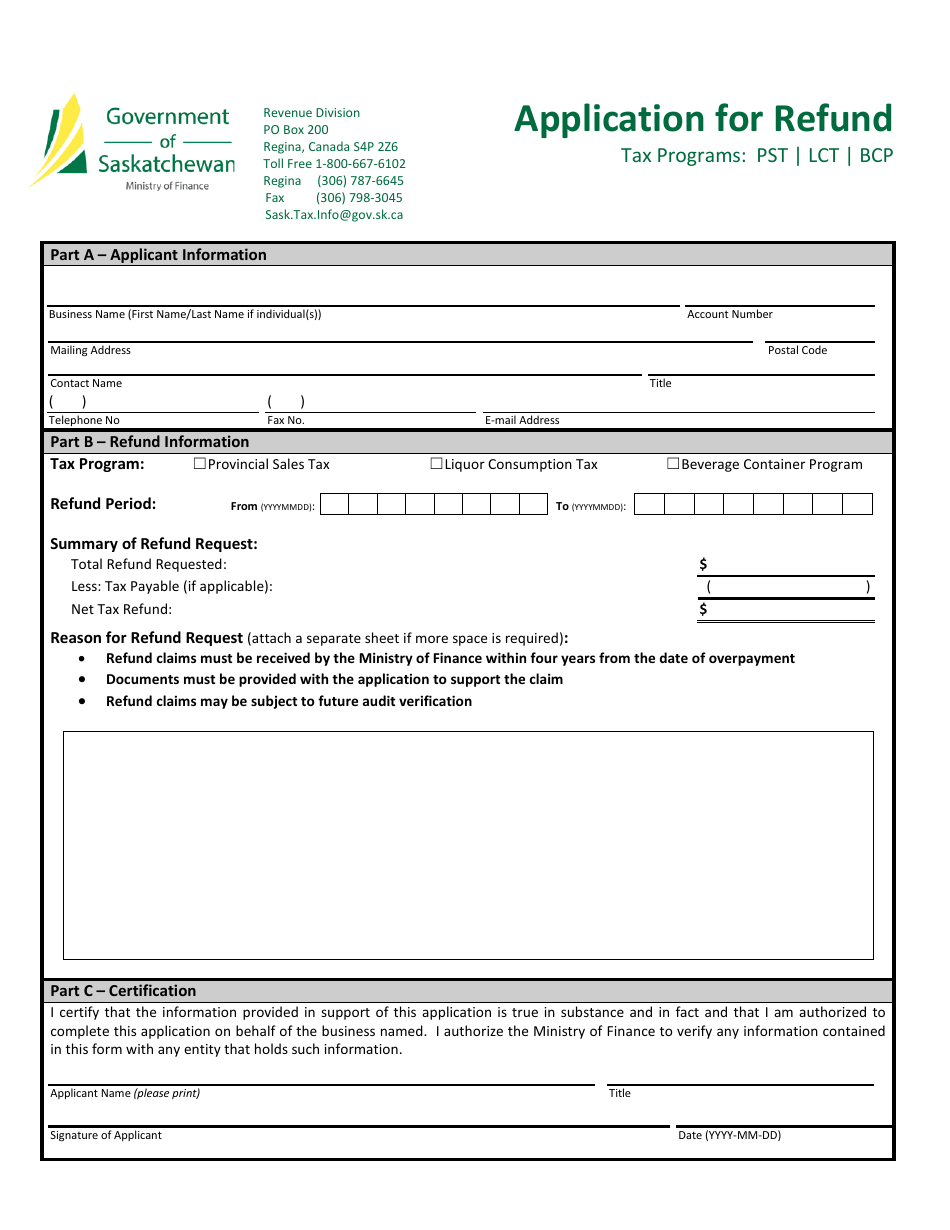

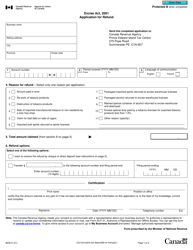

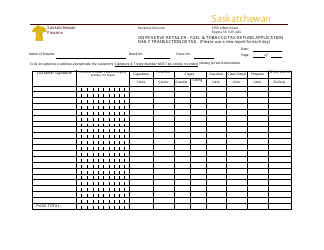

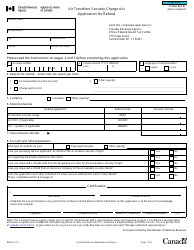

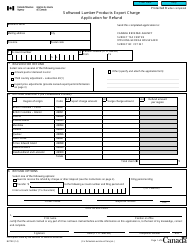

Application for Refund - Saskatchewan, Canada

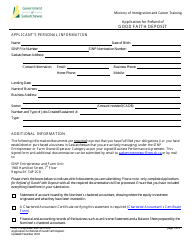

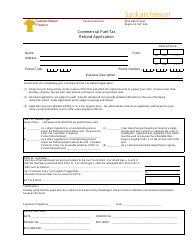

The Application for Refund in Saskatchewan, Canada is a form that individuals can use to request a refund of certain taxes or fees paid to the government. This form is typically used to claim refunds for provincial taxes such as the Provincial Sales Tax (PST) or the Saskatchewan Liquor Consumption Tax. It is important to note that specific eligibility requirements and supporting documentation may be necessary to complete the application process.

In Saskatchewan, Canada, the application for a refund is typically filed by the individual or business that paid the taxes and is seeking a refund. This could be a taxpayer who believes they have overpaid their taxes or a business that is eligible for a specific refund program. It is important to review the specific refund program and its requirements to determine who is eligible to file the application.

