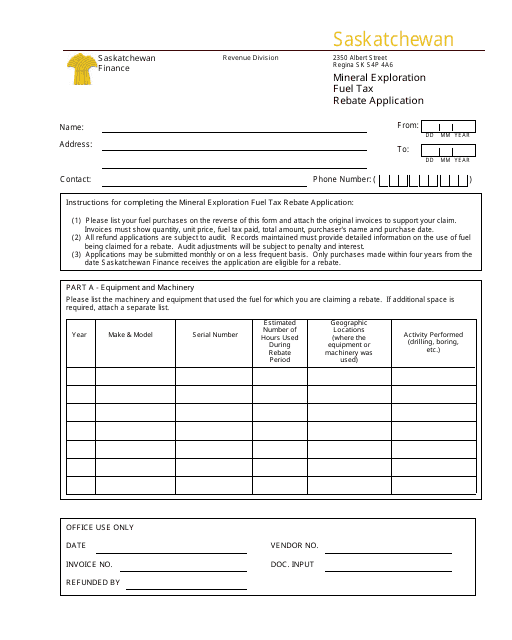

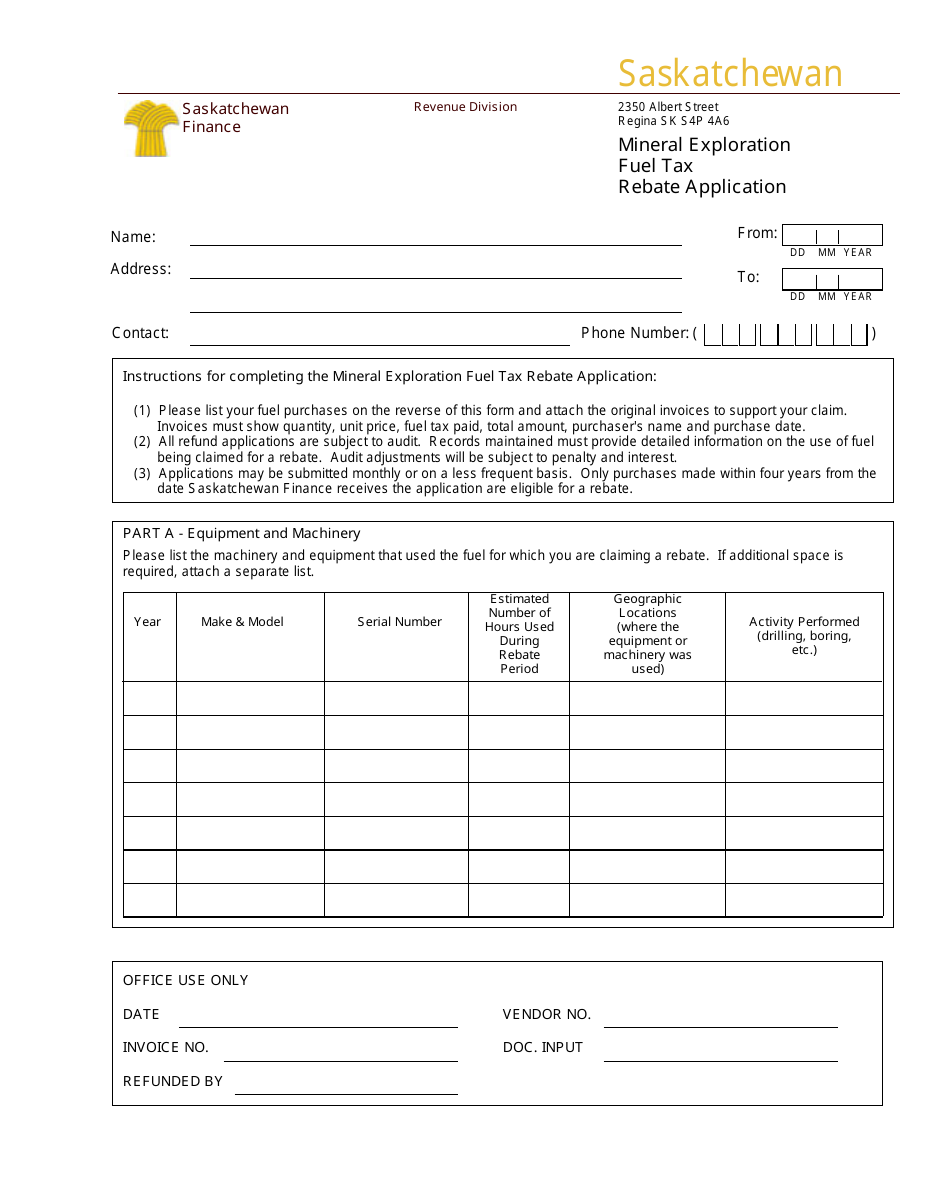

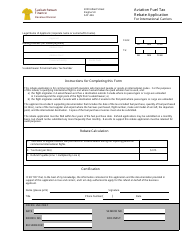

Mineral Exploration Fuel Tax Rebate Application - Saskatchewan, Canada

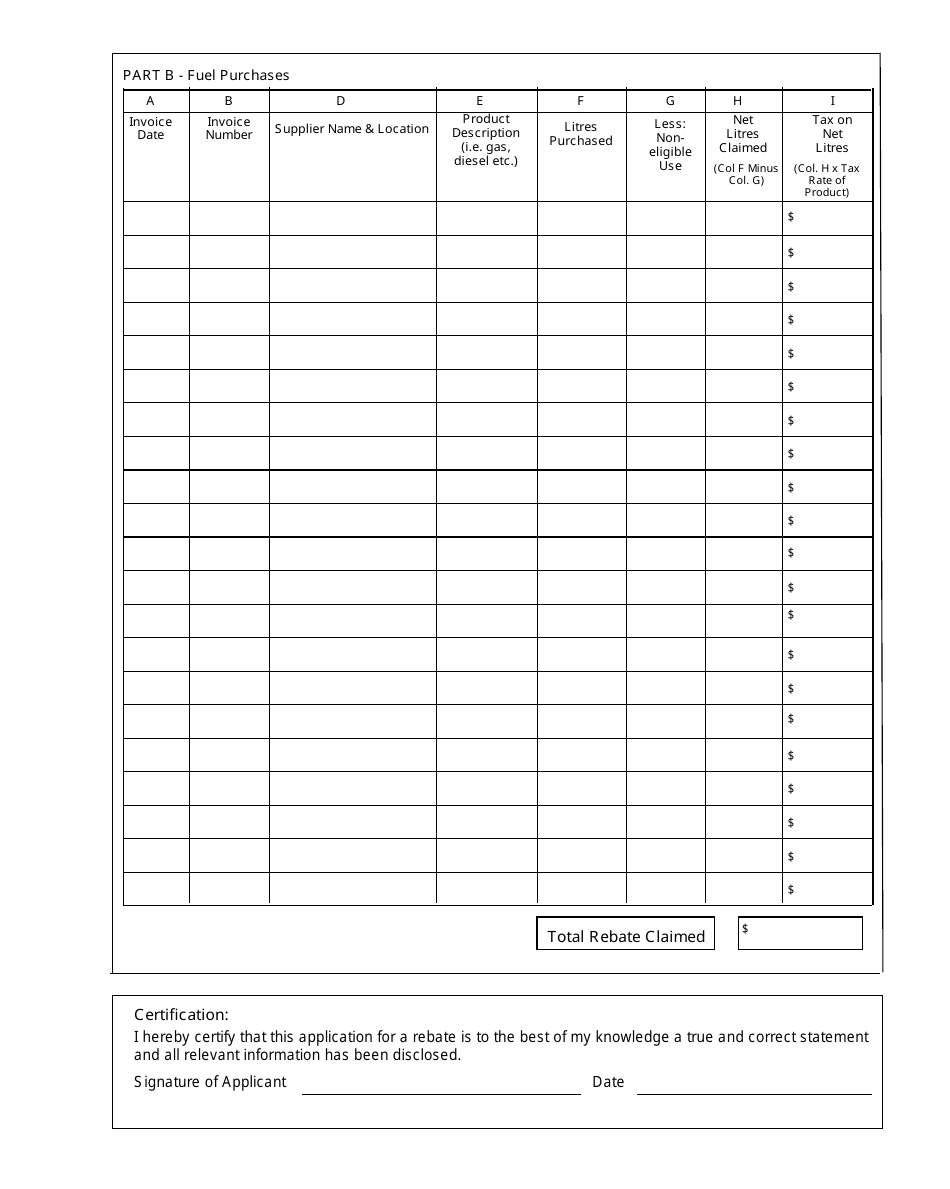

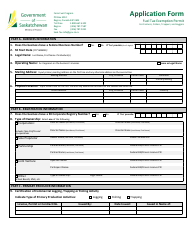

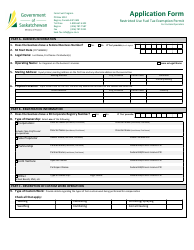

The Mineral Exploration Fuel Tax Rebate Application in Saskatchewan, Canada is for companies involved in mineral exploration to apply for a rebate on the fuel taxes paid during their exploration activities.

In Saskatchewan, Canada, the mineral exploration fuel tax rebate application is filed by the exploration company or their authorized representative.

FAQ

Q: What is the Mineral Exploration Fuel Tax Rebate?

A: The Mineral Exploration Fuel Tax Rebate is a program in Saskatchewan, Canada that provides a refund on fuel tax paid by eligible mineral exploration companies.

Q: Who is eligible to apply for the Mineral Exploration Fuel Tax Rebate?

A: Eligible companies include those engaged in mineral exploration activities in Saskatchewan and hold a valid exploration permit.

Q: What is the purpose of the rebate?

A: The rebate aims to support and stimulate mineral exploration in Saskatchewan by reducing the costs associated with fuel used during exploration activities.

