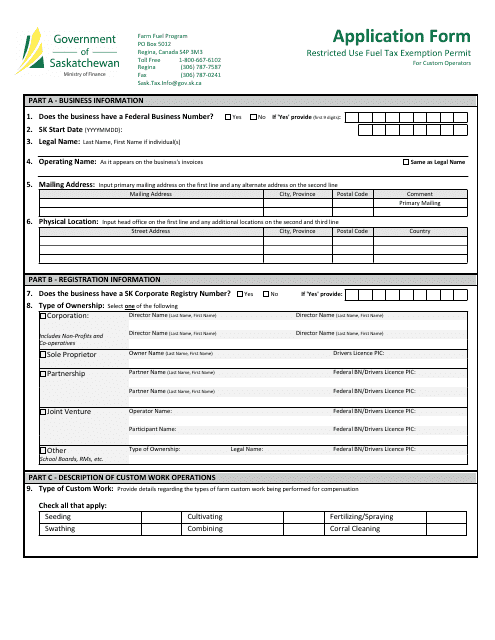

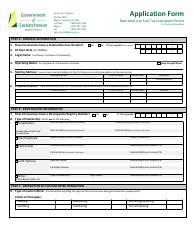

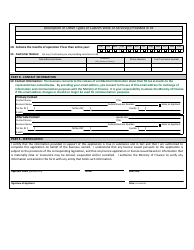

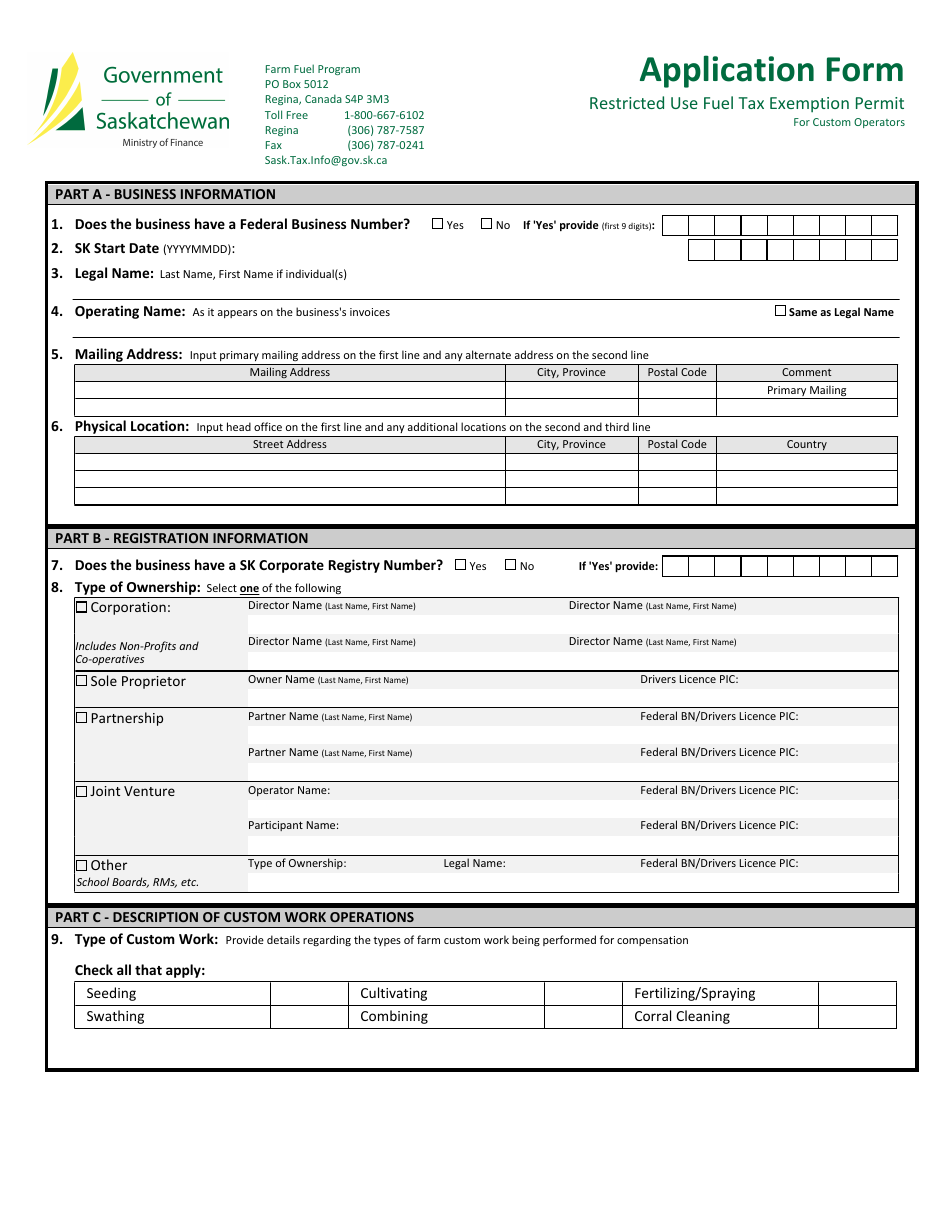

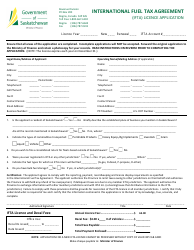

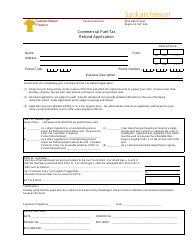

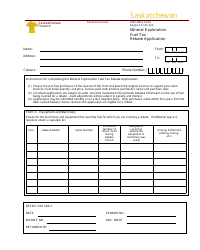

Application for a Restricted Use Fuel Tax Exemption Permit for Custom Operators - Saskatchewan, Canada

