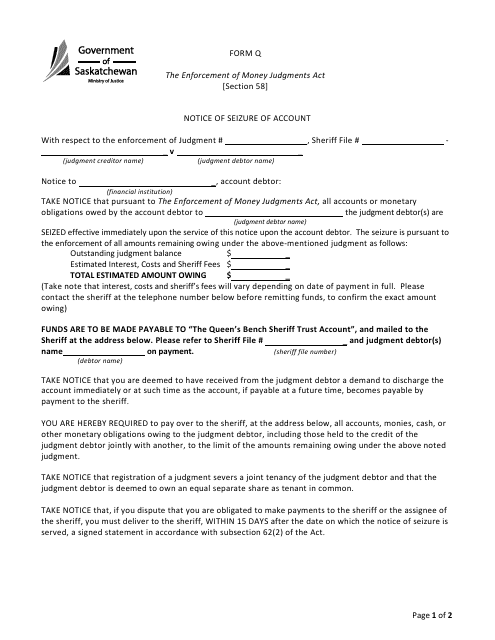

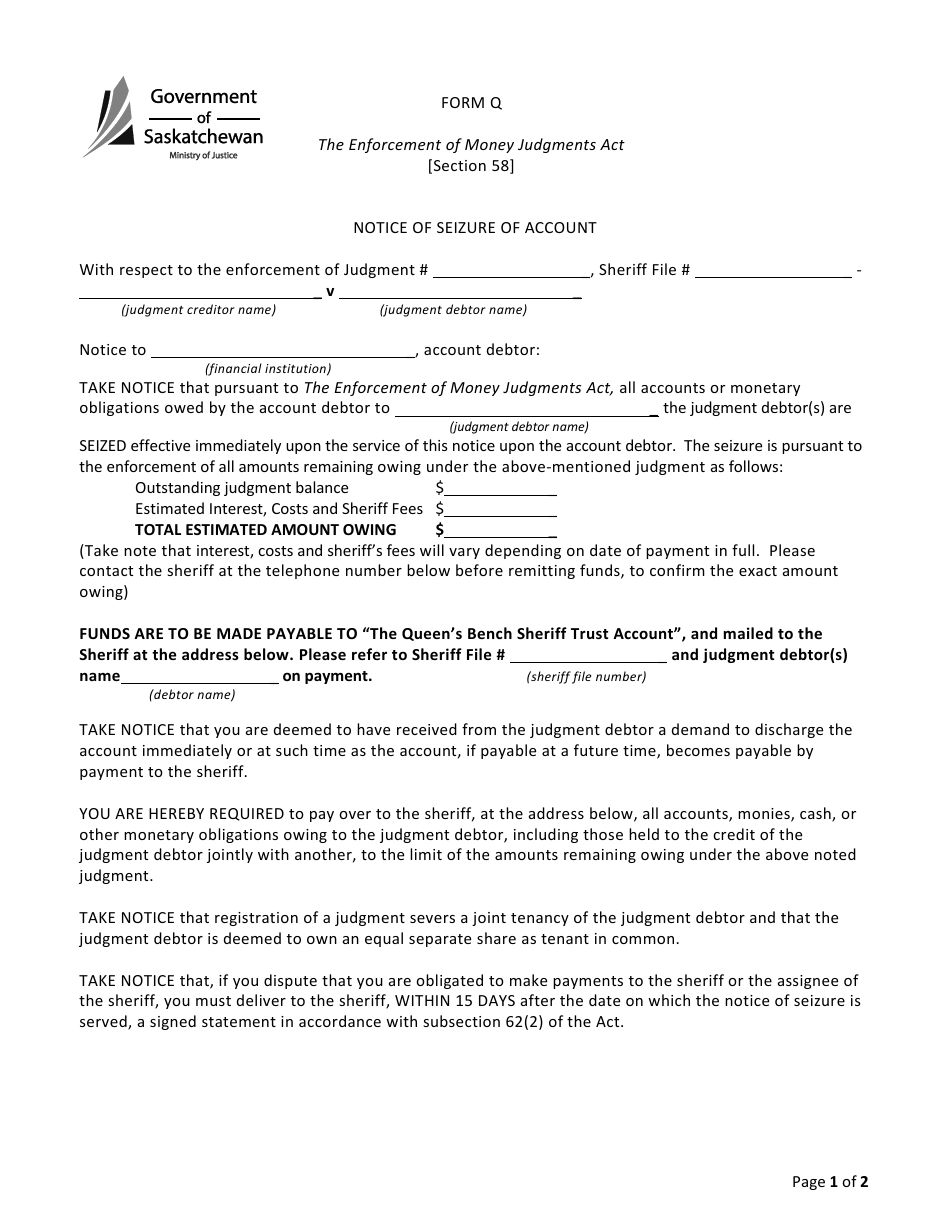

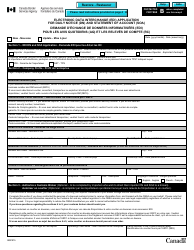

Form Q Notice of Seizure of Account - Saskatchewan, Canada

Form Q Notice of Seizure of Account in Saskatchewan, Canada is used to notify an individual or business that their bank account has been seized by the government due to unpaid taxes or other debts. This form informs the account holder about the seizure and provides information on how to resolve the issue.

The form Q Notice of Seizure of Account in Saskatchewan, Canada is typically filed by the Canada Revenue Agency (CRA) or other governmental authorities.

FAQ

Q: What is a Form Q Notice of Seizure of Account?

A: A Form Q Notice of Seizure of Account is a legal document served by the government authorities to inform you that your bank account has been seized.

