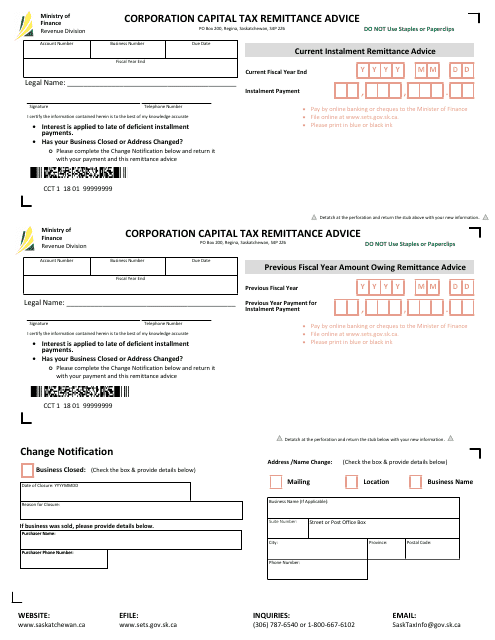

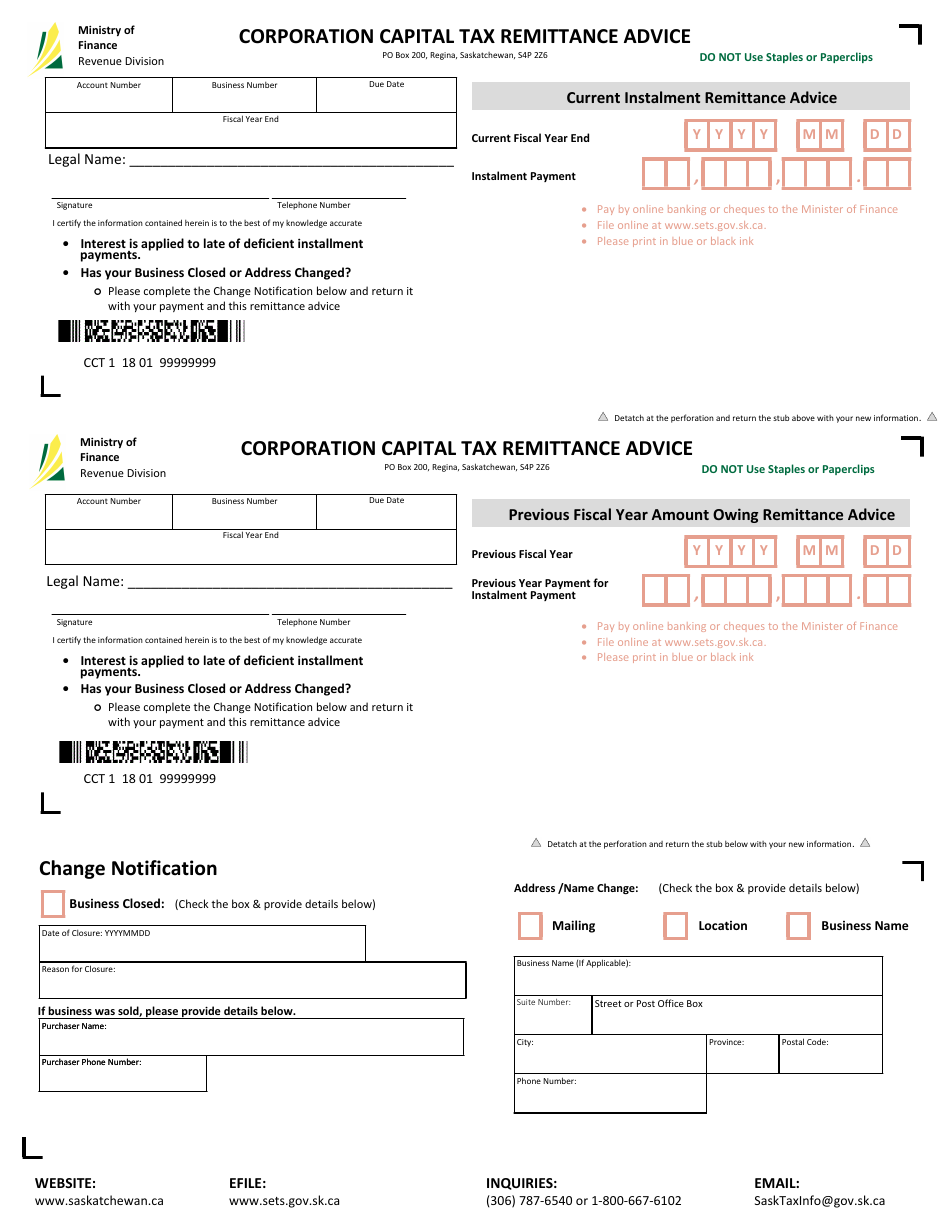

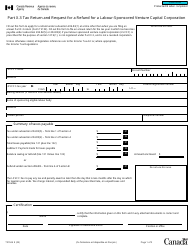

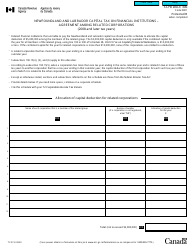

Corporation Capital Tax Remittance Advice - Saskatchewan, Canada

The Corporation Capital TaxRemittance Advice in Saskatchewan, Canada is a document used for remitting the corporation capital tax in the province. It is for businesses or corporations to provide information and make payments for their corporate capital tax obligations to the Saskatchewan Ministry of Finance.

The corporation files the Corporation Capital Tax Remittance Advice in Saskatchewan, Canada.

FAQ

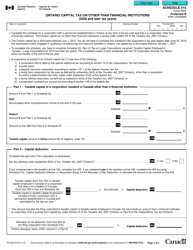

Q: What is the Corporation Capital Tax Remittance Advice?

A: The Corporation Capital Tax Remittance Advice is a document used in Saskatchewan, Canada to report and remit the corporation capital tax.

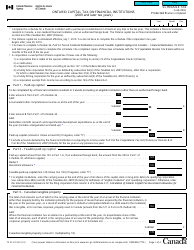

Q: Who is required to file the Corporation Capital Tax Remittance Advice?

A: All corporations operating in Saskatchewan are required to file the Corporation Capital Tax Remittance Advice.

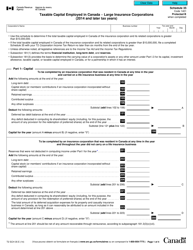

Q: What is the purpose of the Corporation Capital Tax?

A: The Corporation Capital Tax is a tax on the taxable paid-up capital of corporations operating in Saskatchewan.

Q: How often does the Corporation Capital Tax Remittance Advice need to be filed?

A: The Corporation Capital Tax Remittance Advice must be filed annually.

Q: What happens if a corporation fails to file the Corporation Capital Tax Remittance Advice?

A: Failure to file the Corporation Capital Tax Remittance Advice may result in penalties and interest.