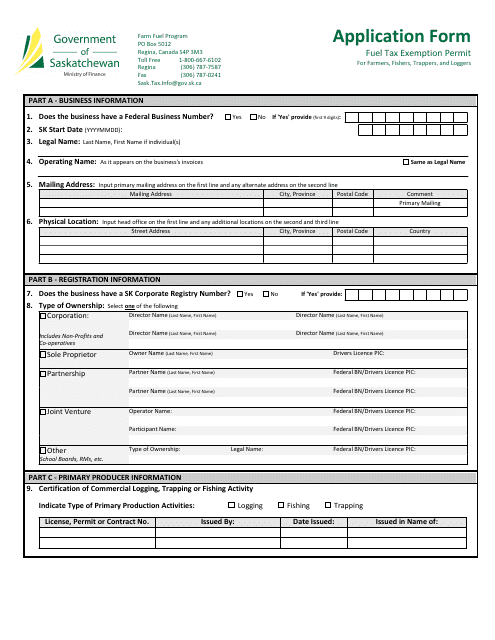

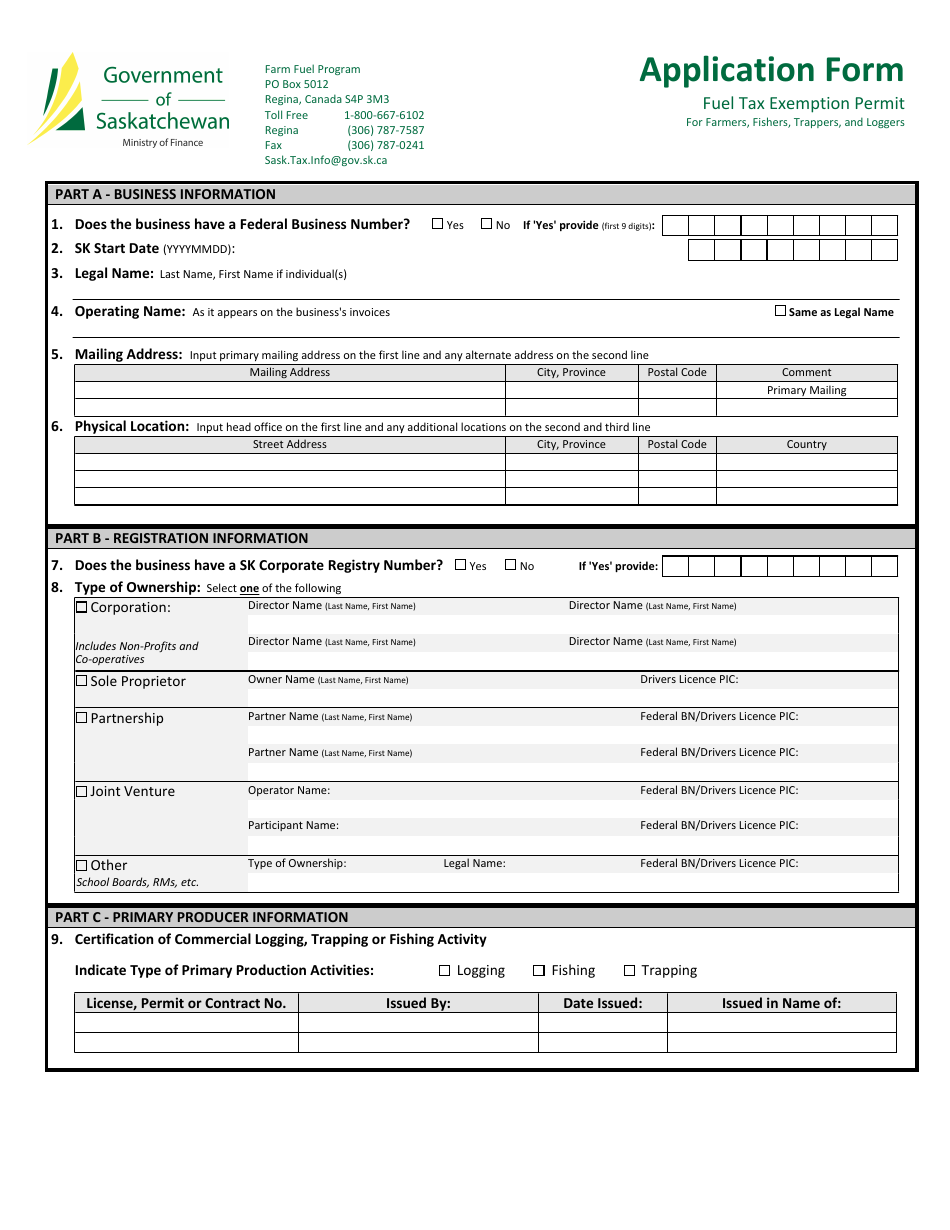

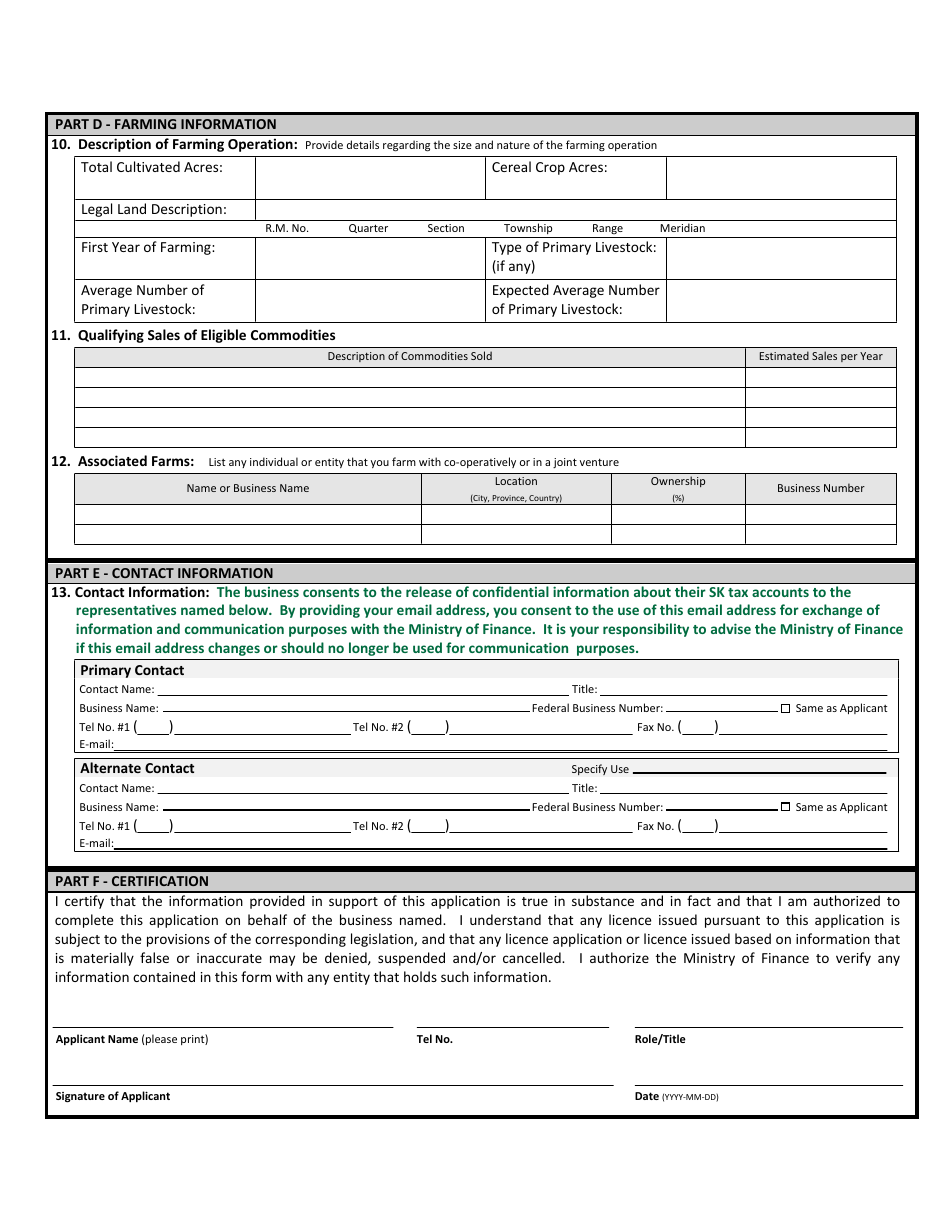

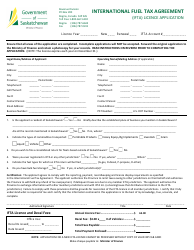

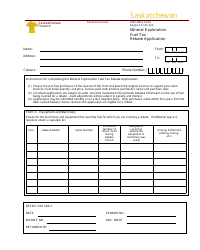

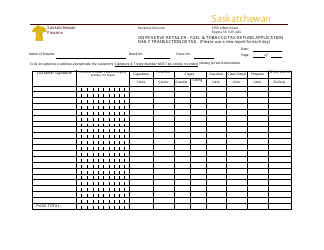

Application for Fuel Tax Exemption Permit - Saskatchewan, Canada

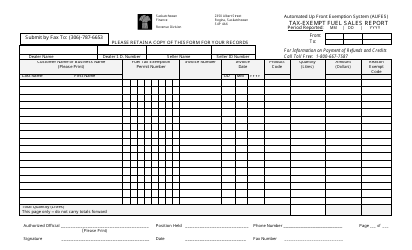

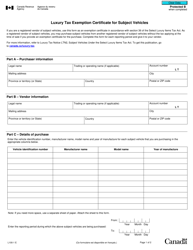

The Application for Fuel Tax Exemption Permit in Saskatchewan, Canada is for individuals or organizations seeking an exemption from paying fuel taxes for certain eligible uses, such as farming, mining, or logging activities.

