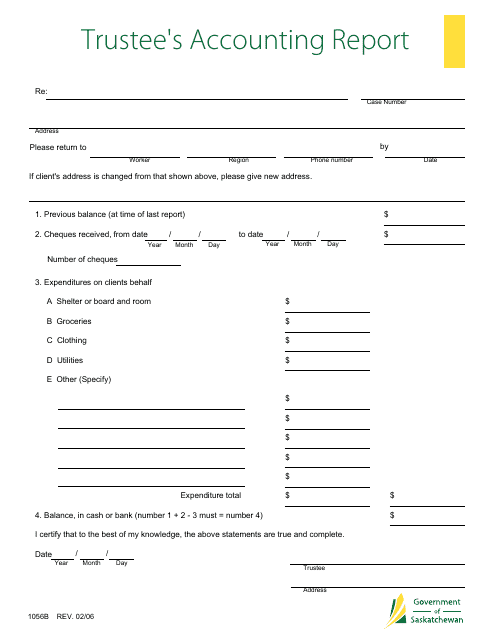

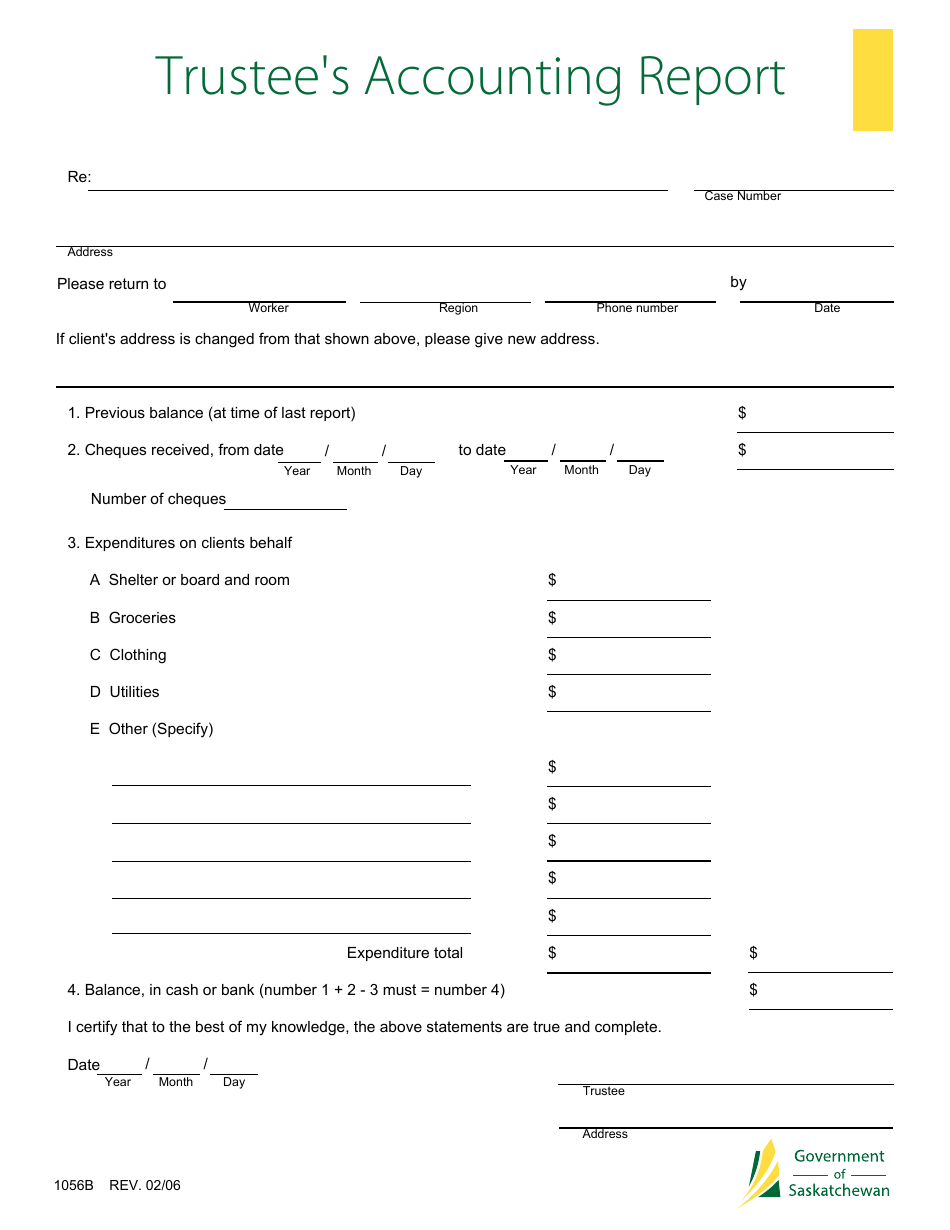

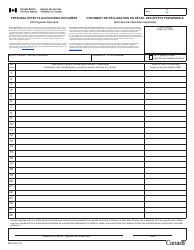

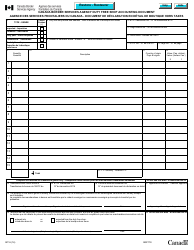

Form 1056B Trustee's Accounting Report - Saskatchewan, Canada

The Form 1056B Trustee's Accounting Report in Saskatchewan, Canada is used to report and account for the financial transactions of a trust. It provides a detailed record of the trust's income, expenses, and assets to ensure transparency and fulfill legal obligations.

The Form 1056B Trustee's Accounting Report in Saskatchewan, Canada is typically filed by the trustee of the trust.

FAQ

Q: What is Form 1056B?

A: Form 1056B is the Trustee's Accounting Report in Saskatchewan, Canada.

Q: Who needs to submit Form 1056B?

A: Trustees in Saskatchewan, Canada are required to submit Form 1056B.

Q: What is the purpose of Form 1056B?

A: Form 1056B is used to report the financial activities and transactions of a trust.

Q: What information is needed to complete Form 1056B?

A: The form requires details of the trust's assets, income, expenses, and distributions.

Q: When is Form 1056B due?

A: Form 1056B is due within 3 months after the end of the trust's fiscal year.

Q: Is there a fee for submitting Form 1056B?

A: There is no fee for submitting Form 1056B in Saskatchewan, Canada.

Q: Are there any penalties for late submission of Form 1056B?

A: Late submission of Form 1056B may result in penalties or fines.

Q: Can I get assistance in completing Form 1056B?

A: Yes, you can seek assistance from a professional accountant or the Saskatchewan Ministry of Justice for completing Form 1056B.