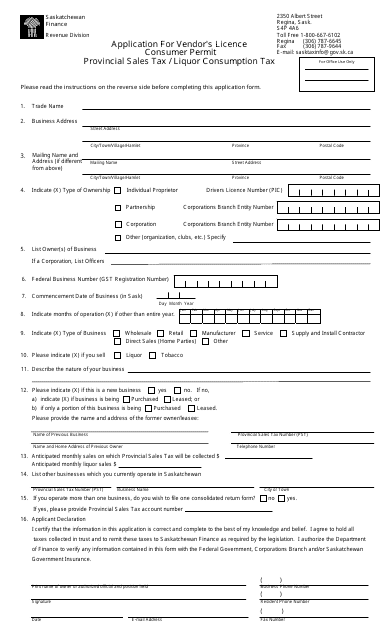

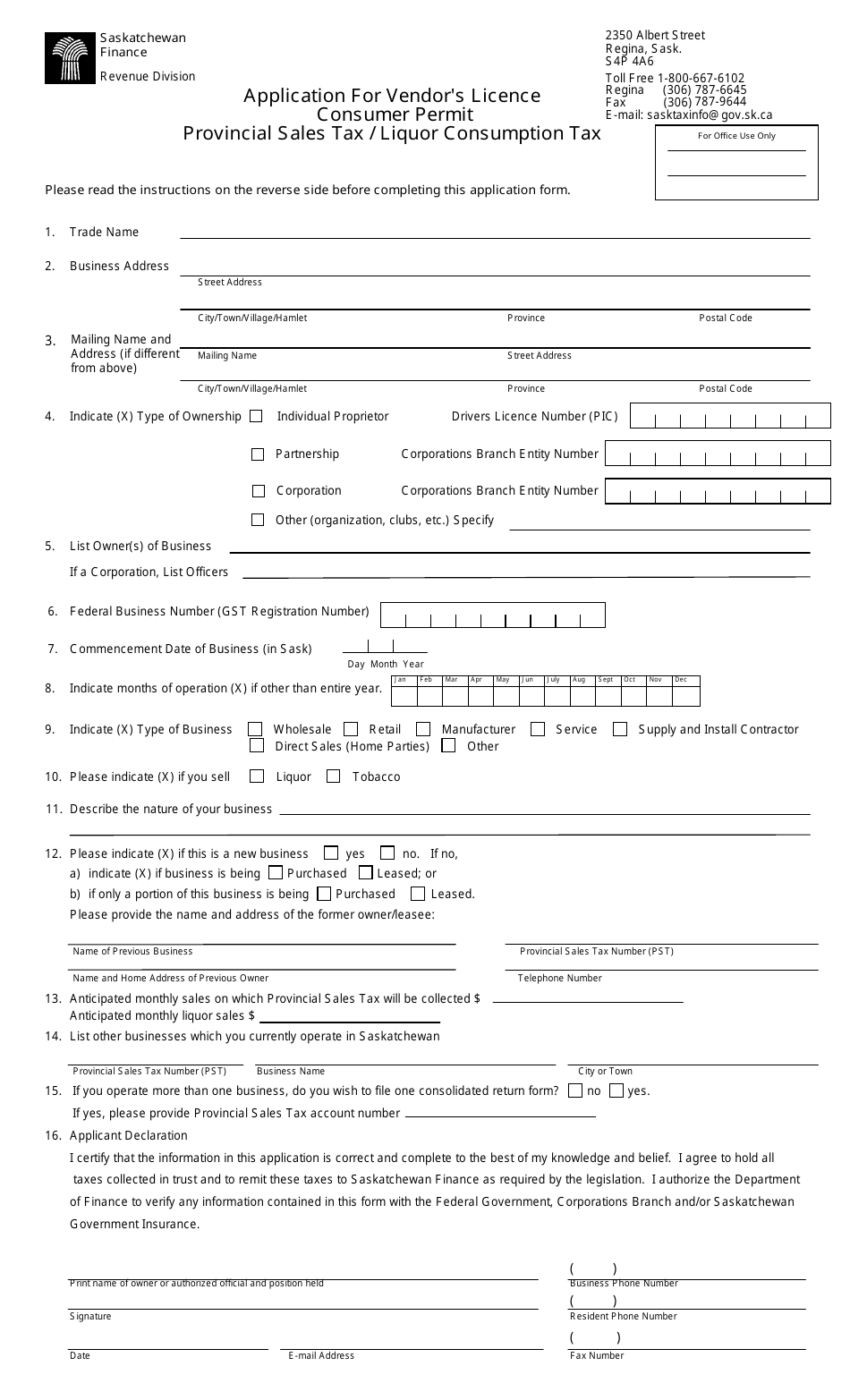

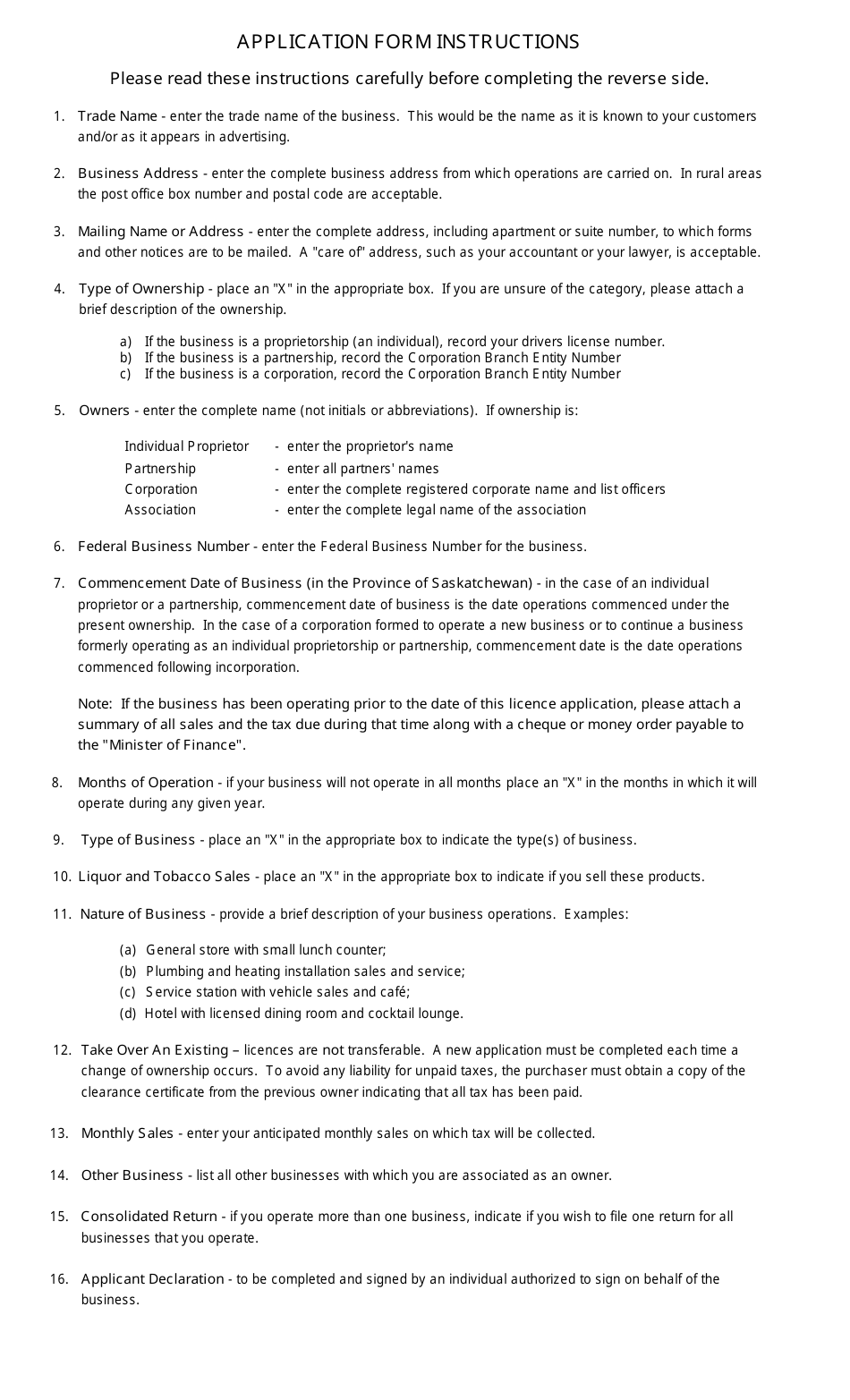

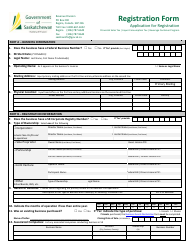

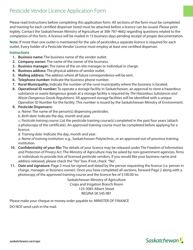

Application for Vendor's Licence Consumer Permit Provincial Sales Tax / Liquor Consumption Tax - Saskatchewan, Canada

The Application for Vendor's License Consumer Permit Provincial Sales Tax/Liquor Consumption Tax in Saskatchewan, Canada is used for individuals or businesses to apply for a permit that allows them to sell liquor and collect the applicable sales tax or consumption tax in the province.

In Saskatchewan, Canada, the application for a Vendor's Licence Consumer Permit, Provincial Sales Tax, and Liquor Consumption Tax is filed by the business or individual who intends to sell goods or services that are subject to these taxes. There is no specific requirement for a particular entity to file the application. It is the responsibility of the person engaging in the taxable activities to apply for the necessary permits and licenses.