Q: Who can issue a Form Q Notice of Seizure of Account?

A: A Form Q Notice of Seizure of Account can be issued by the government authorities, such as the Canada Revenue Agency (CRA) or provincial authorities, in Saskatchewan.

Q: Why would my account be seized?

A: Your account may be seized if you have unpaid taxes, outstanding fines or penalties, or if you owe money to the government or other creditors.

Q: What should I do if I receive a Form Q Notice of Seizure of Account?

A: If you receive a Form Q Notice of Seizure of Account, you should contact the issuing authority immediately to address the issue and seek resolution.

Q: Can I challenge a Form Q Notice of Seizure of Account?

A: Yes, you have the right to challenge a Form Q Notice of Seizure of Account. You should consult with a legal professional to understand your options and navigate the process.

Q: Can I continue to use my bank account after receiving a Form Q Notice of Seizure of Account?

A: No, once your account is seized, you will not have access to the funds in that account. It is important to address the issue promptly to work towards resolving it.

Q: Can my other accounts be seized as well?

A: It is possible for other accounts you hold with the same financial institution to be seized if they are linked to the account mentioned in the Form Q notice. It is important to contact the issuing authority for clarification.

Q: What happens to the funds in my seized account?

A: The funds in your seized account may be used to satisfy your outstanding debts or obligations. It is important to address the issue promptly to work towards resolving it.

Q: How can I prevent my account from being seized?

A: To prevent your account from being seized, it is crucial to fulfill your financial obligations, such as paying taxes and fines, and resolving any outstanding debts.

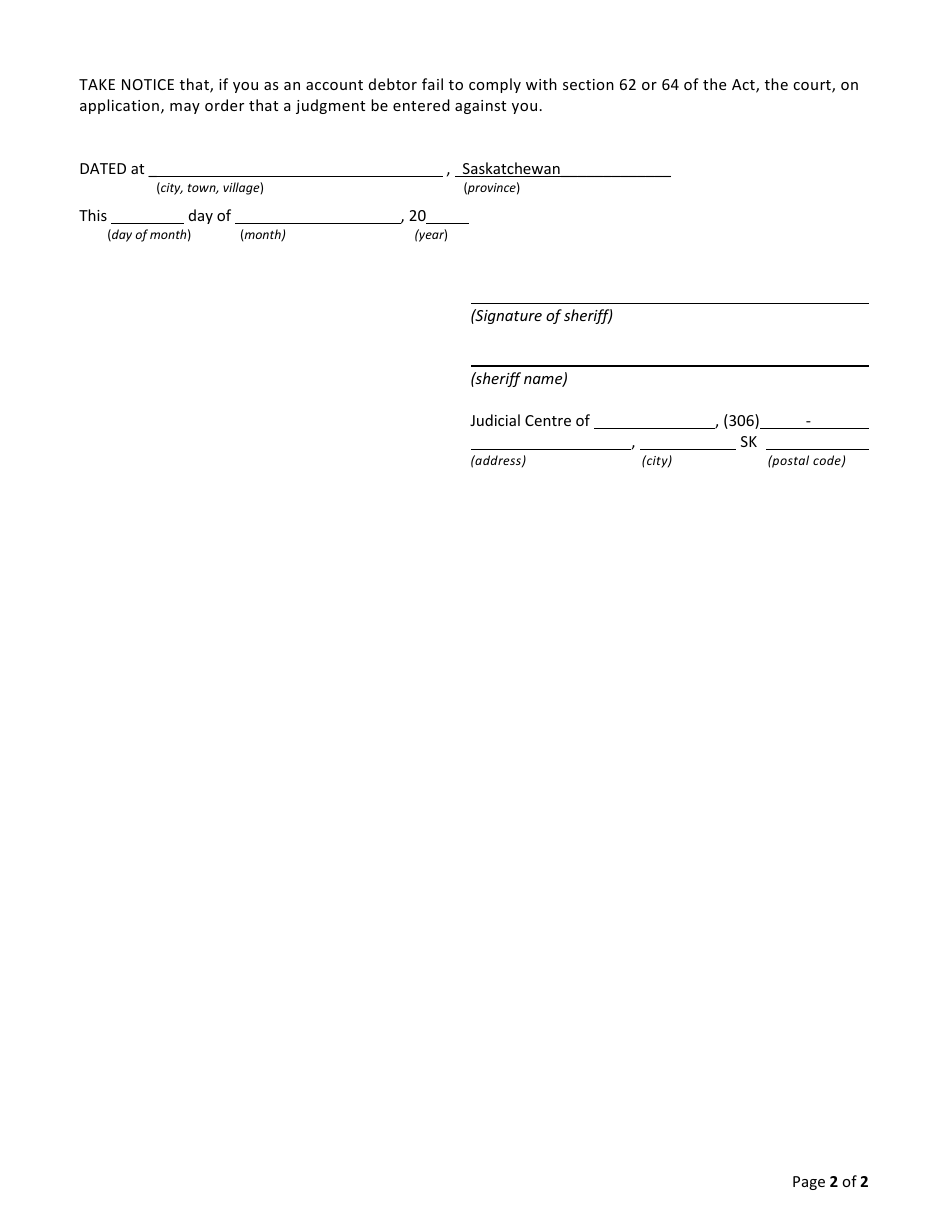

Q: What are the consequences of not addressing a Form Q Notice of Seizure of Account?

A: Not addressing a Form Q Notice of Seizure of Account can lead to further legal actions, such as wage garnishment or liens on your property. It is important to take prompt action to address the issue.