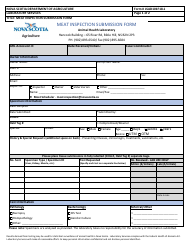

IRS Inspection Form - Nova Scotia, Canada

FAQ

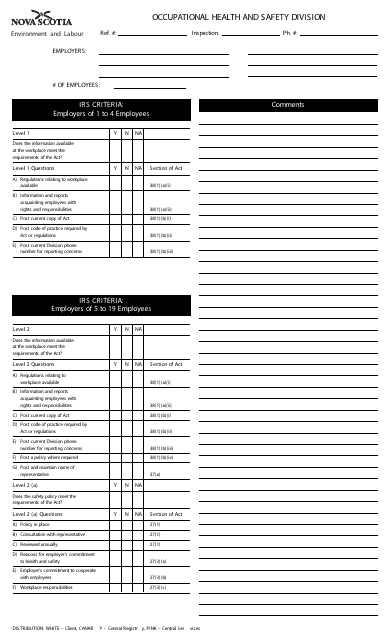

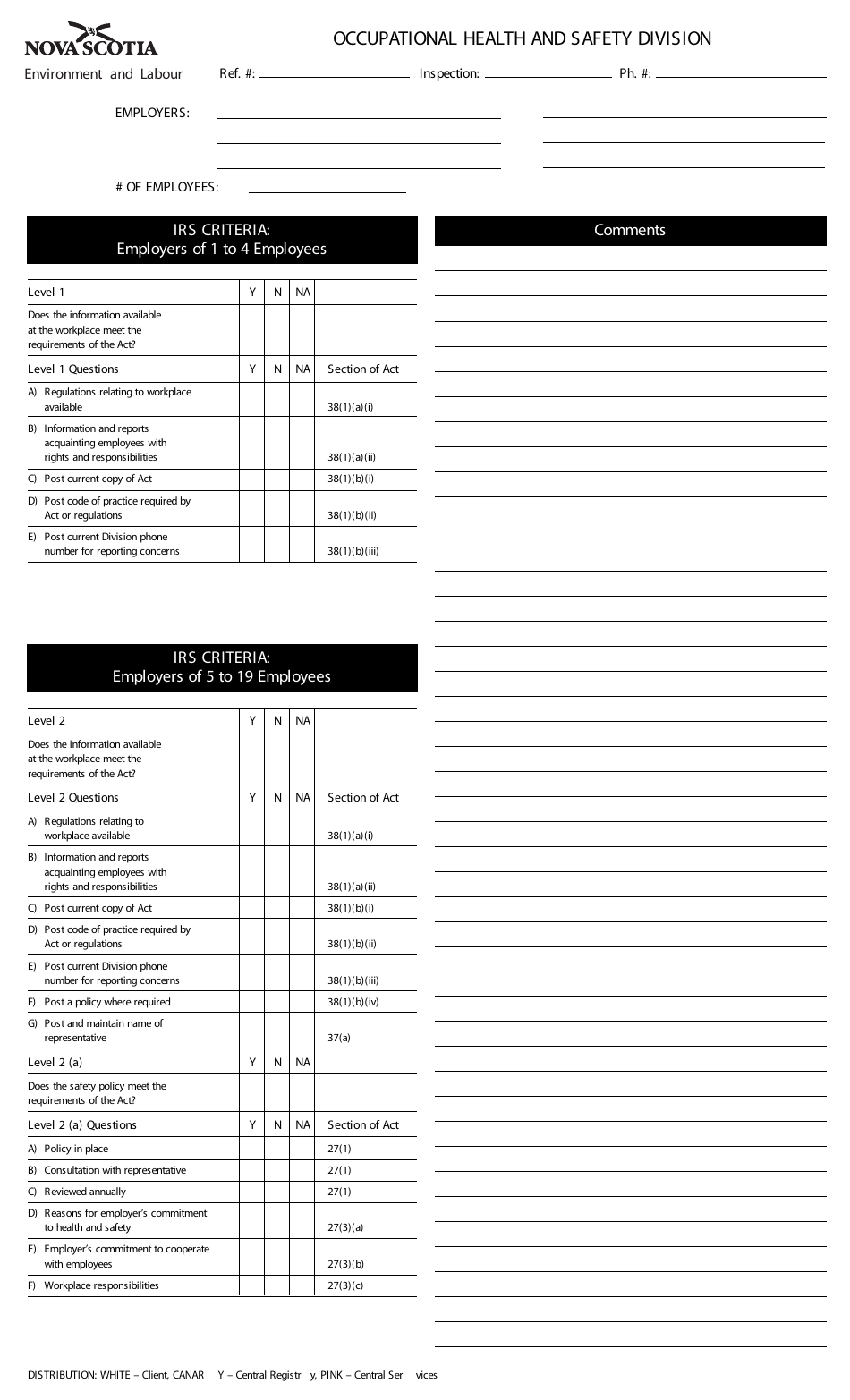

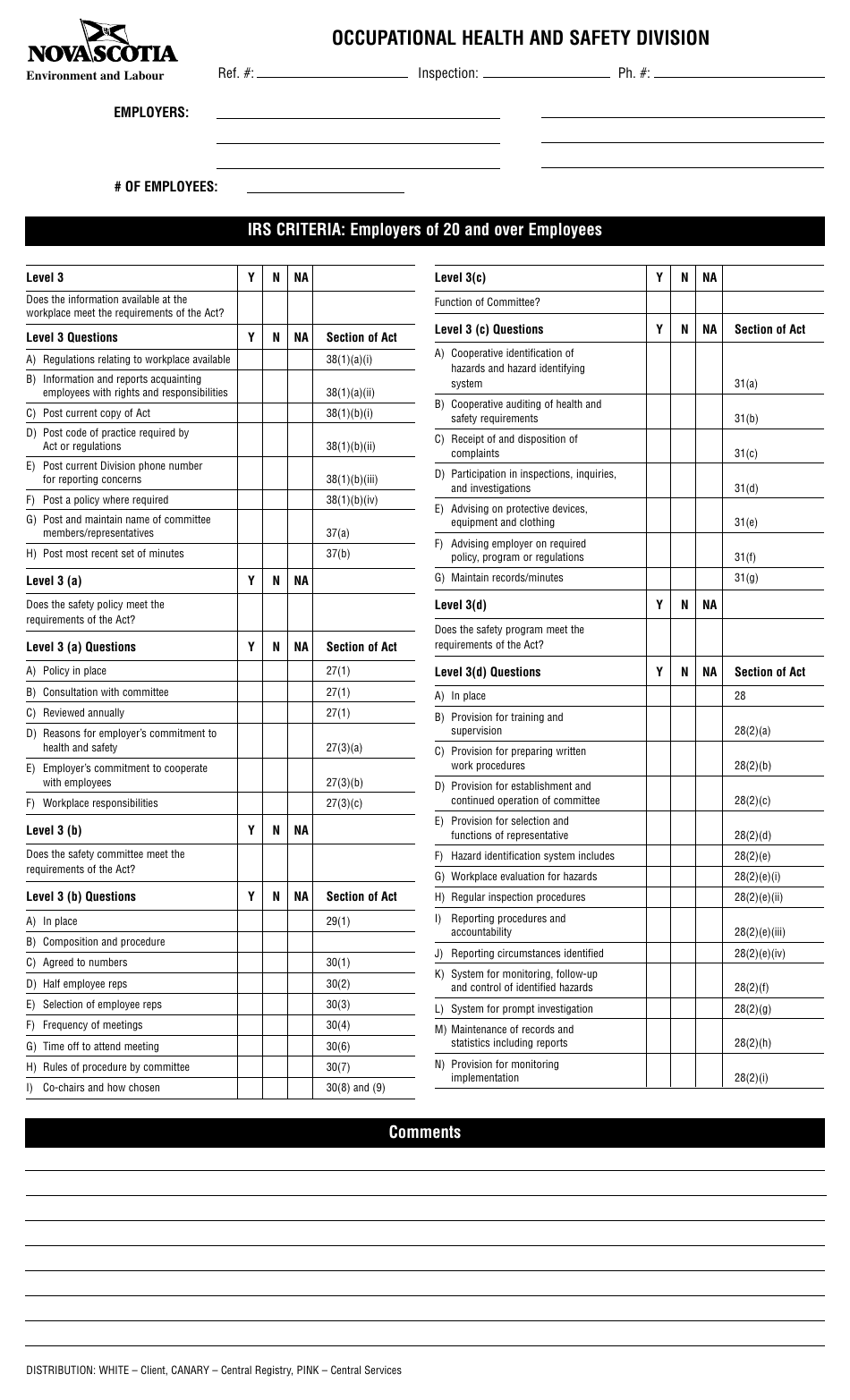

Q: What is the IRS Inspection Form?

A: The IRS Inspection Form is a form used by the Canada Revenue Agency (CRA) in Nova Scotia, Canada.

Q: Who needs to fill out the IRS Inspection Form?

A: Businesses and individuals in Nova Scotia who are selected for an inspection by the CRA may be required to fill out the IRS Inspection Form.

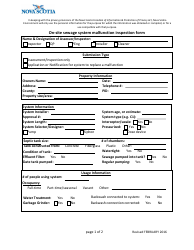

Q: What information is required on the IRS Inspection Form?

A: The IRS Inspection Form typically requires information about the taxpayer's income, expenses, deductions, and records supporting those figures.

Q: What happens after I submit the IRS Inspection Form?

A: After you submit the IRS Inspection Form, the CRA will review the information provided and may contact you for further clarification or documentation.

Q: Are there any penalties for not filling out the IRS Inspection Form?

A: If you are selected for inspection by the CRA and fail to comply with the request to fill out the IRS Inspection Form, you may be subject to penalties or fines.

Q: How long do I need to keep a copy of the IRS Inspection Form?

A: It is recommended to keep a copy of the IRS Inspection Form and any supporting documents for at least six years, as the CRA may request them for auditing purposes.

Q: Can I request an extension to submit the IRS Inspection Form?

A: In certain circumstances, you may be able to request an extension to submit the IRS Inspection Form. Contact the CRA for more information and to discuss your specific situation.

Q: What should I do if I have questions or need assistance with the IRS Inspection Form?

A: If you have questions or need assistance with the IRS Inspection Form, you can contact the Canada Revenue Agency (CRA) directly for guidance and support.