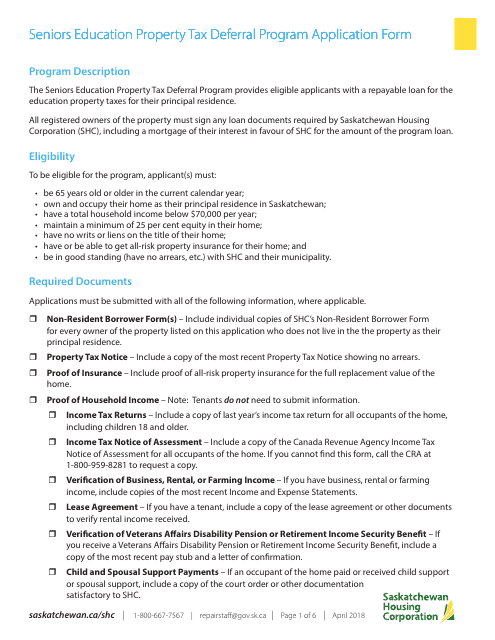

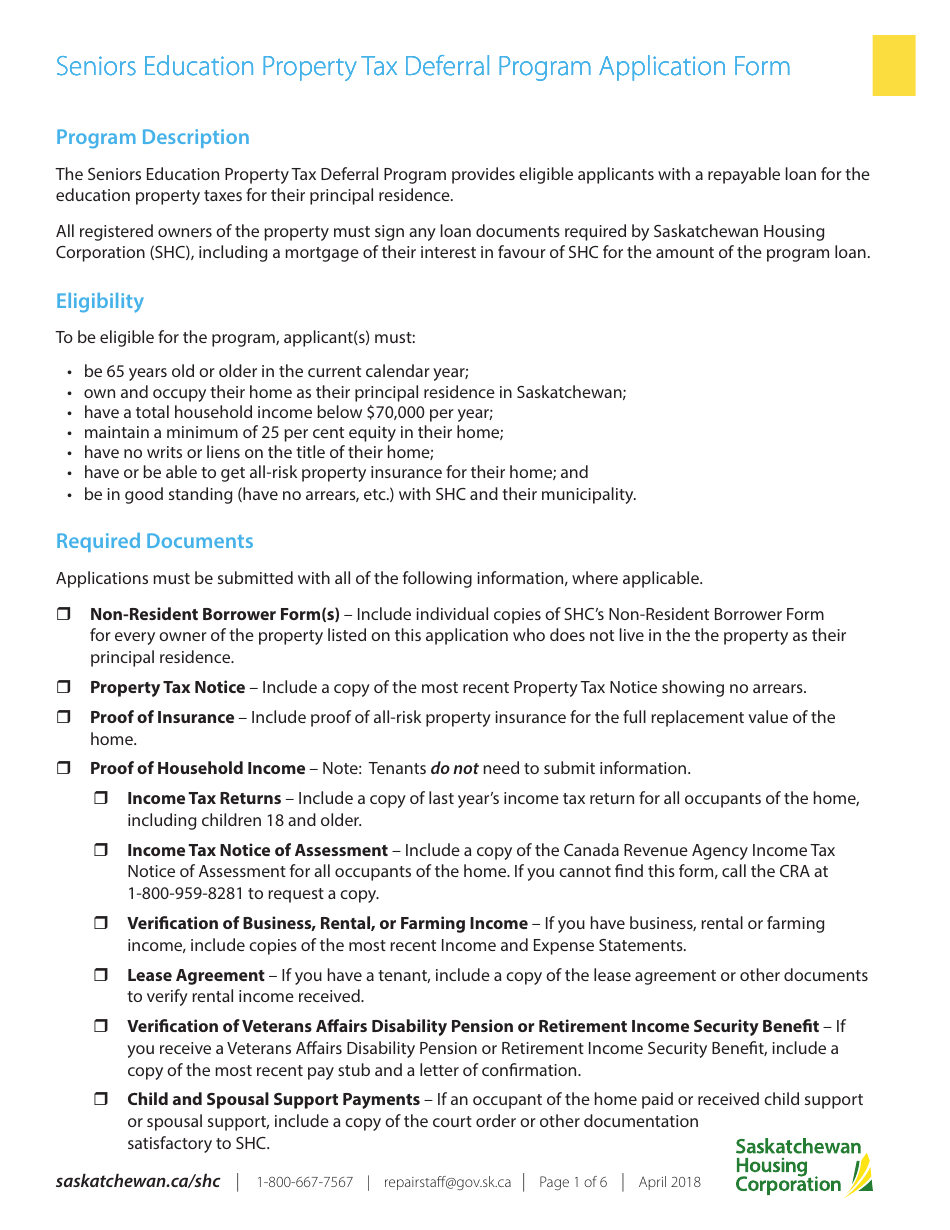

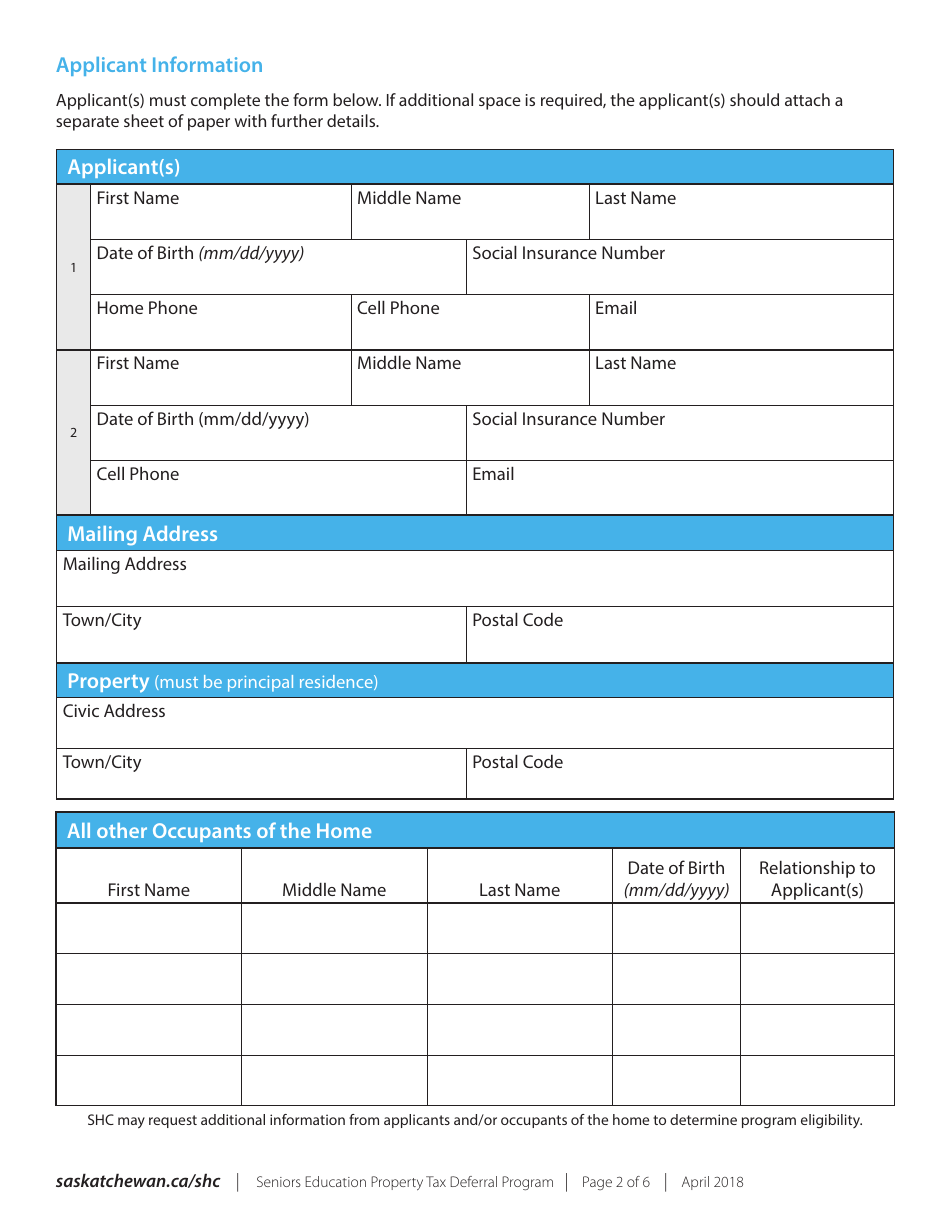

Seniors Education Property Tax Deferral Program Application Form - Saskatchewan, Canada

The Seniors Education Property Tax Deferral Program Application Form in Saskatchewan, Canada is used to apply for a tax deferral program specifically designed for seniors. This program allows eligible seniors to defer paying their education property taxes until they sell their home or no longer meet the eligibility requirements.

