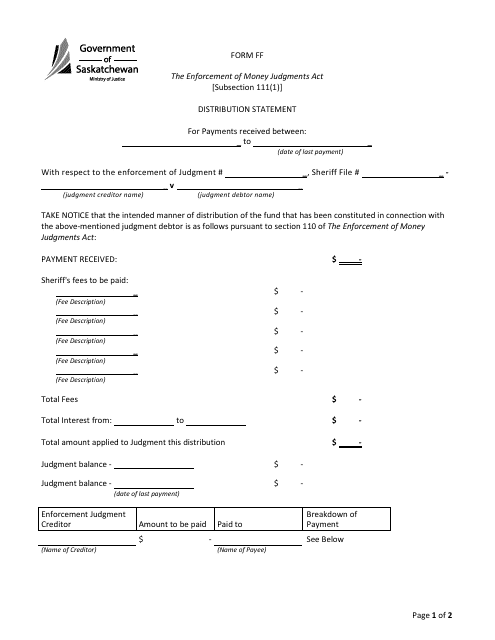

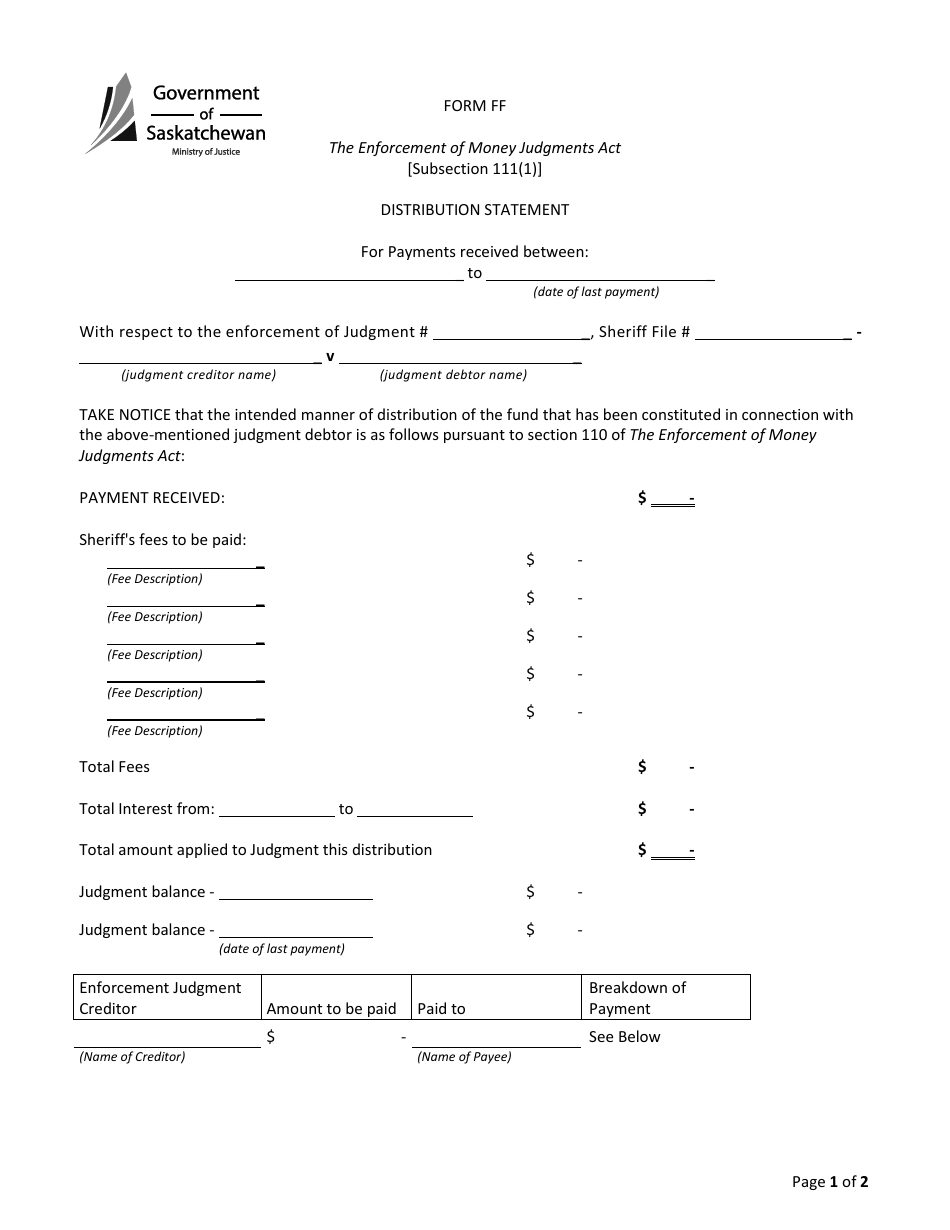

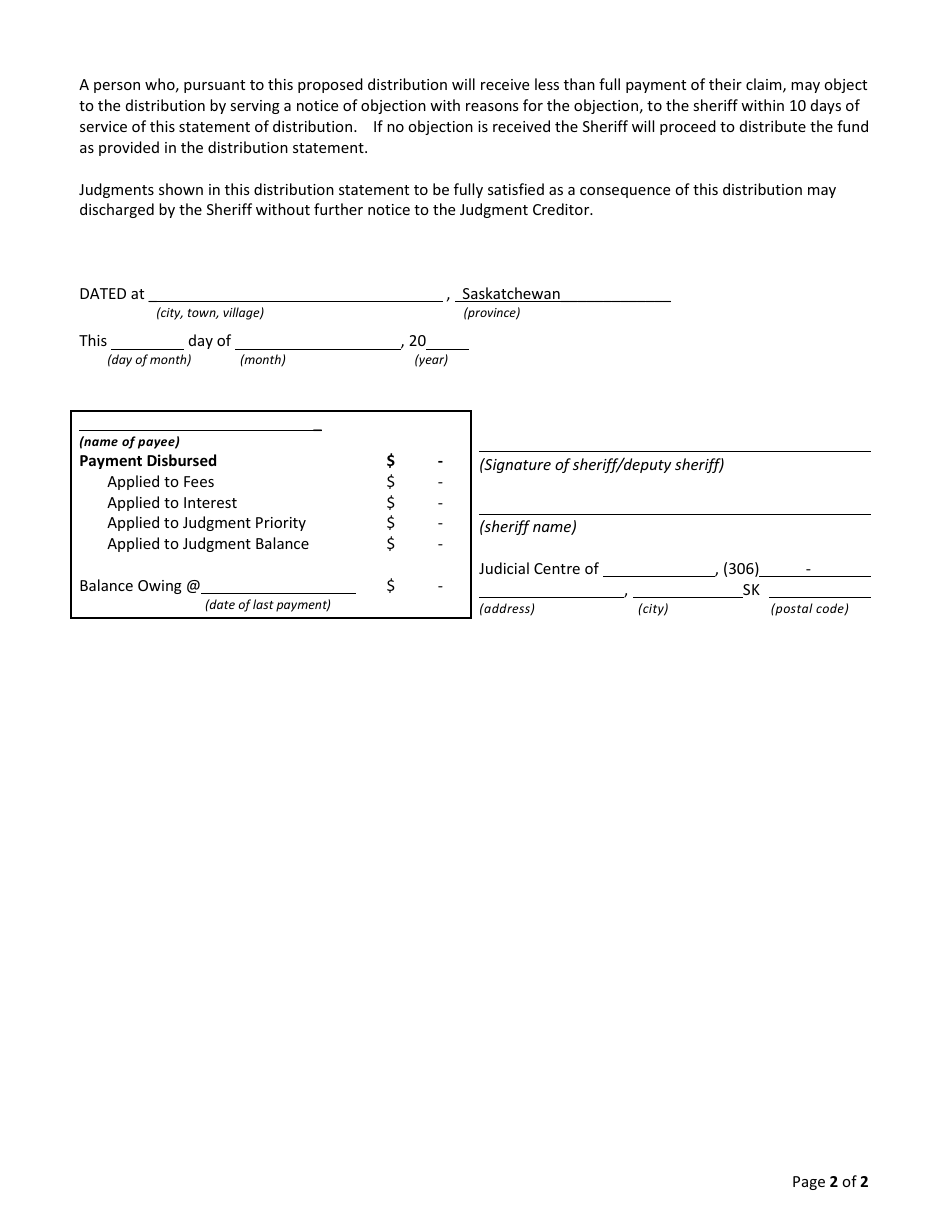

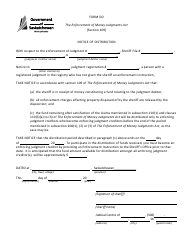

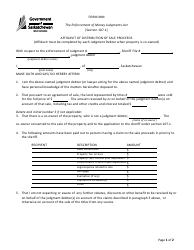

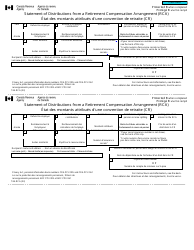

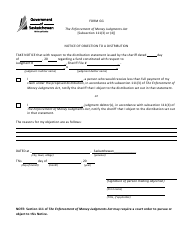

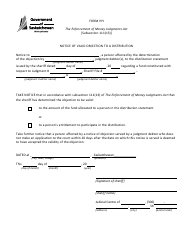

Form FF Distribution Statement - Saskatchewan, Canada

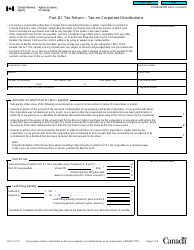

Form FF Distribution Statement - Saskatchewan, Canada is used to declare the income and distribution received from a corporation based in Saskatchewan, Canada. It is typically used for tax reporting purposes.

FAQ

Q: What is a Form FF Distribution Statement?

A: The Form FF Distribution Statement is a document used in Saskatchewan, Canada to report the distribution of income or capital gains from a mutual fund.

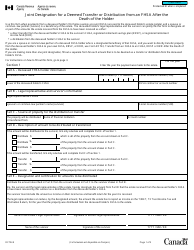

Q: Who is required to submit a Form FF Distribution Statement?

A: Mutual fund companies in Saskatchewan, Canada are required to submit a Form FF Distribution Statement to report the distribution of income or capital gains to their investors.

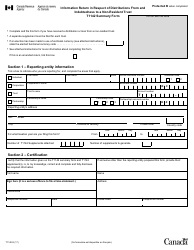

Q: What information is included in a Form FF Distribution Statement?

A: A Form FF Distribution Statement includes details of the income or capital gains distributed by the mutual fund, such as the amount per unit and the total amount distributed to each investor.

Q: When is a Form FF Distribution Statement submitted?

A: A Form FF Distribution Statement is usually submitted annually, within 90 days after the end of the mutual fund's fiscal year.

Q: What is the purpose of a Form FF Distribution Statement?

A: The purpose of a Form FF Distribution Statement is to provide investors with information about the income or capital gains they have received from a mutual fund, which is important for tax reporting purposes.