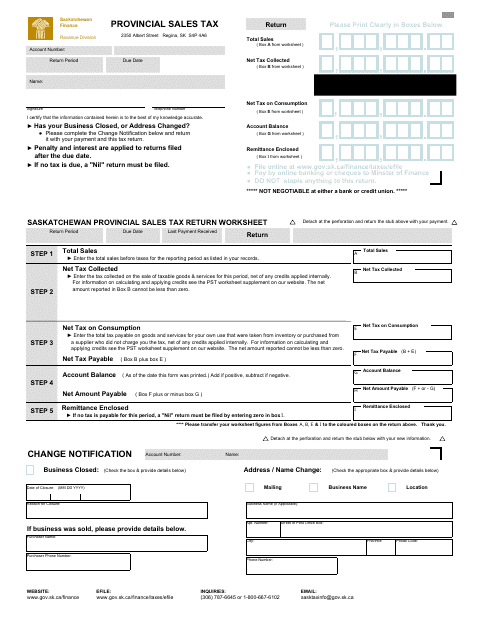

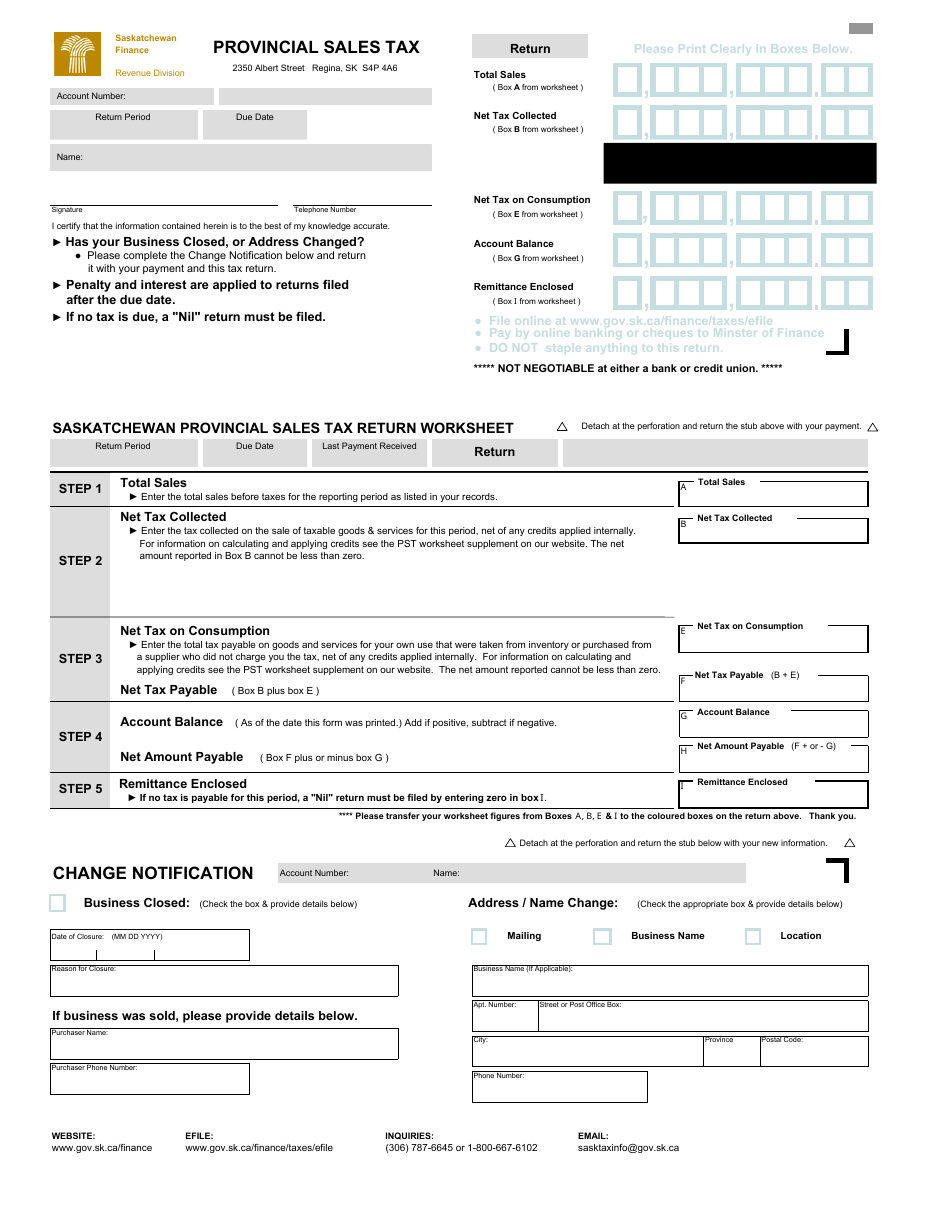

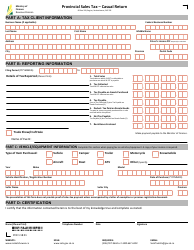

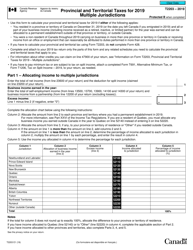

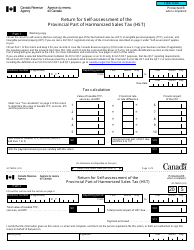

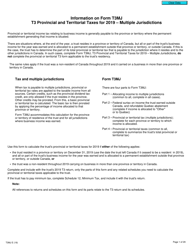

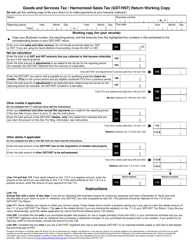

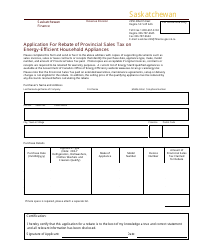

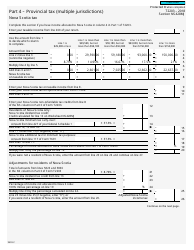

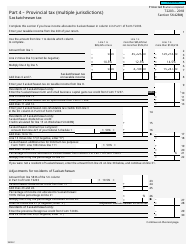

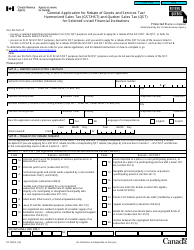

Provincial Sales Tax Return - Saskatchewan, Canada

The Provincial Sales Tax Return in Saskatchewan, Canada is a form that businesses use to report and remit the sales tax collected on taxable goods and services in the province.

The business or individual who is registered for the Provincial Sales Tax (PST) in Saskatchewan, Canada is responsible for filing the PST return.

FAQ

Q: What is a Provincial Sales Tax (PST) Return?

A: The Provincial Sales Tax (PST) Return is a form used by businesses in Saskatchewan, Canada to report and remit the provincial sales tax they have collected.

Q: Who needs to file a Provincial Sales Tax (PST) Return?

A: Any business that is registered for the Provincial Sales Tax (PST) in Saskatchewan, Canada needs to file a PST Return.

Q: When is the deadline to file a Provincial Sales Tax (PST) Return?

A: The deadline to file a PST Return in Saskatchewan, Canada is generally the last day of the month following the reporting period.

Q: What information do I need to include in a Provincial Sales Tax (PST) Return?

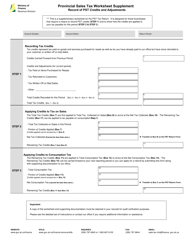

A: When filing a PST Return in Saskatchewan, Canada, you will need to provide information such as your business details, sales and tax collected, and any allowable deductions.

Q: Are there any penalties for late filing or non-filing of a Provincial Sales Tax (PST) Return?

A: Yes, there are penalties for late filing or non-filing of a PST Return in Saskatchewan, Canada. It is important to file your return on time to avoid these penalties.