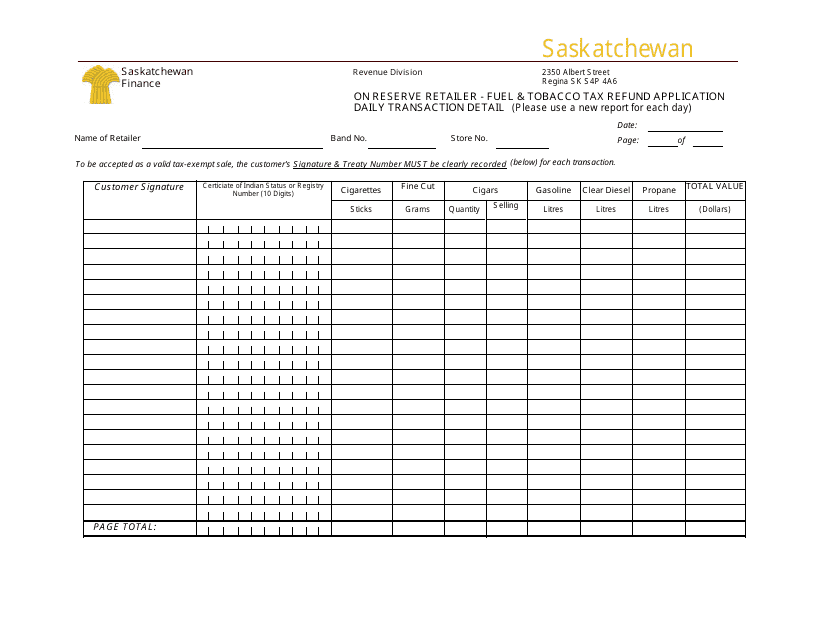

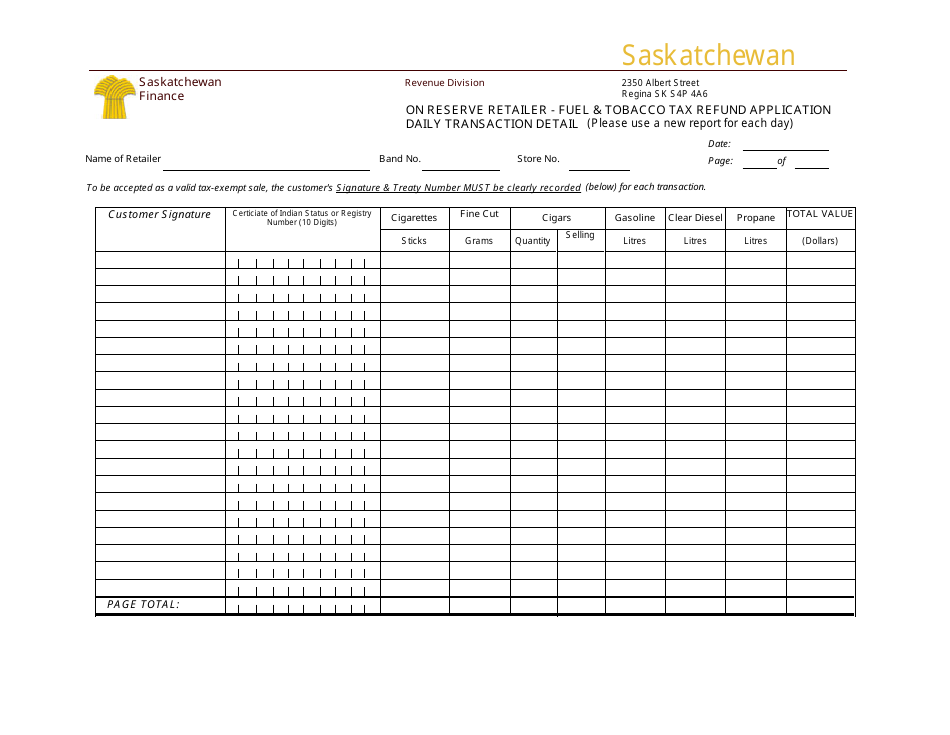

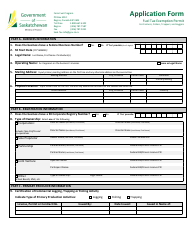

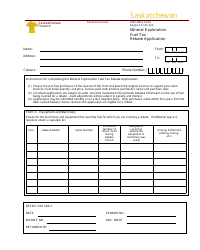

On Reserve Retailer - Fuel & Tobacco Tax Refund Application Daily Transaction Detail - Saskatchewan, Canada

The On Reserve Retailer - Fuel & Tobacco Tax Refund Application Daily Transaction Detail is a document used in Saskatchewan, Canada to track and provide details of daily transactions related to fuel and tobacco tax refunds for retailers operating on reserve lands.

The On Reserve Retailer - Fuel & Tobacco Tax Refund Application Daily Transaction Detail in Saskatchewan, Canada is filed by the retailer themselves.

FAQ

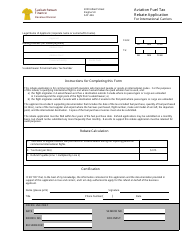

Q: What is the Reserve Retailer - Fuel & Tobacco Tax Refund Application Daily Transaction Detail?

A: The Reserve Retailer - Fuel & Tobacco Tax Refund Application Daily Transaction Detail is a document related to the refund of fuel and tobacco taxes for reserve retailers in Saskatchewan, Canada.

Q: Who is eligible for the refund?

A: Reserve retailers in Saskatchewan, Canada are eligible for the refund of fuel and tobacco taxes.

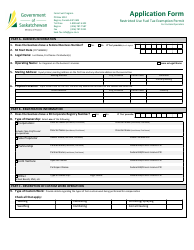

Q: What is the purpose of the daily transaction detail?

A: The daily transaction detail provides a breakdown of fuel and tobacco sales made by reserve retailers, which is used to calculate the refund amount.

Q: How can reserve retailers apply for the refund?

A: Reserve retailers can apply for the refund by submitting the Reserve Retailer - Fuel & Tobacco Tax Refund Application Daily Transaction Detail form along with supporting documents to the appropriate authorities.

Q: What supporting documents are required for the refund application?

A: Supporting documents such as sales invoices, purchase invoices, and inventory records are required to be submitted along with the refund application.