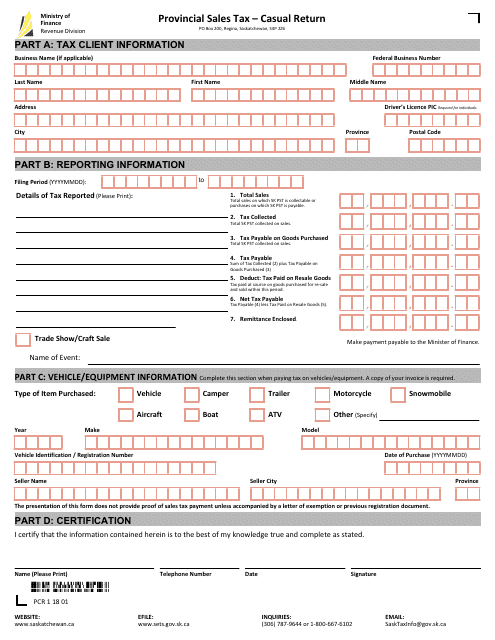

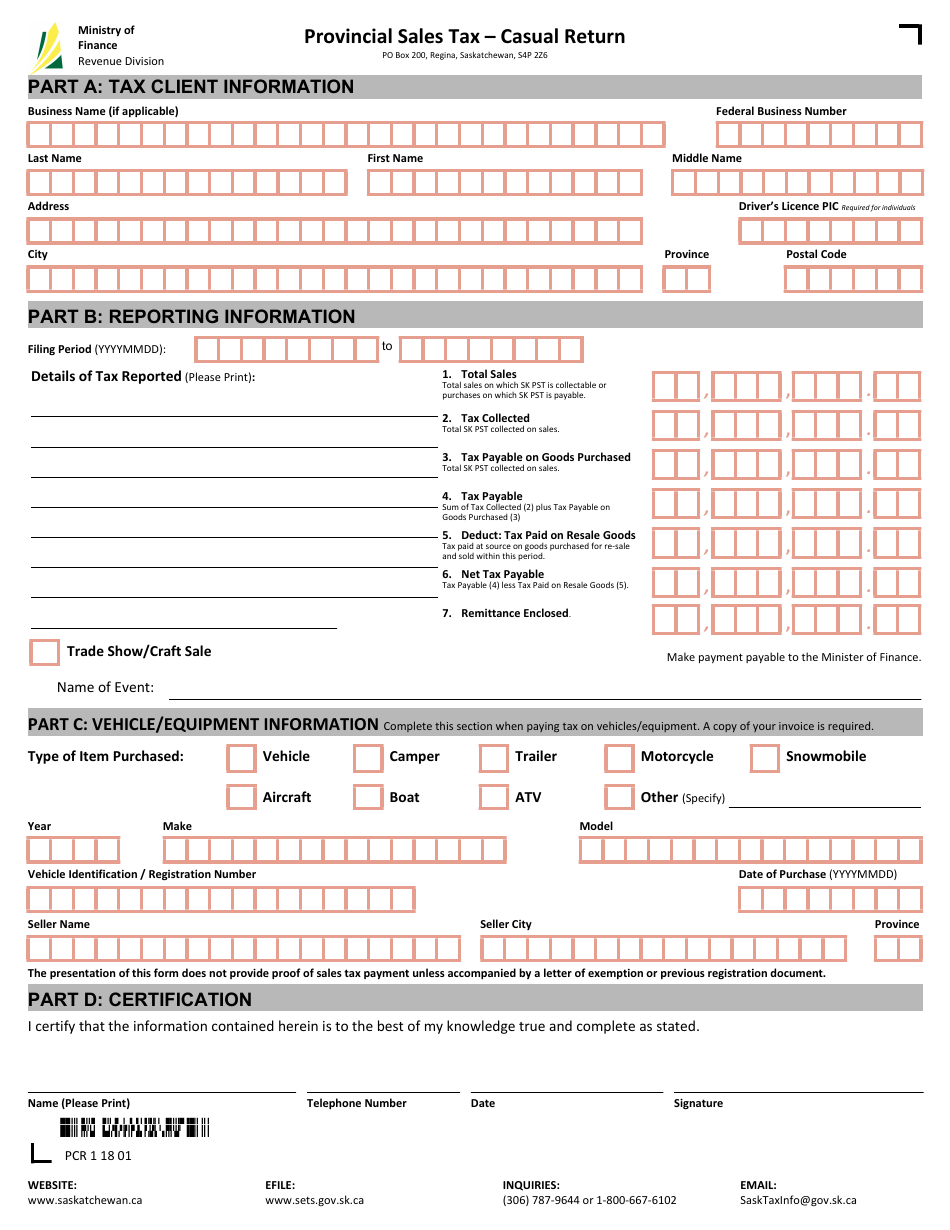

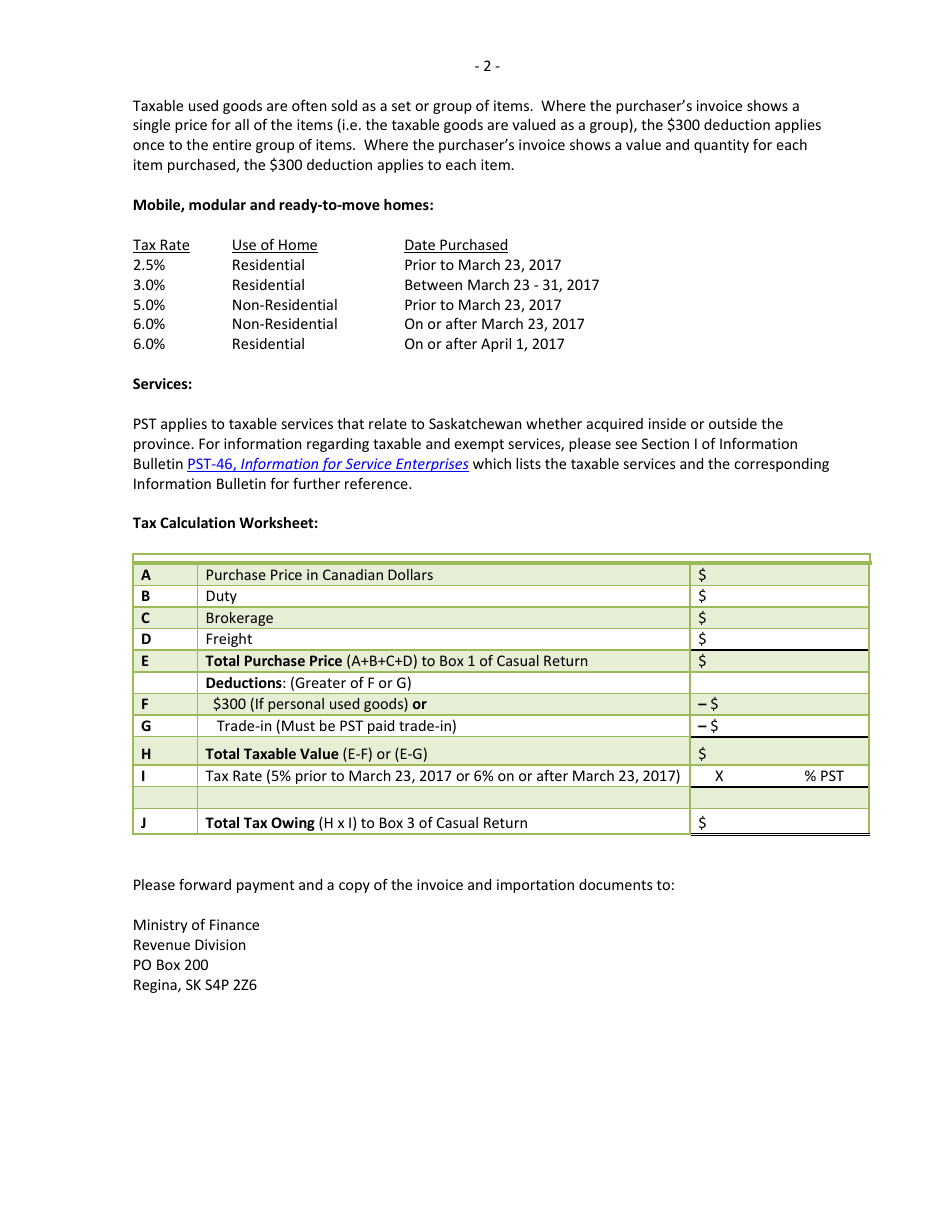

Form PCR1 Provincial Sales Tax - Casual Return - Saskatchewan, Canada

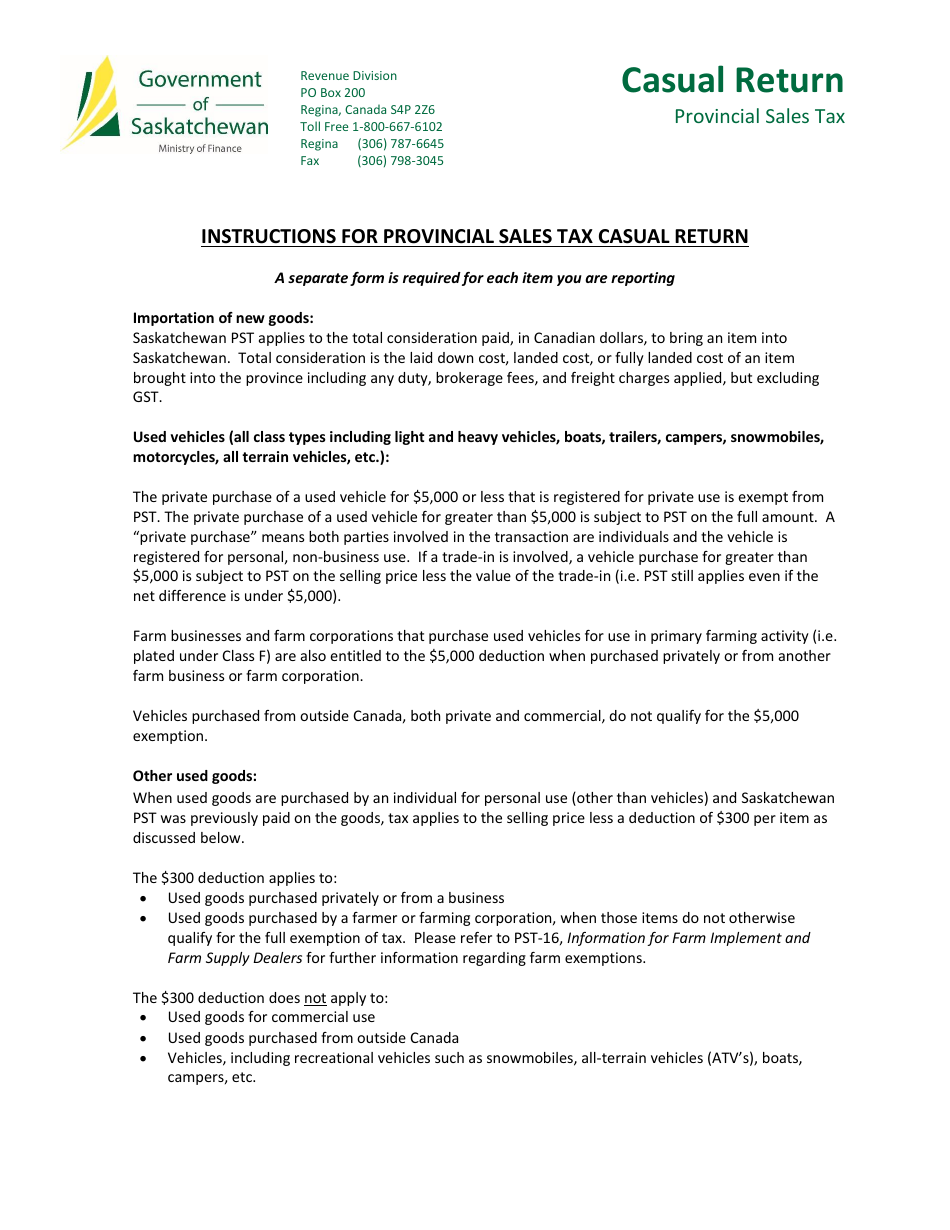

Form PCR1 is used for reporting and remitting provincial sales tax on casual sales in the province of Saskatchewan, Canada. Casual sales refer to transactions made by individuals or businesses that are not registered for regular sales tax purposes.

The Form PCR1 Provincial Sales Tax - Casual Return in Saskatchewan, Canada is filed by individuals or businesses who have made casual sales of taxable goods in the province.

FAQ