Q: How much of the fuel tax can be refunded?

A: Eligible companies can receive a refund of up to 100% of the fuel tax paid on qualifying exploration activities.

Q: What are qualifying exploration activities?

A: Qualifying exploration activities include surface exploration, drilling, and seismic activities related to mineral exploration.

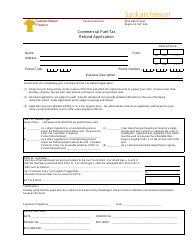

Q: How can companies apply for the rebate?

A: Companies can apply for the Mineral Exploration Fuel Tax Rebate by submitting an application to the Saskatchewan Ministry of Energy and Resources.

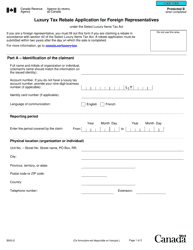

Q: Is there a deadline for submitting applications?

A: Yes, applications must be submitted within two years of the end of the calendar year to which the application relates.

Q: How long does it take to process the rebate application?

A: The processing time can vary, but the Ministry aims to process applications within 90 days of receiving a complete application.

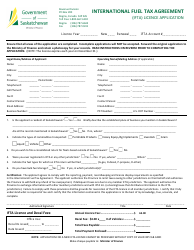

Q: Are there any conditions or requirements for receiving the rebate?

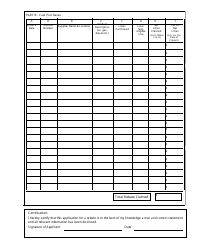

A: Yes, companies must meet certain conditions and requirements, such as keeping adequate records and providing supporting documentation.