FAQ

Q: How do I apply for a refund in Saskatchewan, Canada?

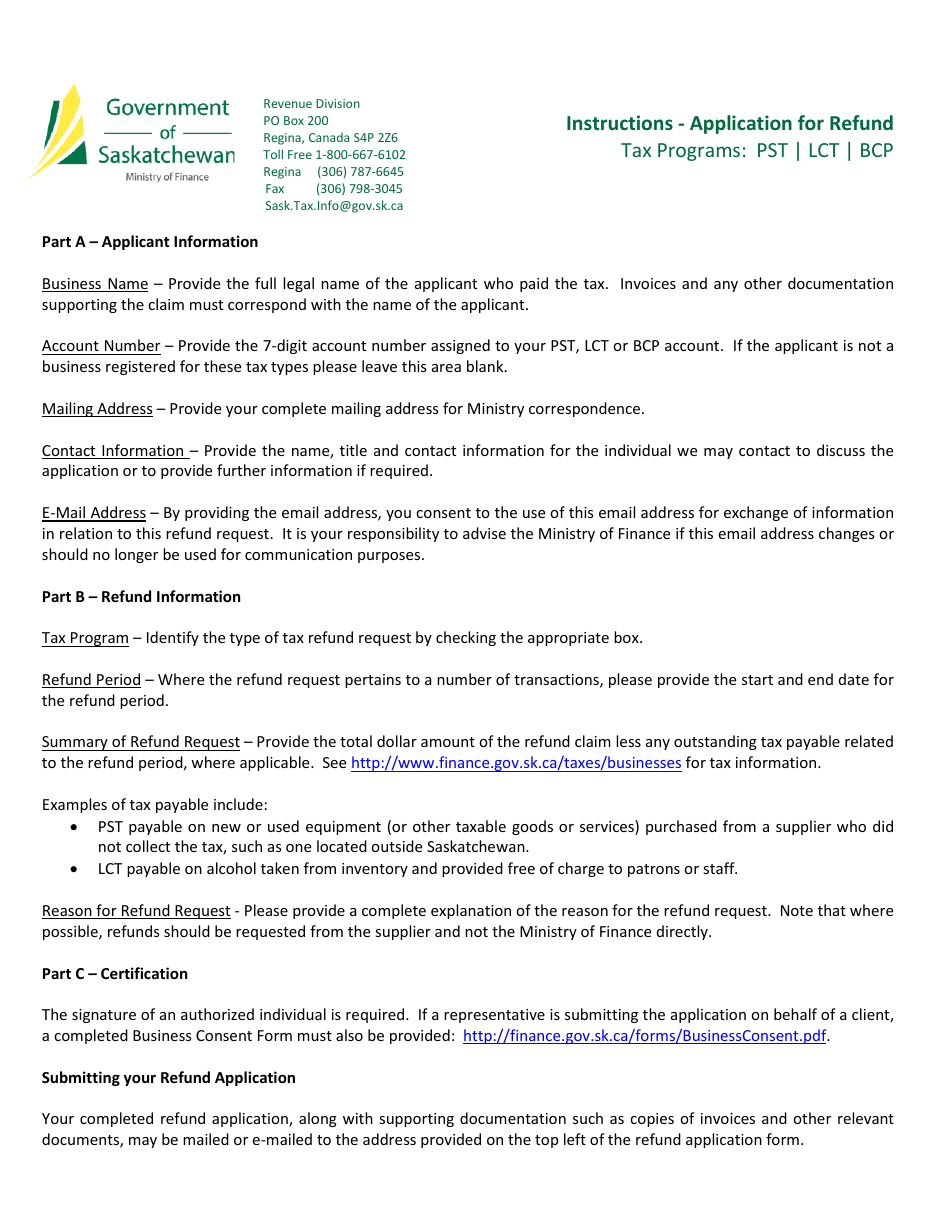

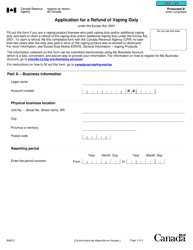

A: To apply for a refund in Saskatchewan, Canada, you need to complete a refund application form provided by the appropriate government agency or organization. The form typically requires you to provide information such as your personal details, the reason for the refund, and any supporting documentation. Make sure to follow the instructions provided and submit the completed form along with any required documents to the designated office or address.

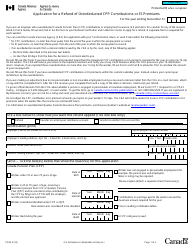

Q: What types of refunds can I apply for in Saskatchewan, Canada?

A: In Saskatchewan, Canada, you can apply for various types of refunds depending on the specific circumstances. Common refund categories include income tax refunds, property tax refunds, healthcare premium refunds, and education-related refunds. Each type of refund may have specific eligibility criteria and application processes, so it's important to consult the relevant government agency or organization for accurate information.

Q: How long does it take to receive a refund in Saskatchewan, Canada?

A: The processing time for refunds in Saskatchewan, Canada may vary depending on the type of refund and the volume of applications received. In general, it can take several weeks to several months to receive a refund. It is advisable to contact the respective government agency or organization handling your refund to get an estimate of the processing time.

Q: What documents do I need to provide when applying for a refund in Saskatchewan, Canada?

A: The specific documents required when applying for a refund in Saskatchewan, Canada will depend on the type of refund you are seeking. Common documents may include identification proof, proof of residency, relevant receipts or invoices, supporting medical documents, or any other documentation specified by the government agency or organization handling the refund. It is important to carefully review the refund application instructions and ensure you provide all the necessary documents.