In Saskatchewan, Canada, seniors themselves are responsible for filing the Seniors Education Property Tax Deferral Program application form.

FAQ

Q: What is the Seniors Education Property Tax Deferral Program?

A: The Seniors Education Property Tax Deferral Program is a program in Saskatchewan, Canada that allows eligible seniors to defer payment of their education property taxes.

Q: Who is eligible for the Seniors Education Property Tax Deferral Program?

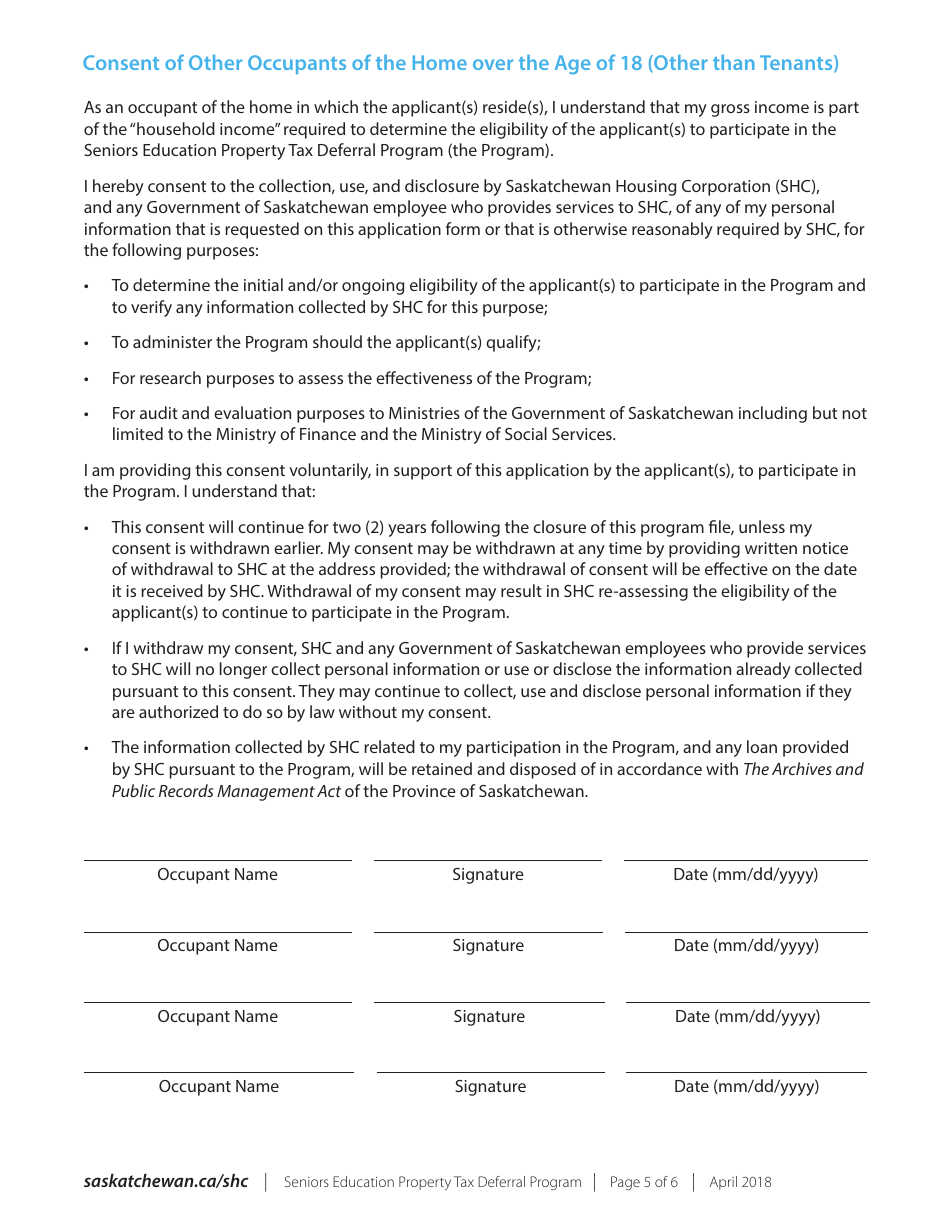

A: Eligibility criteria for the program include being at least 65 years old, having a combined household income below a certain threshold, and owning and occupying a property that is subject to education property taxes.

Q: How does the program work?

