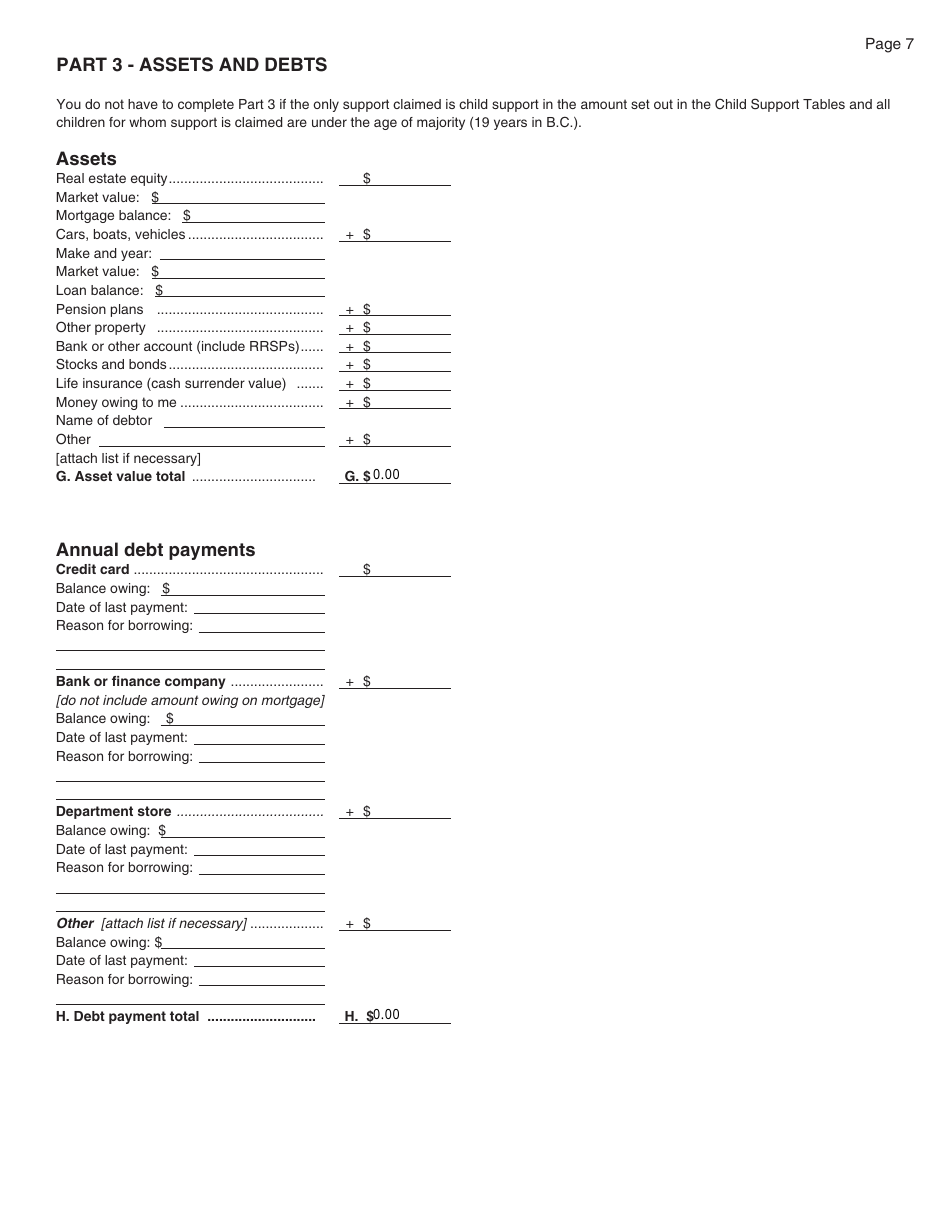

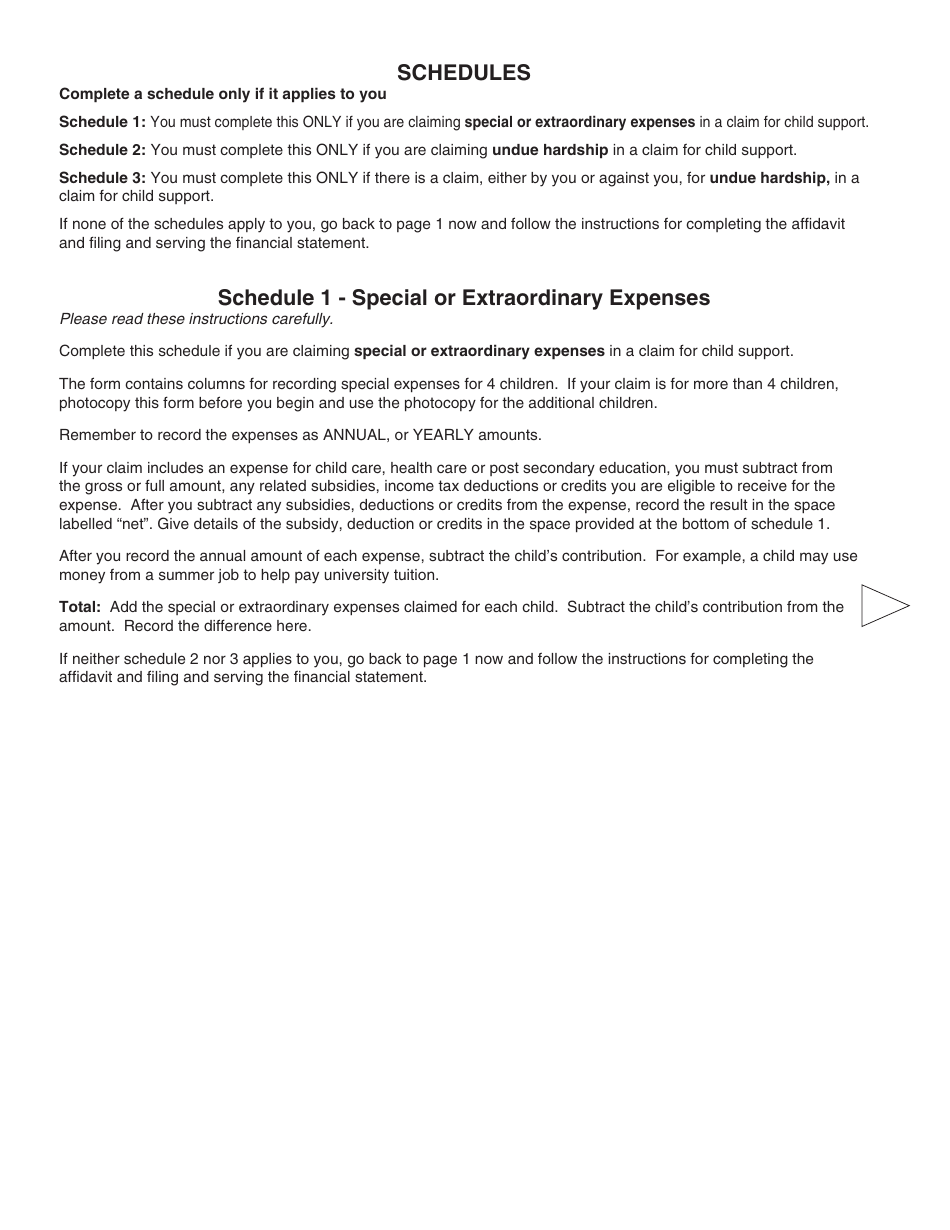

PCFR Form 4 (PFA022) is a financial statement used in British Columbia, Canada. It is filed by individuals or businesses to report their financial information to regulatory authorities or for other legal purposes. It provides details about income, expenses, assets, and liabilities.

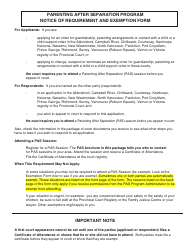

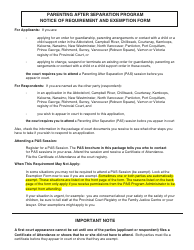

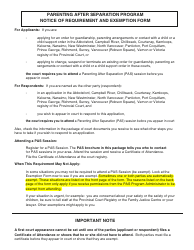

The PCFR Form 4 (PFA022) Financial Statement in British Columbia, Canada, is typically filed by individuals who are involved in a family law case, such as spouses or partners going through separation or divorce.

FAQ

Q: What is PCFR Form 4?

A: PCFR Form 4 is a Financial Statement.

Q: What is the purpose of PCFR Form 4?

