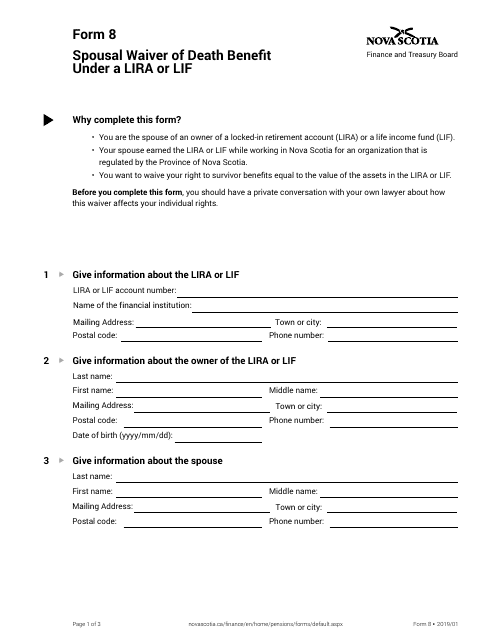

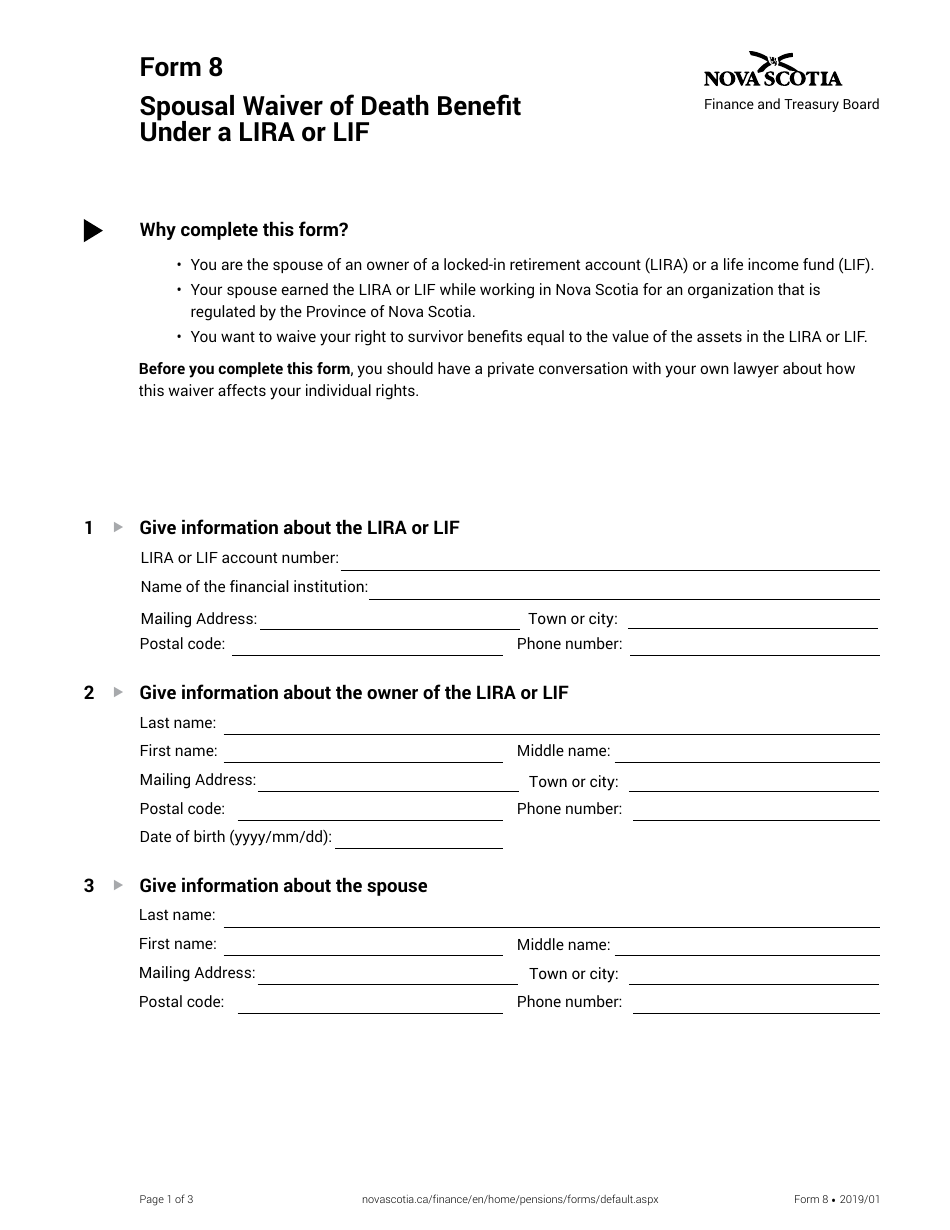

Form 8 Spousal Waiver of Death Benefit Under a Lira or Lif - Nova Scotia, Canada

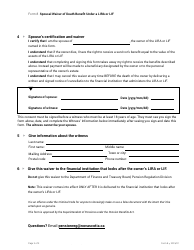

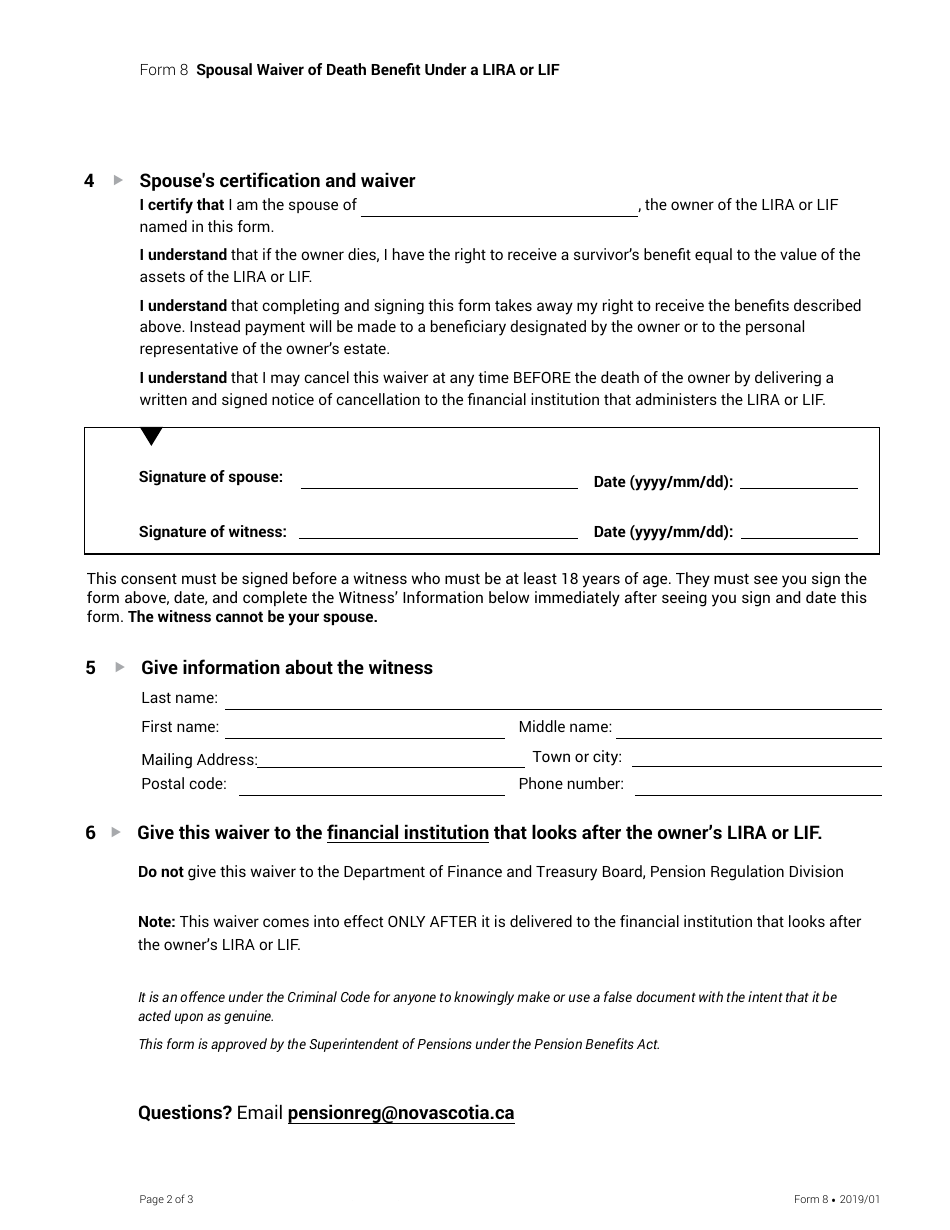

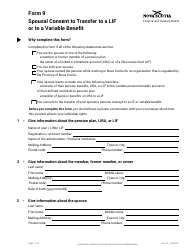

Form 8 Spousal Waiver of Death Benefit Under a LIRA or LIF in Nova Scotia, Canada is used to waive the right of the spouse or common-law partner to receive the death benefit from a Locked-in Retirement Account (LIRA) or a Life Income Fund (LIF) upon the plan holder's death. This form allows the plan holder to designate someone else as the beneficiary of the death benefit.

In Nova Scotia, Canada, the form 8 Spousal Waiver of Death Benefit under a LIRA or LIF is typically filed by the spouse of the LIRA or LIF plan holder.

FAQ

Q: What is Form 8?

A: Form 8 is a document used in Nova Scotia, Canada.

Q: What is a Spousal Waiver of Death Benefit?

A: A Spousal Waiver of Death Benefit is an agreement where a spouse or partner gives up their right to receive a death benefit from a LIRA or LIF (Locked-in Retirement Account or Locked-in Retirement Income Fund) in the event of the account owner's death.

Q: Who is eligible to use Form 8?

A: Form 8 is specifically for individuals in Nova Scotia, Canada who have a LIRA or LIF and want to waive the death benefit for their spouse or partner.

Q: Why would someone use Form 8?

A: Someone may use Form 8 to indicate their desire to waive the death benefit in order to provide flexibility in the distribution of their retirement assets.

Q: Is using Form 8 mandatory?

A: No, using Form 8 is not mandatory. It is an optional agreement that can be used if desired.

Q: Are there any legal requirements for using Form 8?

A: It is recommended to consult with a legal or financial professional to ensure compliance with any specific legal requirements or regulations that may apply.

Q: Is Form 8 specific to Nova Scotia?

A: Yes, Form 8 is specific to Nova Scotia and may not be applicable in other provinces or territories in Canada.