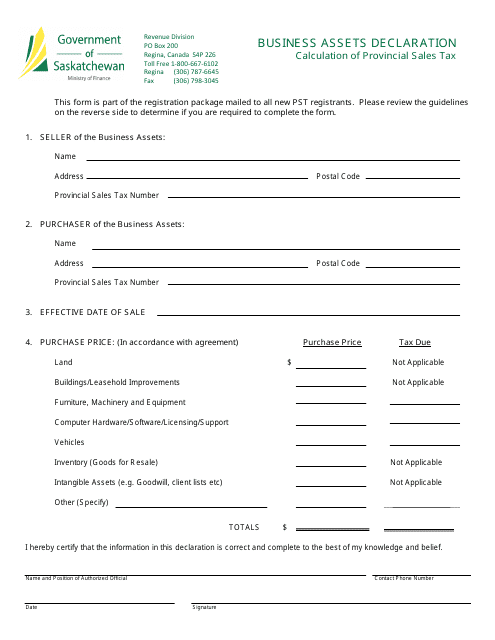

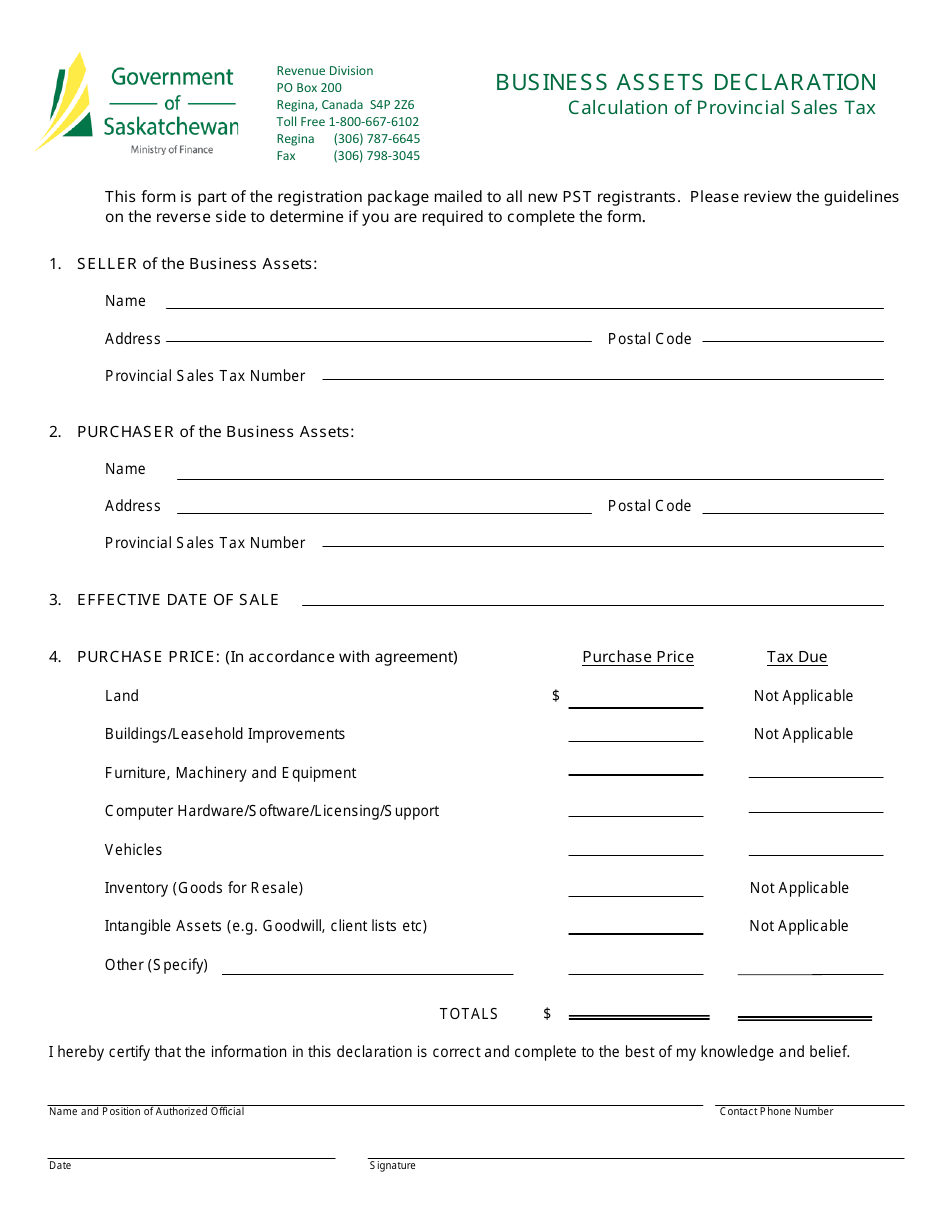

Business Assets Declaration - Saskatchewan, Canada

The Business Assets Declaration in Saskatchewan, Canada is a requirement for businesses to disclose their assets for taxation purposes and to provide transparency in financial reporting.