In Saskatchewan, Canada, the application for a fuel tax exemption permit is filed by the person or entity that is eligible for the exemption. This could be a farmer, a non-profit organization, or any other eligible party.

FAQ

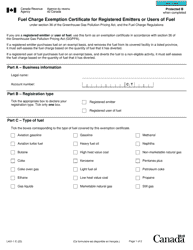

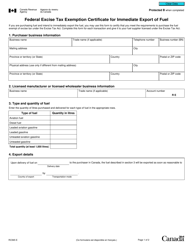

Q: What is a Fuel Tax Exemption Permit?

A: A Fuel Tax Exemption Permit is a permit that allows certain entities in Saskatchewan, Canada to be exempt from paying fuel tax on certain types of fuel.

Q: Who is eligible for a Fuel Tax Exemption Permit?

A: Certain entities such as farmers, First Nations, and registered non-profit organizations may be eligible for a Fuel Tax Exemption Permit.

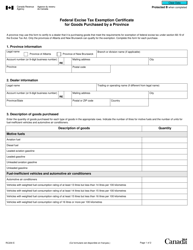

Q: How can I apply for a Fuel Tax Exemption Permit?

A: You can apply for a Fuel Tax Exemption Permit by completing an application form and submitting it to the Saskatchewan Ministry of Finance.

Q: What types of fuel are exempt from tax with a Fuel Tax Exemption Permit?

A: With a Fuel Tax Exemption Permit, certain types of fuel such as gasoline, diesel, propane, and natural gas may be exempt from tax.

Q: Can I use a Fuel Tax Exemption Permit for personal use?

A: No, a Fuel Tax Exemption Permit is only intended for use by eligible entities for specific purposes such as farming or non-profit activities.