FAQ

Q: What is a Vendor's Licence?

A: A Vendor's Licence is a license that allows a business or individual to sell goods or services in Saskatchewan, Canada.

Q: What is a Consumer Permit?

A: A Consumer Permit is a permit that allows an individual to purchase liquor for personal consumption in Saskatchewan, Canada.

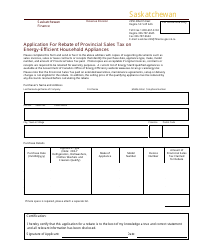

Q: What is Provincial Sales Tax?

A: Provincial Sales Tax is a tax imposed on the sale of goods and services in Saskatchewan, Canada.

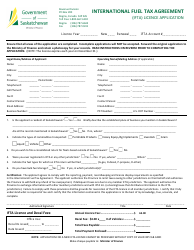

Q: What is Liquor Consumption Tax?

A: Liquor Consumption Tax is a tax imposed on the consumption of liquor in Saskatchewan, Canada.

Q: How do I apply for a Vendor's Licence?

A: To apply for a Vendor's Licence, you will need to complete an application form and submit it to the appropriate authorities in Saskatchewan, Canada.

Q: How do I apply for a Consumer Permit?

A: To apply for a Consumer Permit, you will need to complete an application form and submit it to the appropriate authorities in Saskatchewan, Canada.