In Saskatchewan, Canada, businesses do not typically file a separate Business Assets Declaration. However, businesses may be required to include information about their assets in other tax-related filings. It is recommended to consult with a professional accountant or the Saskatchewan Ministry of Finance for specific guidance on asset reporting for businesses.

FAQ

Q: What is a business assets declaration?

A: A business assets declaration is a document that businesses in Saskatchewan, Canada are required to fill out to declare their assets.

Q: Which businesses need to fill out a business assets declaration?

A: All businesses operating in Saskatchewan, Canada are required to fill out a business assets declaration.

Q: What is the purpose of a business assets declaration?

A: The purpose of a business assets declaration is to provide accurate information about a business's assets to the government for taxation and regulatory purposes.

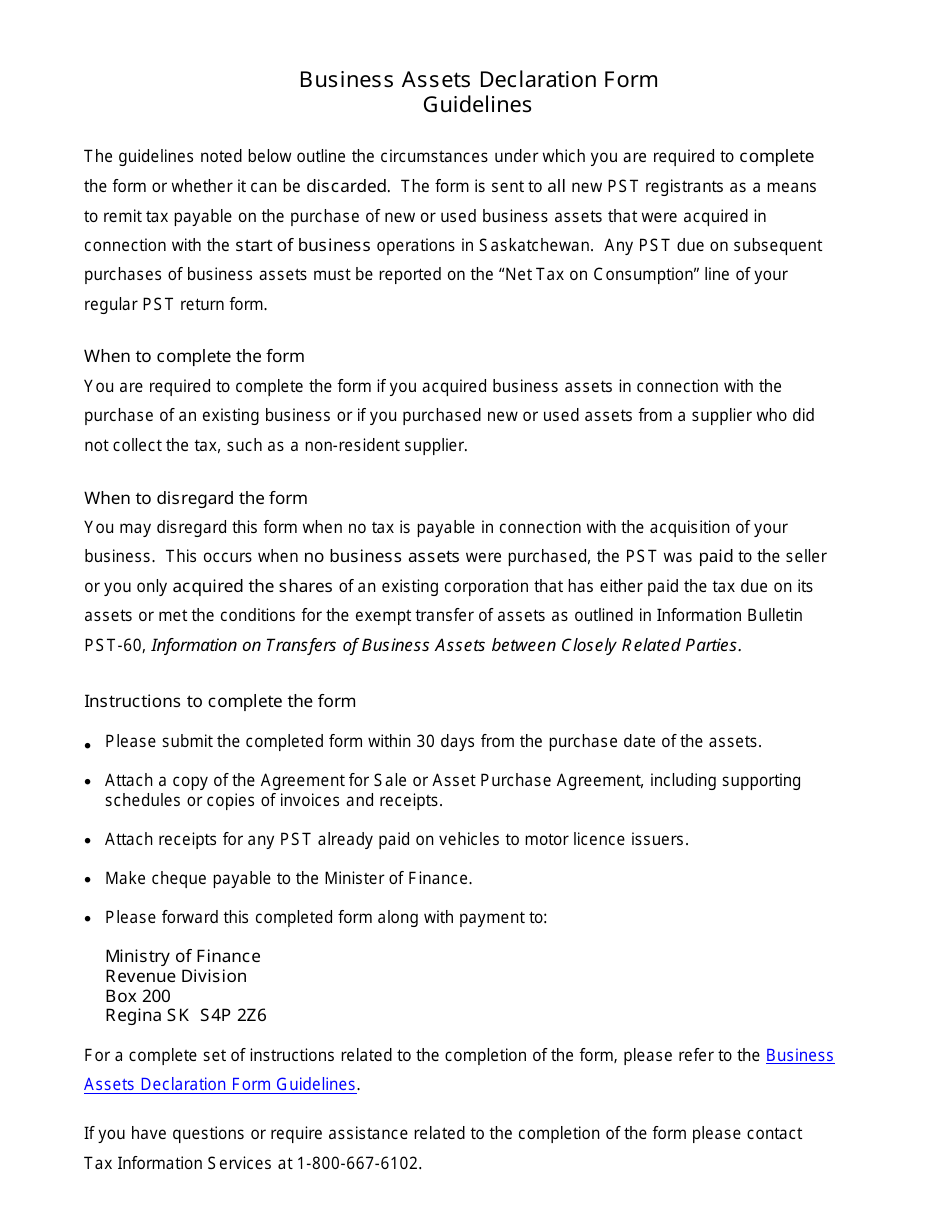

Q: When is a business assets declaration due?

A: The due date for a business assets declaration in Saskatchewan, Canada varies and is typically indicated on the form or communicated by the government.

Q: What information is required in a business assets declaration?

A: A business assets declaration typically requires information about the business's assets, including their description, value, and location.

Q: What happens if a business fails to submit a business assets declaration?

A: Failure to submit a business assets declaration in Saskatchewan, Canada can result in penalties or fines imposed by the government.