A: The purpose of PCFR Form 4 is to provide financial information.

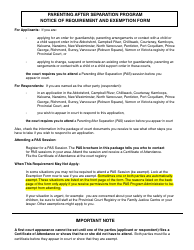

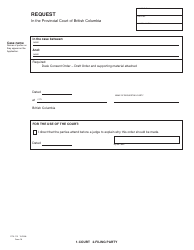

Q: Who needs to fill out PCFR Form 4?

A: Anyone in British Columbia, Canada who is required to submit a Financial Statement.

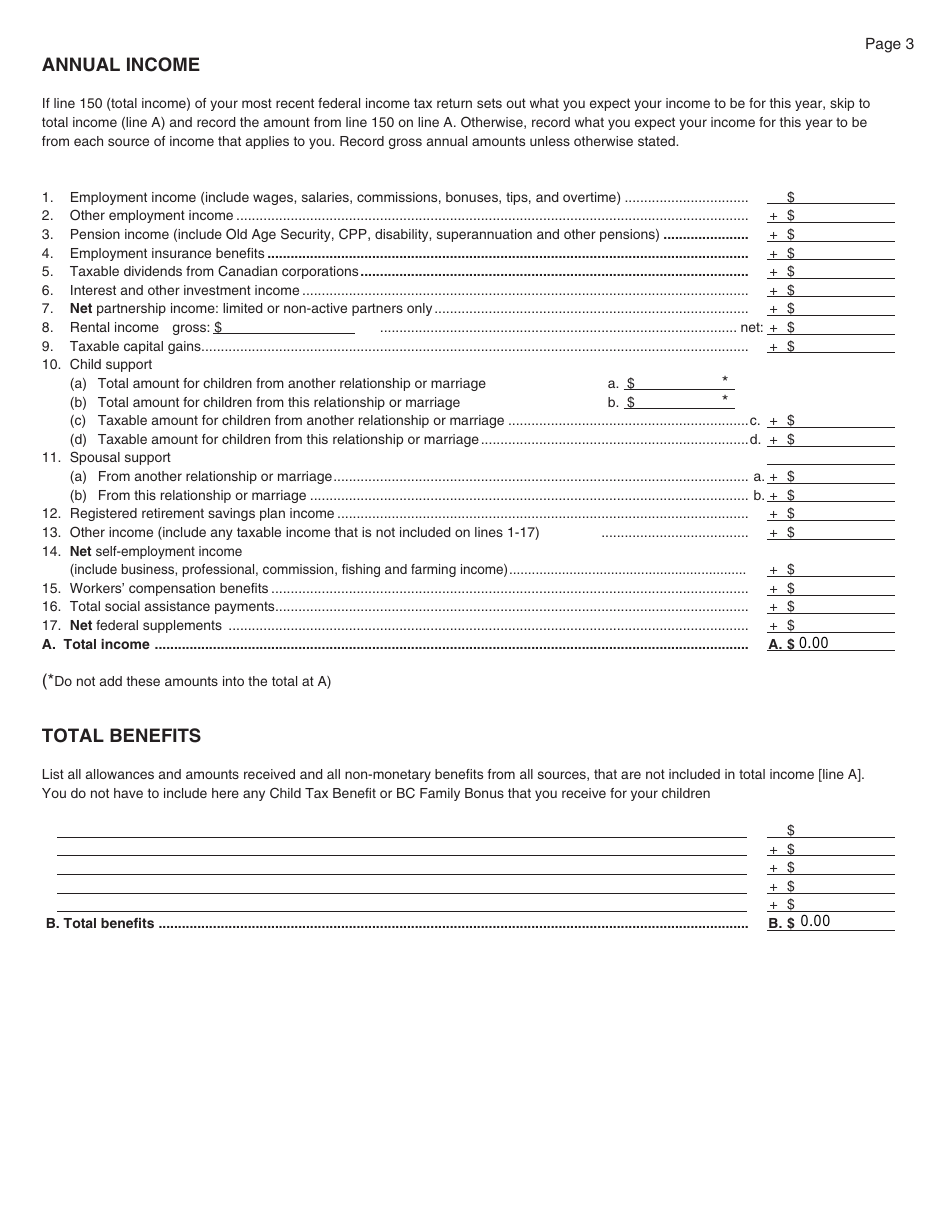

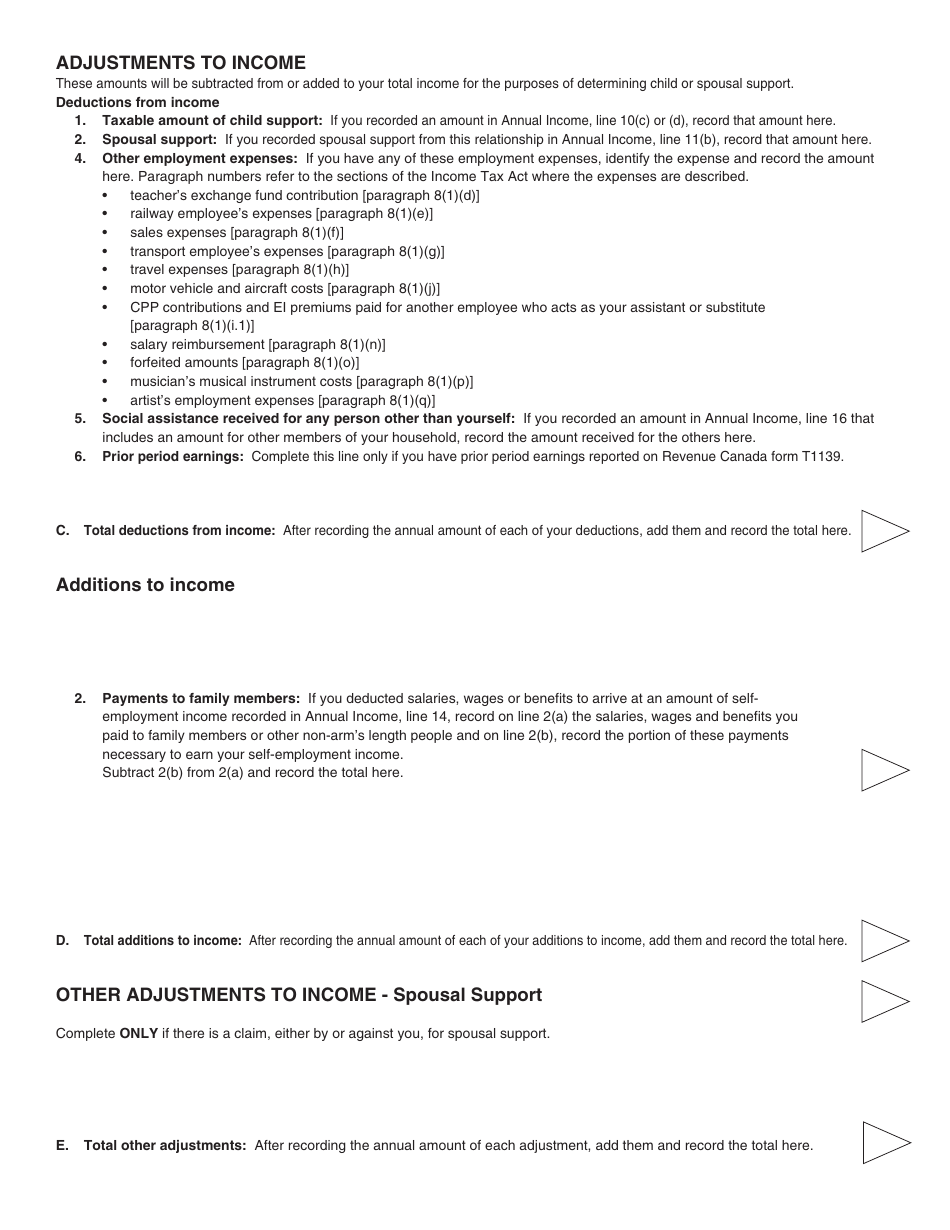

Q: What information is required in PCFR Form 4?

A: PCFR Form 4 requires details on income, expenses, assets, and debts.

Q: Is PCFR Form 4 mandatory?

A: Yes, PCFR Form 4 is mandatory for those who are required to submit a Financial Statement.

Q: Are there any fees associated with PCFR Form 4?

A: No, there are no fees associated with submitting PCFR Form 4.

Q: What happens after I submit PCFR Form 4?

A: After submitting PCFR Form 4, it will be reviewed by the appropriate authorities.