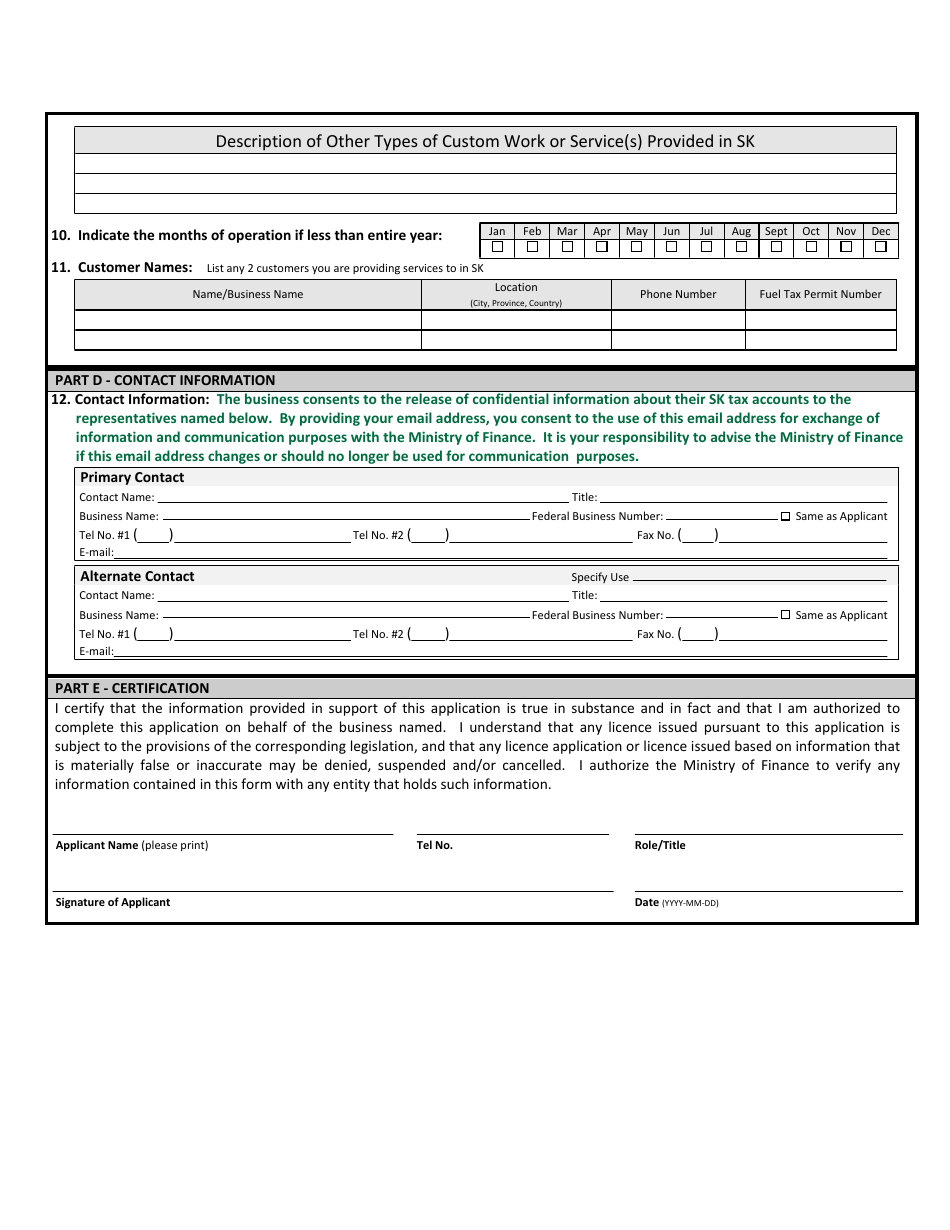

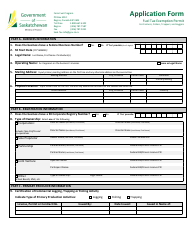

The Application for a Restricted Use Fuel Tax Exemption Permit for Custom Operators in Saskatchewan, Canada is for custom operators who perform specific tasks on behalf of farmers and ranchers. This permit allows these operators to claim a fuel tax exemption for their equipment used exclusively for these tasks.

The custom operators themselves must file the application for a Restricted Use Fuel Tax Exemption Permit in Saskatchewan, Canada.

FAQ

Q: What is a Restricted Use Fuel Tax Exemption Permit?

A: A permit that allows custom operators in Saskatchewan to purchase fuel without paying certain taxes.

Q: Who can apply for a Restricted Use Fuel Tax Exemption Permit?

A: Custom operators in Saskatchewan.

Q: What is a custom operator?

A: A person or business that provides agricultural services for hire.

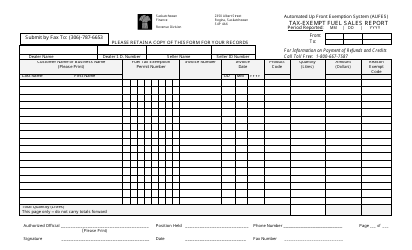

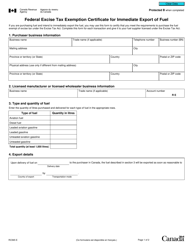

Q: What taxes are exempted with this permit?

A: The federal excise tax and the provincial fuel tax.

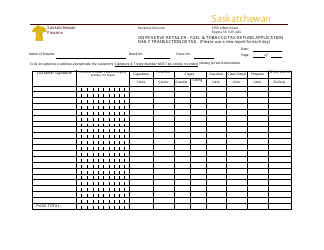

Q: What services are covered under this permit?

A: Custom operators providing agricultural services, such as plowing, seeding, and harvesting.

Q: Is there a fee for the permit?

A: Yes, there is an annual fee for the permit.