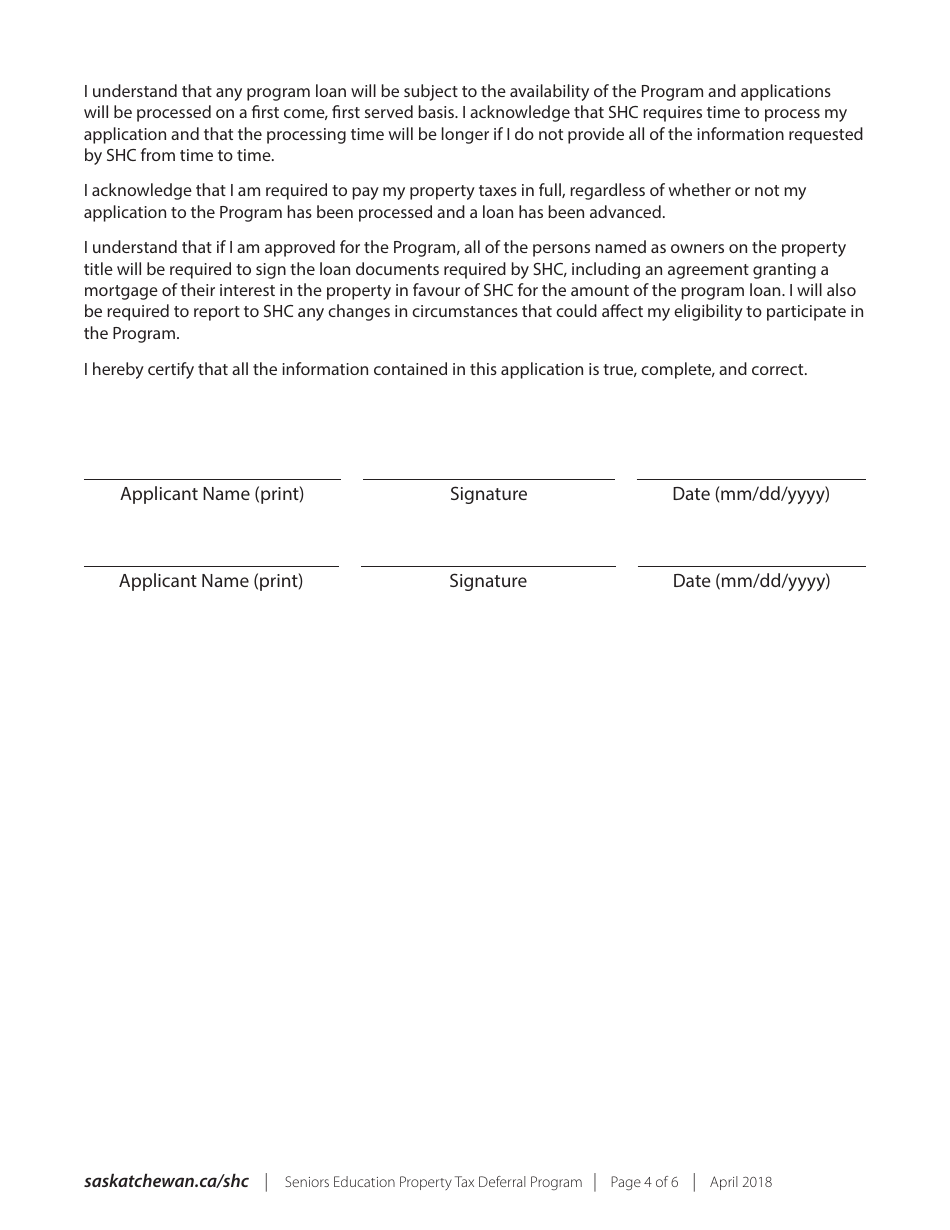

A: Under the program, eligible seniors can apply to defer payment of their education property taxes. The deferred taxes, plus interest, will become a lien on the property and will need to be repaid when the property is sold or transferred.

Q: What are the benefits of the Seniors Education Property Tax Deferral Program?

A: The program allows eligible seniors to defer payment of their education property taxes, providing financial relief for those who may be facing difficulty in paying their taxes on time.

Q: Are there any limitations or conditions for participating in the program?

A: Yes, there are certain limitations and conditions for participating in the program. These include meeting the eligibility criteria, having a property that is subject to education property taxes, and being willing to have the deferred taxes become a lien on the property.

Q: Is the Seniors Education Property Tax Deferral Program available in all provinces in Canada?

A: No, the Seniors Education Property Tax Deferral Program is specific to the province of Saskatchewan, Canada.