Q: What is PCR1 Provincial Sales Tax?

A: PCR1 Provincial Sales Tax is a form used in Saskatchewan, Canada to report and remit sales tax for casual businesses.

Q: Who needs to file PCR1 Provincial Sales Tax?

A: Casual businesses operating in Saskatchewan need to file PCR1 Provincial Sales Tax.

Q: What is a casual business?

A: A casual business is one that occasionally sells taxable goods or services in Saskatchewan, but is not registered as a regular business.

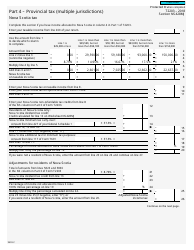

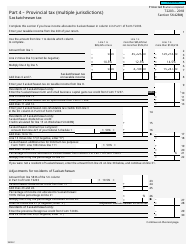

Q: What information is required in the PCR1 form?

A: The PCR1 form requires information about the business, sales made, and sales tax collected during the reporting period.

Q: How often should PCR1 Provincial Sales Tax be filed?

A: PCR1 Provincial Sales Tax should be filed on a monthly basis.

Q: Is there a deadline for filing PCR1 Provincial Sales Tax?

A: Yes, the form must be filed and payment must be received by the 20th day of the month following the reporting period.

Q: What happens if I don't file PCR1 Provincial Sales Tax?

A: Failing to file PCR1 Provincial Sales Tax may result in penalties and interest charges.

Q: Is PCR1 Provincial Sales Tax the same as GST?

A: No, PCR1 Provincial Sales Tax is specific to Saskatchewan, while GST (Goods and Services Tax) is a federal tax that applies to all of Canada.